Most teams discover the real challenge of reconciliation only when payouts and summaries refuse to agree. Timing differences, adjustments, and platform-specific rules quickly turn a simple comparison into a complicated task. Even small discrepancies can have a ripple effect, making it difficult to be confident that your financial data is accurate. Without a reliable balance reconciliation process, businesses risk reporting errors, delayed accounting, and time-consuming manual checks.

In this article, we’ll explore how balance reconciliation works, why it’s so important, and how Synder’s new Balance Reconciliation feature helps you trust the numbers you bring into your accounting system.

TL;DR

- Balance reconciliation confirms that your summary data matches the actual beginning and ending balances reported by your payment platform.

- Manual reconciliation becomes unreliable at scale due to timing differences, missing events, platform logic, and currency conversions.

- Synder’s workflow lets you review, select, and reconcile summaries confidently before syncing anything to your accounting system.

- Reconciled periods create faster month-end closes, cleaner reports, and a clear audit trail.

How balance reconciliation works when you’re posting summary-level entries

Balance reconciliation sounds like something straightforward. In practice, it’s the step where you confirm that the high-level numbers coming from your sales channels align with the actual payouts released by payment processors.

It’s often confused with balance sheet reconciliation, but the two are very different. Balance sheet reconciliation happens inside your accounting system. The kind we’re talking about starts much earlier, right at the data source.

Batch entries group large volumes of transactions into clean daily, periodic or per-payout summaries. Instead of thousands of individual lines, you get a structured rollup of revenue, fees, discounts, taxes, refunds, and adjustments. But even if the summary looks complete, it still needs validation. A summary might show $10.000 in net revenue for the day, but the payout might be slightly lower or higher for reasons that aren’t immediately obvious.

Payout cycles, batch behavior, currency conversions, and late-arriving webhooks often create natural differences that need to be checked before syncing anything into your accounting platform. Balance reconciliation is the step that confirms the summary reflects reality, not just a theoretical total.

Why balance reconciliation matters in practice

You might assume that a payout and a summary should agree most of the time. After all, they’re describing the same sales, right? But once you start looking closely, you realize that platforms rarely move money and data on the same schedule. And that mismatch is exactly where reconciliation becomes more important than people expect.

For example, your Shopify sales for Monday look perfect and everything adds up. But the payout arriving on Wednesday includes part of Monday, part of Sunday, a few refunds from last week, and a small fee adjustment that was processed overnight. Technically, nothing is wrong, but if you try matching it manually, you’ll probably wonder where half of those numbers came from.

Or think about a Stripe dispute that gets resolved ten days after the sale. You already counted the original transaction in your summary. The payout that includes the reversal lands long after the original reporting period closed. Suddenly, your books show a dip you didn’t anticipate. Without reconciliation, you wouldn’t know why.

So this is why reconciliation matters so much. These timing differences aren’t exceptions but the norm. If you handle multiple channels or high-order volume, you experience them daily. The only way to keep your numbers trustworthy is to validate them before they enter your accounting software.

Introducing Synder’s new Balance Reconciliation feature for summarized journal entries

Synder’s summarized journal entries already help you manage high volumes of data without pushing thousands of individual transactions into your accounting system, including QuickBooks Online, Xero, NetSuite, and more. The solution provides the option to aggregate transactions daily, monthly, per payout, or for custom periods. But even with clean summaries, you still need to make sure those summaries create the correct financial story across a specific period.

That is exactly what the new Synder´s Balance Reconciliation feature is built for. Instead of reviewing summaries one by one or comparing payout reports manually, you can now check the accuracy of the entire period in one place. The feature shows whether your selected summaries match the expected starting balance and ending balance for the timeframe you’re reconciling. If something doesn’t line up, you see it immediately.

What this feature actually does

This feature acts like a financial checkpoint. Before your data travels into your accounting platform, you get a clear confirmation that everything inside that period aligns with the expected balances.

- It verifies that the summaries for your chosen period connect correctly from start to finish.

- It confirms that the ending balance produced by those summaries matches what the platform says it should be.

- It highlights discrepancies so you can understand whether they come from timing gaps, missing events, or integration issues.

- It works with both daily summaries and payout-based summaries, depending on how you structure your sync.

- It gives you full control over what enters your accounting system, because only reconciled summaries can be posted.

In short, instead of trying to rebuild the puzzle after it’s already inside your books, you validate it upfront, when corrections are far easier to make.

Want your reconciliations to feel clear, accurate, and easy to manage? Try Synder free or book a demo to see how every summary, payout, and balance connects seamlessly.

When reconciliation is complete: what clean books actually give you

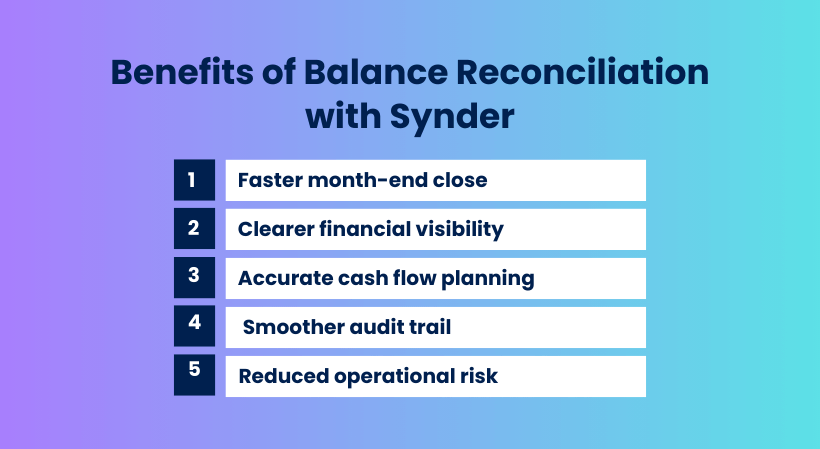

When a period reconciles cleanly in Synder, and your beginning and ending balances match exactly, the benefits go well beyond a tidy financial report. A reconciled period gives you clarity, control, and confidence in the data flowing into your accounting system. Here’s what that looks like in practice.

Faster month-end close

Once Synder confirms that the entire sequence of summaries connects correctly, you can move through your month-end process without stopping to question every payout or adjustment. There’s no need to chase down missing numbers or wonder whether a refund landed in the right period. Synder removes those interruptions by validating the flow before you ever start closing the books.

Clearer financial visibility

Because Synder ensures that each summary aligns with the actual balances reported by your payment platform, you get a precise picture of what happened during the period. Revenue, fees, taxes, discounts, refunds, and adjustments all sit where they belong. This makes internal reporting more accurate and helps you spot trends without double-checking whether the underlying data is correct.

More accurate cash flow planning

When Synder reconciles a period successfully, you gain a reliable view of how money moved in and out. You’re not left wondering why a payout looks slightly off or whether a timing gap will resolve itself later. Synder shows you the real activity behind the numbers, which makes forecasting and budgeting way easier and far more dependable.

A smoother audit trail

Every reconciled period is stored in Synder’s Reconciliation History page. If you ever need to revisit a cycle, you can see exactly which summaries were included and how the balances were matched. Instead of sorting through old exports or trying to remember which adjustment belonged where, Synder gives you a full record that is ready to review whenever you need it.

Less stress and fewer surprises

The real payoff is peace of mind. When Synder validates your summaries before they reach your accounting software, you avoid the frustration of unwinding errors later. You know your books reflect real activity, not assumptions. That confidence reduces cleanup work, minimizes corrections, and allows you to focus on decisions instead of tracking down discrepancies.

| Area of reconciliation | Manual process | Synder Balance Reconciliation |

| Data sources | Spread across multiple platforms and reports | Unified view inside Synder |

| Timing differences | Investigated by hand | Automatically validated through beginning and ending balances |

| Missing or delayed data | Hardly detectable without deep review | Highlighted immediately before reconciliation |

| Currency conversion | Manual calculations required | Fully accounted for in platform balances |

| Error risk | High, especially at scale | Reduced through automated checks and complete summaries only |

| Speed | Slow and repetitive | Fast, guided workflow |

| Confidence level | Depends on team skill and time available | Guaranteed by balance matching from start to end |

| Post-sync corrections | Common and time-consuming | Rare, because data is verified before syncing |

| Audit trail | Usually scattered across spreadsheets | Full history stored inside Synder |

Final thoughts: why Synder’s reconciliation approach sets your books up for long-term accuracy

When your summaries line up with the actual balances reported by your payment platform, everything that follows becomes easier. The month-end feels lighter. Reports become clearer. Forecasts start making more sense. Better yet, you’re no longer spending hours backtracking through payouts or trying to decode platform-specific behavior just to understand why something is off by a few dollars.

Synder’s Balance Reconciliation feature takes the uncertainty out of this process. Instead of hoping the numbers match, you see them match. Instead of trusting that a payout reflects the right activity, you confirm it directly. It means that you move through your financial workflow with grounded confidence.

FAQ: Balance reconciliation

What is the meaning of balance reconciliation?

Balance reconciliation is the process of confirming that the financial activity recorded in your system matches the actual balances reported by your payment platform for a specific period. In Synder, this means verifying that the beginning and ending balances produced by your daily, monthly, or payout-based summaries align with the platform’s real numbers before syncing anything into your accounting software.

What is the difference between balance reconciliation and balance sheet reconciliation?

Balance reconciliation checks whether your summaries match platform balances across a defined period. It happens before posting data to your accounting system.

Balance sheet reconciliation happens inside your accounting system. It involves comparing the balances of your asset, liability, and equity accounts against external statements to ensure your books remain accurate. They serve different purposes and occur at different stages of your financial workflow.

What is an example of reconciliation?

A simple example is reconciling a Stripe payout. Let’s say Stripe reports an ending balance of $5,000 for the week, but your summary totals show $4,950. Synder automatically aggregates all transactions, including fees, refunds, and adjustments, and matches them to your bank deposits. If there’s a late-arriving fee adjustment of $50, Synder will account for it when you run the reconciliation, automatically updating the balances. You simply review the summaries and trigger the final reconciliation inside Synder to confirm that beginning and ending balances now match exactly.