Running a successful business means keeping a close eye on the money that comes in your door and flows out (read: expenses).

Once upon a time, expense tracking was a manual process that required substantial time and resources — think many hours spent in Excel.

Thankfully, we’re not living in 2000 anymore, and business owners and their accounting teams have many automated systems to track expenses available at their fingertips. These automation tools streamline reconciliation, expense tracking, and invoice management for small businesses and LLCs.

It’s through financial data syncing that many small businesses are improving their accounting processes and reducing human errors by creating a single source of truth.

In this guide, we’ll explain how automated financial systems simplify expense tracking and make it easier to run your business.

Let’s dive in.

Contents:

1. What are automated financial systems (AFS)?

2. What are the challenges of manual expense tracking?

3. How to integrate expense tracking with your LLC’s financial systems

4. Top considerations for AFS data syncing

5. Best practices for automating expense tracking

6. Top automated expense tracking systems for LLCs

What are automated financial systems (AFS)?

Financial automation is the process of automating key workflows in your company’s central bookkeeping system. This specific business process automation relies on artificial intelligence (AI) and machine learning to study financial patterns and take over repeated sequences.

In other words, automated financial systems (AFS) help take care of mundane and repetitive financial processes, such as monthly expense tracking and payroll processing.

What’s more, AFS reduces the human margin of error, improves business efficiency, and frees up accounting teams to focus on other time-sensitive tasks.

TL;DR. Financial data syncing is the real-time adjusting of financial information for your LLC. For example, you can rely on financial data syncing to stay on top of daily expenses instead of waiting for monthly reports to gauge essential data, such as:

- Irregular spending habits

- Profit and loss

- Cash flow

- Revenue

Leveraging financial data syncing gives your accounting team the power to make real-time decisions that can ultimately impact (read: improve) your bottom line.

For businesses seeking external funding or reporting to investors, accurate bookkeeping is crucial. Investors and financial institutions appreciate transparency, and automated systems provide just that.

What are the challenges of manual expense tracking?

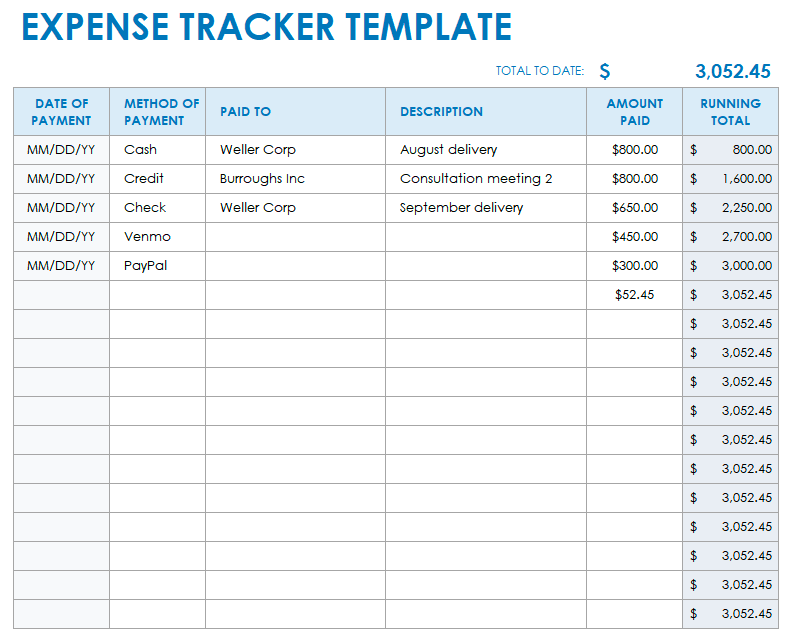

Manual expense tracking is a tedious and error-prone process. It involves collecting paper receipts, manually entering data into spreadsheets, and reconciling expenses with bank statements.

It’s like nails on a chalkboard. Misplaced receipts, data entry mistakes, and inaccurate calculations can lead to financial discrepancies and hinder decision-making.

Also, manual expense tracking makes gaining real-time insights into your LLC’s financial health extremely challenging. It’s nearly impossible to track expenses on time, identify trends, and make informed decisions to optimize your spending.

As Shane Barker once said about manual expense tracking: “’It’s like trying to capture a torrential downpour with a paper cup. But in today’s complex financial landscape, it’s more akin to doing so in a hurricane – overwhelming and nearly impossible to get it all right.”

Did you know that a common oversight for many LLCs is categorizing business meals or minor operational expenses? It’s easy for them to find themselves in heaps of receipts. By missing these deductibles, your LLC might end up overpaying thousands in taxes.

Meanwhile, the IRS also shells out penalties for inaccuracies or late tax filings due to messy expense tracking. This scenario can be crippling for small businesses. That’s where automated systems help you maximize all your deductibles, so you’re ready for tax season.

These challenges can impede the growth and profitability of your business. In other words, without investing in automation services, you’re holding your business back from its true potential.

It might take a few months (or even quarters) to figure out that you’ve been spending $100 a month on software that you don’t use. That’s money down the drain (read: lower profit margin).

How to integrate expense tracking with your LLC’s financial systems

The first step is choosing the right accounting software that already integrates or connects with your current LLC’s financial systems.

For instance, if you use Stripe to collect payments from your clients (or pay for services), you’ll want to look for an accounting software that offers a Stripe integration.

Or, if you need to file cryptocurrency taxes, you’ll want to seek tax software services that integrate with your primary crypto platform or wallet.

Why? This integration is the linchpin for seamless syncing of financial data between different systems, removing the need for manual data entry and reducing the risk of errors.

Thankfully, most accounting software services and AFS offer integration options with popular financial systems such as banks, credit card providers, and payment processors.

Connecting these systems allows you to automatically import transactions, categorize expenses, and reconcile accounts. The result? A holistic view of your LLC’s financial health.

Top considerations for AFS data syncing

If you’re ready to explore the benefits of automated financial systems, take a look at these basic considerations:

- Connect your financial accounts: Link your LLC’s bank accounts, credit cards, and payment processors to the expense tracking software. This step allows for the automatic importing of transactions.

- Categorize expenses: Set up expense categories that align with your LLC’s chart of accounts to paint an accurate picture of your spending for financial reporting purposes.

- Configure automation rules: Define rules within the software to automatically categorize expenses based on keywords or merchant names.

- Enable receipt scanning: Turn on this feature if your expense tracking software offers receipt scanning capabilities. It allows you to capture and store digital copies of receipts, removing the need for physical paperwork.

- Test and validate: Once your integrations are complete, test the syncing process to ensure that transactions are imported as expected and appear in your LLC’s financial systems.

Best practices for automating expense tracking

To maximize the benefits of automating financial data syncing, consider the following best practices.

Regularly review and reconcile

Even with automation, it’s essential to review and reconcile your LLC’s expenses and business wires regularly. That way, you can immediately check for accuracy and identify any discrepancies or potential issues in your AFS.

Train your team

Lending a hand to your employees responsible for expense tracking will give them the proper training they need to use the AFS and clearly outline your expense policies. You can even have your management subscribe to reports.

Pro tip: Consider creating a user-friendly manual or guide that staff can refer to when they’re unsure about any feature of the AFS. Store this information in an easy-to-access location like an internal website or wiki page.

Keep backups

While automation reduces the risk of data loss, it’s always prudent to keep backups of your financial data. Regularly export and store backups in a secure location to safeguard against unforeseen circumstances (like you see in the news).

Did you know? Cloud backup solutions often provide multiple layers of encryption, making it an excellent choice for safeguarding sensitive financial data.

Stay updated

Keep your expense tracking software and financial systems up to date with the latest versions and security patches. Like consumer technology, this step helps keep your LLC’s data safe and your AFS working like a well-oiled machine.

Insider’s note: Sometimes, new updates might have a learning curve. When such significant updates are released, consider having a refresher training session for your team.

Foster a collaborative environment

Financial data and insights, especially from the general ledger software and the AFS, are most useful when shared across relevant departments. Encourage teams to communicate and collaborate based on data from the AFS.

For example, if the marketing department identifies a surge in ad expenses, it should collaborate with the finance team to understand the reasons and assess its ROI.

Audit your automation rules periodically

Over time, the nature of your expenses or transactions might change. The rules you’ve set up for automation initially might no longer be applicable.

For instance, if you’ve pivoted from offering a service to a product-based model, the categorization of certain expenses might need revision. Periodically auditing and updating these rules protects accuracy in automated expense tracking.

Top automated expense tracking systems for LLCs

With the shift towards digital transformation, dozens of software platforms have emerged to cater to the specific needs of LLCs and small businesses.

These tools aim to streamline financial data syncing, automate reporting, and enhance the overall efficiency of automating bookkeeping tasks. Here are three top choices for your financial data synching needs:

1. Synder

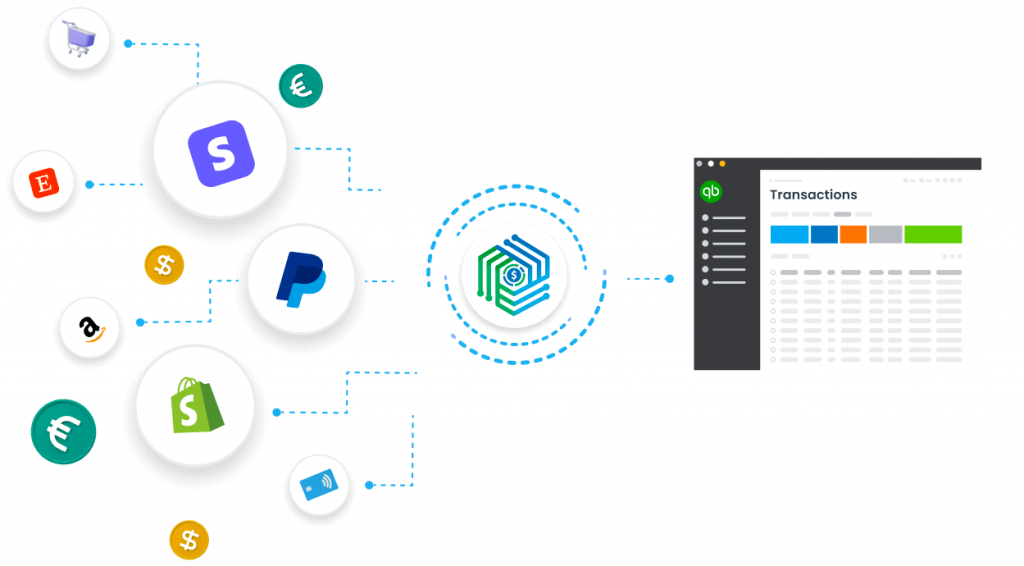

Synder is a robust accounting software solution designed to simplify accounting processes for businesses of all sizes. Growing ecommerce and subscription-based businesses particularly favor it for its powerful capability to connect all sales channels into one common ecosystem.

Features:

- Multi-platform integration: Synder effortlessly integrates with popular accounting software such as QuickBooks, payment platforms as Stripe, and more. It ensures real-time synchronization between your ecommerce platforms, payment processors, and accounting solutions.

- Transaction management: The software provides automatic recording, categorizing, and reconciliation of all sales and expenses. The result? Data accuracy while avoiding the tedious task of manual entries.

- Smart rules and automation: Users can set up custom rules to automate categorization and mapping, which means financial data is processed and stored based on the company’s unique needs.

- Advanced reporting: With its dynamic reporting capabilities, Synder allows businesses to generate in-depth financial reports, aiding in strategic decision-making.

- Multicurrency and tax handling: Perfect for LLCs with global operations. Synder can handle transactions in multiple currencies and help automate tax computations.

Pricing: Synder offers a transparent pricing model, catering to different business sizes and needs, with a free trial option available. Paid plans start at $48/month.

Why LLCs love it: The versatility and comprehensive feature set make Synder a go-to choice for many LLCs. Its ability to seamlessly consolidate data from various sources into one unified accounting platform is a significant draw.

2. FreshBooks

FreshBooks is an all-in-one invoicing and accounting solution tailor-made for small businesses and LLCs. It offers a suite of tools to manage expenses, track time, and get paid faster.

Features:

- Expense tracking: Automatically connect to your bank account and organize expenses effortlessly.

- Custom invoicing: Create professional invoices with ease, tailored to your branding.

- Time tracking: Especially useful for service-based LLCs, track time against specific clients or projects.

- Collaboration tools: Share files and discuss matters with clients right from the platform.

Pricing: FreshBooks offers various pricing plans based on the number of billable clients, with a 30-day free trial. Paid plans start at $17/month.

Why LLCs love it: Its simplicity, coupled with robust features, ensures even those without a financial background can manage their company’s finances with ease.

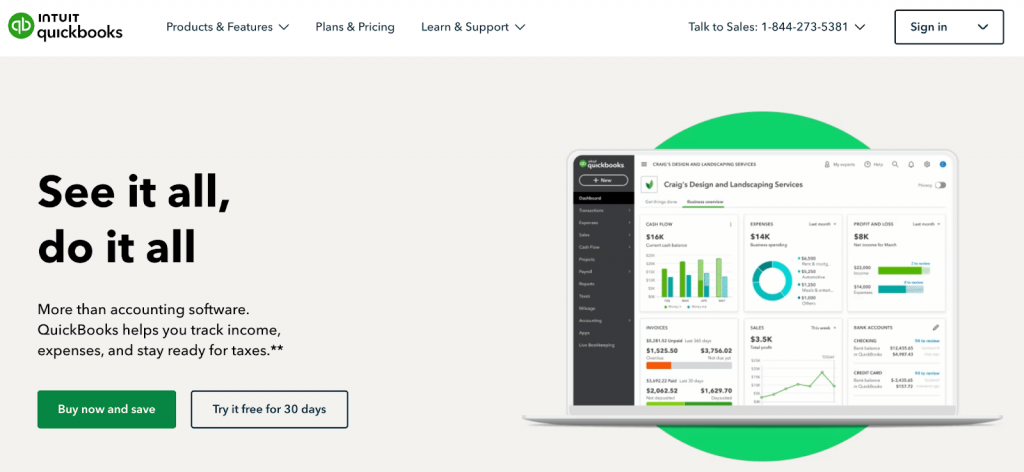

3. QuickBooks Online

A household name in the accounting software world, QuickBooks Online offers a cloud-based platform with many features suitable for LLCs.

Features:

- Income and expense tracking: Get a clear view of your finances at a glance.

- Invoice customization: Tailor invoices with the look and feel of your brand.

- Tax calculations: Automated tax calculations to comply with local tax regulations.

- Inventory tracking: Monitor stock levels and get reorder reminders.

Pricing: QuickBooks Online provides different pricing tiers based on features, with a 30-day free trial. Paid plans start at $30/month.

Why LLCs love it: Known for its reliability. QuickBooks Online offers comprehensive financial management tools in an easy-to-navigate interface.

Final words

And there you have it — automated financial systems allow you to streamline your important accounting processes.

As a business owner, that’s music to your ears. Now, you can rely on accounting automation to keep your accounts in order and focus on more urgent tasks and growth initiatives.

Also, automation helps give you peace of mind by making sure that you have the right services to:

- Pay invoices on time

- Seamlessly reconcile expenses to your bank statements

- Give your employees their paycheck (and for the right amounts)

Sounds idyllic, right?

Follow these simple tips and begin your path to syncing data across your automated financial systems. You won’t regret it. And neither will your bottom line.

And if you need help with technology transformation along the way, visit Synder’s site for a free demo.