One of the major changes in the financial industry has been the automation of the accounting process as business owners need quick, efficient, and cost-effective accounting services to solve their complex financial problems. Automated bookkeeping solutions use modern technology to cope with labor-intensive and prone-to-human-error tasks.

This guide will be very useful if you’re a small business owner and you want to understand how automated bookkeeping works. Let’s get into it!

Key takeaways:

- Accounting automation is a must in today’s bookkeeping. It cuts down on errors, accelerates financial procedures, saves on labor expenses, and scales with your company.

- Bookkeeping software is a fully automated process. It takes information from your bank, credit cards, and other accounts and transfers it to your system, reconciling and preparing reports.

- The automated bookkeeping software does everything from invoicing, expense tracking, bank reconciliations, report generation, and tax calculations.

Contents:

1. What is automated bookkeeping?

2. How automated bookkeeping works

3. Tips for choosing an automated bookkeeping tool

4. How Synder automates bookkeeping

What is automated bookkeeping?

Automated bookkeeping uses modern software, AI, and machine learning to replace the traditional accounting process. In fact, applying automation is much easier than spending hours doing the same tasks over and over again.

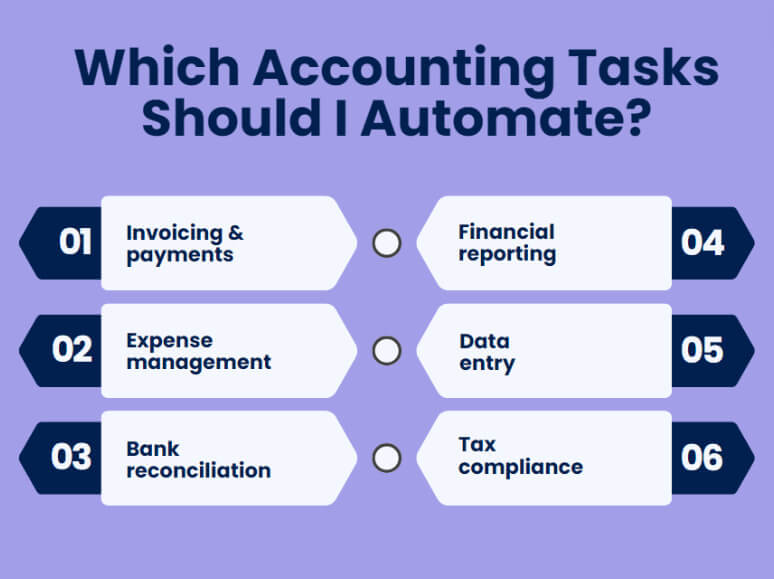

Now, let’s discuss some of the most important processes that can be effectively automated.

1. Invoices & payments

The application can generate, send, and track Accounts Payable and Receivable. Using accounts receivable automation software allows businesses to streamline invoicing and payment tracking, ensuring bills are paid on time while avoiding last-minute rushes and penalties.

2. Expense management

Expense automation can make life easier for everyone in your company. You can limit the amount of time spent tracking business expenses and eliminate the stressful administrative work that comes with filling out expense reports.

3. Bank reconciliation

This will help you match bank transactions with your records in a very efficient way so that you don’t spend a lot of time doing it. In addition, it’ll make it easier to spot vulnerable areas that need fixing. And you can make adjustments before things get out of control.

4. Financial reports

You can easily prepare financial reports, and balance sheets in a few clicks and monitor the financial health of the business. Automated reporting enables real-time financial projections and helps track them accurately.

5. Data entry

Automating the entry of financial transactions as well as data extractionIt eliminates manual work and possible errors.

6. Tax compliance

You can use automation to track tax documents and calculations. It prevents non-compliance with the tax laws by ensuring that all the documents required for tax filing are well arranged. It can also determine how much tax has to be paid and check on any legal allowances so that you don’t miss out on any benefits or make errors.

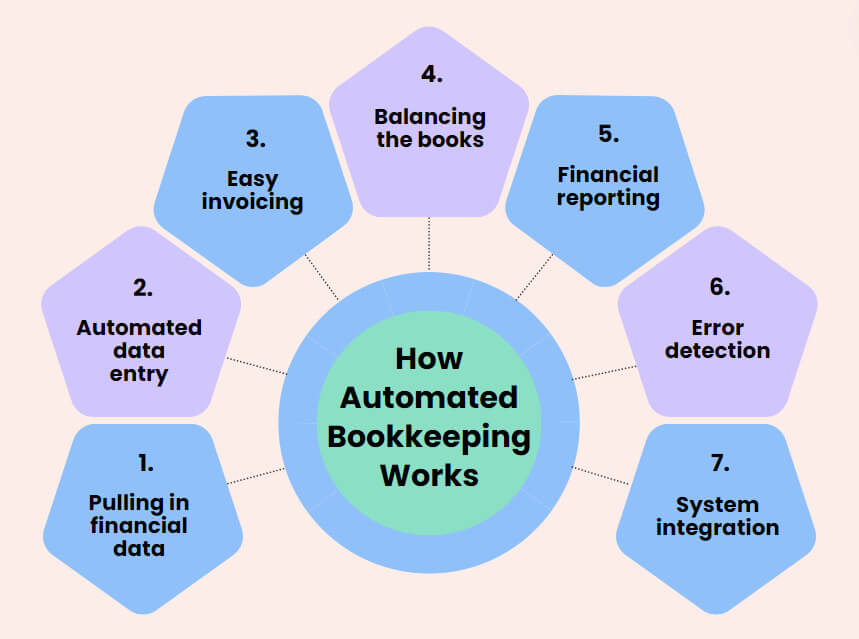

How automated bookkeeping works

The actual strength of the automated bookkeeping tools is that they can be integrated with various accounting systems and payment processors. It’s now time to describe how these systems usually function.

1. Pulling in financial data

Such systems sync data from various sources, such as bank accounts, credit cards, and payment processors. They also pull data from invoice and expense management systems.

2. Automated data entry

It’s designed to take the received data and put it into the correct bookkeeping software once it’s received.

3. Easy invoicing

The app automates Accounts Payable by creating, sending, and tracking invoices. Some systems can notify the customer when the payment is due or when it’s overdue.

4. Balancing the books

It compares the records of the bank with the records of the financial transactions and makes sure that they line up perfectly.

5. Generating financial reports

It easily produces income statements, balance sheets, business forecasts, and financial projections with the click of a button, giving you insights into financial health and assistance in strategic planning.

6. Spotting the slip-ups

Advanced algorithms and machine learning find discrepancies and potential issues before they become major problems.

7. Connecting all your systems

Automated systems work with other accounting software, CRM systems, and inventory management systems, ensuring constant data flow and a complete view of business operations.

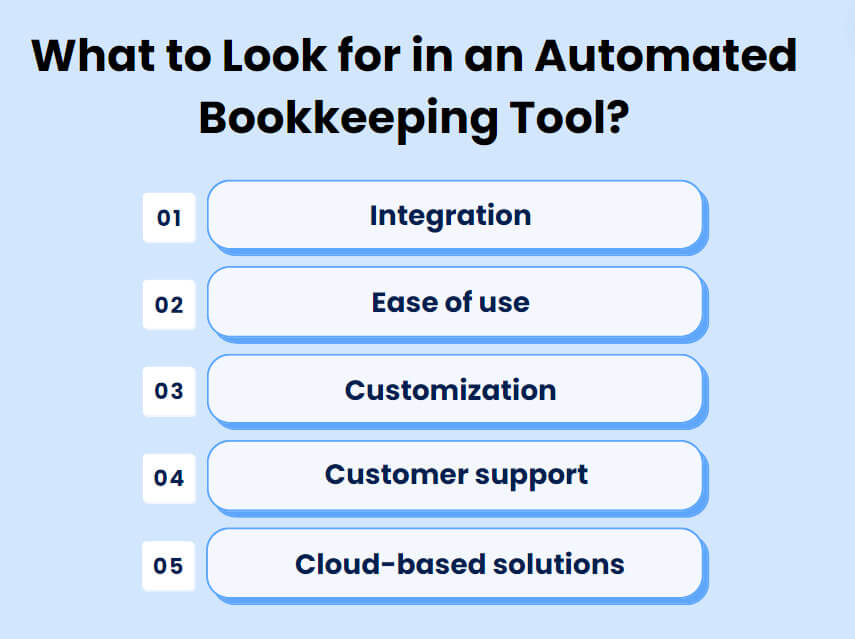

Tips for choosing an automated bookkeeping tool

Choosing the right automated bookkeeping software can make, break or fully automate your financial operations. A checklist will help you make the right decision.

- Tip 1. The tool should integrate seamlessly with your existing accounting system and payment processors.

- Tip 2. The software has to be user-friendly, which means requiring minimal training so that your finance teams can work effortlessly.

- Tip 3. It should be able to meet the needs of your particular accounting operations and the overall financial management.

- Tip 4. Ideally, you should select the app with reliable customer support to assist with any issues or inquiries.

- Tip 5. The app should give you the ability to upload your records to the cloud for safety purposes and also be easily accessible. This is particularly useful for small business owners and accounting professionals who may require data on the move.

How Synder automates bookkeeping

Accounting automation doesn’t replace accountants; it makes their work easier and more productive. To let accountants focus on important tasks like compliance and risk management, you should use an app for repetitive tasks such as syncing, categorizing transactions, and reconciling bank statements.

That’s where Synder comes in handy. This robust automation tool syncs with over 30 well-known platforms, including QuickBooks Online, Xero, and payment gateways like Stripe, Square, and PayPal. And there’s more:

- Synder automatically syncs sales and expense transactions from connected platforms into the accounting system. It handles multiple currencies and sales taxes and offers flexible syncing options.

- Synder automatically matches transactions from payment processors with corresponding bank deposits.

- It also groups and manages customers’ data and invoices and updates payments on its own.

- Synder tracks and sorts all the fees of transactions, refunds, and expenses, providing a full picture of financial spending.

- It automatically generates reports to assist businesses in making timely, informed decisions.

- Synder helps determine the sales tax, keep track of the taxes owed, and plan for taxes.

So using Synder, you’ll manage your business finances much more effectively and keep your bookkeeping in order.

Wrapping up

Automated bookkeeping solutions bring a shift in the way we manage finances. They cut down on manual work and provide real-time reporting, hence making financial management quite easy. Automated bookkeeping ensures that your financial information is organized and that everything is in its place without you having to lift a finger. In addition, such solutions balance your accounts with utmost speed and accuracy so that at any time, you will know where you stand financially or if you have the money available for financial obligations. As your business grows, using automated bookkeeping services like Synder can make your accounting simpler and help your business flourish.

Share your thoughts

Have you already jumped on the automation? Or are you planning to? In your opinion, what impact will automated bookkeeping have on your business? Please feel free to share your stories and opinions in the comments section below!