The landscape of financial reporting underwent a significant transformation with the introduction of ASC 606 by the Financial Accounting Standards Board (FASB) in the United States and IFRS 15 by the International Accounting Standards Board (IASB). These standards were developed with the intention of streamlining revenue recognition practices across industries and geographical boundaries. Before their implementation, revenue recognition practices varied widely, leading to inconsistencies that made it difficult for investors and stakeholders to compare the financial statements of entities across borders.

ASC 606 and IFRS 15 aim to remove inconsistencies and provide a more robust framework for addressing revenue issues. They apply to all contracts with customers, except for those that are within the scope of other standards, such as leases, insurance contracts, and financial instruments.

Now, let’s dive into more details.

→ Learn how to maximize revenue recognition efficiency with Synder.

The core principle of revenue recognition

Core principle of ASC 606

At the heart of ASC 606 is the principle that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled. This principle necessitates that entities evaluate the terms of their contracts and apply a five-step model to determine when and how much revenue should be recognized.

Core principle of IFRS 15

IFRS 15 shares the same core principle as ASC 606. It mandates that revenue from contracts with customers be recognized in a manner that accurately reflects the transfer of goods or services to customers at the transaction price. This alignment between ASC 606 and IFRS 15 represents a concerted effort by standard setters to ensure that revenue recognition practices are universally applicable and understandable.

Is IFRS 15 and ASC 606 the same?

IFRS 15 and ASC 606 are similar but not the same. Both standards govern revenue recognition from contracts with customers, but they were issued by different standard-setting bodies and used in different jurisdictions.

IFRS 15: Issued by the International Accounting Standards Board (IASB), IFRS 15 is used by companies following International Financial Reporting Standards. It provides guidance on recognizing revenue from contracts with customers and applies to most revenue arrangements, including the sale of goods, services, and intangible assets. IFRS 15 was issued in May 2014.

ASC 606: Issued by the Financial Accounting Standards Board (FASB) in the United States, ASC 606 is part of the Accounting Standards Codification (ASC) and is the standard for revenue recognition under US Generally Accepted Accounting Principles (GAAP). Similar to IFRS 15, ASC 606 provides a five-step model to recognize revenue from customer contracts. It was issued in May 2014, alongside IFRS 15, as part of a joint effort between the FASB and IASB to harmonize revenue recognition standards globally.

While both standards aim to provide a more robust framework for revenue recognition that is applicable across industries and sectors, similar to the principles outlined in ASC 842 for lease accounting, there are some differences in their specific requirements and applications due to the differing principles underlying IFRS and US GAAP. However, the core principle of recognizing revenue in a way that reflects the transfer of promised goods or services to customers at an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services is consistent between the two standards.

What is the major difference between IFRS and US GAAP as regards revenue recognition practices?

A major difference between IFRS (International Financial Reporting Standards) and US GAAP (United States Generally Accepted Accounting Principles) regarding revenue recognition practices lies in the detailed guidance and application specifics, despite both having converged significantly with the adoption of IFRS 15 (“Revenue from Contracts with Customers”) and ASC 606 (“Revenue from Contracts with Customers”), respectively. Before this convergence, the differences were more pronounced, but even after adopting these aligned standards, nuances remain.

One notable difference is in how each framework deals with the capitalization of costs to obtain and fulfill a contract:

Capitalization of contract costs:

IFRS 15 requires an entity to recognize an asset from the costs to obtain or fulfill a contract with a customer if those costs are expected to be recovered. The standard specifies that costs to obtain a contract that are incremental and would not have been incurred if the contract had not been obtained (e.g., sales commissions) should be recognized as an asset. Similarly, costs to fulfill a contract need to meet specific criteria to be capitalized, focusing on whether they are directly related to a contract, enhance the resource to fulfill future contracts, and are expected to be recovered.

ASC 606 also requires the capitalization of incremental costs of obtaining a contract and certain costs to fulfill a contract. However, US GAAP provides more detailed guidance on the amortization and the impairment testing of such capitalized costs. It specifies the period over which the capitalized costs should be amortized, which is generally over the transfer of the goods or services to which the asset relates. ASC 606 also includes specific examples and scenarios, offering a more prescriptive approach than IFRS 15.

The convergence of IFRS and US GAAP through IFRS 15 and ASC 606 has significantly reduced the differences in revenue recognition practices. However, entities applying these standards need to be mindful of the remaining differences, especially those with international operations that may require compliance with both IFRS and US GAAP.

Leverage accounting automation! Embrace the powerful capabilities of Synder as it transforms your revenue recognition process into an automated and seamless experience.

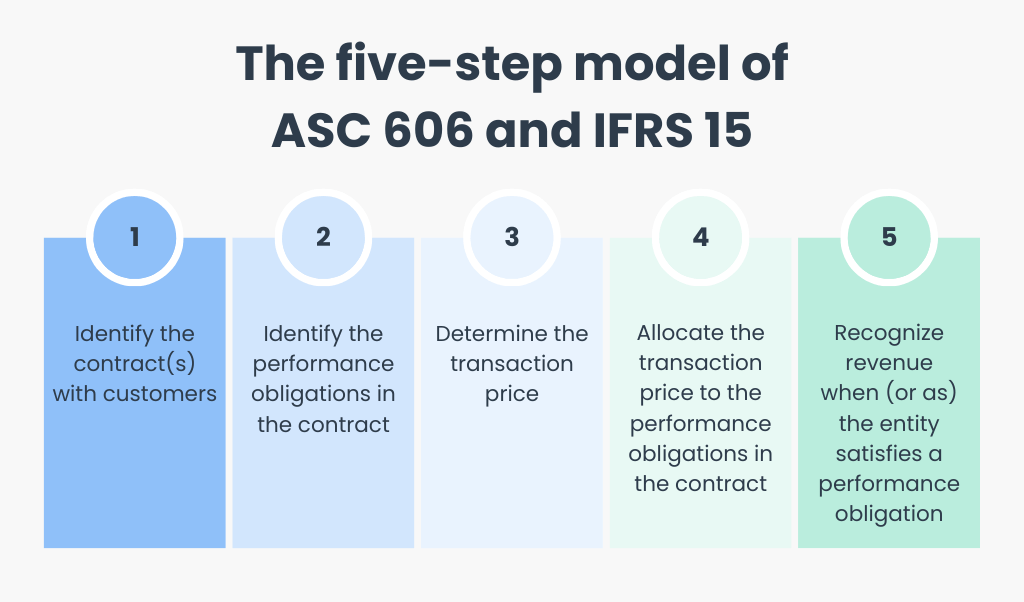

Five-step model of ASC 606

The five-step model of ASC 606 was introduced by the Financial Accounting Standards Board (FASB) as part of the Accounting Standards Codification (ASC) Topic 606. It aims to create a more standardized and transparent method for reporting revenue across industries.

- Identify the contract(s) with a customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations in the contract.

- Recognize revenue when (or as) the entity satisfies a performance obligation.

This process requires significant judgment, particularly in identifying performance obligations and determining the transaction price, which may include variable consideration.

1. Identify the contract(s) with a customer

A contract is an agreement between two or more parties that creates enforceable rights and obligations. The first step involves identifying the contract with a customer. A contract can be written, oral, or implied by an entity’s customary business practices. It must be approved by the parties, have identifiable payment terms, have commercial substance, and it must be probable that the entity will collect the consideration to which it will be entitled in exchange for the goods or services it transfers to the customer.

2. Identify the performance obligations in the contract

A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. The second step requires an entity to identify all the performance obligations in the contract. A good or service is distinct if the customer can benefit from it on its own or together with other readily available resources and if it is separately identifiable from other promises in the contract.

3. Determine the transaction price

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties. This step involves determining the transaction price, which may include fixed amounts, variable considerations, and may also require an adjustment for the time value of money if there is a significant financing component present in the contract.

4. Allocate the transaction price to the performance obligations in the contract

Once the transaction price has been determined, it must be allocated to each specific performance obligation in the contract in proportion to the standalone selling prices of the goods or services underlying each performance obligation. If a standalone selling price is not directly observable, it must be estimated considering available information.

5. Recognize revenue when (or as) the entity satisfies a performance obligation

Revenue is recognized when a performance obligation is satisfied by transferring a promised good or service to a customer. A good or service is transferred when (or as) the customer obtains control of that good or service. Revenue can be recognized at a point in time or over time, depending on when control of the good or service is transferred to the customer.

Five-step model of IFRS 15

IFRS 15 adopts an identical five-step approach, underscoring the global convergence on recognizing revenue. The application of this model ensures that entities recognize revenue in a way that closely reflects the transfer of goods and services to customers, irrespective of the industry or the complexity of the transaction.

Similarities and differences between ASC 606 and IFRS 15

Developed through a collaborative effort between the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), these standards are built on a common framework with numerous similarities in principles and application. Here are the key similarities between ASC 606 and IFRS 15:

1. Core principle

Both standards are based on the core principle that an entity will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

However,

ASC 606 offers detailed implementation guidance to determine whether an entity is acting as a principal or an agent in a transaction. This determination affects how revenue is reported (gross revenue vs. net).

IFRS 15 provides indicators for assessing whether an entity is a principal or an agent but does not have as extensive implementation guidance as ASC 606. The principles are similar, but the application can differ due to the level of guidance provided.

2. Recognition of revenue over time or at a point in time

Both standards provide criteria for recognizing revenue over time, which is a significant shift from previous practices under certain circumstances. If these criteria are not met, revenue is recognized at a point in time.

3. Disclosure requirements

ASC 606 and IFRS 15 both have enhanced disclosure requirements compared to previous standards. These requirements are intended to provide more detailed information about an entity’s revenue recognition practices, contract balances, performance obligations, and significant judgments.

However, while both standards significantly enhance the disclosure requirements for revenue recognition, there are differences in the specifics of what is required.

ASC 606 has detailed disclosure requirements tailored to the needs of U.S. GAAP stakeholders.

IFRS 15’s disclosure requirements are designed for a global audience and may result in differences in the type and amount of information disclosed, especially regarding disaggregation of revenue and information about performance obligations.

4. Variable consideration

ASC 606 and IFRS 15 both address how to deal with variable consideration, including estimates of variable consideration and constraints on the amount of variable consideration that can be recognized.

While both standards have a threshold for recognizing variable consideration, they differ slightly in how they articulate the constraint on variable consideration.

ASC 606 requires that variable consideration is only recognized to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is resolved.

IFRS 15 uses a slightly different threshold, stating that revenue from variable consideration can be recognized only when it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur.

5. Contract costs

Both standards provide guidance on accounting for incremental costs of obtaining a contract and costs to fulfill a contract, including criteria for when these costs should be capitalized and amortized.

6. Applicability across industries and transactions

Both standards are designed to apply to a wide range of transactions and industries, aiming to improve comparability and understanding of revenue recognition practices across different sectors and capital markets.

Conclusion

The adoption of ASC 606 and IFRS 15 has marked a significant milestone in the standardization of revenue recognition practices worldwide. By understanding and applying these standards, entities can ensure greater transparency, comparability, and reliability in their financial reporting, ultimately benefiting all stakeholders in the financial ecosystem.

FAQs: ASC 606 vs IFRS 15

What are the main differences between ASC 606 and IFRS 15?

While fundamentally aligned, the standards differ in specific areas such as the treatment of contract costs and the criteria for recognizing revenue over time.

How do the disclosure requirements under ASC 606 and IFRS 15 compare?

Both standards have robust disclosure requirements aimed at enhancing transparency and comparability, although the specifics may vary slightly between ASC 606 and IFRS 15.

What challenges do companies face when implementing these standards?

Entities may encounter challenges related to system upgrades, contract reviews, and the need for increased judgment and documentation.

How have the new revenue recognition standards impacted the technology sector?

The technology sector has seen changes in revenue recognition practices, particularly for software and service contracts, requiring adjustments in accounting and reporting processes.

Can you provide examples of how companies have successfully transitioned to ASC 606 or IFRS 15?

Successful transitions often involve early preparation, leveraging technology, and engaging cross-functional teams to address the complexities of the new standards.

Is ASC 606 under GAAP?

Yes, ASC 606 is under GAAP. ASC 606 provides the framework for revenue recognition under U.S. GAAP and was developed to standardize how companies across various industries recognize revenue from contracts with customers. It replaced previous revenue recognition guidance and aimed to improve comparability, transparency, and consistency in revenue recognition practices across industries and capital markets.

Is ASC 606 part of IFRS?

No, ASC 606 is not part of IFRS. As said above, ASC 606, issued by the Financial Accounting Standards Board (FASB), is the standard for revenue recognition under U.S. Generally Accepted Accounting Principles (GAAP).

IFRS has a corresponding but separate standard for revenue recognition, IFRS 15 “Revenue from Contracts with Customers”, issued by the International Accounting Standards Board (IASB). Although ASC 606 and IFRS 15 are the result of a joint project between the FASB and the IASB and share the same core principle and a five-step model for recognizing revenue, they are part of two distinct accounting frameworks. IFRS is used in many countries around the world, while U.S. GAAP, including ASC 606, is used primarily in the United States.

Share your experience

How have these standards impacted your financial reporting? What strategies have you found most effective in managing the transition? Are there any tips or pitfalls you’d like to share?

Leave your comments below! Let’s learn from each other and continue to grow together!