Suppose that you own a small design firm. A client just ordered $10,000 worth of work, but instead of paying in advance, they’ll pay the invoice in 30 days. You’re excited! But until that money hits your cash account, it’s no more than an accounts receivable (AR) balance—a promise to pay.

Tracking accounts receivable properly means you always know how much customers owe you and when payments are due. You might think you have more cash than you actually do, leading to financial missteps.

This guide will walk you through the right way to record accounts receivable journal entries, what makes accounts receivable journal entries important, how AR impacts financial statements, and how automation can simplify the process.

Contents

Key takeaways

Here are a few quick tips for busy biz owners and their teams seeking to streamline their AR processes:

- AR impacts financial statements differently: While revenue is recorded on the income statement when earned, AR is an asset on the balance sheet and a potential drain on the cash flow statement. You need to understand these differences in order to interpret finances correctly.

- Accurate journal entries for accounts receivable are the key to financial health: Knowing how to debit and credit accounts receivable correctly for sales, payments, partial payments, bad debt write-offs, and discounts makes your books accurately reflect your financial situation and prevents cash flow surprises.

- Proactive AR management improves cash flow and reduces risk: Regularly tracking AR, using aging reports, and following up on overdue invoices are vital for ensuring sound cash flow, making solid business choices, and reducing bad debt risk.

- Automation simplifies AR and makes it more efficient: Tools like Synder automate AR tasks, eliminating manual data entry, providing real-time financial reporting, and facilitating automated payment reminders, which both save time and minimize errors.

Want to know more? Keep reading.

Where do accounts receivable go in financial statements?

Though accounts receivable (AR) isn’t cash in hand, it has a vital impact on your financials, influencing how profitable and stable your business looks.

Balance sheet

Think of your accounts receivable as a short-term asset, like a promise of payment. It sits on your balance sheet until the money is collected. A bakery with $10,000 of unpaid invoices will count this money as an asset, and that makes the company worth more on paper overall.

Income statement

Here’s where things get interesting. Even though you haven’t been paid, revenue from credit sales is still recognized on your income statement when the sale happens. What that means is your bakery’s book record may reflect excellent earnings, even though cash has not yet flowed.

Cash flow statement

But when you switch to the cash flow statement, the reality hits—unpaid invoices translate to no real cash flow. This is where businesses may get themselves into trouble. They have lots of revenue, believe they’re doing great, but at the same time, they can’t pay expenses since they’re still awaiting payment.

What it comes down to is that if you don’t keep tabs on accounts receivable, your company can fall into a dangerous cycle: you’re selling things, you’re recording revenue, but you’re not having sufficient actual cash in the bank to cover ingredients, payroll, and rent. So, good AR management is not merely a matter of posting transactions, but of keeping your company solvent.

Journal entry for accounts receivable: Debit or credit?

A typical question about recording accounts receivable is: Should we debit or credit accounts receivable? A typical response is: Well, it depends.

- When you sell a good or service on credit, you record accounts receivable as a debit because it increases the money owed to your business.

- When the customer pays, you record accounts receivable as a credit because it decreases the balance owed.

Example: Your business is graphic design and you do a $5,000 project on credit for a customer.

Journal entry for a credit sale

- Debit: Accounts Receivable – $5,000

- Credit: Revenue (Service) – $5,000

This entry records the sale and shows that your client owes you money.

Now, what happens when your client pays you?

Journal entry when the customer pays

- Debit: Cash Account – $5,000

- Credit: Accounts Receivable – $5,000

This ensures your books reflect cash received and remove the outstanding invoice from receivables.

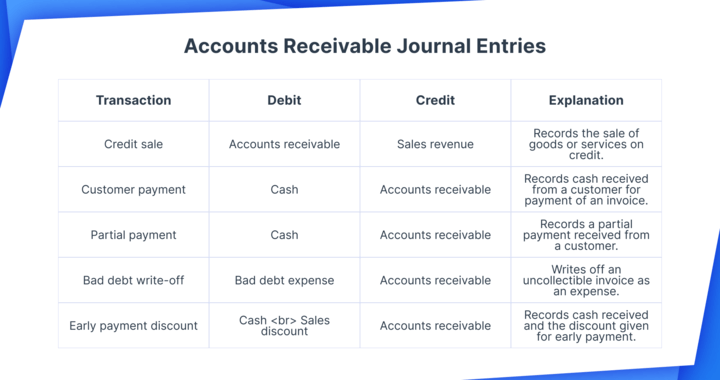

Other common accounts receivable journal entries

Beyond simple credit sales and payments, there are several other transactions involving accounts receivable journal entries.

Journal entry for recording a partial payment from a customer

Sometimes, customers make partial payments instead of paying the full invoice at once.

Example: A client pays $2,000 toward a $5,000 invoice.

- Debit: Cash Account – $2,000

- Credit: Accounts Receivable – $2,000

Note: The remaining balance of $3,000 stays in accounts receivable until fully paid.

Journal entry for writing off a bad debt (unpaid invoice)

If a customer fails to pay after multiple attempts, the business may write it off as a bad debt expense.

Example: Writing off a $1,000 uncollectible invoice.

- Debit: Bad Debt Expense – $1,000

- Credit: Accounts Receivable – $1,000

Journal entry for applying an early payment discount

Some businesses offer discounts for early payments to encourage faster cash flow.

Example: A customer pays early and gets a 5% discount on a $5,000 invoice.

- Debit: Cash Account – $4,750

- Debit: Sales Discount – $250

- Credit: Accounts Receivable – $5,000

These variations highlight the flexibility needed in managing receivables properly.

Here’s a short recap.

How accounts receivable impacts your business financials

Managing AR correctly improves cash flow and financial health. Key benefits include:

Improved cash flow

You know, 82% of companies go out of business because of cash flow issues, a great many of which are the result of poor AR management? Cash flow is oxygen for a business. It’s having funds available when you require them to pay bills, invest in growth, or simply keep the lights on. When you manage accounts receivable efficiently, you always have visibility into when payments are due, so it’s easier to plan for future expenditures without getting blindsided.

For example, if you see that some large invoices are due for payment in two weeks’ time, you might decide to postpone a large purchase until the money is actually in the bank. Similarly, if too many payments are overdue, you will know it’s time to start following up with customers before you run into serious liquidity problems.

Better decision-making

Suppose you’re thinking of expanding your business—perhaps adding employees or opening another store. You take a look at your income statement, and the revenue is strong. But if a significant amount of that revenue is still locked up in unpaid invoices, you could be making financial decisions based on money that’s not actually in hand yet.

By monitoring accounts receivable closely, you get a clearer picture of your true financial position. Instead of assuming that you can manage a hefty investment, you’ll have an exact idea of when cash will be arriving, and thus be able to make smarter, timely business choices.

Reduced bad debt risk

One of the worst risks businesses face with accounts receivable is bad debt—money that is never received. A customer places a big order, but after months of delay, it turns out they won’t be paying after all. Suddenly, what appeared to be a profitable sale turns into a financial loss.

Studies show that approximately a third of businesses report having approximately 20% of their accounts receivable more than 90 days overdue. In addition, nearly 95% of businesses have experienced late invoice payment within the last 12 months.

Tracking AR regularly allows companies to identify overdue accounts sooner, so they can act—by sending reminders, arranging a payment schedule, or bringing the issue to a head before it is too late.

A regularly updated aging report (which lists unpaid bills by how long they’ve been overdue) assists companies in getting problems under control before they get out of hand. The longer a bill is outstanding, the more difficult it is to collect.

How to automate accounts receivable

Drowning in overdue invoices? Facing tedious manual AR tracking riddled with errors? Put an end to the madness!

Synder automates your accounts receivable, turning mayhem into harmony. Picture it: you can automatically record transactions from Shopify, Stripe, Amazon, and 30+ other channels seamlessly and precisely recorded in Xero, QuickBooks, or Sage Intacct—all with one tool.

No more reconciliation headaches. No more manual data entry. Synder provides real-time financial reporting, giving you laser-like visibility into your cash flow. And with automated, personalized payment reminders, customers are gently nudged, reducing bad debt risk and improving your bottom line.

Get your time back, cut out mistakes, and have financial peace of mind. Experience the Synder difference with a 15-day free trial.

Final thoughts

Steer clear of the trap of bad AR management by understanding how it affects your balance sheet, income statement, and cash flow. Accurate and clear journal entries, regular monitoring, and automation using Synder are your secrets to avoiding cash flow disasters and making good financial choices.

If you’re ready to strengthen your AR process, join our Weekly Public Demo and learn how to secure your business’s financial future.

FAQ

What’s the difference between AR and revenue?

Consider revenue the entire pie, and that is all income from sales, whether or not it has been received. Accounts receivable is a slice of the pie, and that’s how much your customer owes for credit purchases. Revenue is recorded when the sale occurs, but AR remains an asset on your balance sheet until you receive the payment.

How does AR affect cash flow?

AR affects cash flow by causing a lag between cash receipt and revenue recognition. As AR represents money not received yet, companies might face cash deficit in cases of delayed payments. Proper tracking of pending invoices provides effective liquidity management and ensures a smooth cash flow.

How to age accounts receivable?

To age accounts receivable, categorize unpaid invoices by how long they’ve been outstanding. Common aging periods include:

- 0–30 days (current)

- 31–60 days (past due)

- 61–90 days (overdue)

- 90+ days (high risk of bad debt)

This helps track overdue payments and manage collections effectively.

What happens if a customer never pays?

In this case, the company can write off the unpaid invoice as bad debt and record it as an expense. This lowers accounts receivable and records the financial loss on the income statement. Timely AR tracking and follow-ups reduce the risk of bad debts.

How do you write off old accounts receivable?

To write off old accounts receivable, either use the allowance method by crediting allowance for doubtful accounts and debiting bad debt expense or you can use the direct write-off method by crediting accounts receivable and debiting bad debt expense. This eliminates uncollectible amounts from your financial statements.

What are the GAAP rules for accounts receivable?

GAAP rules for accounts receivable require businesses to:

- Recognize revenue when earned (accrual accounting).

- Report AR as a current asset on the balance sheet.

- Estimate bad debts using the allowance method.

- Disclose AR details in financial statements.

These rules ensure accurate financial reporting and compliance.