QuickBooks has dominated small business accounting for decades, but it’s not the only option on the market. The global accounting software market was valued at $19.38 billion in 2024 and is projected to reach $31.25 billion by 2030, reflecting an 8.4% annual growth rate. This expansion has brought dozens of viable alternatives that address QuickBooks’ common pain points. Whether you’re a freelancer overwhelmed by QuickBooks’ complexity, a growing business bumping against user caps, or a CFO frustrated with slow reconciliation, there’s likely a better-fit solution.

This article breaks down the top QuickBooks alternatives for 2026, comparing features, pricing, and automation capabilities to help you make an informed switch. We’ll cover everything from free options like Wave to enterprise solutions like NetSuite.

TL;DR

- Businesses look beyond QuickBooks due to rising costs, user limits, cluttered features, and inconsistent support as operations grow more complex.

- QuickBooks alternatives often offer simpler pricing, cleaner interfaces, unlimited users, and better alignment with specific business models or industries.

- Most alternatives still fall short on multi-channel ecommerce data, historical imports, and GAAP-compliant revenue recognition without manual work.

- Accounting automation tools like Synder fill these gaps by syncing sales, fees, taxes, and subscriptions automatically across platforms.

- The best setup combines the right accounting software with automation, reducing manual work, keeping books clean at scale, and avoiding future migrations.

Why consider a QuickBooks alternative?

QuickBooks works well for many businesses, but as operations become more complex, recurring limitations start to surface. Cost pressure, workflow friction, and collaboration constraints are the most common reasons teams begin evaluating other accounting platforms.

- Rising subscription costs – Pricing increases are frequent and often not tied to meaningful feature improvements, costs scale quickly for multi-entity businesses and teams with multiple users, and alternative platforms often provide simpler pricing with lower long-term spend.

- Feature overload paired with missing essentials – The interface includes many features smaller teams never use, while core needs like multi-currency, project profitability, or advanced reporting often require paid add-ons, pushing businesses to consider leaner platforms focused on accounting automation and clarity.

- Customer support limitations – Users frequently report long response times and scripted support experiences, with limited ability to resolve complex accounting issues, whereas many alternatives offer faster access to knowledgeable specialists or dedicated account managers.

- Collaboration and user access constraints – User caps and per-seat pricing make collaboration expensive, growing teams struggle to provide access to accountants, managers, and reviewers, and some competing platforms remove these limits by offering unlimited users by default.

Switching accounting software requires planning and data migration, which makes the evaluation stage especially important.

What to expect from QuickBooks alternatives

Before comparing specific platforms, it’s important to understand what typically improves when you switch and what gaps often remain without automation.

Key benefits of switching

QuickBooks alternatives often offer lower costs and simpler pricing, especially for small teams and multi-user setups. Many platforms remove per-user fees and focus on core accounting functions without pushing businesses into higher tiers.

Interfaces are usually cleaner and easier to learn, which reduces onboarding time for non-accountants. Some tools also provide industry-specific features that fit certain business models better than QuickBooks’ general-purpose approach.

Many alternatives place stronger emphasis on flexible integrations and modular pricing, letting businesses pay only for what they use instead of bundled features they don’t need.

Common limitations across alternatives

Most accounting platforms still struggle with multi-channel sales automation. Bank feeds work well, but ecommerce and payment data often require manual CSV imports, reformatting, and reconciliation.

Integration gaps are common. A platform may sync one sales channel but fail to handle marketplace fees, refunds, or tax logic correctly across multiple providers. Categorization rules are often too rigid for businesses operating across regions or revenue streams.

Historical data and revenue recognition remain pain points. Many tools limit how far back data can be imported, and few support GAAP-compliant subscription revenue recognition without spreadsheets or workarounds.

How automation tools address these gaps

This is where accounting automation tools like Synder complement accounting software. Synder connects accounting platforms with 30+ ecommerce and payment systems, handling what core accounting tools don’t.

- Sales, fees, refunds, and taxes sync automatically from dozens of platforms, eliminating manual CSV imports and reformatting.

- Smart Rules apply consistent categorization by product, location, tax logic, or sales channel without manual review.

- Historical data can be imported years back with minimal effort, preserving full financial history.

- Automated revenue recognition keeps deferred revenue and monthly recognition GAAP-compliant for subscription businesses.

- Flexible sync modes support both per-transaction detail and clean ,daily, monthly, per payout or custom-period summaries for high-volume operations.

- Balance reconciliation validates that summary data matches platform-reported balances before syncing, preventing discrepancies from timing differences and ensuring clean month-end closes.

Together, an accounting platform plus automation creates a more reliable, scalable setup than either solution alone, letting you choose software based on reporting and usability without sacrificing data accuracy or control.

Ready to automate your accounting workflow? Start Synder’s 15-day free trial or schedule a demo to see how it works with your specific workflow.

Top QuickBooks alternatives for 2026

Here’s an in-depth look at the strongest QuickBooks competitors, from enterprise-grade systems to free solutions for startups.

1. Xero

Xero consistently ranks as the top QuickBooks alternative, combining similar functionality with better usability and pricing. Founded in 2006, Xero now serves over 4 million subscribers worldwide, with particular strength in markets outside the United States.

Core features

- Comprehensive accounting with accounts payable/receivable, bank reconciliation, inventory tracking, and multi-currency transactions

- Hubdoc included in all plans for automated bill and receipt capture

- Strong mobile app matching desktop functionality for approvals, invoicing, and reporting

- Project tracking tools for time, expenses, and budget monitoring

- Customizable reporting with class, location, and custom tracking category options

- Purchase order management and expense claims handling

Pricing

| Plan | Price | Features |

| Early | $15/mo | 20 invoices, 5 bills, basic reporting |

| Growing | $38/mo | Unlimited invoices/bills, multi-currency |

| Established | $65/mo | Advanced reporting, analytics, expense claims |

All tiers include unlimited users, a significant advantage over QuickBooks’ user restrictions.

Ideal for

Xero is a good fit for growing businesses needing collaborative access across teams, international companies requiring multi-currency support, and organizations wanting simpler interfaces than QuickBooks provides.

How Synder automates Xero workflows

Synder syncs transactions from 30+ platforms directly into Xero using either Per Transaction mode (detailed data for each sale) or Summary Mode (consolidated journal entries for high-volume businesses). Synder’s automated sync with proper categorization, multi-currency handling, and subscription revenue recognition lets you cut reconciliation time from days to minutes.

2. Sage Intacct

Sage Intacct provides cloud-based financial management designed specifically for growing mid-market organizations that have outgrown QuickBooks but don’t need NetSuite’s full ERP complexity. The platform excels at multi-entity accounting, dimensional reporting, and workflow automation.

Core features

- Multi-entity consolidation with inter-company transactions and global currency management

- Dimensional reporting system (slice data by department, location, project, custom dimensions)

- Advanced automation workflows for purchasing, expenses, and journal entry approvals

- ASC 606 revenue recognition for subscription businesses

- Industry-specific editions for nonprofits, healthcare, hospitality, construction, and professional services

- 350+ pre-built integrations through Sage Intacct Marketplace plus open APIs

- Project accounting with time tracking, contract billing, and resource management

Pricing

Sage Intacct uses custom quote-based pricing starting around $15,000-$20,000 annually for basic configurations. Most mid-market companies invest $25,000-$35,000 yearly depending on user count, required modules, and entities. Implementation costs typically run 1-1.5x the annual subscription, ranging from $15,000-$50,000 for most deployments.

Ideal for

Sage Intacct works well for companies with $10M+ revenue, multi-entity organizations requiring consolidated reporting, businesses needing industry-specific accounting features, and companies preparing for rapid expansion or eventual IPO.

How Synder automates Sage Intacct workflows

Synder connects ecommerce platforms and payment processors to Sage Intacct using Summary Sync mode, which consolidates transactions into batch journal entries – ideal for the high transaction volumes typical of mid-market companies. The integration automatically maps transactions to Intacct’s dimensional structure (departments, locations, projects, custom dimensions) and routes data to appropriate entities for multi-subsidiary organizations.

3. NetSuite

NetSuite goes beyond accounting to provide full enterprise resource planning (ERP), making it the choice for mid-size to large companies outgrowing QuickBooks Enterprise. Oracle acquired NetSuite in 2016, bringing enterprise backing to the cloud-based platform.

Core features

- Complete ERP integrating accounting with CRM, inventory, order fulfillment, and procurement

- Multi-subsidiary management across countries and currencies

- Advanced revenue recognition for GAAP compliance

- Real-time dashboards, customizable reports, and sophisticated analytics

- Department-spanning workflow automation (quote-to-cash, purchase approvals)

- Industry-specific editions for manufacturing, wholesale distribution, professional services

Pricing

NetSuite uses custom enterprise pricing starting around $999 monthly for core financials, with typical deployments ranging from $3,000-$10,000+ monthly depending on modules, users, and transaction volume. Implementation costs run $25,000-$100,000+ for most mid-market deployments. Annual contracts are standard, with costs often exceeding $100,000 yearly for growing companies.

Ideal for

NetSuite is suitable for mid-market to enterprise companies needing integrated ERP, multi-national operations requiring global accounting, and fast-growing businesses wanting to avoid future software migrations.

How Synder automates NetSuite workflow

Synder brings multi-channel ecommerce data into NetSuite through the Summary Sync mode, generating aggregated journal entries that keep your books clean and organized. Multi-entity organizations benefit from automatic transaction routing to the correct subsidiaries based on your business logic.

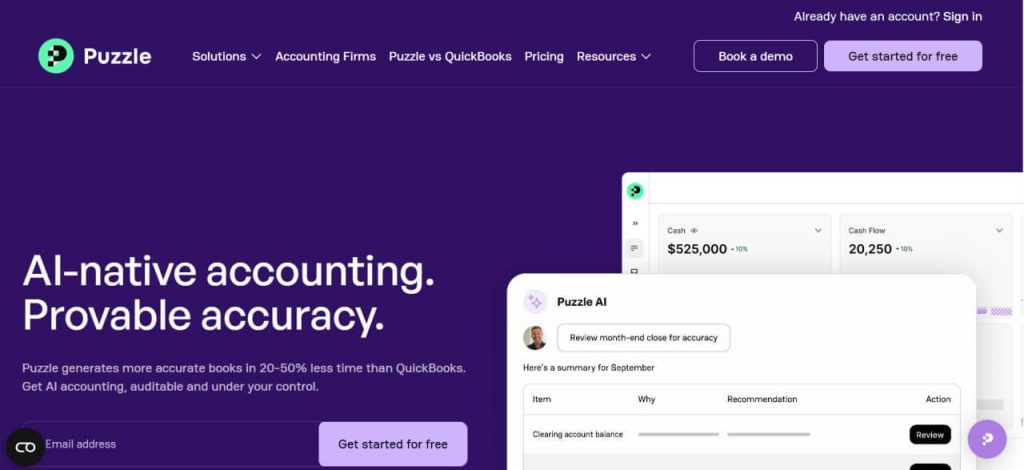

4. Puzzle

Puzzle delivers modern, AI-driven accounting designed specifically for startups and venture-backed companies. The platform combines automated bookkeeping with real-time financial insights, startup metrics, and collaborative features that traditional accounting software lacks.

Core features

- AI-powered categorization (90-95% accuracy) that learns from corrections

- Automated accrual accounting including revenue recognition, deferred revenue, prepaid expenses, fixed asset depreciation

- Real-time dashboards with burn rate, runway, cash flow, ARR/MRR, spending analysis

- Scenario planning tools for fundraising and financial forecasting

- Native integrations with Stripe, Gusto, Rippling, Brex, Ramp, Mercury, and major banks via Plaid

- Collaborative features for transaction review, documentation requests, and task tracking

- One-click GAAP-compliant financial statements, tax packages, and investor reports

Pricing

| Plan | Price | Features |

| Accounting basics | Free | Under $5,000 monthly expenses, basic features |

| Plus insights | $43/mo | Real-time dashboards, burn analysis, unlimited expenses |

| Plus advanced automation | $85/mo | AI categorization, auto-reconciliation, auto-accruals |

| Scale | $255/mo | Full automation, priority support, custom features |

Ideal for

Puzzle is best for venture-backed startups, SaaS companies needing burn and runway tracking, tech companies wanting AI-powered automation, and businesses preparing for fundraising or audit.

How Synder automates Puzzle workflows

Synder expands Puzzle’s ecommerce capabilities by connecting Shopify, Amazon, eBay, WooCommerce, and other platforms that Puzzle doesn’t support natively. Using Summary Sync mode, transactions are consolidated into clean journal entries that work seamlessly with Puzzle’s AI categorization, maintaining the startup-friendly simplicity while handling high-volume multi-channel operations.

5. FreshBooks

FreshBooks targets freelancers and service providers who prioritize invoicing and time tracking over complex accounting features. The platform emphasizes ease of use, with a colorful, friendly interface that minimizes accounting jargon.

Core features

- Professional invoicing with online payments and automated payment reminders

- Time tracking integrated directly into invoicing for accurate hourly billing

- Expense tracking via receipt photos with automatic categorization

- Project management features including client collaboration, file sharing, and profitability tracking

- Strong mobile app for invoicing, expense capture, and time entry

- Basic financial reporting (less comprehensive than QuickBooks or Xero)

Pricing

| Plan | Price | Features |

| Lite | $8.50/mo | 5 billable clients, 1 user + accountant |

| Plus | $15/mo | 50 billable clients, 1 user + accountant |

| Premium | $27.50/mo | Unlimited clients, 1 user + accountant |

| Select | Custom | Unlimited clients, custom users |

Additional users cost $11 monthly, which adds up quickly for teams.

Ideal for

FreshBooks is a solid option for freelancers, consultants, creative professionals, and small service businesses that bill clients hourly and need simple, beautiful invoicing more than complex accounting features.

6. Wave

Wave stands out as the only truly free accounting platform that doesn’t sacrifice essential features. It generates revenue through optional premium services rather than software subscriptions, making it ideal for micro-businesses and startups.

Core features

- Unlimited invoicing with online payment options

- Expense tracking with automatic categorization from bank feeds

- Receipt scanning and bank connections (unlimited)

- Basic financial reporting including profit and loss statements and tax summaries

- Dashboard with cash flow graphs and bank balances

- Simple interface focused on essential features without overwhelming complexity

Pricing

Wave’s core accounting is free forever. Premium services include payroll (starting at $20 monthly + $6 per employee) and payment processing (2.9% + $0.60 per transaction for credit cards). Wave Advisors bookkeeping offers custom pricing.

Ideal for

Wave is a popular choice among startups, micro-businesses, and self-employed individuals with simple accounting needs, particularly those in US and Canada who value saving money over advanced features.

7. Zoho Books

Zoho Books delivers robust accounting functionality at lower prices than QuickBooks, with the added benefit of seamless integration across Zoho’s extensive business software ecosystem. The platform balances affordability with comprehensive features.

Core features

- Full-cycle accounting from estimates to payments with invoice automation

- Expense tracking, inventory management, and bank reconciliation

- Project profitability tracking by client and project

- Multi-currency support for international operations

- Workflow automation for recurring invoices and payment reminders

- Native integration with Zoho CRM, Inventory, Expenses, and other Zoho ecosystem apps

Pricing

| Plan | Price | Features |

| Free | $0 | Up to $50k annual revenue, 1 organization, 1 user |

| Standard | $20/mo | Essential features, automation, 1 org, 3 users |

| Professional | $50/mo | Custom fields, purchase orders, 3 orgs, 5 users |

| Premium | $70/mo | Advanced inventory, budgets, 5 orgs, 10 users |

| Elite | $150/mo | Custom modules, 10 orgs, 10 users |

| Ultimate | $275/mo | Enterprise features, 20 orgs, 15 users |

Additional users cost $2.50 to $4 monthly depending on plan.

Ideal for

Zoho Books fits growing businesses wanting comprehensive features at reasonable prices, companies already using Zoho products, and organizations needing workflow automation without QuickBooks’ price tag.

8. Sage 50

For businesses requiring desktop accounting software rather than cloud solutions, Sage 50 provides the strongest alternative to QuickBooks. The platform delivers powerful features for inventory management, job costing, and financial reporting.

Core features

- Advanced inventory tracking with multiple costing methods (FIFO, LIFO, average), serial numbers, and multiple warehouses

- Robust job costing for construction and project-based businesses

- Multi-entity accounting with consolidated reporting

- Budgeting tools with what-if scenarios and variance analysis

- Bank reconciliation with automatic matching and exception handling

- Microsoft 365 integration for Excel data import/export and automated report distribution

Pricing

| Plan | Price | Features |

| Pro | $629/yr | Basic accounting, 1 user |

| Premium | $899/yr | Inventory, job costing, 5 users |

| Quantum | $2,200/yr | Advanced features, multiple companies, 40 users |

Ideal for

Sage 50 is a good QuickBooks alternative for businesses requiring desktop software, companies with complex inventory or job costing needs, and organizations preferring local data control over cloud solutions.

9. AccountEdge

AccountEdge targets businesses needing robust inventory controls without paying QuickBooks Enterprise prices. The desktop software provides advanced inventory features at a fraction of the cost.

Core features

- Clear separation of COGS from inventory value for straightforward profitability analysis

- Reorder points, multi-location tracking, and item-level reporting

- Multiple costing methods with serialized inventory support

- Basic accounting functionality: invoicing, bill payment, bank reconciliation, financial reporting

- Job tracking for project-based cost monitoring

- Payment processor integration for online payment collection

Pricing

AccountEdge offers both subscription ($20 monthly) and one-time purchase ($399) options. Network editions for multi-user access cost more but remain significantly cheaper than QuickBooks Enterprise.

Ideal for

AccountEdge is best for retail and wholesale businesses needing detailed inventory tracking, companies preferring desktop software, and budget-conscious operations wanting better inventory tools than QuickBooks Online provides.

10. Kashoo

Kashoo emphasizes mobile access, making it ideal for business owners managing finances on the go. The platform provides essential accounting tools with strong smartphone and tablet apps.

Core features

- Core accounting: invoicing, expense tracking, bank reconciliation, basic reporting

- Custom invoice templates for brand consistency

- Multiple bank account integration with consolidated financial views

- Mobile apps matching desktop functionality for on-the-go management

- Inventory tracking with level monitoring across locations

- Sales tax management including calculation and reporting

Pricing

Kashoo costs $19.95 monthly (or $199 annually), including unlimited users.

Ideal for

Kashoo suits mobile-first business owners, field service companies, and entrepreneurs who manage finances primarily from smartphones rather than desks.

Quick comparison: Key features and pricing

Here’s how the top QuickBooks alternatives stack up on pricing, target audience, and core strengths.

| Software | Starting price | Best for | Key strength |

| Xero | $15/mo | Growing businesses | User collaboration |

| Sage Intacct | $15,000/yr | Mid-market companies | Multi-entity consolidation |

| NetSuite | $999+/mo | Enterprise | Complete ERP |

| Puzzle | Free | Startups | AI-powered automation |

| FreshBooks | $8.50/mo | Service providers | Invoicing & time tracking |

| Wave | Free | Micro-businesses | Zero cost |

| Zoho Books | Free | Growing companies | Value & automation |

| Sage 50 | $629/yr | Desktop users | Job costing |

| AccountEdge | $20/mo | Inventory businesses | Low-cost tracking |

| Kashoo | $19.95/mo | Mobile workers | Phone-first design |

How to choose the best accounting software

Before comparing specific platforms, define what good looks like for your business. The right accounting software depends on your transaction volume, workflows, and long-term operating model. Use these tips to guide your evaluation.

Tip 1: Match the software to your business size and transaction volume

Choose tools based on how much data you process and how often. Freelancers handling a few dozen transactions need simplicity and clear records, while ecommerce businesses processing thousands of orders benefit from summary-based posting that keeps books readable without sacrificing accuracy.

Tip 2: Prioritize integrations over feature lists

Strong integrations matter more than an impressive list of features. Your accounting software should connect smoothly with payment processors and sales platforms such as Stripe, PayPal, Shopify, or Amazon. Poor integrations lead to manual work and reconciliation issues that automation is meant to eliminate.

Tip 3: Evaluate total cost, not just the subscription price

Look beyond the advertised monthly fee. Review user limits, transaction caps, and which features are locked behind higher tiers. Some platforms charge extra for bank connections, payroll, or reporting. Calculate the total cost of ownership and consider whether pricing scales reasonably as your business grows.

Tip 4: Confirm support for your accounting method

Make sure the software supports the accounting method you use today and the one you may need tomorrow. Many businesses start with cash-basis accounting and move to accrual as reporting requirements increase. Choosing software that supports both reduces the risk of another migration later.

Tip 5: Account for industry-specific requirements

Industry needs vary widely. Ecommerce and retail businesses rely on marketplace and POS integrations, service businesses need project profitability tracking, and construction companies depend on job costing. Software aligned with your industry reduces setup time and delivers more relevant reports out of the box.

Following these tips helps narrow your options and ensures the software you choose supports your workflows without becoming a limitation as the business evolves.

QuickBooks migration cheat sheet

Migrating away from QuickBooks doesn’t have to be disruptive. With the right timing, clean data, and early testing, most businesses complete the switch in a few weeks while keeping daily operations running. Use this cheat sheet to avoid common mistakes and keep the transition controlled and predictable.

1) Choose the right timing:

- Avoid mid-month migrations and tax season

- Best option: fiscal year-end

- Second best: early in a new quarter with lower transaction volume

2) Prepare your data exports:

- Back up your QuickBooks account first

- Export as CSV:

- Chart of accounts

- Customers and vendors

- Products and services

- Decide how much history to move:

- Common approach: last 1–2 years summarized

- Keep older QuickBooks files for reference

3) Clean and map your chart of accounts:

- Review and consolidate duplicate or unused accounts

- Rename confusing accounts before migrating

- Map each QuickBooks account to the new system to preserve reporting consistency

4) Run systems in parallel:

- Test the new software alongside QuickBooks for at least one full month

- Record the same transactions in both systems

- Compare balances, reports, and workflows to catch issues early

5) Plan team training:

- Allocate 2–4 hours of initial training per user

- Tailor training by role:

- Accountants: full system and reporting

- Sales or ops: invoicing and basic workflows

- Expect lighter follow-up support during the first month

6) Set up automation early:

- Connect bank accounts, payment processors, and sales platforms

- Configure matching rules and categorization logic

- If using Synder, set up integrations and mapping during the trial phase to validate data flow before going live

Pro tip: A successful migration is less about the software and more about preparation. Clean data, correct timing, and early automation setup prevent most post-migration issues.

Final thoughts on finding your QuickBooks alternative

QuickBooks alternatives can offer clearer pricing, fewer user restrictions, and interfaces that better match specific business models. For many teams, they remove unnecessary complexity and reduce ongoing software costs. The key is choosing a platform that fits how your business operates today without creating new limitations as volume, entities, or reporting needs grow.

Automation is what makes that setup sustainable. Tools like Synder handle the data flows most accounting platforms struggle with: multi-channel sales, fees, taxes, historical data, and revenue recognition, so your books stay accurate without manual work. Combined with the right accounting software, automation turns accounting from a maintenance task into a reliable system you don’t have to constantly fix.

FAQ

What is a good alternative for QuickBooks?

Xero ranks as the best overall QuickBooks alternative, offering similar features at lower prices with unlimited users across all plans. For free options, Wave provides solid core accounting without subscription fees. FreshBooks works best for service businesses prioritizing invoicing, while Zoho Books delivers comprehensive features at competitive prices for growing companies.

What’s better, Wave or QuickBooks?

Wave wins for micro-businesses and startups prioritizing cost savings, offering free core accounting that handles basic invoicing, expense tracking, and financial reporting. QuickBooks provides more advanced features like inventory management, project profitability, and extensive integrations, making it better for growing businesses with complex needs. Wave suits businesses under $50,000 in annual revenue, while QuickBooks scales better as operations expand and require more sophisticated accounting capabilities.

Is there a free alternative to QuickBooks?

Wave offers completely free accounting software with unlimited invoicing, expense tracking, and basic reporting. The free tier includes bank connections and mobile apps, generating revenue through optional payroll and payment processing fees. Manager provides another free option as open-source desktop software, though it requires more technical knowledge. Zoho Books has a free tier for businesses under $50,000 annual revenue, including three users and essential features.

Why choose Xero vs QuickBooks?

Choose Xero when you need unlimited users without extra fees, prefer a simpler interface, or operate internationally requiring strong multi-currency support. Xero costs less at comparable feature tiers and includes Hubdoc for automated receipt capture. QuickBooks offers more extensive third-party integrations, better inventory management in mid-tier plans, and phone support that Xero lacks. US-based businesses deeply embedded in Intuit’s ecosystem may prefer QuickBooks’ familiarity despite Xero’s advantages.

What other systems need to connect to accounting software?

Modern businesses typically need connections between accounting software and payment processors (Stripe, PayPal, Square), ecommerce platforms (Shopify, Amazon, WooCommerce), and point-of-sale systems. The more platforms you use, the more critical automated data syncing becomes. Tools like Synder eliminate manual CSV exports and imports by connecting all these systems directly to accounting software, ensuring transaction data flows automatically with proper categorization.

Thank you!

I have small business (in fact I’m freelancer) and I’m searching right now such solutions.

Thank you for your feedback! We’re doing our best to provide you with comprehensive pieces.

Great article Ana will check out these alternatives to quickbooks.

informative

A very detailed and great Article for understanding Quick book and alternative softwares.

How ever small business must be run through cloud based alternative softwares. Tnx

Thank you for this, It’s very informative. Our main accounting system is a payroll based cost accounting system that has a horrible invoicing system. We use Quickbooks for pretty invoices and the chart of accounts. Unfortunately the 2017 software we’re using is getting glitchy. Do any of the free systems have a somewhat comparable invoicing system?

Hi Andrea, it’s great that you’re looking into alternatives for your invoicing needs, especially since your current setup with the 2017 QuickBooks version is becoming problematic. While many free accounting systems may not offer all the robust features of QuickBooks, there are definitely some with commendable invoicing capabilities that might suit your needs. Systems like Wave, Akaunting, ZipBooks, and Zoho Books offer good free invoicing features. Alternatively, you might consider dedicated invoicing software that can sync with your main accounting tool. It’s worth testing out these platforms to see which one best meets your specific needs, especially considering that your main accounting system is payroll-based.

Thanks for this. I have used firstly Quicken and then Quickbooks since the early nineties but found that the switch to online was not only expensive but rather rudely imposed. Will check out the options above and see how it goes for the rest of this year.