Automation and workflow optimization aren’t new words to those working in the accounting field. However, the dawn of artificial intelligence has raised a number of new questions, and many accountants and CPAs in particular worry that automation will kill their profession, or change it completely.

How justified are these fears? Do the benefits outweigh the fears? In this article, We’ll attempt to answer these questions and describe the benefits of automation for CPAs.

Level of accounting automation processes in CPA firms: present and future

If you look at the trends and statistics, you can see that the accounting profession is one of the most likely to be automated by 2040. But another interesting fact is that there’s been a consistent increase in the number of accounting jobs added, and it’s projected to grow another 6 percent by 2028. How can you explain a projected growth in a profession that’s supposedly endangered by automation? CPA firms can provide a good answer.

In recent years productivity has increased across all fields, giving the CPAs an ever-mounting workload to deal with. Truth be told, automation couldn’t have come into the picture at a better time. Without it, it wouldn’t be possible to manually manage an increasing volume of data, avoiding the mistakes which can occur when human beings are the ones entering the data manually.

With technology there to perform such tasks as transactional accounting work, bookkeeping, payroll, expense recording, verifying e-signatures, and completing tax preparation, accountants can do the higher-skill level of work they have been trained for. In fact, many already do.

Nowadays, finance and accounting organizations are developing strategies around the use of big data, which can help to uncover correlations, hidden patterns, and other important insights.

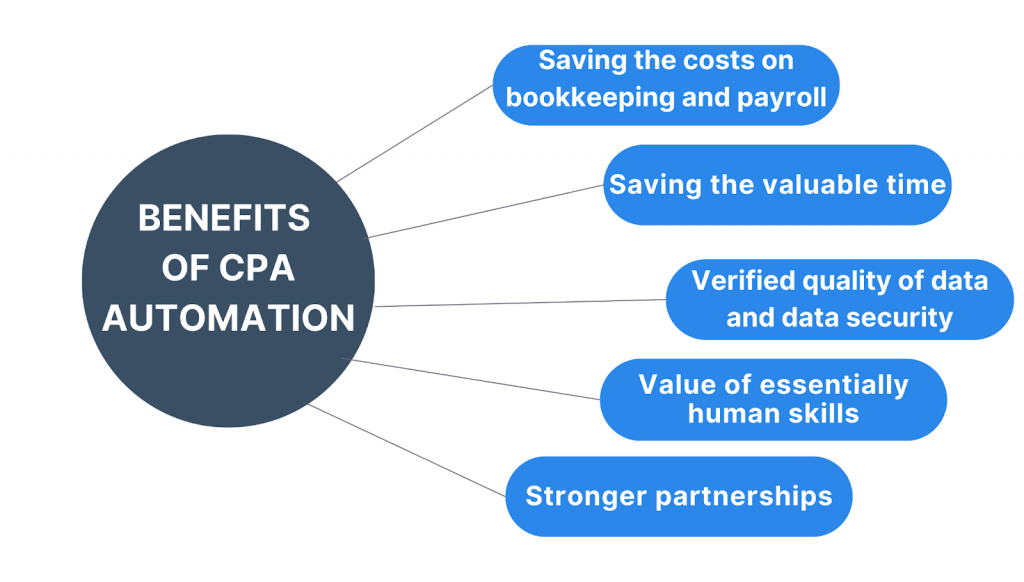

The benefits of leveraging CPA automation

Saving the costs on bookkeeping and payroll

Today, the potential for automating accounting tasks is staggering. This realization underscores the inherent efficiency and cost-saving advantages of embracing automation within the accounting realm.

One of the most immediate and tangible benefits of accounting automation is the substantial reduction in operational expenses. Expense-processing, payroll, file reviews – all of that can be automated. Now imagine it in billable hours. Services like this, when used by CPA firms, allow them to put the data entry processes on auto-pilot, at the cost of a few billable hours a month, saving a ton of time and money weekly on repetitive tasks that can and should be automated.

Take Synder, for instance, with 2.5 million syncs of sales transactions from ecommerce сhannels and payment platforms into the books annually – the time-saving impact is obvious. If each transaction was handled manually, it’d consume approximately 30 seconds per transaction. However, Synder streamlines the process, reducing it to just a few clicks. When you do the math, 2.5 million transactions multiplied by 30 seconds equals 75 million seconds, which translates to 1,250,000 minutes or approximately 20,833 hours of manual work saved for businesses and accounting firms. To put it into perspective, this amounts to a staggering 2,604 full 8-hour workdays or 130.2 months of workdays, equivalent to saving around 11 career years for hardworking accountants. So companies like Synder not only save time but revolutionize how it’s spent, freeing up valuable resources for networking, learning, and growing client bases.

Furthermore, the level of accuracy achieved through automation is unparalleled. In the CPA environment, where precision and reliability are key, using accounting automation such as Synder, ensures that data entry is consistently flawless. This reduces the risk of costly errors and discrepancies that may arise from manual input practically to zero. It safeguards the integrity of financial records and prompts trust among clients and stakeholders.

Saving the valuable time

Everything takes less time now, and the clients of CPA firms are well aware of that. They expect everything to be done instantaneously and are often unwilling to wait. In order to stay ahead of this time pressure, tech-savvy accountants have begun using software that replaces those processes they previously performed manually. It doesn’t matter to their clients. If anything, the clients will appreciate the efficiency and accuracy of machine-generated reports. It’s the CPA expertise that matters, and entire careers that have been built around entering data, finding numbers, and other repetitive tasks now have the opportunity to transform into those that use the valuable time wisely.

A much-discussed McKinsey report shows that accountants and bookkeeping professionals are the ones that spend most of their time on tasks that can be automated. This revelation changes the perspective of forward-looking accountants, rephrasing the question of whether to use automation into how to leverage it in the most effective way.

Verified quality of data and data security

Accounting software doesn’t just streamline processes; it also introduces a heightened level of security and reliability into the equation. No more painstaking reconciliations! This software automates the once-dreaded task into a swift one-minute operation. All financial transactions are seamlessly integrated into the accounting software in real-time, ensuring that the books are always up-to-date and accurate. Expenses, on the other hand, are effortlessly organized with the help of intuitive solutions like Expensify, reducing the potential for human error and ensuring that every expenditure is correctly categorized. And time management becomes equally efficient, thanks to providers like TSheets, which meticulously track work hours.

By eliminating time-consuming and error-prone tasks from accountants’ to-do lists, automation allows CPAs to focus on the value-added aspects of their work, where their expertise and analysis truly shine, while entrusting the machines to handle the rest with utmost precision and reliability. This close connection between accountants and automation not only enhances efficiency but also stands for the trustworthiness of financial data, a critical factor in today’s data-driven and compliance-oriented business landscape.

Watch a short video to learn about what it takes Synder to prepare synchronized transactions for accurate and smooth reconciliation.

Moreover, top public accounting solutions provide an unprecedented level of securing customers’ data. Take Synder, for example, where security is of utmost priority, with no human involvement in handling your Synder data at any point. They consistently adhere to industry encryption standards and undergo routine independent PEN testing and are fully compliant with GDPR, HIPAA, and CCPA regulations.

Synder also ensures the security of your data through a rigorous third-party security audit process. With its SOC 2 Type 2 certification, Synder undergoes thorough security assessments that evaluate its handling of sensitive client information and the effectiveness of its security measures. The Service Organization Control (SOC) 2 Type 2 report confirms that Synder fully complies with the Trust Criteria encompassing Security, Availability, Processing Integrity, Confidentiality, and Privacy. This certification demonstrates Synder’s ability to safeguard data, providing clients with peace of mind.

Learn more about how to enhance data security and how to avoid data security risks during tax season.

Value of essential human skills

True skills that belong to the future can’t be automated. An ability to connect, to tell a story, to empathize, to come up with innovations and create opportunities that don’t currently exist – all of that, based on the intimate knowledge of the industry, will allow CPAs to become increasingly more creative, spend less to no time on mundane tasks, and go beyond the expected, beyond the logical. It’s also fortunate that these are the skills that the clients value the most.

The role of an advisor that begins to define CPAs becomes possible when the human skills can begin to shine, and that becomes possible when the weight of recurring repetitive tasks is lifted by smart automation.

Stronger partnerships

Clients of accountancy firms ultimately look for a trustworthy partner who can guide them through the intricacies of the finance and tax regulations. Without automation, an accountant can advise on regulatory questions but wouldn’t have the time necessary to delve into forecasting, wouldn’t have the tools to back their insights on the financial future of their client with smart data analytics, and would be prone to human error.

This is mainly the job of client accounting advisory services (CAAS), or simply client accounting services (CAS) that encompass a wide array of accounting solutions provided by CPAs, ranging from basic bookkeeping to advanced advisory and management reporting. CAS firms leverage technology, particularly cloud-based tools, to offer tailored, outsourced accounting support to meet the unique needs of their clients. Beyond traditional bookkeeping, CAS involves delivering data-driven business advice and strategic insights for growth. CPAs adjust the scope of services to align with their clients’ specific requirements in areas such as advanced reporting, operational efficiency, payroll, tax, human resources, and software management.

In short, professional accountants who can consistently deliver expert, error-free results will be able to build long-lasting partnerships with their clients.

Looking for an experienced accountant? Check out the find-an-accountant directory, where Synder made up a comprehensive list of esteemed CPA firms.

Accounting automation in a nutshell

The transactional part of the accounting work will be automated. It’s inevitable. Those whose skills center mostly around manual data entry will have to up-skill their portfolio. But there are so many skills that are intrinsically human and will only galvanize and be developed further. CPA firms can look into the future with confidence, as backed by automation and equipped with new, higher skills they can keep advancing.

Do you think automation is a curse or a blessing for accountants and bookkeepers? Share your ideas with us in the comments.

There is not doubt we live in a technology driven world. And technology is and automation is inevitable. So is automation of the transactional and other parts of accounting. Thank you for sharing this wonderful blog post with us. I enjoyed reading it and and it was very helpful.

Thanks for stopping by, Noori!

All though we hate change at times, It will come sooner or later. I actually think technology is a good thing, but it is relatively early in a grand scheme of things. Having my own accounting practice I now see the importance of it all. I can do more with technology than without it. Especially responding to customers reviews , accounting softwares etc. etc. Thanks for the insightful post!

We’re delighted to hear that you found the post insightful! It’s true, change, especially with technology, can be daunting at first, but as you’ve experienced in your accounting practice, it often brings about efficiency and growth. We’re glad you’re seeing the positive impact it can have on your business. If you ever need more tips or insights on leveraging technology in your field, feel free to check back with us. Thanks for your feedback!

Wow, this blog is fantastic. I love reading your articles. Keep up the good work! You realize that many individuals are searching around for this info, and you could aid them greatly.