Many businesses in the US prefer QuickBooks Online for its solid accounting features. Yet, with ecommerce, QuickBooks has some challenges, like blending online sales and handling inventory changes.

Today, we’re looking at some common QuickBooks hiccups and how businesses can tackle them using third-party tools and integration apps. So, hop on reading to learn how to smoothly combine accounting with ecommerce operations, getting the best of both worlds.

Contents:

1. The current status of QuickBooks Online in managing accounting

2. Managing ecommerce: Problems and challenges one might encounter

3. Issues businesses can experience using QuickBooks Online to manage ecommerce accounting

4. Synder – one solution to handle all these problems

The current status of QuickBooks Online in managing accounting

As previously mentioned, QuickBooks Online (by Intuit) is a widely used accounting solution designed to simplify financial management for various businesses. For ecommerce ventures, QuickBooks offers a set of tools to help streamline critical processes. It enables businesses to track income and expenses, manage inventory, and generate financial reports in a user-friendly manner. This accounting solution aims to provide a straightforward approach to handling the financial side of ecommerce operations.

Under the hood, QuickBooks offers some handy features – it integrates with various online platforms, allowing businesses to import sales records automatically. This feature aids in maintaining accuracy without the need for manual entry. Additionally, QuickBooks supports tracking product variations, facilitating control over inventory management. It also assists in automating essential tasks, such as order fulfillment and invoice creation, enhancing overall efficiency for ecommerce businesses.

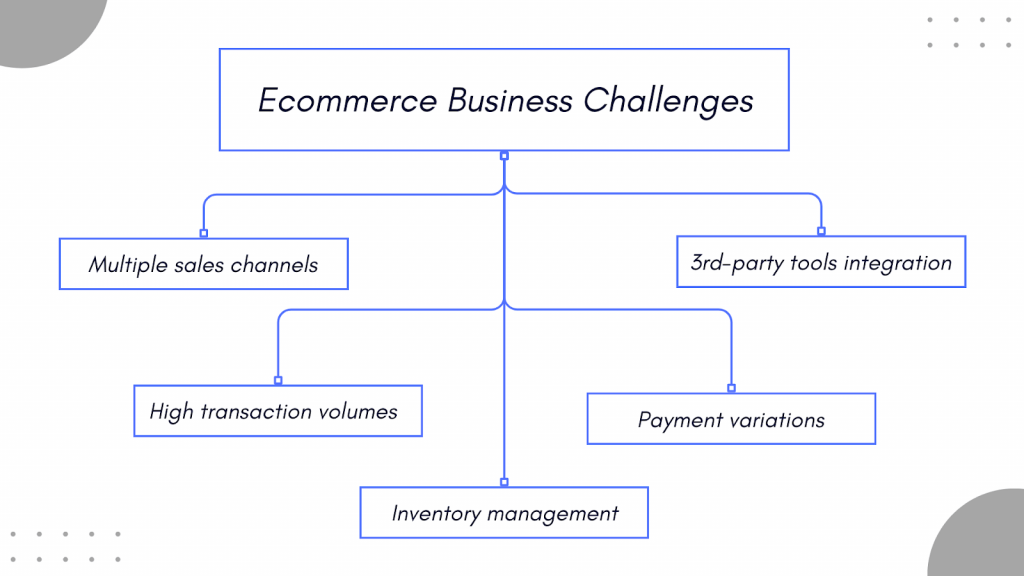

Managing ecommerce: Problems and challenges one might encounter

While QuickBooks offers valuable tools for financial management, for many ecommerce businesses, they aren’t enough to cover their needs. We’ll proceed to the potential challenges and limitations QuickBooks users can face managing an ecommerce business a little further on. Meanwhile, let’s look at the specificity of ecommerce to understand the nature of these challenges better.

Challenge #1 – Multiple sales channels

Managing the financials of ecommerce businesses becomes complicated due to their engagement across various sales channels. They can range from online marketplaces to personal websites and social media platforms, generating diverse transactional data.

The challenge lies in consolidating and integrating this varied data into accounting. Maintaining an accurate and holistic financial overview requires a solution that can synchronize sales, returns, and inventory updates from each channel.

Related:

– Omnichannel Retail Strategy: Create Your Own Omnichannel Strategy for Ecommerce Business

Challenge #2 – High transaction volumes

The nature of ecommerce entails a high volume of sales data, often comprising numerous small-value operations daily. Ideally, accounting systems should handle this influx of information swiftly without compromising accuracy.

However, avoiding performance issues and ensuring the accounting solution can efficiently process substantial transaction numbers can be difficult. Provided these numbers grow as a business expands, they might also need a solution capable of scaling with the growth in transaction volume.

Challenge #3 – Inventory management complexity

Ecommerce operations involve constant product movement with varying attributes and stock levels. Accounting systems of online businesses face the challenge of managing the intricacies of inventory, including tracking product variations and handling stockouts and returns.

The goal is to offer businesses an updated and clear view of their inventory across different channels, ensuring precise financial reporting while accommodating the dynamics of ecommerce inventory.

Related:

– How to Create the Best Inventory Management System

Challenge #4 – Currency and payment method variations

Ecommerce’s global reach introduces payments in various currencies and through different payment methods, so its accounting systems must seamlessly handle these variations to prevent discrepancies in financial records. The challenge lies in accurately managing currency conversions, recording transaction fees, and streamlining payment reconciliations. For businesses looking to simplify this process, QuickBooks multicurrency capabilities can offer a robust solution, enabling them to manage transactions in multiple currencies without manual calculations or conversions. This feature enhances the accuracy of financial records and simplifies global transactions, making it easier for businesses to expand their international presence.

Related:

– Handling Foreign Currency Transactions with Synder Multi-Currency

Challenge #5 – Integration with third-party tools

Beyond core accounting functions, ecommerce businesses rely on third-party tools like CRM, shipping, and analytics. All these tools might possess business-critical and financial data that a business might want to reflect in their financial reporting alongside the accounting data. Integrating these tools with accounting to create a cohesive ecosystem – the one providing a 360-degree view of business performance – might be complicated.

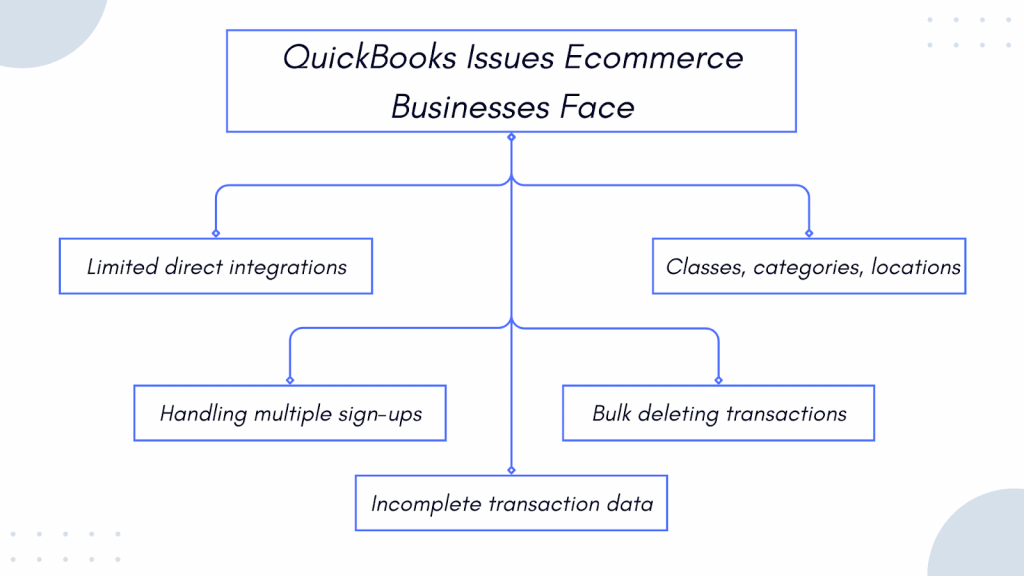

Issues businesses can experience using QuickBooks Online to manage ecommerce accounting

In many cases, QuickBooks can handle ecommerce accounting by efficiently tracking income and expenses, automating key processes, and more. However, depending on the unique settings of a business, there might be some challenges. Adjusting QuickBooks to work seamlessly with these specific business conditions can take time and effort. Now, let’s explore the common issues that QuickBooks users might face when handling accounting for ecommerce and look at how you can potentially handle those challenges.

1. Limited direct integrations

While offering integration with various ecommerce and payment processing platforms, QuickBooks has limitations in its direct compatibility with several popular marketplaces and innovative payment solutions. Notably, marketplaces like Walmart and some Buy Now, Pay Later services, like Afterpay or Affirm, are absent from its direct integrations. It can pose a challenge for businesses aiming to incorporate these services into their workflow.

Businesses have a couple of strategic options to address this gap.

A solution using the QuickBooks App Store

Businesses can navigate the QuickBooks App Store, the platform’s own marketplace for third-party applications that can extend QuickBooks functionality, enabling a bridge between QuickBooks and platforms it doesn’t have a direct integration with.

A solution using accounting integration

Another approach is to leverage an accounting integration solution as a centralized hub for all sales channels, both ecommerce and payment platforms. It serves as an intermediary layer, consolidating data from various sources and integrating it with QuickBooks. By adopting this method, businesses can overcome the limitations of direct integrations and ensure a comprehensive and unified accounting system.

2. Multiple sign-ups problem

As businesses strive to streamline their operations through direct integrations and third-party connectors for QuickBooks, a significant challenge arises – the proliferation of multiple subscriptions and the need for numerous sign-ins across various applications. Managing this intricate web of credentials can introduce risks and complexities to the business workflow.

The risks associated with this problem include:

- Security concerns

Handling multiple sign-ins raises security concerns as businesses manage and secure various credentials. It increases the risk of password-related vulnerabilities, potential breaches, and challenges in enforcing robust security practices across different platforms. - Operational inefficiencies

Juggling multiple subscriptions and sign-ins leads to operational inefficiencies. It requires additional time and effort to navigate between different applications, impacting overall productivity and potentially causing delays in critical business processes. - Subscription costs

Each integrated platform or third-party connector often comes with its subscription costs. Managing multiple subscriptions can quickly escalate expenses, and tracking these costs becomes complex. It can lead to financial oversights and difficulties in budget management.

Solving the problem

Businesses can turn to an accounting integration solution, making it a single access point to manage and monitor their entire ecosystem, mitigating the multiple sign-up risks. Look at what you get, point by point.

- Unified access

Accounting integration solutions provide a centralized interface, allowing users to access and manage data from multiple platforms without separate logins. It enhances user experience and promotes operational efficiency. - Cost-efficiency

With accounting integration solutions, businesses can often achieve cost savings compared to maintaining individual subscriptions for each integrated platform. This approach simplifies budgeting and reduces the financial burden associated with multiple subscriptions. - Security and compliance

A centralized hub ensures a more secure environment, with standardized security measures and centralized control over access, helping maintain compliance with data protection regulations and industry standards.

3. Incomplete transaction details

When utilizing QuickBooks to pull transaction data from different sales sources, businesses might encounter a critical challenge – the potential for incomplete transaction data. Depending on the source, transaction details can vary, so if you have the same sale transaction recorded in several systems but fetch it from only one source to bring to accounting, you might lack crucial information on products or buyers that could be present in another source.

For example, you’re selling your products or a service through a Shopify store and have PayPal as an additional payment option (apart from Shopify Payments) to give buyers more flexibility in paying for their purchases. If someone buys something from you and pays via PayPal, you’ll have this sale recorded in both Shopify and PayPal. QuickBooks can connect with either Shopify or PayPal to import this transaction to accounting, so if some sale details for this transaction were recorded in one system, the other one might lack those, and so will the accounting software.

These details may include specific product information, customer details, or other nuances crucial for a thorough analysis of business operations. Without a consolidated view, the analysis may be incomplete or misleading, providing an inaccurate representation of the overall business health.

Can you solve it with an accounting integration solution?

Accounting integration tools can bridge the gap, connecting various sales sources and consolidating all transaction data into a unified format before integrating it with QuickBooks. So, businesses ensure that all pertinent details from different sources get together into a comprehensive record within QuickBooks.

With a complete dataset, businesses unlock enhanced analytical capabilities within QuickBooks, gaining detailed insights into product performance, customers’ behavior patterns, and overall financial health. This comprehensive approach empowers businesses to make informed strategic decisions based on reliable and complete financial data.

Related:

– Shopify QuickBooks Integration: How to Set up Shopify Integration with QuickBooks

4. Bulk delete issues

Managing erroneously imported records or removing specific data from QuickBooks can be a cumbersome task, as you have to manually open and edit each transaction.While it might be manageable for a few entries, the process becomes time-consuming and labor-intensive when faced with tens or hundreds of records needing correction. This issue becomes pronounced when considering the need for precision in data management.

How to address this hardship?

Here, an accounting integration tool can help resolve it, offering the capability to perform bulk deletes. Instead of individually addressing each transaction, businesses can conveniently choose and remove multiple entries in one go. This streamlined approach saves considerable time and ensures efficient and accurate data management, allowing users to focus on core business tasks rather than navigating through an extensive manual deletion process.

5. Handling classes, categories, and locations problem

In QuickBooks, direct integrations may encounter a limitation. They can’t automatically add classes, categories, and locations, so you should do it manually for each transaction. Not having those applied poses a challenge for a business aiming to maintain detailed and organized financial records.

- Classes help in categorizing records based on different segments of the business,

- Categories assist in tracking expenses and income sources,

- Locations are essential for companies with multiple physical outlets.

When this crucial data is missing, it can mess up the segmentation and analysis of accounting records based on specific criteria, making it challenging to generate accurate financial insights and hindering businesses’ ability to make informed decisions. Meanwhile, manual data entry consumes valuable time and increases the risk of discrepancies.

Is there a way out?

Accounting integration solutions can help by offering various workflow customizations. Namely, businesses can automatically apply classes, categories, and locations to their transactions during integration. The benefit here is twofold. First, it eliminates the need for manual data entry, reducing the risk of errors, and second, it ensures that critical details are consistently and accurately recorded in QuickBooks Online.

Please bear in mind that QuickBooks evolves, so the team behind it might fix the issues described above in the future. For any updated information on Quick Books Online capabilities, please turn to its official website.

Synder – one solution to handle all these problems

With all the above mentioned in mind, Synder Sync can be a game-changer for businesses struggling with QuickBooks limitations in ecommerce management. With compatibility across over 25 ecommerce, payment, and accounting platforms, including names like Stripe, PayPal, Square, Shopify, eBay, Wix, Magento, Walmart, QuickBooks, Xero, and more, Synder Sync serves as a bridge between sales sources and accounting systems, creating a unified ecosystem for financial data management and analytics. Using Synder Sync allows businesses to continue with QuickBooks, providing the added functionality they need without changing the accounting solution.

Beyond data integration, Synder Sync fetches transaction data with remarkable granularity, enabling businesses to have comprehensive financial and business KPI reporting. The platform supports accurate record-keeping, simplifying account reconciliation and helping a company file taxes accurately. Businesses aren’t limited in the number of sales sources they can connect, irrespective of their pricing plan tier.

This way, Synder Sync ensures a streamlined and efficient pathway to informed decision-making, empowering ecommerce businesses with a robust solution tailored to their unique needs.

Turning the last page: Final word

As you can see, even several years ago QuickBooks used to be a leading small to medium business accounting solution. However, as the ecommerce industry expands, some businesses might find it not fitting their needs to the full, as they face limitations that can’t be resolved without external help. While offering robust accounting features, QuickBooks encounters hurdles when handling ecommerce management. It can lack some functionality that ecommerce businesses might fancy. The specificity of ecommerce introduces challenges like dealing with multiple sales channels, high transaction volumes, complex inventory management, currency and payment variations, and integration with third-party tools.

Accounting integration solutions can address QuickBooks limitations, bridging the gap with missing integrations, ensuring complete transaction data, enabling bulk delete capabilities, and automating workflows that, otherwise, you’ll be doing manually in QuickBooks. In other words, it can ensure a unified and efficient financial ecosystem that complements QuickBooks without the need to change it for some other solution.

Share with the community

Do you run an ecommerce business? Have you ever encountered these or other issues using QuickBooks to manage your ecommerce accounting? Share your thoughts with our community in the comments section below!