In our digital era, ecommerce businesses are multiplying at an unprecedented rate, but many of them struggle when it comes to the accounting part. Bookkeeping has a reputation for being a very complicated process, which requires precision and accuracy. Mistakes in bookkeeping can end up costing a lot of money, and business owners rightly worry about making sure the data cannot be messed up. That’s where the Synder smart bookkeeping automation solution comes in, ensuring that no important data is lost in transition, bringing customers, taxes, items, shipping, and other details into your accounting software and moreover, that it will be properly categorized and reconciled. Moreover, Synder protects your data with two flagship features: duplicate detector and rollback. You can give yourself peace of mind knowing that all the power is in your hands and your accounting is secured.

Excited? Follow easy steps in this helpful guide, and enjoy seamless synchronization of AffiniPay transactions with Synder.

Overview:

Start the AffiniPay integration from scratch

1. Create an account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate your payment platform with QuickBooks Online or Xero, and this article to connect your QuickBooks Desktop company.

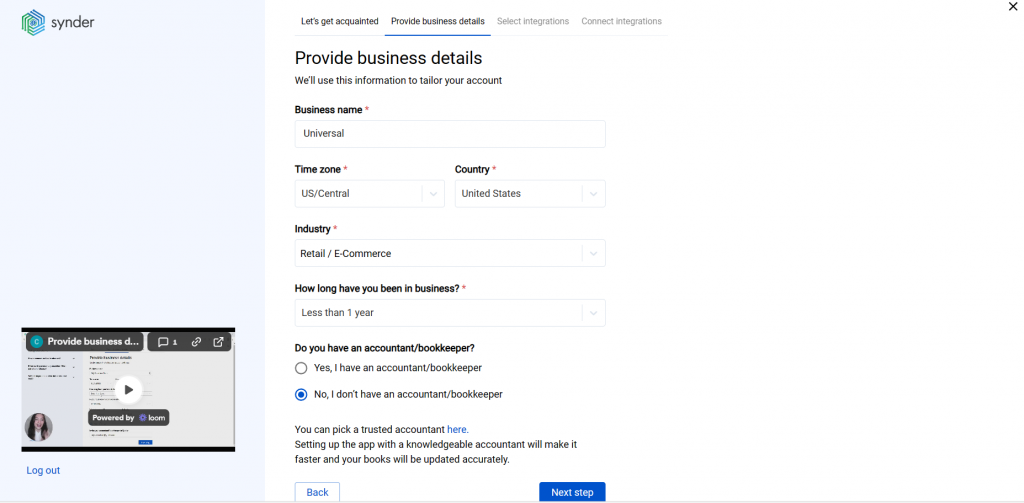

2. Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company, fill in the information about your business and hit the Next step button.

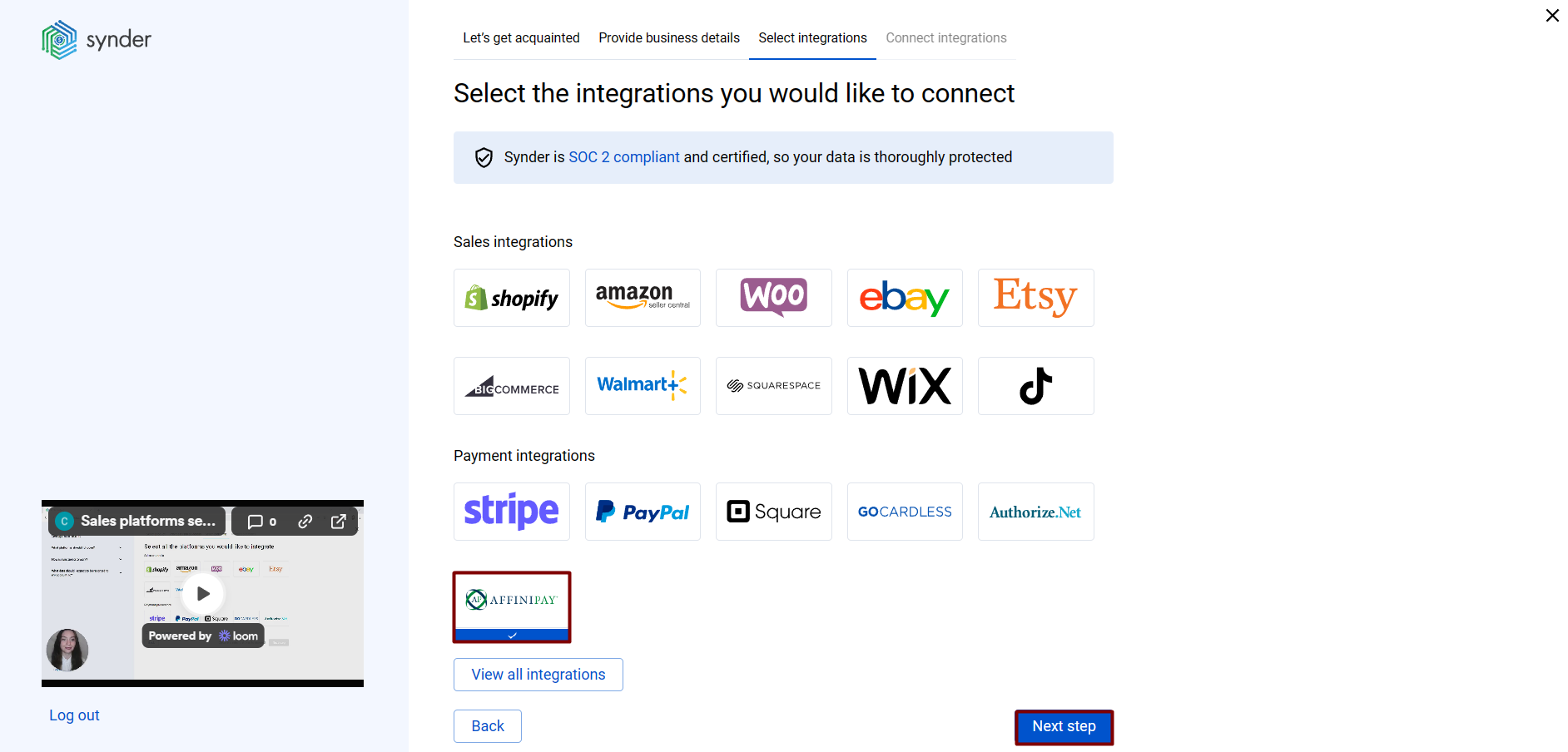

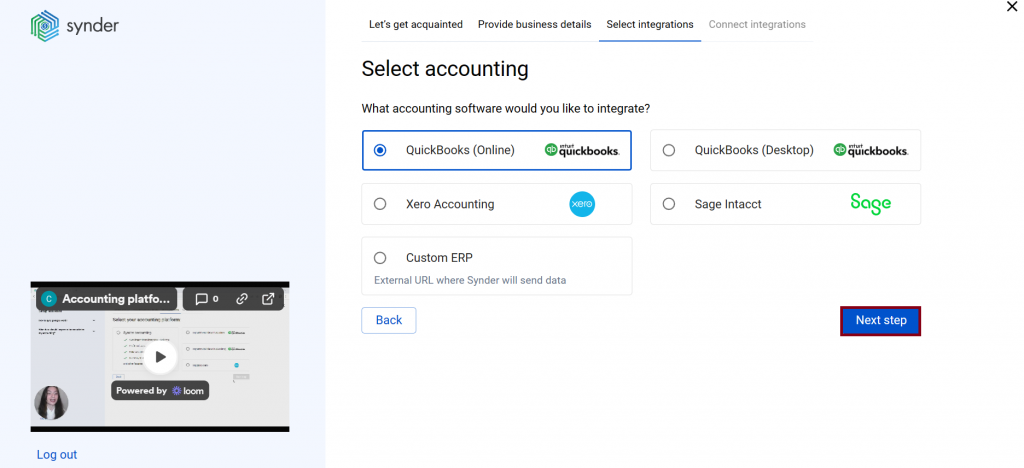

3. Select the platforms you’d like to integrate

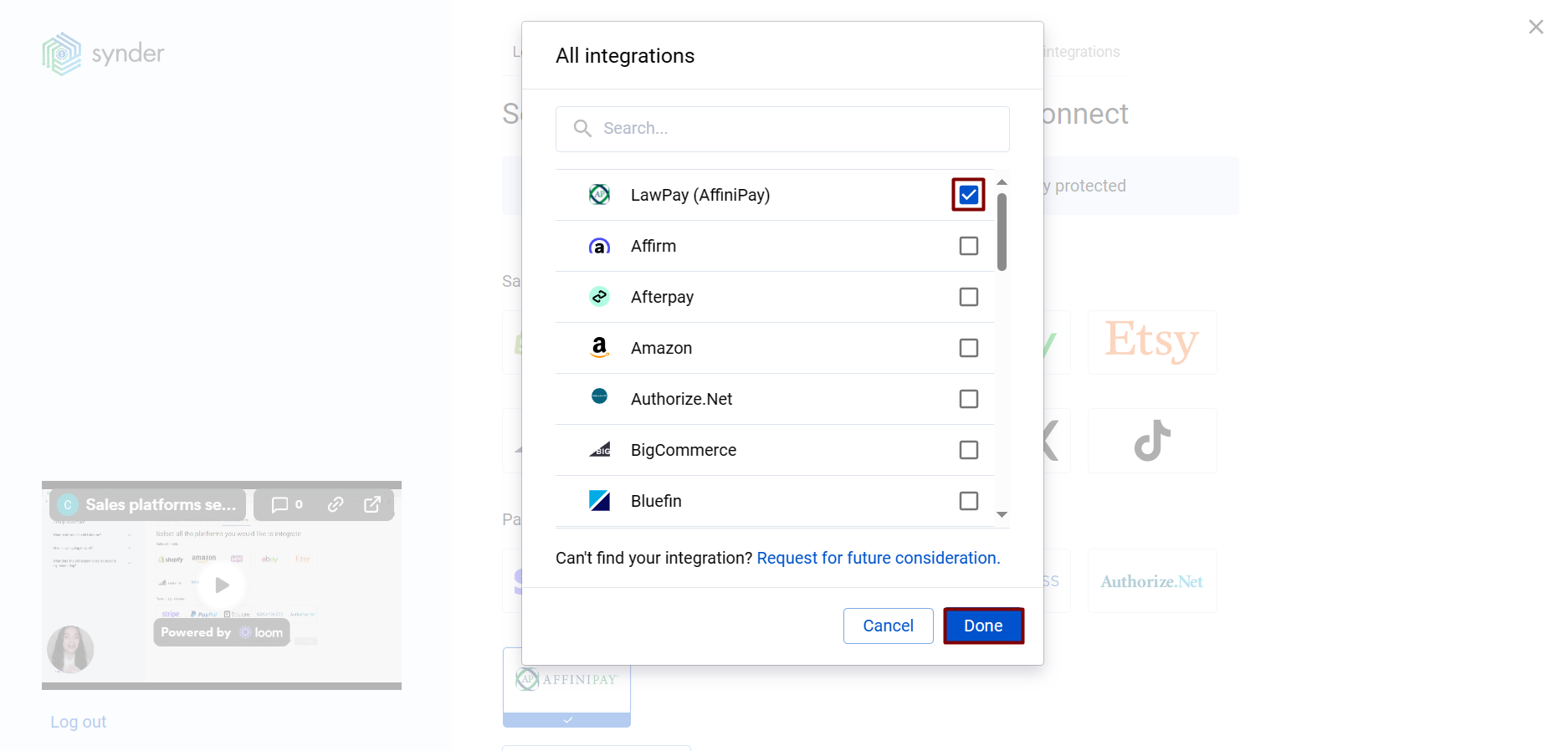

Now you need to select the platforms you would like to connect to Synder. Click View all integrations to see the list of all available platforms.

Note: Mark all the services you are using to receive payments, you will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

4. Connect your accounting platform

Select the accounting company you’d like to connect to Synder and click on Next step.

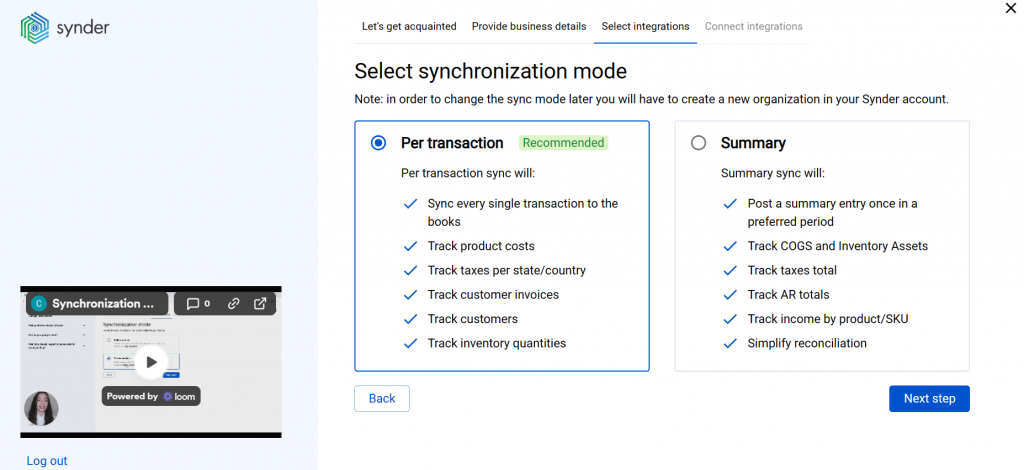

Note: If you are connecting QuickBooks Online or Xero, you will be prompted to select the sync mode. Proceed with the desired option.

Click on Connect to connect your accounting company.

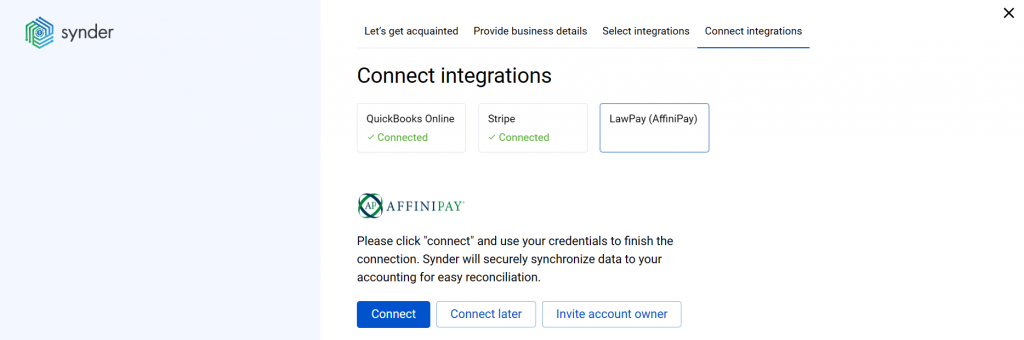

5. Connect your AffiniPay account

Almost there! To complete the setup, you just need to connect your AffiniPay and other sales platforms to Synder. Click on Connect if you are an admin, or Invite account owner if you do not have admin access in AffiniPay.

Alternatively, you can skip the connection and set them up later in the Settings.

Note: You can find our detailed guides on how to connect your sales channels and payment providers to Synder accounting/QuickBooks /Xero via Synder in our Help center.

Connect AffiniPay to an already existing account

If you already have a Synder account and would like to integrate your Affinipay platform, follow the steps below:

You can integrate other sales platforms one by one straight away or skip the connection for other additional payment processors and set them up later in the Settings:

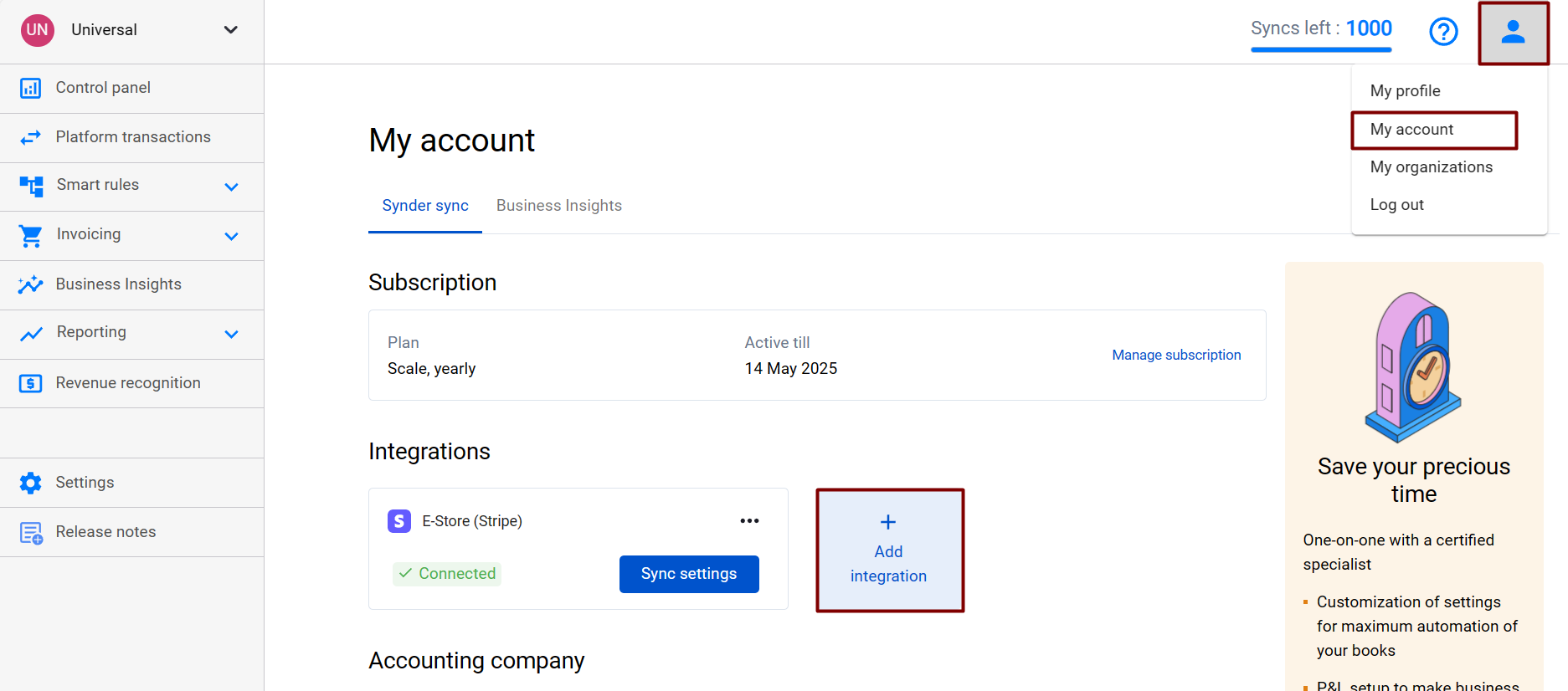

a. Click on the Person icon in the upper-right corner and select My account.

b. In the Integrations section, click Add integration.

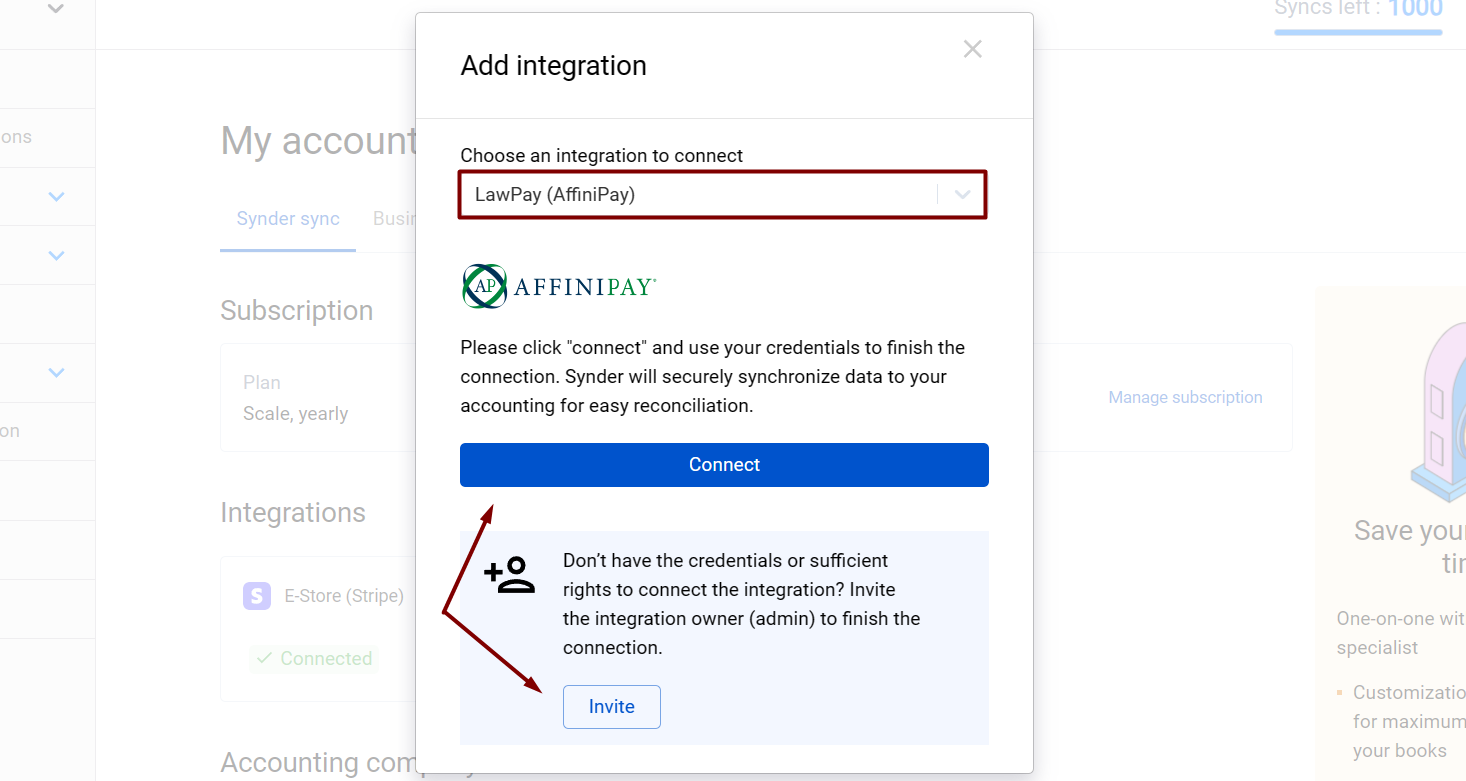

c. Select AffiniPay and click Connect. If you don’t have admin rights, send an invitation to the account owner.

Tips and tricks on the AffiniPay integration

Note 1. Synder currently imports gross amounts from AffiniPay, which means that fees and payouts need to be entered manually in your accounting system.

- Fees: you may want to create one batch expense for all the fees for a week or a month instead of entering each fee.

- Money transfers: you may need to create transfers in your accounting company from the AffiniPay clearing to your business checking account to zero out the clearing account and reconcile checking.

Note 2. Having the auto-sync mode enabled, your individual AffiniPay transactions, along with all the information they contain, will be automatically recorded in the AffiniPay (required for Synder) account (a Clearing account).

Note 3. Check out our 3 Must-Watch beginner guides to find out how Synder can help you automate your bookkeeping.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!