You’ve probably seen a balance sheet before—one of those must-have financial statements that every business owner has crossed paths with at least once. But if you’re just getting started, it’s worth diving into all the details because, surprise, not everything makes the cut on the balance sheet.

And that’s what we’re going to discuss today: the key components of this financial statement, why Service Revenue doesn’t appear on the balance sheet, and what the off-balance sheet assets are. Let’s get into it!

Contents:

1. What are the components of a balance sheet?

2. What are the off-balance sheet assets?

3. Where are off-balance sheet items reported?

The components of a balance sheet: Which accounts do not appear on the balance sheet?

So, what else is a balance sheet besides being a financial statement?

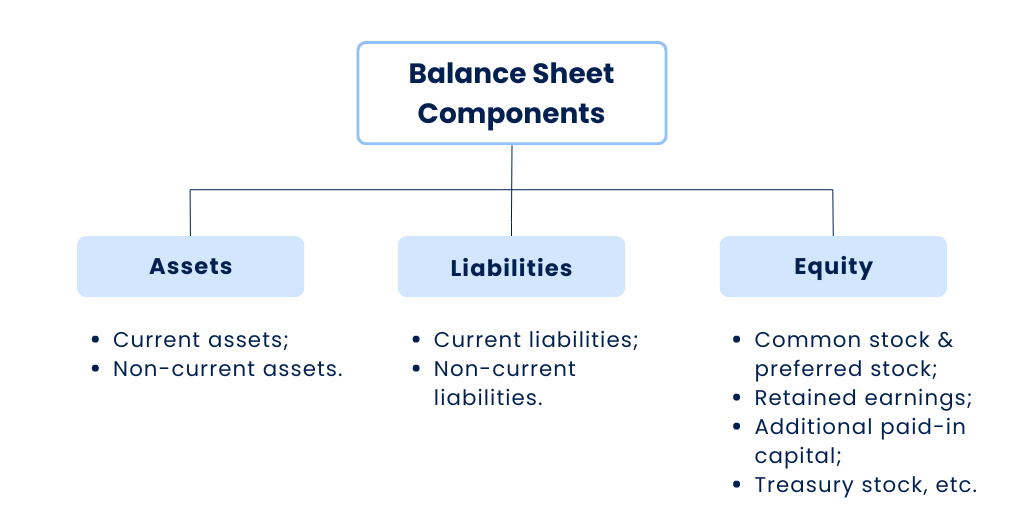

In simple terms, it’s a sum of your business’s financial standing, capturing the total of your assets, liabilities, and equity at a specific point in time. The magic here is in balance, where everything lines up perfectly according to the golden rule of accounting:

Assets = Liabilities + Equity

Before we discuss why some accounts aren’t shown on balance sheets, let us quickly remind you of the details of the key components in this financial equation.

Why does Service Revenue not appear on the balance sheet?

Let’s picture this: you’ve got a few accounts in front of you—Service Revenue, Salaries Payable, and Unearned Revenue. Now, you need to play detective and find the imposter, the one that doesn’t belong on the balance sheet.

So, what’s the odd one out?

A quick answer:

Service Revenue won’t appear on the balance sheet. Why? Because it’s an income statement account, not a balance sheet one.

An extended answer:

Service Revenue reflects the earnings from services provided, which means it doesn’t qualify as an asset, liability, or equity. It’s all about the money coming in, not what the company owns or owes.

Meanwhile, Salaries Payable is a liability account, representing the salary the company still needs to pay its employees. And Unearned Revenue? That’s also a liability, showing money received for services yet to be delivered. These two are legit balance sheet items.

Since the balance sheet is all about capturing a specific moment in time, ongoing activities like revenue generation are handled by the income statement. That’s why Service Revenue doesn’t get a spot on the balance sheet.

What are the off-balance sheet assets?

Off-balance sheet (OBS) assets are the company’s assets that aren’t reported on the balance sheet but are still doing some serious work behind the scenes. The reason for this omission is often due to certain transactions that can be ‘hidden’ off the balance sheet according to accounting rules. Typically, it’s done to make a company appear in better health by not including extra obligations.

So, what kind of sneaky assets are we talking about?

Types of off-balance sheet assets

Even though off-balance sheet assets don’t make an appearance on the balance sheet, they still count when it comes to influencing a company’s financial standing. As we’ve said above, there are different examples of these hidden assets. Now, let’s check them in more detail.

1. Operating leases

An operating lease is like a long-term rental agreement where a company gets to use an asset without actually owning it. The asset stays on the books of the lessor (the owner), so it doesn’t show up as an asset on the company’s balance sheet. Likewise, the lease obligations don’t show up as liabilities. Instead, the company simply records the lease payments as operating expenses on its income statement.

This setup lets companies enjoy the benefits of using assets—like equipment, vehicles, or office space—without adding extra debt or liabilities to their balance sheet. It can make the company look less leveraged and, in turn, more financially stable, all while still getting the tools they need to operate smoothly.

2. Leaseback agreements

Imagine selling your car but still getting to drive it. This is similar to the whole point of a leaseback agreement. Here’s how it works: a company sells an asset—like a building or equipment—to another party, pockets the cash from the sale, and then leases the asset back from the new owner. The asset moves over to the buyer’s balance sheet, not the original seller’s.

For the company, this deal is a win-win. They free up capital to use elsewhere while continuing to benefit from the asset as if they still owned it—all without adding any liabilities or the asset itself to their balance sheet.

3. Accounts receivable

Accounts receivable represent the money owed to a company for goods or services delivered on credit. Normally, these sit on the balance sheet as assets, but there’s a way to turn them into cash quickly: securitization. This involves selling the receivables to a third party (often called a factor) in exchange for immediate cash. Once sold, those receivables vanish from the company’s balance sheet.

This move gives the company a quick cash boost without adding any debt. But there’s a trade-off: by selling those receivables, the company gives up future income from them, which might tighten long-term cash flow and affect business’s financial performance.

Where are off-balance sheet items reported?

Off-balance sheet activities might not appear on the balance sheet itself, but they don’t stay entirely hidden. These items are usually disclosed in the notes to the financial statements, which include explanations of the company’s types of off-balance sheet arrangements.

This section provides additional information on items not included in the income statement, balance sheet, or cash flow statement. These notes are especially important for investors and stakeholders who want a full picture of the company’s financial obligations and potential risks.

Wrapping up: Which accounts do not appear on the balance sheet?

And there you have it—how the accounts on a balance sheet come together. It’s not easy, especially when you have to delve into the details of whatever is actually on the balance sheet before you even get to the accounts that are not stated. Accounting can feel like a maze with a lot of twists and turns, but here’s the thing: once you grasp one piece, it often unlocks a whole bunch of others because everything in accounting is interconnected.

Just keep learning, exploring different cases, and deepening your understanding. Before you know it, you’ll be the one breaking down these concepts for others. Keep at it!

Share your thoughts

What in this guide did you find helpful? What other topics from accounting practice would you like to explore? Share your thoughts in the comment section below.