Shopping online can be a great way to save time and money, but there are often limits to what you can buy. Afterpay is a payment service that allows buying items in installments and paying for them over time. But have you ever wondered what the maximum you can spend on Afterpay is?

Well, this guide will explain how Afterpay works and provide all the information you need to know about the maximum you can spend on Afterpay.

What is Afterpay?

Afterpay is a service that lets you buy items from participating retailers in installments.

After you select the items you want to purchase, you get the total item price and the total cost of installments you need to pay. After you accept the terms and conditions of Afterpay, your items are sent to you as soon as possible. It means that you may receive your items before you receive the first installment from Afterpay.

Afterpay is a great way to shop online while maintaining control of your finances because you will only pay for the items you purchase during each installment. And even though you make smaller payments, the items you buy will have the same value as if you were to buy them with a credit card. It happens thanks to the Afterpay connection to your debit card, but you will not be charged any interest when you make payments using Afterpay. Afterpay is available to anyone over 18 years old with a debit card and a valid email address.

What is the Maximum You Can Spend on Afterpay?

The maximum you can spend on Afterpay will vary depending on the retailer you purchase from. However, Afterpay has a general maximum of $1000 for all items. In other words, when buying items from a retailer that is not listed as an exception, you can only spend up to $1000 per order.

There are, however, plenty of retailers who will let you spend more than $1000 on one order. If you would like to shop for more expensive items, you can view a list of exceptions on the Afterpay website.

When buying items that exceed the maximum, you might be charged interest on the exceeding amount. The charge amount is usually up to the retailer and will vary from item to item.

What Happens if You Exceed the Maximum?

If you exceed the maximum you can spend on Afterpay, Afterpay will contact you and let you know you are exceeding the amount. Afterpay may also contact your bank to have the payment blocked.

If your payment is blocked, you can contact Afterpay and let them know you wish to pay for the item in full. It can be good to know that if you exceed the maximum and Afterpay blocks your payment, your items go back to the retailer. In some cases, you may still be charged for the items even if you return them. Usually, it depends on the retailer and its policies.

With all this in mind, you might want to keep an eye on your spending. It can be the best way to know how much will be your total spend.

How to Shop Within Your Budget

Shopping on Afterpay is easy. However, to keep it within your budget, you might need to control your monthly spending. You can do it by tracking your expenses. Once you know how much you can spend, you can choose the items to purchase using Afterpay wiser.

A good rule of thumb is always to use your common sense and ensure you can pay your monthly installments before you decide to purchase with Afterpay. Sometimes, it can be better to postpone a purchase to when you’re able to pay for it without making a hole in your budget.

Additional Benefits of Using Afterpay

If you are still unsure about using Afterpay, there are many benefits to using this service.

Afterpay offers flexible payment plans, so you can decide how to pay for your items. If you are shopping for expensive items, you may wish to pay for them in installments and make smaller payments to save money on interest.

Afterpay protects your identity: it doesn’t require you to enter any financial information when signing up. You don’t need a credit card or bank account to use Afterpay. Just link your debit card to Afterpay and choose how much you wish to spend on each installment.

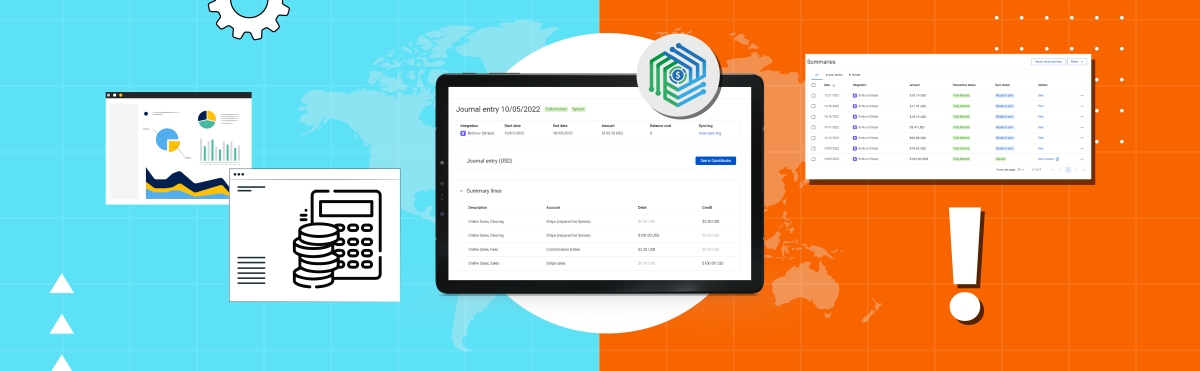

Afterpay vs. Other Payment Services

There are many payment services similar to Afterpay. At this point, you may be wondering if Afterpay is the right fit for you.

When comparing different payment services, you might want to consider the maximum you can spend on each service. It will help you to determine which service is best for you.

For example, if you wish to spend $1000 or more on a single order, Afterpay may be a better option. However, to buy more expensive items, a service like Zip Financing may be a better fit.

Conclusion

Afterpay is a great purchasing option that allows you to split the payment for a product that otherwise would be too expensive for you to buy. It helps you better control your spending and, thus, make buying decisions wiser. Still, Afterpay limits your order amount to $1000. This way, if you want to buy more expensive goods, you might want to consider other services with higher limits.

%20(1).png)