As a business owner, you know that running a successful business is about more than just turning a profit. You also have to protect your personal assets and minimize your liability in case of any legal issues or financial struggles. That’s where Form 8832 comes in. This simple form can help you protect both your business and personal assets and give you the peace of mind you need to focus on growing your company.

In this article, we’ll break down everything you need to know about Form 8832, including what it is, when to file it, and how it can help business owners safeguard their finances and assets. By the end of this guide, you’ll have a clear understanding of why Form 8832 is so important and how to file it correctly. So, let’s dive in and get your business protection plan in place!

The importance of protecting your small business and personal assets

As a business owner, you have a lot at stake. Not only have you invested your time, money, and energy into building your business, but you may also have personal assets that could be at risk if something goes wrong. That’s why it’s essential to protect both your business and personal assets from any legal or financial trouble that could arise.

One way to do this is by setting up a Limited Liability Company (LLC). An LLC is a type of business structure that provides limited liability protection to its owners. That means that if the company or entity is sued, the owners’ personal assets are generally protected from being seized to pay off any debts or legal judgments. However, simply setting up an LLC is not enough to ensure complete protection. You also need to file Form 8832.

Understanding the Limited Liability Company (LLC)

Before we dive into Form 8832, let’s take a closer look at the Limited Liability Company (LLC) and how it works.

An LLC is a hybrid business structure that combines the liability protection of a corporation with the tax benefits of a partnership or sole proprietorship. Unlike a corporation, an LLC does not have shareholders, and there is no need for a board of directors or officers. Instead, an LLC is owned by its members and is typically managed by one or more of those members.

One of the biggest advantages of an LLC is that it provides limited liability protection to its owners. That means that if the business is sued, the owners’ personal assets are protected. This protection is not absolute, and there are some circumstances where an owner’s personal assets could be at risk. However, in general, an LLC is an effective way to protect your personal assets from any legal or financial trouble that could arise from your business activities.

What Form 8832 is and how it can protect your assets

While setting up an LLC provides some level of liability protection, it’s not always enough. That’s where Form 8832 comes in.

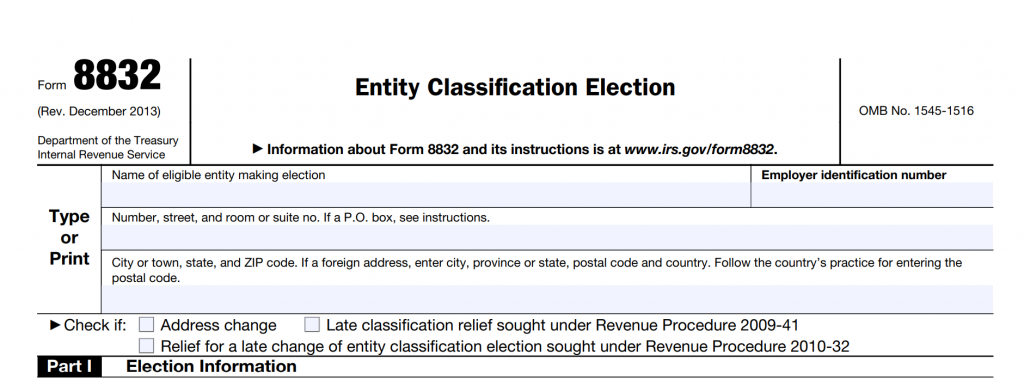

Form 8832, also known as the “Entity Classification Election” form, is an important document for businesses in the United States that allows them to choose how they will be taxed for federal tax purposes. This IRS form is used by eligible entities to elect their tax classification or status, which can have significant implications for their financial reporting, tax obligations, and legal liabilities.

Who should file Form 8832?

Eligible entities that can use Form 8832 to elect their tax classification or status include limited liability companies, partnerships, and S corporations. By default, these types of entities are taxed differently. For example, a single-member LLC is generally taxed as a sole proprietorship, while a multi-member LLC is taxed as a partnership. However, an eligible entity can choose to be taxed as a corporation by filing Form 8832 with the Internal Revenue Service (IRS).

The decision to elect a certain tax classification or status on Form 8832 should be made with careful consideration of the specific circumstances, goals, and future plans of the entity. For example, an entity may choose to be taxed as a corporation because it offers certain tax benefits or because it helps to protect the members’ personal assets from legal liabilities.

Additionally, if your LLC has multiple members, you may want to consider filing Form 8832 to protect your personal assets. When you have multiple members, the risk of legal or financial trouble is higher, and the protection provided by an LLC may not be enough. By filing Form 8832 and choosing to have your LLC taxed as a corporation, you can provide an additional layer of protection for yourself and your fellow members.

It is important to note that the election made on Form 8832 is binding for five years, unless the entity meets certain criteria that allow for a change in classification or status before the end of the five-year period. Therefore, each entity should carefully consider their tax classification and consult with a tax professional before making a decision to change something in their forms.

Learn what tax deductions your business may claim.

When should the tax Form 8832 be filed?

The 8832 IRS form should be filed no more than 75 days prior to the desired effective date of the election and no later than 12 months after the desired effective date of the election. The desired effective date of the election is the date on which the entity wants the new tax status or classification to become effective.

For example, if an LLC wants to elect to be taxed as a corporation effective January 1 of the current year, the Form 8832 must be filed no earlier than October 17 of the previous year (75 days before January 1) and no later than December 31 of the current year (12 months after January 1).

Find out what the major IRS tax audit red flags are and how to avoid them.

How to file Form 8832 – Step by step instructions

If filing forms scares you, just follow the instructions. Filing Form 8832 is a simple process, but it’s important to do it correctly to ensure that you get the protection and tax benefits you need. Here’s a step-by-step guide to filing Form 8832:

Step 1. Download the form from the IRS website

Go to the IRS website and download a 3-page, 11-question IRS Form 8832.

Step 2. Fill out the basic business information

Fill out the first block in the form, providing your LLC’s name, address, phone number and Employer Identification Number (EIN).

Step 3. Choose the type of election

Here you’ll have to choose the reason for filing the form: initial tax status or classification, or change in current tax status or classification of your business.

Step 4. Fill out previous elections

In this part of the form, you need to provide the info about previous elections for your business if any.

Step 5. Fill out affiliated companies

Submit the info about affiliated companies if there are any. This is done in case these companies submit a consolidated tax return.

Step 6. Select the type of entity

Elect how your business wants to be taxed depending on the specific circumstances and requirements we’ve described previously.

Step 7. List a foreign entity if applicable

If your company was created not in the USA, you’ll have to provide this information during this step of filing the form. You’ll be able to optimize your tax return if your business was created outside the USA, but pays US taxes.

Step 8. Specify the effective date of election

If you’re a new business, specify the date when you started your operations in the form. If you have to select the date is after you started operations, you’ll need to consult a business tax professional.

Step 9. Provide signature and contact information

At this step of filing, you’ll have to provide the name, title, and phone number of a person the IRS should contact if any questions arise.

Step 10. Sign the form

Don’t forget that the form must be signed by a business owner, manager or other responsible member.

Step 11. Mail the form to the IRS

Note that these forms cannot be filed electronically, you have to mail it at the address listed in the instructions. In line with the IRS, you’ll have to attach a copy of your Form 8832 to the federal income tax return for your business for the tax year of the election.

Once the form is submitted and approved by the IRS, the entity’s tax status or classification will be changed accordingly. It is important to note that the election made on Form 8832 affects how the entity is taxed for federal income tax purposes, but it may not necessarily affect how the entity is treated for other purposes, such as state tax purposes or for legal purposes.

Feeling lost in tax forms? Find out how to file income tax return for your small business.

Common mistakes to avoid when filing Form 8832

Filing Form 8832 is a straightforward process, but there are some common mistakes that you should avoid. Here are a few things to keep in mind:

- Verify that you choose the correct tax classification for your LLC. If you’re not sure which classification to choose, consult with a tax professional.

- Make sure all members of your LLC sign the form if your company has multiple members.

- Double-check your form for errors or omissions before mailing it to the IRS.

- Be sure to mail the form to the correct address listed in the instructions.

Alternatives to Form 8832 – Other ways to protect your assets

While Form 8832 is an effective way to protect your personal assets, it’s not the only option. Here are a few other ways you can protect your assets:

- Purchase liability insurance. Liability insurance can protect you from legal and financial trouble that could arise from your business activities.

- Create a trust. A trust can help protect your personal assets by transferring ownership to a trustee.

- Incorporate your business. Incorporating your business provides additional liability protection and tax benefits.

- Use automated software to ensure your accounting records are collected correctly. Filing taxes is impossible without accurate reconciliation. Why waste time reconciling your accounts manually, when you can trust this task to automated accounting software and use this time to grow your business? Synder Sync is a smart automated tool that connects all popular sales channels and payment gateways that your business has in use with your accounting software and allows for smooth reconciliation come tax season. No duplicates, no hassle. Check out the power of automationduring our 15-day free trial, or save a spot at our free webinar to explore the tool with a specialist.

Conclusion – Why Form 8832 is essential for protecting your assets

As a business owner, protecting not only your business, but your personal assets as well should be a top priority. Form 8832 is a simple way to provide an additional layer of protection for yourself and your fellow LLC members. By choosing to have your LLC taxed as a corporation, you can protect your personal assets from any legal or financial trouble that could arise from your business activities. If you haven’t already filed Form 8832, now is the time to file it. With this overview, you have all the information you need to file the form correctly and protect your assets for years to come.