When it comes to electronic fund transfers (EFT), accuracy is crucial to avoid payment failures and potential financial losses. This is where a prenote and prenote authorization come into play.

The concept of prenote is widely used in different countries for financial transactions, but do you know what is a prenote and what it really means and involves? In this article, we’ll break down what a prenote is, how prenote authorization functions, and the pros and cons of using prenotes. Ready? Dive in!

Prenote authorization: What is a prenote or ACH prenote?

If you search for ‘prenote’ on Google, you’ll see various search results. Let’s delve into defining the term. Prenote is a zero-dollar transaction used to verify the accuracy of account information before sending a live transaction. Prenote authorization, on the other hand, is the process of obtaining consent from the recipient to send a prenote.

The purpose of a prenote is to reduce the risk of failed transactions due to incorrect account information. Prenote is commonly used in different payment systems such as Automated Clearing House (ACH), wire transfers, and direct deposits.

The key difference between prenote and a live transaction is that prenote is not an actual payment. Instead, it is a notification that alerts the receiving bank to verify the account information. Prenote can include information such as the name and address of the account holder, account number, routing number, and transaction amount. This information is critical to ensuring that the payment is sent to the correct account and that it is not rejected due to incorrect account information.

Prenote process: How does a prenote work?

The process of sending and receiving a prenote varies slightly depending on the payment system used. In general, the initiating bank sends a prenote to the receiving bank, which verifies the account information and sends a response back to the initiating bank. The initiating bank then reviews the response and either approves or rejects the transaction.

Well, how long does it actually take?

Prenote period

A prenote period is a 3-5 business day timeframe used to confirm account details and ensure smooth electronic fund transfers. The timeline for sending and receiving a prenote can also vary depending on the payment system used.

Prenotes in payroll

In payroll, prenote refers to a zero-dollar transaction used to verify the accuracy of an employee’s bank account information before initiating direct deposit of their paycheck. The prenote is a test transaction that is sent to the employee’s bank account before the actual payroll direct deposit is made. This test transaction allows the employer to verify that the employee’s bank account information, such as the account number, name(s) on the account, name and address of the bank, is correct and the direct deposit can be successfully processed.

Note that a prenote usually has an expiration date. This date signifies the final opportunity for the banking information to be verified before sending the paycheck. If the verification process is not completed by the expiration date, the provided information will be deemed accurate, and the direct deposit will proceed accordingly. It’s important to mention that sending a prenote in payroll is optional – it’s recommended but not required.

Want to know more about payroll? Read our article on payroll management for SMBs.

Prenote vs direct deposit (automatic)

When it comes to payroll, there might be some kind of confusion in terminology – prenotes and direct deposits may sometimes get mixed up. Let’s define what an automatic deposit is.

Automatic deposits offer a convenient and efficient method to accomplish your long-term savings aspirations. Deposit instructions in this case are simple: you automatically receive paychecks through direct deposit and time an automatic transfer funds from your checking account to your savings or money market account. This way you resist the urge to spend and allows you to time your savings and bring more stability to expenses.

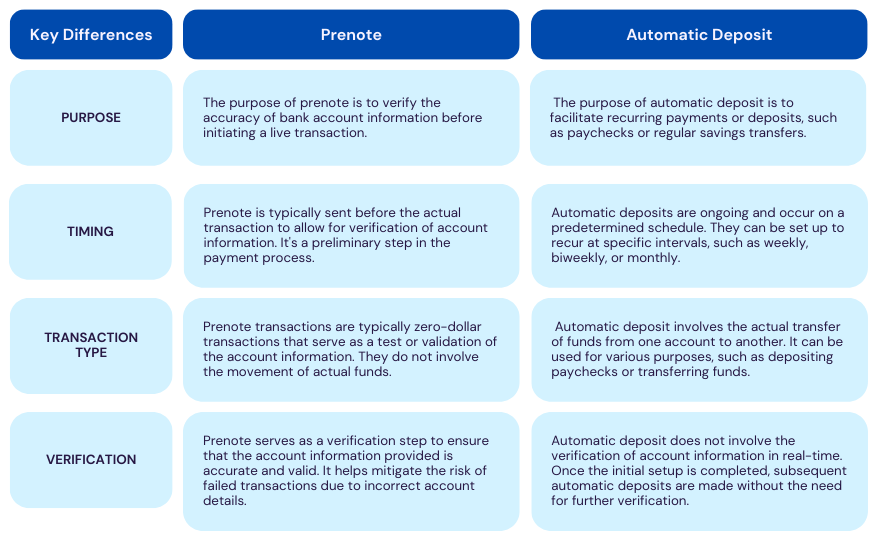

As you can see, prenote and automatic deposit serve different purposes in the context of financial transactions. Want a clearer picture? The key differences between prenote vs direct deposit are described in the table below:

Prenote in business

In business, a prenote is a notification that is sent to a vendor or supplier before the actual payment is made. This notification serves as a pre-authorization to confirm the accuracy of the vendor’s bank account information before initiating the payment. Here, a prenote is commonly used in accounts payable processes, particularly for recurring payments such as rent, utility bills, and subscriptions.

The purpose of a prenote in business is to reduce the risk of failed payments due to incorrect account information. By sending a prenote, the business can verify the vendor’s bank account information, including the account number, routing number, and account holder’s name. This helps ensure that the payment is sent to the correct account and reduces the risk of fraud.

The process of sending a prenote in business is similar to that of other payment systems. The business sends a notification to the vendor’s bank, requesting confirmation of the account information. Once the bank verifies the information, it sends a response back to the business, indicating whether the payment can be processed. If the response is positive, the business can then initiate the payment.

Benefits of using prenote

There are several benefits of using a prenote in financial transactions. For financial institutions, a prenote helps prevent errors in transactions, reducing the risk of failed payments due to incorrect account information. It also helps improve the efficiency of payment processing, reducing the need for manual reviews of payment data.

For customers, a prenote provides an added layer of security by verifying their bank information before any payment is made. This helps reduce the risk of fraudulent transactions and protects customers from unauthorized charges.

Do prenotes have any cons and limitations?

Limitations of prenote

While a prenote offers several benefits, there are also some limitations to consider. One potential drawback is that a prenote can cause delays in payment processing since it adds an extra step to the payment process. Additionally, a prenote can be costly for financial institutions, particularly for smaller institutions that may not have the resources to implement the necessary technology and processes.

Conclusion

In conclusion, a prenote is an essential component of electronic fund transfers that helps ensure the accuracy and efficiency of financial transactions. By verifying account information before initiating a payment, a prenote helps reduce the risk of failed transactions due to incorrect account information. While there are some limitations to consider, the benefits of using a prenote make it a valuable tool in payroll and business.

Learn more about What asset cannot be depreciated!