Every year, millions of Americans dutifully file their taxes, ensuring that they pay their fair share to fund essential government services. But what happens when someone suspects another individual or business of not being quite so honest?

Thanks to the IRS Whistleblower Program, there’s not only a mechanism to report tax fraud. There are also potential rewards for those whose information leads to action. So, what happens when you report someone to the Internal Revenue Service, IRS?

Want to ensure your business’s tax reporting is accurate? Discover Synder Sync‘s functionality to achieve a smooth tax season for your online business.

Understanding tax evasion

Before discussing the reporting process, it’s essential to grasp what constitutes tax evasion. Does it apply only when you don’t pay tax?

Defined by the IRS, United State competent authority, tax evasion is “the failure to pay or a deliberate underpayment of taxes.” This can manifest in various ways:

- unpaid taxes, underpayment of taxes

- underreporting cash transactions

- paying household employees off the books

- misrepresenting personal expenses as business expenses

- ignoring income from international sources, etc.

As you can see, the scope of tax violations is quite wide. Even filing a suspicious tax return can trigger the audit.

Find out more about the IRS tax audit red flags and how to file income tax return.

Reporting to the IRS

Finding a whistleblower attorney

Before blowing the whistle on any tax fraud activity, it’s key to speak to a savvy whistleblower lawyer. This will help you to protect yourself and consider all pros and cons. Under the False Claims Act, you must use a lawyer to file certain lawsuits. This will help to keep them secret from all but the government.

While you can file claims on your own, having a lawyer often makes them take your claim more seriously. And if you’d like to stay anonymous while filing, you’ll need a lawyer for that too.

Submitting evidence and filing necessary documents

When you decide to submit information about tax fraud, use the IRS Form 211, titled “Application for Award for Original Information.” This form requires you to provide detailed original information about:

- the alleged tax noncompliance,

- evidence supporting your claims,

- an account of how you came across this information,

- your relationship (if any) to the person or entity in question.

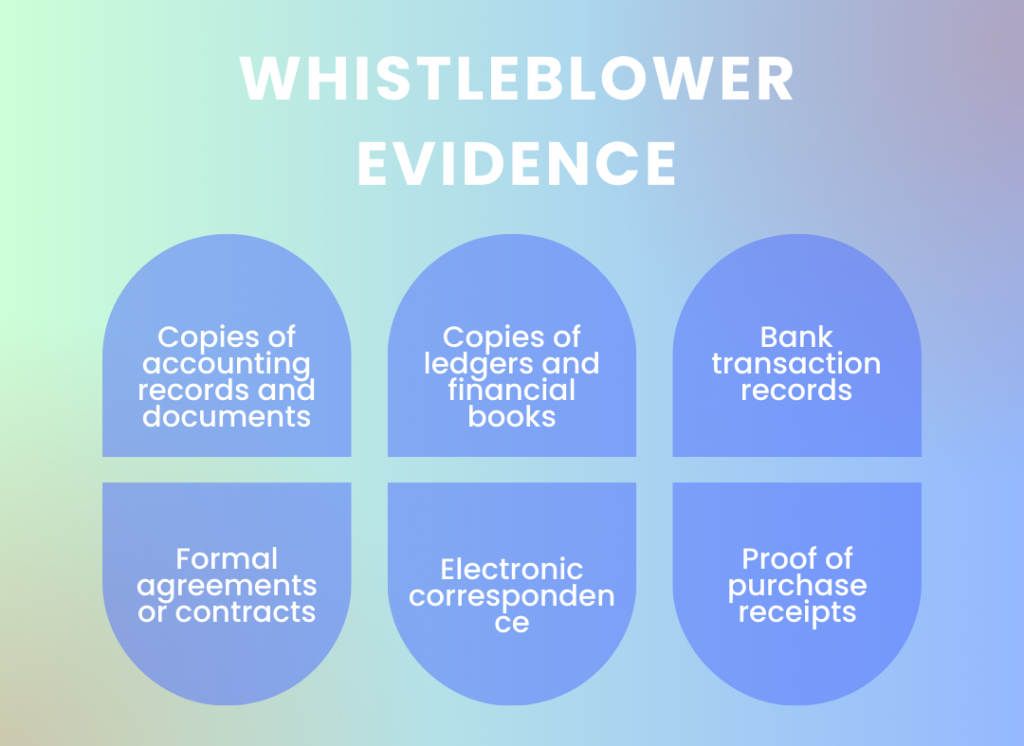

In particular, potentially valid evidence for whistleblowers encompasses:

- copies of accounting records and documents,

- copies of ledgers and financial books,

- bank transaction records,

- formal agreements or contracts,

- electronic correspondence,

- proof of purchase receipts.

The whistleblower must sourced the data legally and without breaching any tax regulations. If whistleblowers lack direct access to such evidence, they may indicate the probable location of said information.

To formally report a tax law violation involving tax cheats – an individual, a business, or both, you need to fill out Form 3949-A Information Referral. You can submit the alleged violations to the IRS by completing the IRS Form 3949-A online.

After filling out the necessary details and gathering supporting documents, including a signed declaration under penalty of perjury, submit the form to the IRS Whistleblower Office for evaluation.

The journey after reporting to the IRS: What to expect

After lodging your claim, a dedicated IRS analyst will examine it. They will either discard the claim or categorize it as per sections 7623 (a) or (b) of the Internal Revenue Code (IRC). If your submission doesn’t fit the parameters for section 7623 (b), they will consider it under the discretionary protocol of section 7623 (a).

Subsequently, the Whistleblower Office will relay their final verdict on the claim in written form. For claims assessed under section 7623 (b), claimants have the right to challenge the decision in the US Tax Court within 30 days. However, judgments based on section 7623 (a) are exempt from such appeals.

Duration of the procedure

Navigating the IRS reporting system, starting with the comprehensive submission of details until the final settlement, can span several years. Note that the IRS withholds whistleblower rewards until the accused taxpayer has exercised all available administrative and judicial appeal rights. And this can be a lengthy process.

Presently, certain constraints within the IRS Whistleblower Program have led to prolonged delays in disbursing whistleblower rewards. A 2020 annual report disclosed that the program generally requires approximately 10.79 years to finalize a claim. But the good news is that whistleblower advocates are actively lobbying for reforms to expedite the process.

Whistleblower cases

To offer some perspective on the timeline, we can explore a few whistleblower cases.

The GlaxoSmithKline case

Whistleblowers Thomas Gerahty and Matthew Burke exposed fraudulent activities within Glaxo. The case against a pharmaceutical giant lasted for nearly a decade. It eventually lead to the largest Medicare and Medicaid fraud settlement in history: a whopping $3 billion. Beginning in early 2003, they revealed insider secrets about Glaxo’s illicit marketing and sales strategies.

The UBS case

Bradley Birkenfeld revealed illicit banking activities of UBS bank in Switzerland to the IRS in May 2007. This led to a 2009 settlement where UBS shelled out $780 million. Birkenfeld received a whistleblower award of $104 million in September 2012.

The Cisco Systems case

In a case that lasted eight years, James Glenn filed a lawsuit against Cisco Systems Inc. He uncovered cybersecurity issues in their video surveillance systems sold to the government. Filed in 2011 and settled in 2019, the case resulted in an $8.6 million settlement after revealing these notable security concerns.

Conclusion

Reporting someone to the IRS is a vital action that follows a specific and organized procedure. But know you know exactly what happens when you report someone to the IRS.

It’s pivotal to understand that when individuals evade taxes, the broader community loses out on funds that support public services. Whistleblowers ensure that everyone pays their fair share, fostering a sense of fairness and trust in our tax system. They play a key role in maintaining integrity and accountability.

Looking for alternative digital payment methods? Discover what FPX is.