When waiting for a tax refund, business owners often have many questions and thoughts about navigating the complex tax system. Journey with us to learn more about IRS refund timeframes, ensuring you are well-informed and prepared to navigate your financial voyage during the tax season.

Day of the week for IRS refund deposits

The IRS typically processes tax refunds and executes direct deposit transactions within 21 days after accepting your tax return. It’s common for the IRS to issue them on business days, from Monday through Friday.

Learn how to speak to someone at IRS.

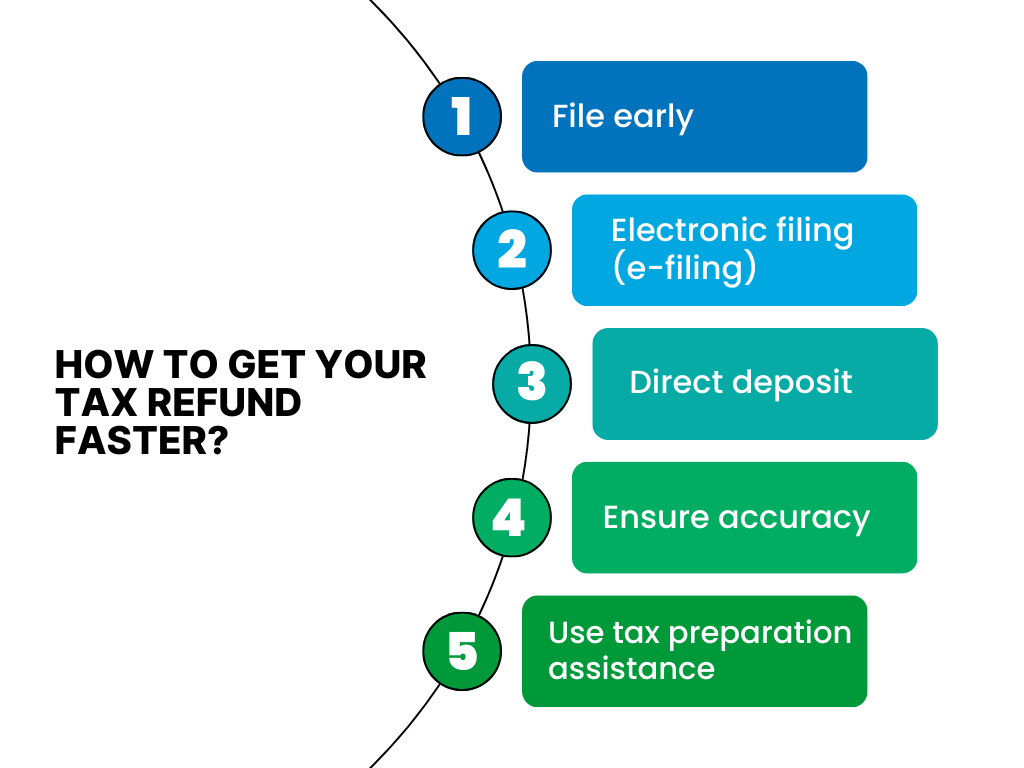

How can I get my tax refund faster?

For business owners looking to streamline their tax filing process and receive refunds more swiftly, here are detailed descriptions of effective strategies:

File early

Submitting your tax return at the earliest opportunity is wise. Don’t procrastinate until the deadline; instead, file as soon as you’ve gathered all necessary tax documents, such as W-2s and 1099s. Early filing also provides additional time to address any issues or audits from the IRS without the pressure of an impending deadline.

Electronic filing (e-filing)

The IRS processes e-filed returns faster than paper returns, often within three weeks. This method is quicker and more secure and reliable, reducing the risk of errors and lost paperwork. E-filing is available through IRS-approved software, professional tax preparers, or an authorized e-file provider. It’s a convenient and efficient way to submit your business’s tax return, ensuring faster delivery of any potential refunds.

Direct deposit

Choose direct deposit tax refund as your method to receive the refund instead of waiting for a paper check through the mail. Make sure your bank account and routing numbers are accurate to facilitate a smooth and swift deposit of your refund. It’s a secure and efficient way to access your refund, allowing for immediate use or investment back into your business.

Ensure accuracy

Accuracy in filing your tax return is crucial to avoid delays in processing and receiving your refund. Errors, missing information, or inconsistencies can trigger audits or requests for additional information, significantly delaying your refund. Ensure all income is accurately reported, and deductions and credits are correctly calculated.

Use tax preparation assistance

Utilizing a tax professional or Certified Public Accountant (CPA) can streamline the filing process. Tax professionals can provide personalized advice tailored to your business’s specific situation, potentially uncovering savings and strategies you might overlook.

Eliminate manual data entry errors from the process by automating the record of the transactions and sales data with an automated accounting solution, learn how Synder can help.

Benefits of choosing IRS direct deposit

Selecting direct deposit for receiving your business tax refund from the IRS offers several compelling advantages, making it a superior option for savvy business owners. Here’s why choosing direct deposit could be highly beneficial for your business.

Speed of refund

Direct deposit is often the fastest way to receive your tax refund. Compared with paper checks, electronic transfer ensures that your money reaches you as swiftly as possible. Often within 21 days if there are no issues with the return. This speed enables quicker access to funds, which can be critical for cash flow management and timely investment back into your business operations.

Security

Opting for direct deposit significantly increases the security of your refund. Paper checks are vulnerable to loss, theft, or damage, but direct deposit eliminates these risks. The money is electronically transferred to your bank account, ensuring it’s securely and reliably received without the vulnerabilities associated with physical checks.

Convenience

Choosing direct deposit eliminates the need to visit a bank or check-cashing service to access your refund. Your funds are automatically deposited into your bank account, saving you time and effort.

Multiple allocation options

Direct deposit offers the flexibility to distribute your refund across up to three different accounts, enabling efficient financial management. You can allocate funds to checking and savings accounts, or even invest in an Individual Retirement Account (IRA), streamlining your financial planning and potentially enhancing your savings strategy.

Simplicity and easy tracking

Setting up direct deposit is straightforward and can be done while filing your tax return by providing your bank account and routing numbers. Moreover, you can easily track the status of your refund using the IRS “Where’s My Refund?” tool or the IRS2Go app.

Possible issues

Even with the IRS’s efforts to streamline tax refunds, business owners may face certain challenges when it comes to their deposit refunds. Understanding these potential obstacles can help prepare for and mitigate any impact on the process.

Incorrect bank information

Issue: Providing inaccurate bank account or routing numbers.

Impact: Your refund could be sent to the wrong account or returned to the IRS.

Delayed tax return processing

Issue: Delays in processing due to filing errors, incomplete information, or IRS backlog.

Impact: Your refund may take longer than the typical 21-day window for e-filed returns.

Tax return audits

Issue: Your return may be selected for an audit.

Impact: Additional verification or information might be needed, delaying the refund.

Bank processing times

Issue: Banks may have varying processing times for direct deposits.

Impact: Even after the IRS issues the refund, it might not immediately reflect in your account.

Systemic issues

Issue: Technical issues on the IRS’s end, such as the IRS website downtimes or system failures.

Impact: Delays in processing returns and issuing refunds may occur.

Errors in tax return

Issue: Mistakes in calculations, incorrect filing status, or other inaccuracies in your return.

Impact: Your return may be held for correction, delaying the refund process.

Conclusion

Although the IRS is committed to facilitating a seamless refund process, it’s essential for business owners to remain proactive in addressing potential challenges. A thorough and careful approach to preparing and filing your tax returns, staying informed about IRS announcements, and promptly addressing any discrepancies can greatly reduce the likelihood of encountering problems.

In instances where issues arise, utilizing IRS resources, consulting with tax professionals, and exercising patience can facilitate the resolution process. Always ensure to safeguard your personal information and stay vigilant against potential fraud in order to protect your financial interests.

If you want to learn more about tax compliance, read our article about backup withholding.