Depreciation is a common accounting practice that allows businesses to allocate the cost of an asset over its useful life. By gradually reducing the value of tangible assets, depreciation reflects their wear and tear, obsolescence, or loss of value. While most assets can be depreciated, there are certain types of assets that do not qualify for this treatment.

In this article, we will explore depreciation and it’s calculation, the assets that can and cannot be depreciated and delve into the reasons behind this limitation.

Understanding depreciation: What is depreciation in cost accounting?

Before we discuss the assets, let’s make sure we understand depreciation.

Depreciation in cost accounting refers to the allocation of the cost of a tangible asset over its useful life. It is a systematic process that recognizes the gradual decrease in the value of an asset due to factors such as wear and tear, obsolescence, or technological advancements. Cost accountants utilize depreciation to accurately determine the cost of producing goods or services and to track the expenses associated with the use of assets in the production process.

In cost accounting, depreciation is considered an indirect cost or an overhead expense that is allocated to products or services based on the asset’s contribution to the production process. By assigning a portion of the asset’s cost to each unit of production, cost accountants ensure that the cost of using the depreciated asset is appropriately distributed among the goods or services produced.

Find out more about depreciation from our article ‘Depreciation Journal Entry: How to Keep Your Journal Entries and Accounting Under Control’.

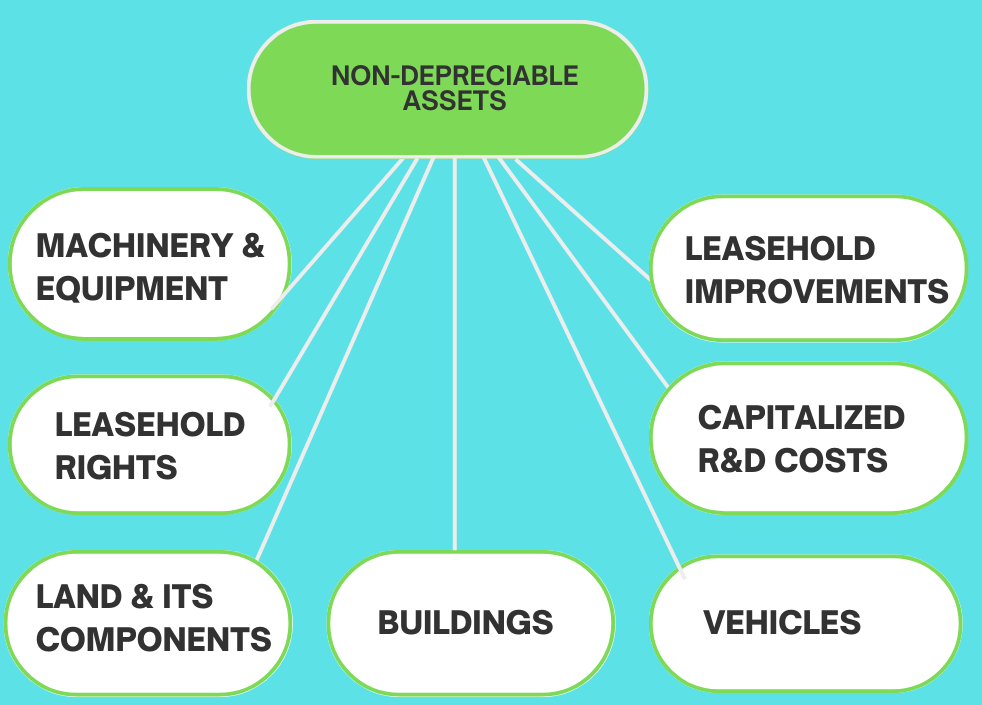

Depreciable assets: Which asset can be depreciated?

Several types of assets can be depreciated. Let’s take a closer look at depreciable assets in this section.

Buildings

Commercial and residential buildings can be depreciated over their useful lives. This includes office buildings, warehouses, factories, apartments, and other structures used for business purposes.

Vehicles

A car, truck, van, and other vehicles used for business purposes are depreciable assets. The depreciation is based on factors such as the initial cost, expected usage, and estimated useful life of the vehicle.

Machinery and equipment

Industrial machinery, manufacturing equipment, computers, servers, furniture, fixtures, and other equipment used in business operations can be depreciated over their useful lives.

Leasehold improvements

Improvements made to leased property, such as renovations, installations, or additions, are depreciable assets as well. These improvements enhance the value or extend the usefulness of the leased space.

Capitalized research and development (R&D) costs

R&D costs that meet specific criteria and are capitalized as depreciable assets. These costs are associated with the development of new products, processes, or services.

Leasehold rights

If a company has acquired the rights to use a leased property, the cost of those rights can be depreciated over the term of the lease.

It’s important to note that the specific depreciable assets may vary based on local tax laws, accounting standards, and industry practices. Asset depreciation is a complex topic, and businesses should consult accounting professionals or tax advisors to ensure proper asset classification and depreciation calculations according to applicable regulations. Depreceable assets should be correctly accounted for in your books and you’d rather turn to a professional than deal with the IRS come the ens of the tax year.

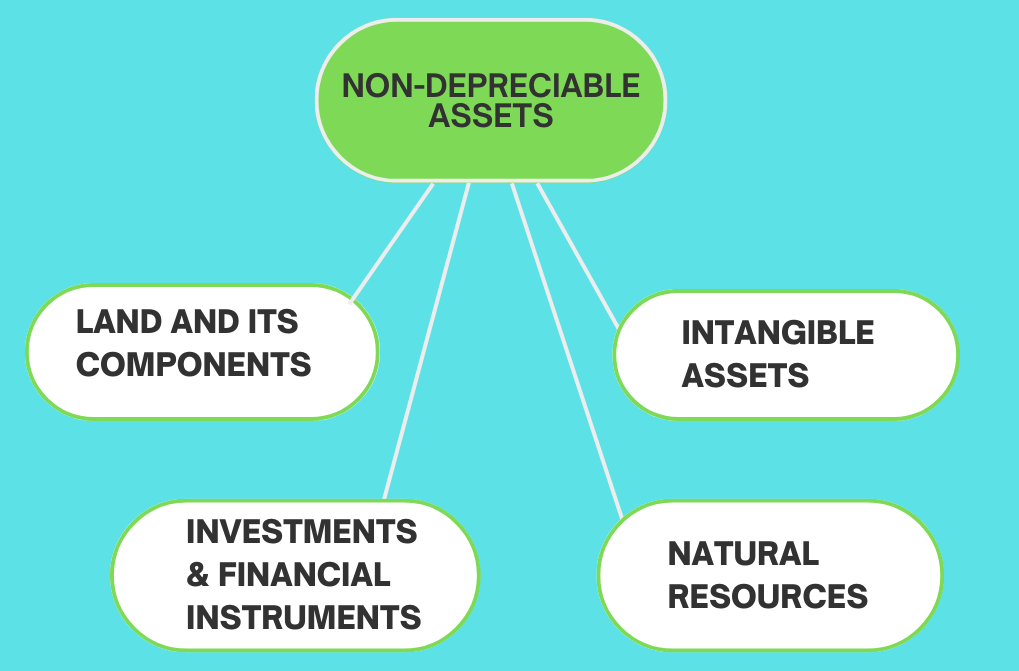

Non-depreciable assets: Which asset cannot be depreciated?

Now that you know which assets can be depreciated, let’s explore the ones you can’t claim depreciation for.

Land and its components

Land as an asset

Land is a unique asset that cannot depreciate. Unlike other assets, land has an indefinite asset life and does not suffer from physical deterioration. It retains its value or may appreciate over time. Land is a non-depreciable asset due to the following reasons:

- Indefinite useful life. Land is considered to have an unlimited lifespan, as it does not wear out or become obsolete.

- Inability to determine consumption. Unlike other assets, land does not diminish in quantity or quality through regular use, and therefore does not depreciate.

Components of land

While land itself cannot depreciate, certain improvements and developments made to land, such as buildings, landscaping, and land development costs, are subject to depreciation. However, the value of land does not decrease with the depreciation of its components due to its inherent characteristics.

Intangible assets

Intangible assets are another category of assets that generally cannot depreciate. These assets lack physical substance and include items such as goodwill, trademarks, brands, copyrights, and patents. The reasons for non-depreciation of intangible assets are as follows:

- Indefinite useful life. Intangible assets often have an indefinite or uncertain useful life, making it difficult to determine a specific period for depreciation.

- Amortization as an alternative. Instead of depreciation, intangible assets are typically amortized, which is a similar concept but specifically applies to the allocation of the asset’s cost over its useful life.

Investments and financial instruments

Investments in stocks, bonds, and mutual funds

Investments in financial instruments such as stocks, bonds, and mutual funds cannot be subject to depreciation. The reasons include:

- Marketable securities. These assets are classified as marketable securities and are accounted for at fair value, which fluctuates based on market conditions.

- Short-term holding period. Investments in stocks, bonds, and mutual funds are typically intended for short-term holding rather than long-term use.

Financial instruments

Certain financial instruments, such as derivatives, futures, and options, also cannot be depreciated. The reasons for their non-depreciation are:

- Market value fluctuations. Financial instruments derive their value from an underlying asset or index and are subject to market fluctuations, making traditional depreciation inappropriate.

- Short-term nature. Financial instruments are usually held for speculative or hedging purposes and are not intended for long-term use.

Natural Resources

Natural resources, such as oil, gas, mineral deposits, and forests are not depreciable assets due to their unique characteristics:

- Exhaustible nature. Natural resources are finite and diminish over time as they are extracted or consumed.

- Depletion accounting. Rather than depreciation, natural resources are accounted for using depletion methods that allocate the cost of extraction over the estimated reserves.

How to calculate the total amount depreciated each year

To calculate the total amount depreciated each year, you need to consider the initial cost of the asset, its estimated useful life, and the depreciation method being used, similar to how one might need to carefully consider each step when looking how to delete a journal entry in QuickBooks Online. Here are the steps to calculate the annual depreciation amount.

Step1. Determine the initial cost

Start by identifying the original cost or purchase price of the asset. This includes not only the purchase price but also any costs incurred to bring the asset into use, such as transportation and installation expenses.

Step 2. Determine the estimated useful life

Estimate the number of years or the total amount of production units that the asset is expected to be used or contribute to the business. The useful life can be determined based on industry standards, asset-specific guidelines, or your own experience with similar assets.

Step 3. Consider the salvage value

Determine the estimated residual value or salvage value of the asset at the end of its useful life. This is the expected value of the asset after it has been fully utilized or depreciated.

Step 4. Select a depreciation method

Choose an appropriate depreciation method based on your business needs, accounting regulations, and tax considerations. The most common methods include straight-line depreciation, declining balance depreciation, and units of production depreciation.

Depreciation is typically calculated using various methods, including:

Straight-line method

The most common depreciation method, it evenly spreads the cost of the asset over its useful life. The formula for straight-line depreciation is:

Depreciation Expense = (Asset Cost – Salvage Value) / Useful Life

- Asset Cost refers to the original cost of the asset.

- Salvage Value represents the estimated residual value of the asset at the end of its useful life.

- Useful Life refers to the estimated duration over which the asset will be utilized.

Declining balance method

This method assumes that an asset will generate more revenue in its early years and, therefore, assigns a higher depreciation expense during those years. The formula for declining balance depreciation is:

Depreciation Expense = (Net Book Value – Accumulated Depreciation) x Depreciation Rate

- Net Book Value is the original cost of the asset minus accumulated depreciation.

- Accumulated Depreciation is the total depreciation expense recognized since the asset was acquired.

- Depreciation Rate is a percentage determined by dividing the straight-line rate by a predetermined factor.

Units of production method

This method bases depreciation on the actual usage or production of the asset. It calculates depreciation expense by dividing the total expected production units over the asset’s useful life.

What is a depreciation tax shield?

A Depreciation Tax Shield refers to the tax benefit that arises from the depreciation expense of a tangible asset. It is a financial advantage that businesses can utilize to lower their taxable income and, consequently, their tax liability to the IRS.

When an asset is depreciated, the cost of the asset is allocated over its useful life, and a portion of the asset’s value is recognized as an expense each accounting period. This depreciation expense is deducted from the business’s taxable income, reducing the amount of income subject to taxation. The tax savings resulting from this deduction is referred to as the Depreciation Tax Shield.

The Depreciation Tax Shield provides a way for businesses to recover some of the initial investment made in acquiring the asset through reduced tax obligations. By recognizing depreciation expenses, businesses can lower their taxable income and, in turn, reduce the amount of taxes they owe.

The value of the Depreciation Tax Shield depends on the tax rate applicable to the business. The higher the tax rate, the greater the tax savings achieved through depreciation. It effectively represents a cash flow benefit for the business, as the taxes saved can be reinvested or used for other purposes.

It’s important to note that while the Depreciation Tax Shield provides short-term tax benefits, it does not eliminate the actual economic cost of the asset. Understanding the complexities of asset management, including the implications of standards like ASC 842 on lease accounting, reveals that the asset’s value is still being consumed or diminished over time,

Conclusion to asset depreciation in accounting

Depreciation is primarily an accounting concept and does not necessarily represent the actual market value or physical condition of an asset. It is used to allocate the cost of an asset over time, ensuring that the expenses associated with acquiring and using the asset are accurately reflected in a company’s financial statements.

If you want to automate your accounting and get accurate and clear reporting, consider using smart automated software. With Synder, all your transactions will be neatly transferred to your accounting system and you’ll enjoy stress-free reconciliation. Check out Synder on a free 15-day trial, or book a seat at our webinar to get a guided tour of the solution and ask questions. Automate your accounting and save time to focus on growing your business!

In this article, we have explored the assets that cannot be depreciated and discussed the reasons behind their non-depreciation. Understanding these limitations is crucial for accurate financial reporting, tax planning, and decision-making within organizations. By comprehending the distinctions between depreciable and non-depreciable assets, businesses can ensure proper asset classification and gain a more accurate picture of their financial health.

Curious to learn more? Read our articles about Prenote and Year-To-Date meaning!

It got me when you discussed that the value of the Depreciation Tax Shield relies on the tax rate ideal for the business. My friend wants to make the most of tax depreciation. I should advise him to turn to an expert in tax depreciation to ensure quality work.