TikTok Shop has quickly become a major sales channel for ecommerce businesses, combining social content and commerce in a single platform. TikTok Shop has quickly become a major sales channel for ecommerce businesses, combining social content and commerce in a single platform. According to eMarketer, TikTok Shop now accounts for 18.2% of total U.S. social commerce, with its share expected to reach 24.1% by 2027.

As volume scales, each transaction carries multiple underlying costs that directly affect profit margins, cash flow, and accounting accuracy if they aren’t tracked carefully. This article breaks down the fees TikTok Shop sellers encounter, explains how those costs impact the bottom line, and shows how to track them correctly in your accounting system.

TL;DR

- TikTok Shop fees are multi-layered and impact margins more than the headline referral rate suggests.

- Strong sales can mask profitability and cash-flow issues if fees aren’t fully accounted for.

- Pricing, fulfillment, and affiliate strategy directly influence net results.

- Clean, transaction-level accounting is required to see true performance across channels.

- Tools like Synder automate TikTok Shop accounting and help maintain consistent, reliable books at scale.

What are TikTok Shop fees?

TikTok Shop fees are the charges sellers pay for transactions completed through TikTok Shop. Instead of a fixed monthly subscription, TikTok Shop uses a per-sale, performance-based model, meaning fees apply only when an order is placed and paid.

TikTok Shop fees typically include:

- Referral fee – A percentage of each item’s sale price. This is the primary platform fee and the largest cost for most sellers.

- Payment processing fee – Covers payment authorization and fund transfer from the customer to the seller.

- Refund handling fee – Applied when orders are refunded or disputed.

- Affiliate commission – Paid to creators when sales come through TikTok affiliate links or shoppable content.

- Shipping and fulfillment fees – Charged if you use TikTok-managed logistics or fulfillment services.

Each fee is recorded as a separate line item in TikTok payout reports, rather than being netted into a single total.

Understanding the full fee structure is critical for accurate pricing and margin tracking. Sellers who account only for the referral fee often find that net payouts are 5–10% lower once processing, affiliate, and refund-related costs are included.

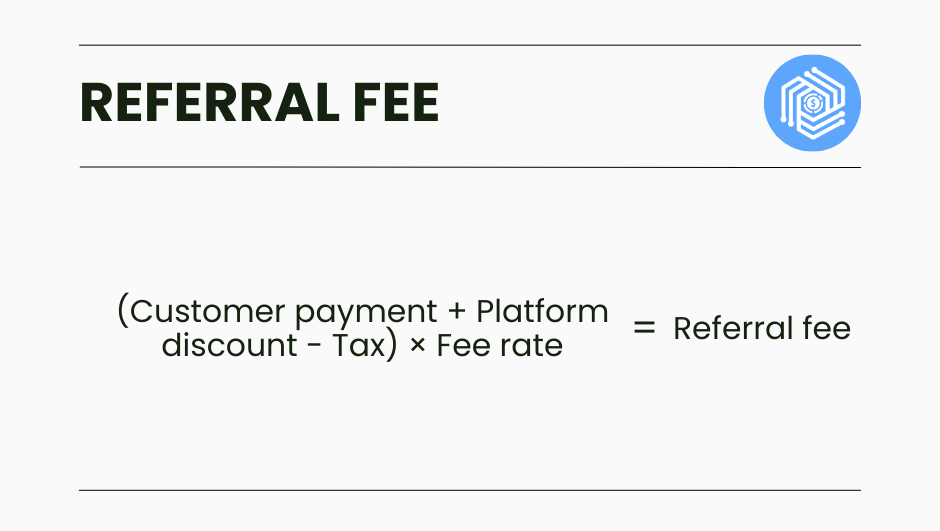

TikTok Shop commission structure: Breaking down the referral fee

The referral fee is TikTok Shop’s core commission and applies to every completed sale. It’s calculated on the item value before tax and shipping and is deducted automatically from each payout, so sellers never receive the gross amount and pay the fee later.

TikTok applies a temporary promotional referral rate for new sellers. This discount is time-limited and automatically expires, so pricing models should be built around the standard category rate rather than the introductory one.

Because the referral fee is taken at the transaction level, it directly affects net payouts and margin calculations. Sellers who price products without accounting for the correct category rate often see lower-than-expected deposits once fees are applied.

For exact percentages, calculation rules, and refund-related charges, see the table below.

| Fee component | Rate | Calculation basis | Example (on $50 product) |

| Referral fee (standard) | 6% | Customer payment + platform discount – tax | $3.00 |

| Referral fee (new seller) | 3% | Customer payment + platform discount – tax | $1.50 (first 30 days only) |

| Refund administration fee | 20% of referral fee | Original referral fee amount | $0.60 (on $3 referral fee, capped at $5/SKU) |

TikTok Shop referral fees by category

While TikTok maintains a standard 6% referral fee across most categories, certain product types have different rates:

| Product category | Referral fee rate | Notes |

| Beauty & personal care | 6% | Most common category |

| Apparel & accessories | 5-6% | Standard clothing items |

| Jewelry & watches | 5% | Reduced rate category |

| Home & kitchen | 6% | Standard rate |

| Sports & outdoors | 6% | Standard rate |

| Electronics | 6-8% | Higher for accessories |

| Books & media | 2-5% | Lower rate tier |

| Food & beverage | 6% | Standard rate |

| Health & wellness | 6% | Standard rate |

| Baby & kids | 6% | Standard rate |

Important: Category rates are subject to change. Always verify current rates in your TikTok Seller Center before finalizing pricing strategies. New sellers receive a promotional 3% rate for the first 30 days after their initial sale, regardless of category.

Additional TikTok Shop fees beyond the referral charge

Beyond the referral fee, TikTok Shop applies several other costs that affect net payouts and margin visibility. These fees are deducted automatically and are not always itemized as clearly in seller reports.

Payment processing fees

Payment processing fees apply on every transaction in addition to the referral fee. These typically run at around 2.9% of the transaction value plus a small fixed fee.

Key points:

- Fees vary by payment method

- Credit cards generally cost more than debit cards or bank transfers

- These charges are deducted from payouts but are not shown as clearly as referral fees in the seller dashboard

Refund administration fees

Refunds trigger a separate administrative charge. When an item is returned:

- TikTok refunds the original referral fee

- 20% of that referral fee is retained as an administration charge

- The fee is capped at $5 per SKU

For high-return categories such as apparel, these charges can add up quickly, especially during promotional periods when return rates increase.

Fulfilled by TikTok (FBT) fees

Sellers using TikTok’s fulfillment services incur additional logistics and storage costs.

FBT fees include:

- Fulfillment fee starting at $3.58 per item, increasing with size and weight

- Storage fees:

- Free for the first 30 days

- $0.02 per cubic foot per day (days 31–90)

- $0.12 per cubic foot per day after 180 days

Slow-moving inventory can significantly increase storage costs over time.

Affiliate commissions

Affiliate commissions apply when sales are driven by TikTok creators through the affiliate program.

Typical characteristics:

- Usually 10–20% of the sale price

- Rates are negotiated directly between sellers and creators

- Commissions vary based on creator reach, engagement, and demand

While sellers control affiliate rates, competitive pressure often pushes these commissions higher. For businesses selling across multiple channels, tracking creator commissions alongside platform and payment fees is essential for accurate profit margin reporting.

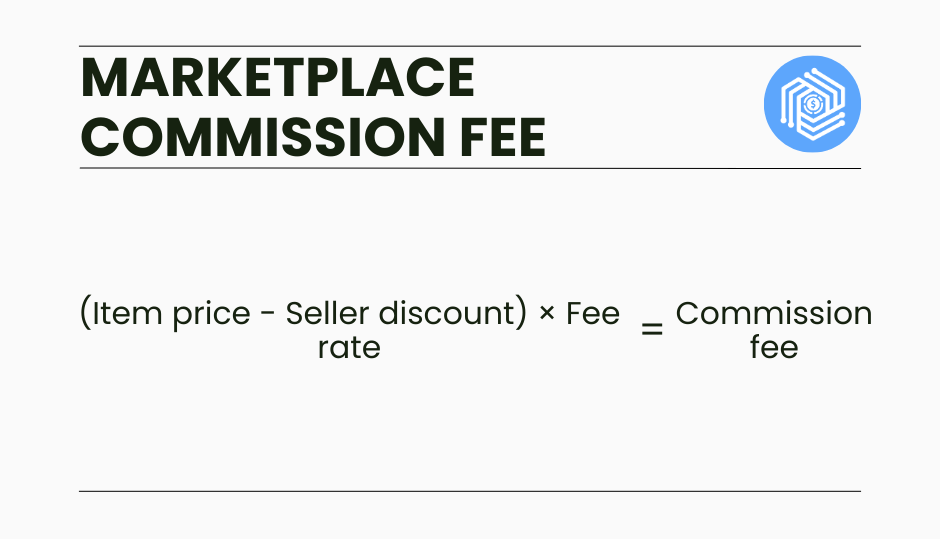

Example of calculating commission fee

Let’s say you’re selling a piece of apparel on TikTok Shop, and the commission rate for apparel is 15%. If you sell a shirt for $100, the commission fee calculation would be as follows:

Commission fee = Selling price × Fee rate

Commission fee = $100 × 15% = $15

So, for a shirt sold at $100, you would pay TikTok $15 as a commission fee, and you would receive the remaining $85, minus any other applicable fees like payment processing or shipping fees, if they apply.

TikTok Shop vs. other platforms: Fee comparison

Understanding how TikTok Shop fees compare to other major ecommerce platforms helps you make strategic decisions about where to allocate inventory and marketing spend:

| Fee type | TikTok Shop | Amazon | Etsy | Shopify |

| Monthly subscription | $0 | $39.99 (Professional) | $0 | $29-$299 |

| Referral/commission fee | 6% (most categories) | 8-15% (category-based) | 6.5% | 0% |

| Payment processing | ~2.9% | Included in referral | 3% + $0.25 | 2.9% + $0.30 |

| Fulfillment (FBT/FBA/self) | $3.58+ per item | $3.30+ per item | Self-ship | Self or 3PL |

| Listing fees | $0 | $0 | $0.20/item | $0 |

| Affiliate/ads (typical) | 10-20% | Variable | Variable | Variable |

| Typical total fees | 15-20% | 20-30% | 10-15% | 3-8% |

Key takeaways:

- TikTok Shop offers lower base fees than Amazon but typically requires higher affiliate spending to drive traffic

- Amazon provides organic search traffic without mandatory creator partnerships, offsetting higher referral fees

- Etsy has similar commission rates but attracts bargain-hunters, making premium pricing difficult

- Shopify has the lowest fees but requires you to drive all your own traffic through paid ads or organic marketing

Managing TikTok Shop fees in your accounting system

TikTok Shop fees look simple on the dashboard, but the numbers that hit your bank account rarely match what you see at the order level. Discounts, reimbursements, reserves, and withheld taxes all change how revenue and fees should be recorded.

Where TikTok accounting gets messy:

- Platform discounts reimbursed by TikTok

- Shipping promotions credited back to the seller

- Balance reserves withheld and released in later payouts

- Marketplace facilitator tax withheld in certain jurisdictions

How Synder handles TikTok Shop activity

Synder is an accounting automation platform that syncs sales, fees, taxes, and payouts from ecommerce platforms and payment providers directly into QuickBooks, Xero, Sage Intacct, NetSuite, or Puzzle. For TikTok Shop, it connects via API and pulls full transaction-level detail.

Synder automatically:

- Creates invoices that reflect gross sales, discounts, and TikTok reimbursements correctly

- Records shipping reimbursements separately from actual shipping costs

- Tracks balance reserves as transfers so clearing and bank accounts stay aligned

- Separates marketplace facilitator tax from sales tax to avoid revenue inflation

All TikTok fee types are captured and mapped to the right accounts:

- Referral fees → marketplace or commission expenses

- Withheld taxes → tax offsets, not revenue

- Shipping costs and reimbursements → tracked independently

Why this matters

With Synder, TikTok Shop data lands in your accounting software in the same structure as Amazon, Shopify, eBay, and other channels. That consistency makes it possible to compare true profitability across platforms, and understand how TikTok fees affect margins.

The time savings are material. Instead of spending hours each week downloading TikTok reports, creating manual journal entries for reimbursements, and tracking reserve movements across payouts, books stay accurate automatically. Multi-channel ecommerce businesses using Synder’s automation save $60,000+ annually in staffing costs while maintaining 99.5%+ reconciliation accuracy, a level that is extremely difficult to achieve with manual TikTok Shop accounting.

See how TikTok Shop accounting should work. Try Synder free or book a demo to understand how TikTok Shop fees, payouts, and reconciliation are handled end to end.

How TikTok Shop fees impact your actual profitability

Looking only at the 6% referral fee understates the real cost of selling on TikTok Shop. Profitability depends on stacking every fee layer together, not treating them in isolation.

What fees look like on a single order

For a typical $50 product, total platform-related costs can add up quickly:

- Referral fee (6%): $3.00

- Payment processing (~2.9%): $1.50

- Affiliate commission (15%): $7.50

- FBT fee: $3.58

That’s $15.58 in fees on one sale, before accounting for product cost, packaging, shipping materials, or overhead.

Across most sellers, this puts total TikTok Shop fees in the 15–20% range of gross sales, and sometimes higher depending on affiliate usage and fulfillment choices.

Cash flow impact most sellers underestimate

Fee structure isn’t the only factor, timing matters. TikTok payouts usually occur only after an order is delivered and the return window has closed, which can create a 10–15 day gap between making a sale and receiving funds.

During that period, inventory is often paid for upfront while FBT storage fees continue to accrue. For businesses operating on thin margins or with fast sales velocity, this delay creates real working capital pressure even when sales volume appears strong.

Now zoom out to a monthly scenario:

- Units sold: 1,000

- Price per unit: $50

- Gross revenue: $50,000

TikTok-related fees:

- Referral fee (6%): $3,000

- Payment processing (2.9%): $1,450

- Affiliate commissions (15%): $7,500

- FBT fees ($3.58/unit): $3,580

Total TikTok fees: $15,530

That’s 31% of gross revenue, before product costs. Now add manufacturing and inbound shipping:

- Product cost: $20/unit → $20,000

Total expenses: $35,530

Gross profit: $14,470

Gross margin: ~29%

This math explains why many sellers post strong top-line numbers on TikTok Shop but struggle to scale profitably once fees, fulfillment, and cash flow timing are fully accounted for.

Tips & tricks: Reducing TikTok Shop fees and improving margins

While some TikTok Shop fees are fixed, many of the costs that impact profitability are influenced by how products are packaged, fulfilled, priced, and promoted. The following tactics help reduce fee drag and protect margins without sacrificing growth.

- Bundle products to lower per-order costs. You can’t negotiate the 6% referral fee, but bundling reduces payment processing and shipping costs. Selling a three-pack instead of three individual items means one payment fee and one shipment, while the referral fee stays the same. Bundles also tend to reduce return rates, especially for consumables or complementary products.

- Control FBT costs through active inventory management. FBT storage fees can quietly erode margins. Moving slow-moving inventory out of TikTok warehouses after 30 days helps avoid ongoing storage charges. Many sellers reserve FBT for fast-moving SKUs and fulfill slower items themselves to balance speed and cost.

- Treat affiliate commissions as a controllable lever. Creator commission rates aren’t fixed. Starting partnerships at 8–10% instead of 15–20% protects margins while you evaluate performance. Increase rates only for creators who consistently convert, and adjust or end partnerships that don’t justify the cost.

- Reduce returns to avoid compounding fees. Returns trigger refund administration fees and additional operational costs. Clear product photos, accurate sizing guides, detailed descriptions, and visual comparisons help set expectations and reduce “not as expected” returns—especially in apparel and home goods.

- Price with total fees in mind. Effective pricing accounts for all TikTok fees: referral, payment processing, FBT, and affiliate commissions. Knowing your true all-in fee percentage allows you to set prices that protect margins while remaining competitive and identify unprofitable SKUs before they drain cash.

Used together, these tactics reduce fee leakage and make TikTok Shop profitability predictable rather than reactive.

Key takeaways about TikTok Shop fees for sellers

TikTok Shop can generate strong sales, but profitability depends on how fees, payouts, and fulfillment costs are managed. Without a clear view of the full fee stack, pricing and growth decisions are based on incomplete information.

Accurate, transaction-level accounting turns TikTok Shop from a volume channel into a measurable profit channel, enabling better margin control, cash flow planning, and sustainable scale.

FAQ

How much does TikTok Shop charge sellers?

TikTok Shop charges a 6% referral fee on most products and 5% on certain jewelry items, calculated on the customer payment plus platform discounts minus tax. New sellers receive a 3% promotional rate for 30 days after their first sale if completed within 60 days of onboarding.

Does TikTok take 50% of sales?

No, TikTok’s standard fees total 15-20% when combining all charges, not 50%. The 6% referral fee is the base platform charge, with additional costs from payment processing (around 2.9%), potential affiliate commissions (10-20%), and FBT fulfillment (starting at $3.58 per item) varying by your business model.

Do you have to pay fees on TikTok Shop for every transaction?

Yes, the referral fee applies to every completed sale, calculated after platform discounts but before tax. Even refunded orders incur a 20% refund administration fee on the original referral charge, meaning some fees apply regardless of whether the customer keeps the product.

Does TikTok Shop collect sales tax automatically?

No, TikTok Shop doesn’t collect sales tax automatically for most transactions: sellers remain responsible for determining nexus, collecting tax, and filing returns. In limited situations where TikTok acts as marketplace facilitator, tax withholding appears as a separate transaction line item distinct from your sales revenue.

How do TikTok Shop fees compare to Amazon?

TikTok Shop’s 6% referral fee is significantly lower than Amazon’s 8-15% category-based fees. However, TikTok typically requires higher affiliate commission spending (10-20%) to drive discovery-based sales, while Amazon provides organic search traffic without mandatory creator partnerships, making total costs comparable depending on your traffic strategy.

Why does pricing on TikTok Shop differ from Shopify?

TikTok Shop includes additional platform, fulfillment, and affiliate fees that don’t exist on owned channels like Shopify, which often forces sellers to price products 20–30% higher. Many sellers rely on TikTok’s discovery-driven traffic rather than direct price comparison, but marketplace dynamics still apply if similar products are priced lower, higher margins won’t compensate for lost conversions.