Sales taxes stay aside from the pull of business taxes that apply to small businesses. Only those businesses that sell taxable products or provide taxable services are liable to sales tax. If you’re one of them, you probably know how complicated the system is and how much time and effort it might take you to stay tax-compliant. From widening or shortening the base of taxable products and services at times to determining which state’s tax rates apply to you if you sell online to many more details to consider. Sometimes, sales taxes look like a puzzle you are to gather into a single picture. (And the picture changes from time to time).

So, let’s break down this puzzle and look closer at the most significant pieces. Hopefully, it’ll help systemize and simplify your dealing with collecting, filing, and paying ecommerce sales taxes.

Here’s what you’re going to learn:

1. What is the sales tax in ecommerce, and why’s it so complicated?

2. What tax type does sales tax belong to?

3. Step #1 – Understanding where to collect and pay sales taxes (your business nexus)

- Option #1 – Physical presence nexus

- Option #2 – Economic nexus

- Track every penny, or how not to miss triggering a nexus

4. Step #2 – Understanding your sales tax base and sales tax rates

- Defining your sales tax base

- Ecommerce sales tax by state

- Ecommerce sales tax calculator – can it help?

5. Step #3 – Get your sales tax permit from the local tax authorities

6. Step #4 – Ensure you collect sales taxes to report them to the tax authorities

7. Step #5 – Finally, file your sales tax returns and pay them on time

Key takeaways

- Ecommerce sales tax varies across states and localities and applies to goods/services sold to consumers, making compliance challenging due to the absence of a federal sales tax, so laws, regulations, and rates differ by location

- Sales tax – a consumption tax collected by sellers from buyers and remitted to the government – is a percentage of the price of goods/services applied at the final sale.

- Businesses should identify their sales tax nexus, collect taxes accurately, and file on time to avoid penalties, use accounting software, and seek tax professionals’ help with compliance and reporting.

What is the sales tax in ecommerce, and why’s it so complicated?

Let’s start with a simple definition.

Sales tax is a tax you pay the government on goods or services you sell or provide to consumers, being a percentage of the price of the said goods and services. Usually, a seller or service provider needs to collect the taxes and pass them on to the government. Speaking of ecommerce sales tax, we mean sales tax you charge and collect from customers buying your products or services online.

Sounds pretty clear so far.

So what’s the fuss about it?

The thing is, the simplicity ends on the definition. In real life, almost every word in it leaves you asking questions.

- Which of the products I sell are taxable?

- Is the service that I provide liable to taxes?

- What tax rates are applicable if I sell interstate?

- How do I collect those taxes?

- Whom do I pay them?

And almost every answer starts with ‘It depends’. And actually, it does.

The biggest thing that complicates the matter is there’s no single federal sales tax. Sales taxes are governed at the state and, sometimes, local level. So, tax laws, regulations, and even rates can differ depending on the state you sell in.

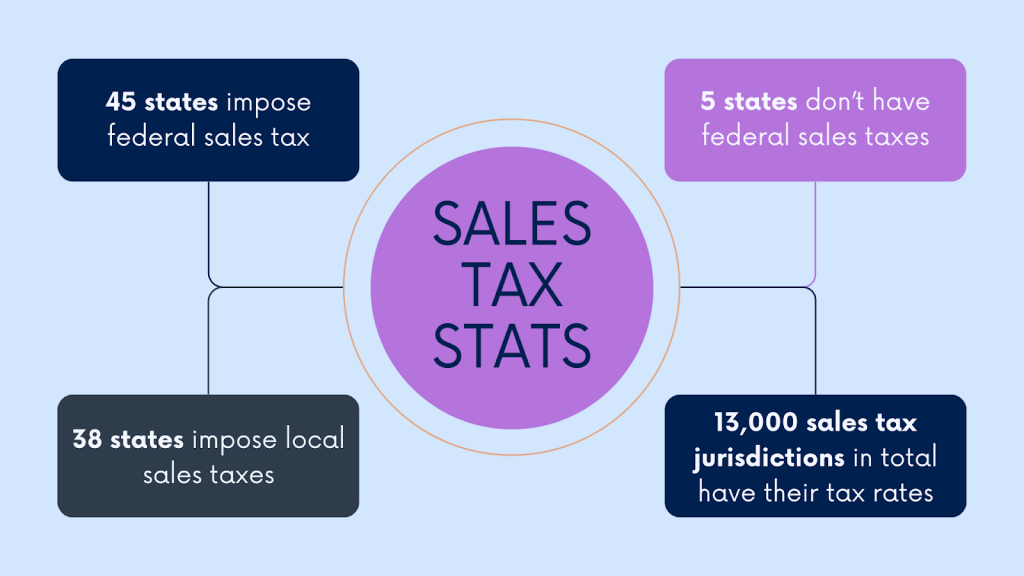

Just let me share some figures to give you a clearer view of the problem:

- 45 states and the District of Columbia impose sales tax;

- 5 states don’t have sales taxes, namely Alaska, Delaware, Montana, New Hampshire, and Oregon;

- 38 states allow local communities, counties, and cities to impose their sales taxes (Alaska, which doesn’t have a state sales tax, however, is included in this list)

- So, in total, about 13,000 sales tax jurisdictions have their tax rates and regulations. Can you imagine this?

On top of that, it’s your responsibility as a business owner to keep an eye on any changes that state or local tax authorities introduce at times.

All this makes sales taxes one of the most complicated things small business sellers face. Here are some steps to understand, prepare, and file sales taxes that might light the way through this maze.

- Understand where to collect and pay sales taxes;

- Understand your sales tax base and sales tax rates;

- Get your sales tax permit from the local tax authorities;

- Ensure you collect sales taxes to report them to the tax authorities;

- Finally, file your sales tax returns and pay them on time.

What tax type does sales tax belong to?

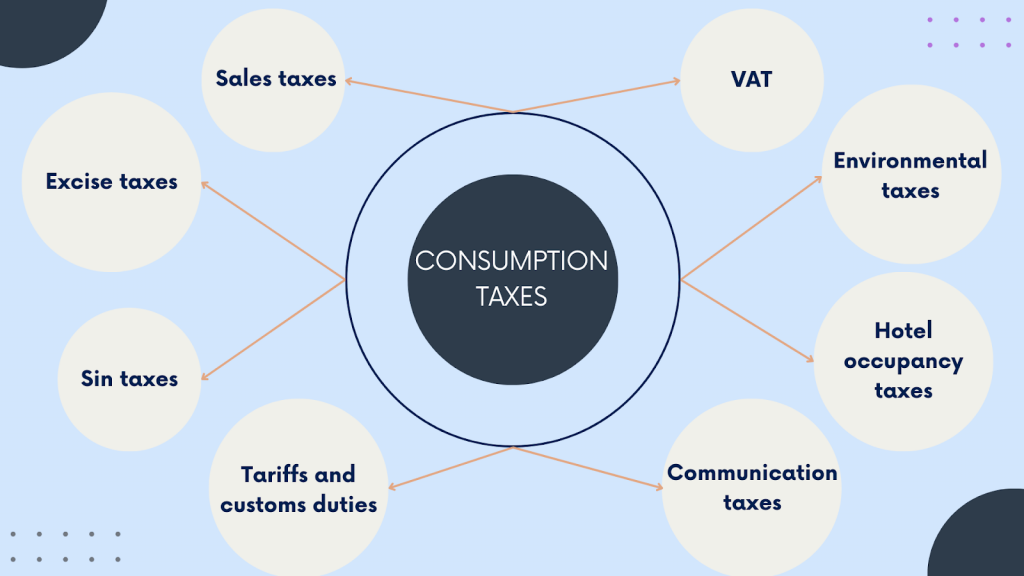

We’ll go through these steps one by one a little further. But before we do it, it’s worth mentioning that sales tax belongs to a family of consumption taxes, and therefore, may be confused with some of its siblings. The most frequent confusion is, probably, between a sales tax and VAT. Let’s look at how they differ.

The difference between sales tax and VAT

Sales tax and Value Added Tax (VAT) are both types of consumption taxes, but they differ in their application and structure. Sales tax is usually imposed only at the final point of sale to the end consumer. It’s levied on the total purchase price of goods and services. On the other hand, VAT is applied at each stage of production and distribution. Businesses collect and remit the tax on the value they add to products or services. Ultimately, the end consumer bears the tax as part of the final price.

The mechanism of collecting taxes also differs between sales tax and VAT. Sellers are responsible for collecting sales tax from buyers and remitting it to the government. Meanwhile, VAT is collected at each stage of production. Businesses offset the tax they collect against the VAT they pay on purchases. VAT often allows businesses to claim refunds or credits for the VAT paid on purchases made in their business activities, helping prevent tax cascading.

Sales tax systems are typically state or local taxes within a single country. In contrast, VAT is employed in over 160 countries worldwide and is a frequent case in international trade, such as the VAT system across European Union member states.

Other consumption taxes you might want to know about

Other consumption taxes also serve different purposes, such as revenue generation, discouraging certain behaviors, promoting environmental sustainability, or protecting domestic industries.

- Excise taxes are levied on specific goods at the manufacturing, sale, or use rather than on the overall value of goods or services. They often go with gasoline, tobacco, alcohol, and certain luxury goods.

- Sin taxes are a specific type of excise tax imposed on products or activities considered harmful to individuals or society, such as tobacco, alcohol, sugary drinks, and gambling.

- Tariffs and customs duties are taxes imposed on imported goods. Calculated as a percentage of the value of the imported goods, they intend to protect domestic industries, generate revenue, or address trade imbalances.

- Environmental taxes are those you pay on activities or products that harm the environment, such as emissions of pollutants, waste disposal, or use of non-renewable resources. These taxes aim to internalize the external costs associated with environmental degradation and encourage more sustainable practices.

- Hotel occupancy taxes are taxes imposed on the rental of hotel rooms and other accommodations and are typically collected by the lodging provider. The revenue generated from hotel occupancy taxes often goes to funding tourism promotion, convention centers, or other local initiatives.

- Communication taxes are those imposed by some jurisdictions on communication services such as telephone, internet, and cable television. These taxes may be levied as a flat fee or a percentage of the service charges.

But let’s get back to the sales tax and break it down.

Step #1 – Understanding where to collect and pay sales taxes (your business nexus)

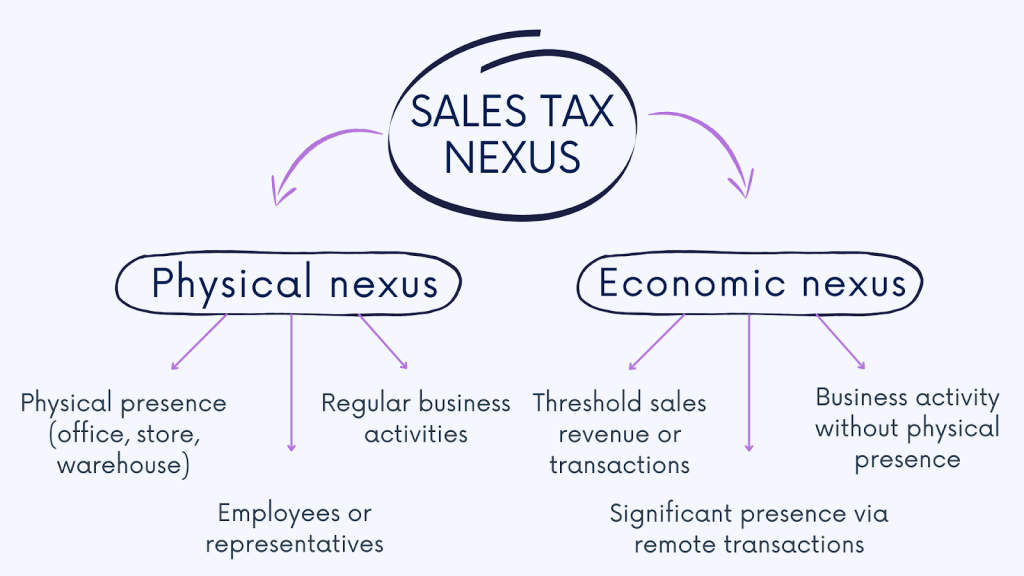

First thing first, you need to define where you can charge taxes and need to report them. Speaking the tax language, you need to know your sales tax nexus. Understanding the concept of nexus is crucial, being the grounds for defining the sales tax base. So, you might want to be super accurate about it so as not to over- or, more likely, underpay your taxes.

Tax nexus, in a nutshell, stands for the relation of your business to the state that permits you to charge sales taxes and obliges you to report them.

Typically, the physical presence of your business or some business activities defines a business nexus. However, many nuances might complicate finding your nexus, especially in the ecommerce industry, where businesses sell country-wide.

At this point, we might need a more detailed look at how it works.

Option #1 – Physical presence nexus

We’ll start with the most straightforward one, which is your physical nexus. Physical nexus means your business is physically present in this or that state. It might include having a store, a warehouse, or your business representative.

A store presence

Imagine you have a brick-and-mortar shop in, let’s say, Maryland. So, it’ll be your nexus, and thus, Maryland sales tax regulations and rates will apply to your business.

Warehouse or inventory presence

Apart from a physical store, being the simplest example, having a physical nexus entails several other scenarios. First, if your business stores inventory in a warehouse within a state, regardless of whether you or a third-party logistics provider (3PL) operates it, that state may establish a nexus based on the presence of your inventory. Second, if your business utilizes fulfillment centers to store and ship products to customers, the location state of your fulfillment center could establish a nexus due to the storage of inventory for order fulfillment within its borders, solidifying a connection between your business and that state.

Sales representative

In many states, having a salesperson or another representative (a contractor, an employee, etc.) who works for your business in a client-facing role is enough to create your physical presence. In the latter case, the requirements may differ from state to state.

Affiliate/click-through nexus

In some states, the definition of nexus expands to encompass the affiliate and click-through nexus. The first occurs when a related or commonly owned company provides services on behalf of a business having no physical presence in the area. The click-through nexus occurs when a business performs sales through the referrals that receive a commission.

Option #2 – Economic nexus

Economic nexus is a more complicated occurrence. (And the most overlooked one). A business might not be physically present in a location. However, receiving payments for products or services from a location can trigger local sales tax obligations.

This rule applies to online sellers and ecommerce businesses, which is quite obvious. It also applies to any company or service provider whose annual gross amount of payments received from a certain area reaches the threshold of over 200 transactions or $100,000 in sales.

Track every penny, or how not to miss triggering a nexus

As you can see, with potential presences in multiple states and the looming specter of economic nexus thresholds, the stakes of non-compliance are hauntingly high. This complexity underscores the importance of robust ecommerce accounting practices to navigate the intricate landscape of sales taxes effectively. Each transaction, whether through brick-and-mortar stores, online platforms like Shopify or WooCommerce, or affiliate networks, holds the potential to trigger nexus obligations in new jurisdictions.

All this demands unwavering attention to detail when tracking your transactions. Failure to monitor and act accordingly might result in costly consequences as states increasingly enforce tax regulations. Thus, accuracy here isn’t just a best practice but a lifeline, ensuring businesses don’t miss the moment when they trigger a nexus in this or that state. Leveraging a sales tax software can reduce the risk of compliance issues by alerting businesses whenever a nexus is triggered in any state.

At this point, turning to a professional ecommerce accountant or tax advisor is highly recommended to ensure accurate reporting and compliance with laws and standards. Also, you can (and should) use accounting software to the full. Today’s solutions are no longer simply digital ledgers. They’re a centralized hub for tracking transactions across all sales channels and states where businesses operate. Automated data entry and integration with various sales platforms streamline the recording process, reducing errors and ensuring comprehensive data capture. These tools categorize transactions by channel and location, simplifying sales tax management and compliance with state regulations.

Synder is accounting software designed for ecommerce businesses, helping them track and manage their sales across multiple channels and platforms (25+ ecommerce and payment systems) and always have detailed and accurate records ready for financial analysis and taxation.

Book your seat at our Weekly Public Demo to see how Synder works, or explore it yourself with a 15-day all-inclusive free trial.

Step #2 – Understanding your sales tax base and sales tax rates

Knowing which state sales tax regulations apply to you, it’s only logical to find out which products and services are liable to sales taxes in this state (and this locality) and how much you might need to pay in sales tax rates.

Defining your sales tax base

First, you might want to understand your sales tax base and its elements, such as taxable and non-taxable products, exemptions, etc. And we’ll break it down right away.

Taxable products

The good news is some products are liable to sales taxes almost everywhere. Those include tangible personal property and services at large.

Tangible personal property refers to a wide range of commonly sold items, such as furniture, tableware, jewelry, books, and even toothpaste. Also, in most states, services such as dry cleaning, legal services, and barber shops are subject to sales tax. Although there are some exemptions, the trend seems to be expanding the list of taxable services instead of reducing it.

Non-taxable products and exemptions

Product categories usually exempt from sales taxes in most cases include grocery, closing, religious books, magazines, prescription medicines, etc.

Still, there are exclusions. Some beverages and prepared foods are usually liable to sales taxes in many states. Non-prescribed medicines fall under the same category, as well as luxury closing.

The taxability of digital products is still subject to discussion. By digital products, we mean audiovisual works, like movies, music videos, news shows, songs, music and sound recordings, and digital books. Various states have different approaches to applying sales taxes to such products.

With so much depending on the sales tax jurisdiction, the best way to correctly distinguish between taxable and non-taxable products is to turn directly to the state or local tax agency.

Ecommerce sales tax by state

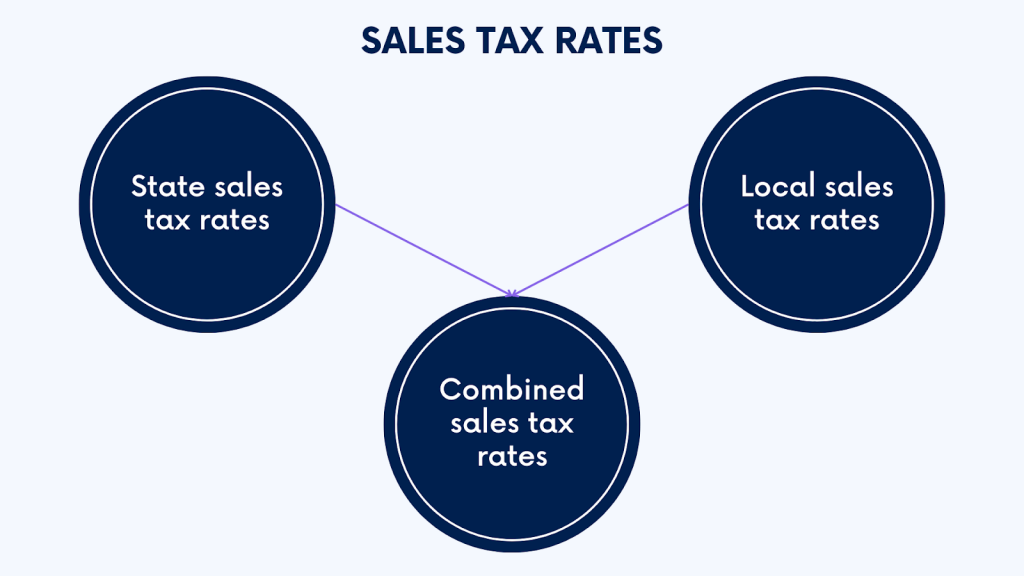

Sales tax rates can vary across states and localities in the United States. The sales tax system includes state-level and local-level components, both influencing consumer behavior and business operations (like setting prices, etc.).

Understanding state, local, and combined rates

State sales taxes are those the state government imposes on items and services sold within the state. Local sales tax is an extra tax added by local governments on top of the state’s tax. It helps fund local projects and services. While state tax is the same state-wide, local tax rates might vary widely.

At this point, to calculate the total amount of sales taxes a business owes, we consider the combined sales tax rate. This rate includes the state sales tax and any additional local sales taxes imposed within a particular jurisdiction. By summing these rates together, businesses can determine the total sales tax percentage applicable to their transactions. This way, businesses can accurately account for all relevant taxes and comply with state and local tax regulations.

Breaking down tax rates by state

Now, let’s look at some figures to see how tax rates might differ by state.

States with no state tax rate include

- Alaska ( but it allows localities to impose local sales taxes)

- Delaware

- Montana

- New Hampshire

- Oregon

State sales tax rates

- California – 7.25%

- Indiana, Mississippi, Rhode Island, Tennessee – 7.00%

- Colorado – 2.9%

- Alabama, Georgia, Hawaii, New York, Wyoming – 4.00%

Local sales tax rates

- Alabama – 5.29%

- Louisiana – 5.11%

- Colorado – 4.91%

- New York – 4.53%

- Oklahoma – 4.49%

States with the highest average combined rates

- Louisiana – 9.56%

- Tennessee – 9.55%

- Arkansas – 9.45%

- Washington – 9.38%

- Alabama – 9.29%

States with the lowest average combined rates

- Alaska – 1.82%

- Hawaii – 4.50%

- Wyoming – 5.44%

- Maine – 5.50%

- Wisconsin – 5.70%

It’s important to note that these sales tax rates aren’t the complete list but a sample to show how much they can differ from state to state. They can also change quite frequently. So, the best way to figure out the exact amount you might owe the government in sales taxes is to consult with your state and local tax authorities (and it literally means those in places where you have all your nexuses, if you have several).

Ecommerce sales tax calculator – Can it help?

Back to the question of the fuss about sales taxes, now you can see the point. And here come sales tax calculators and other tools allowing you to automate defining sales tax rates and calculating sales tax amounts.

Sales tax calculators are invaluable tools that, as mentioned, streamline determining the total cost of a sale by automatically computing the applicable sales tax. These calculators typically allow users to input the item’s pre-tax price and location and then automatically fetch the relevant sales tax rates. Leveraging geolocation services or databases maintained by tax authorities allows these tools to ensure accurate tax calculations without manual research. This functionality is particularly useful in regions with complex tax structures or frequent rate changes, where staying up-to-date on sales tax rates can be challenging.

Certain accounting software (depending on their sophistication) can also simplify financial management for businesses by automatically calculating sales taxes and applying the correct tax rates based on the sale’s location. They can typically update tax rates to ensure compliance with current tax laws. Accounting software can track taxable transactions, generate reports on sales tax liabilities, and integrate seamlessly with ecommerce platforms for online sales. This capability helps businesses stay organized, compliant, and financially secure in managing their tax obligations.

Getting a sales tax permit is an important step. This permit is obligatory for every business that is going to collect sales taxes from customers. Without it, you can be blamed for tax fraud, and the consequences may seriously affect your business.

Where to get your sales tax permit?

Businesses should register with the State Department of Revenue (or another taxing authority eligible to handle such registrations) to obtain a sales tax permit.

Before registration, you might want to gather the necessary documents, the exact set of which may differ from state to state. Usually, you can find those requirements on the official website of the issuing authority, along with the rules that regulate the collection and remittance of sales taxes. Please bear in mind that, in some cases, you’ll need additional permits and licenses.

Once approved, you’ll receive your sales tax permit number. Now, you can officially charge your buyers or customers taxes on top of the products or services they bought from you.

Once you obtain a valid sales tax permit, collecting sales tax begins. And here, you stumble upon sales tax sourcing rules, and you might want to know what they are.

What are sales tax sourcing rules?

Sourcing rules in sales tax refer to the guidelines determining which jurisdiction’s tax rates and rules apply to a particular transaction. These rules help businesses figure out the correct sales tax rate to apply when selling goods or services across different jurisdictions. There are primarily two types of sourcing rules: origin-based and destination-based.

Origin-based sourcing

Origin-based sales tax collection involves charging sales tax at the seller’s business location. For instance, if your business operates in Texas, you’d apply the sales tax rate for Texas to all sales made from your business location, whether online or in-person. It simplifies the process as you only need to know and charge a single sales tax rate for all buyers within the state.

Destination-based sourcing

Destination-based sales tax collection requires sellers to charge sales tax based on the buyer’s ship-to address. In this case, you calculate and apply the appropriate state, county, city, and local sales tax rates based on your buyer’s location. Most states follow destination-based sales tax collection rules.

It’s important to note that these rules primarily apply when selling to buyers within the same state where your business is based.

When having nexus in another state, such as having employees or attending trade shows there, the collection process may differ.

However, in most cases, except for California, Arizona, and New Mexico, when selling to buyers outside your business’s home state, you’d charge the sales tax rate applicable at the buyer’s ship-to location. Understanding these collection methods and adhering to state-specific regulations ensures businesses remain compliant and avoid potential penalties for improper tax collection and reporting.

How to calculate sales tax and collect it?

Now, you know your tax sourcing and sales tax rates across all your nexuses. So, you might want to calculate and factor sales taxes in the price of your products or services and then collect sales taxes accurately. Let’s look at how you can do it.

So, when you make a sale, factor the sales tax into it based on the applicable tax rate by adding the appropriate sales tax amount to the total purchase price of the goods or services sold.

For example, if the sales tax rate is 8% and the total purchase price is $100, the customer would pay $108, with $8 being the sales tax collected.

To calculate it, you might want to consider the following steps:

#1 – Calculate the sales tax per item

Multiply the item’s selling price by the sales tax rate, which should be in decimal form.

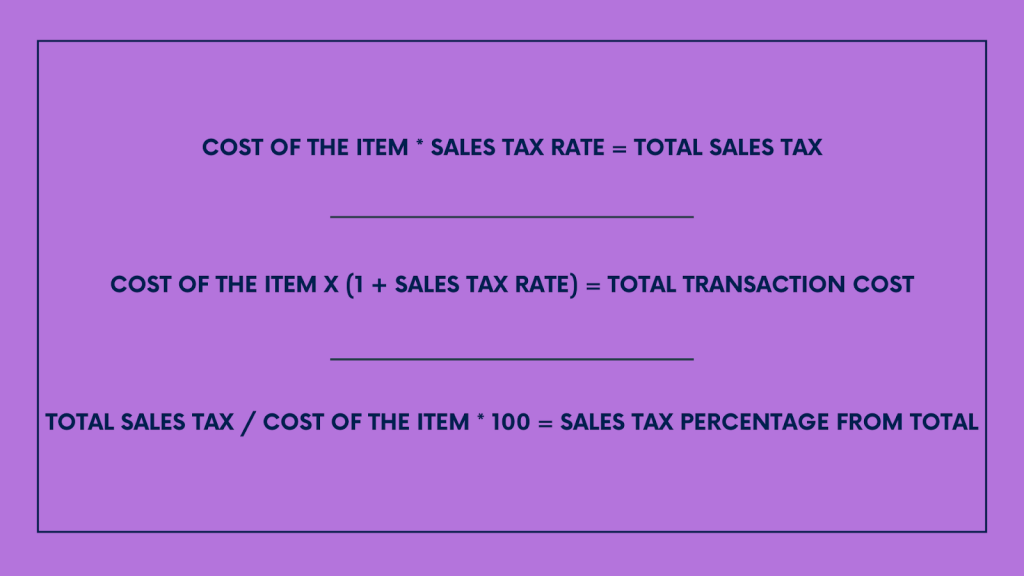

(Cost of the Item) * (Sales Tax Rate) = Total Sales Tax

For example, the sales tax rate in Seattle is 10.1%. Then, for an item you want to sell for $50, the total sales tax will be 50×0.101=$5.05

#2 – Calculate the total transaction amount for an item

Now, you need to combine the selling price and total sales tax. You can add the sales tax amount you calculated to the item’s price. You also can multiply the selling price by one plus the sales tax rate to get your total transaction cost.

(Cost of the Item) * (1 + Sales Tax Rate) = Total Transaction Cost

If we take the same $50 item, we’ll see that the total transaction cost will be 50×1.101=$55.05

#3 – You might as well calculate the sales tax percentage from the total:

It might help if you have the total transaction amount but need to figure out the sales tax percentage.

Total Sales Tax / Cost of the Item * 100 = Sales Tax Percentage from Total

For example, if you sold a $50 item with $5.05 in sales tax, then 5.05/50×100=10.1% (Sales Tax Percentage from Total)

#4 – Separate sales tax from revenue

Now that you know your sales tax percentages, you know what sales tax amount to separate from your business’s revenue. This separation ensures you don’t inadvertently spend the money you owe to the government.

Many businesses set up separate bank accounts or designate specific accounting codes to track collected sales tax separately from their operating funds.

Keeping these funds separate helps you identify and allocate the correct sales tax amount for remittance to the taxing authorities.

You might also like to read:

- Managing Sales Taxes: How Synder Simplifies Amazon Sales Tax Collection

- Does Shopify Collect Sales Tax?

- Taxes for Sellers: Understanding How eBay Sales Affect Your Income Tax

Step #5 – Finally, file your sales tax returns and pay them on time (professional guidance recommended)

When preparing to file a state sales tax return, you might want to determine how much sales tax you collected from buyers in each state, county, city, and other special taxing district.

Why? States rely on sales tax dollars to pay for infrastructure, public safety, and other budget items. But they won’t know which city or other local area to allocate those funds to unless you break down your transactions for them.

In a small number of states, like origin-based states or states that only have a single statewide sales tax rate, filing sales tax isn’t very difficult. But, in most cases, manually breaking down all your transactions is a time-consuming chore, especially if you’re a high-volume seller or sell on multiple channels.

And here’s where you can use your accounting and tax preparation software, a crucial component of ecommerce as a service, to make this process much faster and, which is even more significant, much more accurate. Embracing such services not only streamlines the tax filing process but also ensures compliance with complex ecommerce sales tax regulations, underscoring the invaluable role of specialized ecommerce solutions.

Now, you can proceed with filing.

Most states allow you to file sales tax online, and some require it. The best way to understand which option you can choose, you consult with the local tax authorities.

TL;DR

- Sales tax applies to goods/services sold to consumers and varies across states and localities.

- Sales tax is one of many consumption taxes, including excise and sin taxes, tariffs, environmental, hotel occupancy, and communication taxes.

- Businesses must understand their sales tax nexus, determined by physical presence or economic activity, to comply with tax laws and avoid penalties.

- Businesses might want to grasp taxable products/services, exemptions, and sales tax rates across different jurisdictions to collect and remit taxes accurately.

- Receiving a sales tax permit from local tax authorities is mandatory for businesses to collect and report sales taxes.

- Businesses must accurately calculate and collect sales taxes based on origin-based or destination-based sourcing rules.

- Filing sales tax returns involves determining taxes collected from buyers in each jurisdiction and using accounting software for accurate reporting.

Wrapping up

Summing up, you can see that though there are complications, dealing with sales taxes and sales tax returns shouldn’t necessarily be a pain for small businesses. While there can be several peculiarities that depend on where you collect taxes, knowing what to do, where to look for explanations, and using necessary tools can save a lot of time and effort on collecting, calculating, and reporting sales taxes.

Share your thoughts

Do you pay sales taxes? What helps you stay on top of them? Feel free to share your thoughts in the comments!

Excellent article!