Revenue recognition is a critical financial principle that determines the specific conditions under which income becomes realized as revenue. Its importance cannot be overstated; an accurate revenue recognition process is integral to ensuring transparency, reliability, and consistency in financial reporting. However, traditional methods of revenue recognition are often cumbersome and prone to error. That’s where revenue recognition software comes into play. This powerful tool brings automation, precision, and efficiency to the revenue recognition process.

Contents:

1. Understanding revenue recognition software

2. Why businesses need revenue recognition software

3. How software for revenue recognition works

4. Revenue recognition software solutions to consider

- Synder RevRec

- NetSuite

- Sage Intacct

- Workday Financial Management

- SAP Revenue Accounting and Reporting (RAR)

- Zuora Revenue

5. Choosing the right software for revenue recognition

Understanding revenue recognition software

Revenue recognition software is a sophisticated tool that assists businesses in accurately tracking and recognizing revenue. This software streamlines the often complex process of conforming to various accounting standards, making it a vital component of financial departments.

Key features of revenue recognition software typically include automated revenue calculations, real-time reporting, data tracking, compliance with financial standards (like ASC 606 and IFRS 15), and integration with existing accounting systems or cloud accounting software . This ensures that businesses can rely on a single platform to manage and analyze their revenue.

Why businesses need revenue recognition software

Let’s dive deeper into why businesses require revenue recognition software.

#1. Accuracy in financial reporting

Revenue recognition software automates the process of identifying, calculating, and reporting revenue, reducing the likelihood of human errors. This results in more accurate financial statements, improving the credibility of the company in the eyes of investors, regulators, and other stakeholders.

#2. Compliance with accounting standards

There are specific standards that guide the process of revenue recognition, such as ASC 606 and IFRS 15. Revenue recognition software is designed to ensure compliance with these standards, reducing the risk of non-compliance penalties and reputational damage.

#3. Time and resource efficiency

Manually managing revenue recognition can be time-consuming and resource-intensive. Software automation streamlines and accelerates this process, allowing staff to focus on other strategic activities.

#4. Improved decision making

Revenue recognition software often includes real-time reporting and analytics tools. These features provide businesses with immediate, in-depth insights into their financial status, aiding strategic decision-making and future planning.

#5. Scalability

As businesses grow, so too does the complexity of their revenue recognition. Software solutions can scale with the business, handling increasing volumes of transactions and more complex revenue recognition scenarios.

#6. Audit readiness

With revenue recognition software, all revenue-related data is systematically recorded and easy to retrieve. This makes audit processes smoother and ensures businesses are always ready for internal or external audits.

#7. Revenue forecasting

Some revenue recognition software offers forecasting tools, enabling businesses to predict future revenues based on historical data and trends. This can be instrumental in strategic planning and budgeting.

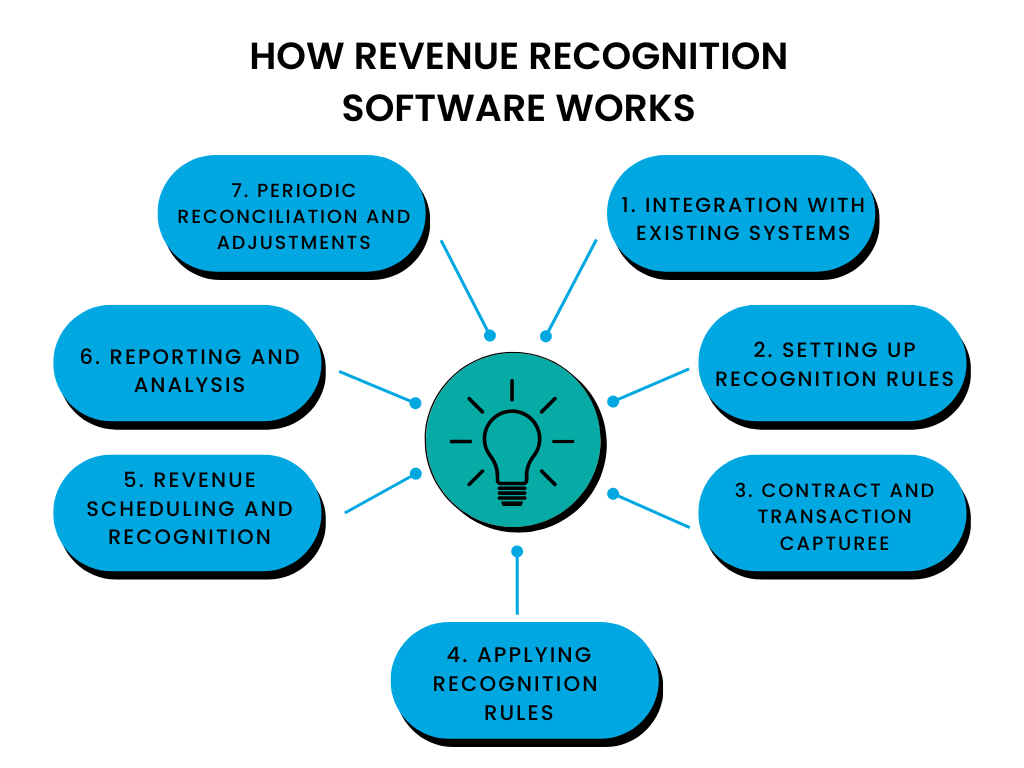

How software for revenue recognition works

Integrating revenue recognition software with existing financial systems usually involves a step-by-step setup process, followed by configuring the software to match the company’s specific revenue recognition policies. The software then begins tracking sales and other revenue-generating transactions, applying the relevant recognition criteria automatically.

It offers real-time reporting and analysis capabilities, enabling businesses to keep a close watch on their revenue performance. This real-time data access also allows for quick adjustments to be made if necessary, promoting financial agility. Overall, the whole process looks like this:

1. Integration with existing systems

The software is first integrated with the company’s existing financial systems and CRM (Customer Relationship Management) systems. This allows for seamless data sharing and eliminates the need for manual data entry.

2. Setting up recognition rules

The business sets up rules within the software that align with their revenue recognition policies and the relevant accounting standards. These rules dictate how and when the revenue should be recognized.

3. Contract and transaction capture

When a sale or service is conducted, the software captures the contract or transaction details. This includes the customer details, contract terms, transaction price, performance obligations, and more.

4. Applying recognition rules

The software then applies the recognition rules to these transactions. It determines when the revenue recognition criteria are met and automatically calculates the amount of revenue to be recognized.

5. Revenue scheduling and recognition

Based on the rules and calculations, the software schedules the revenue for recognition over the appropriate period. When the criteria are met (like delivery of goods or services), the software recognizes the revenue.

6. Reporting and analysis

The software provides comprehensive reports and real-time analytics on the recognized and deferred revenue, giving businesses clear visibility into their financial status. It also keeps track of all data and processes for auditing purposes.

7. Periodic reconciliation and adjustments

The software routinely reconciles the recognized revenue with the actual received payments. If necessary, adjustments are made to account for discrepancies, refunds, cancellations, or changes in contract terms.

Revenue recognition software solutions to consider

1. Synder RevRec

Synder offers Synder RevRec, a GAAP-compliant revenue recognition solution with full support of IFRS 15 and ASC 606 standards.

Synder RevRec is an automated module designed to streamline revenue recognition for Stripe subscriptions, seamlessly managing subscription changes, refunds, custom billing, and more.

Synder’s functionality in terms of revenue recognition revolves around:

- Automatic detection of subscription changes: Synder automatically detects changes to subscription plans in Stripe, such as upgrades, downgrades, cancellations, refunds, or changes in billing periods. This ensures that revenue recognition is accurate and up-to-date without requiring manual intervention.

- Variety of revenue recognition methods: The revenue recognition methods offered by Synder include daily ratable, monthly ratable, which allows businesses to choose the best approach based on their preferences and requirements.

- Handling of invoices with extended payment terms: Synder can handle various billing terms, including extended payment terms like Net 30 and Net 60, ensuring accurate recognition of revenue even for invoices with longer payment cycles.

- Discount recognition: Synder RevRec allows businesses to track and recognize discounts across the billing period, providing several modes of discount processing.

- Granular view of subscriptions: With Synder RevRec, businesses can track revenue at a detailed level. For each Stripe subscription, they can explore an automatically built schedule. This way they can get full visibility into how each subscription is being recognized.

In addition to the features described above, Synder RevRec adjusts revenue recognition when refunds are issued, appropriately reflects disputed amounts and much more!

Take advantage of Synder’s comprehensive 15-day free trial to explore the software’s capabilities, and reach out to our team so that we could assess your revenue recognition needs and tailor RevRec accordingly. Streamline your revenue recognition process with Synder!

2. NetSuite

NetSuite is a popular cloud-based solution offering a comprehensive suite of applications, including revenue recognition software. The software ensures compliance with accounting standards and integrates with other financial systems, reducing manual effort and potential errors. Its key features include contract creation, transaction price allocation, revenue scheduling, and performance obligation management. By automating complex processes, NetSuite helps businesses improve efficiency, ensure compliance, and gain real-time visibility into their financial performance.

3. Sage Intacct

Sage Intacct is a robust financial management platform that provides a specific module for revenue recognition. The software automates and optimizes revenue recognition by aligning it with key accounting standards. It offers features like automatic calculations, real-time revenue insights, audit trails, and customizable reports. With Sage Intacct, businesses can enhance financial accuracy, streamline revenue management, and make data-driven decisions.

4. Workday Financial Management

Workday Financial Management offers revenue recognition software that is designed to manage the entire contract-to-cash lifecycle. This software offers automated revenue calculations, compliance with revenue recognition standards, and integration with sales and billing systems. It allows users to schedule revenue recognition based on different criteria, providing flexibility and precision. Workday Financial Management helps companies simplify financial processes, ensure regulatory compliance, and gain comprehensive insights into their revenue.

5. SAP Revenue Accounting and Reporting (RAR)

SAP RAR is part of SAP’s financial suite, designed to handle revenue recognition, particularly for businesses operating globally. It ensures compliance with various accounting standards. Its features include revenue recognition scheduling, contract management, and extensive reporting capabilities. With SAP RAR, companies can achieve a unified financial view, improve financial accuracy, and simplify revenue recognition processes.

6. Zuora Revenue

Zuora Revenue, formerly known as RevPro, is a leading revenue recognition software designed for subscription-based businesses. It automates revenue recognition, billing, and subscription management processes. Key features include contract modifications, performance obligation tracking, and revenue forecasting. It also provides robust reporting tools to help businesses analyze their revenue. Zuora Revenue helps businesses maintain compliance, increase efficiency, and gain deep insights into their subscription and revenue data.

Choosing the right software for revenue recognition

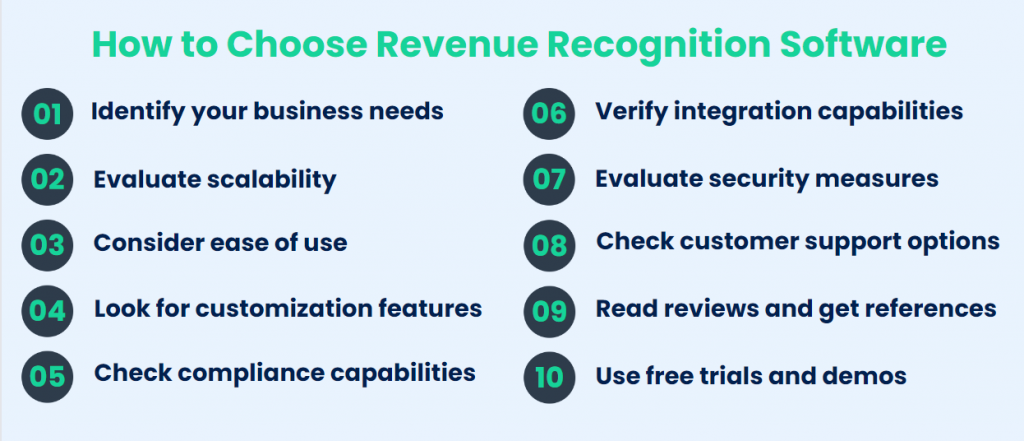

Choosing the right revenue recognition software can seem tricky due to the sheer number of options available. Here’s a step-by-step guide to help you make an informed decision:

Step 1. Identify your business needs

The first step in selecting revenue recognition software is to identify the specific needs of your business. Are you primarily concerned with automating revenue calculations, improving compliance with regulations, integrating with existing systems, or all of the above? Understanding your needs will help you determine which features are most important in your software choice.

Step 2. Evaluate scalability

You’ll want a software solution that can grow with your business. As your company expands, the software should be able to handle an increase in volume and complexity of transactions. Look for solutions that offer scalability.

Step 3. Consider ease of use

A user-friendly interface can make a significant difference in how effectively the software is used. Look for software that is easy to navigate and requires minimal training for your team.

Step 4. Look for customization features

Every business has its unique requirements, and your software should be able to accommodate those. A good revenue recognition software will allow you to customize features according to your business model.

Step 5. Check compliance capabilities

The software you choose should be able to keep up with the ever-changing financial standards and regulations. Make sure it supports the most recent revenue recognition standards.

Step 6. Verify integration capabilities

Your new software should easily integrate with your current accounting or ERP systems. This will streamline your financial processes and ensure that all systems are working together seamlessly.

Step 7. Evaluate security measures

Your revenue recognition software will handle sensitive financial data, so robust security measures are critical. Ensure that the software follows best practices for data security and offers features like data encryption and user access controls.

Step 8. Check customer support options

Excellent customer support is crucial. You’ll want a provider who offers responsive, helpful support to resolve any issues that may arise.

Step 9. Read reviews and get references

Look at reviews and ask for references from other businesses similar to yours that have used the software. This can provide real-world insights into how the software performs.

Step 10. Use free trials and demos

Finally, take advantage of free trials and demos. These can give you a hands-on experience of how the software works and help you decide if it’s the right fit for your business.

Revenue recognition: Conclusion

In conclusion, revenue recognition software is a transformative tool that can significantly improve financial accuracy, streamline processes, and ensure compliance with revenue recognition standards. Given its array of benefits, it’s an investment that modern businesses would be wise to consider. As technology continues to evolve, revenue recognition software is set to become even more valuable in the world of finance.

Read our articles about Accounts Payable automation software and Sales tracking software.

![Business Proposal Template: Steps to Write a Good Business Proposal [Free Templates]](https://synder.com/blog/wp-content/uploads/sites/5/2023/08/business-proposal-template-260x195.png)