QuickBooks Online handles your finances well on its own, but it works even better when connected to the tools your team already uses. Integrations automate routine tasks, reduce errors, and free up hours you’d normally spend entering data by hand.

QuickBooks supports 800+ app integrations, from sales and payments to payroll and project management. That’s why many small and medium-sized businesses rely on it as the center of their financial workflow. Tools connect in, data flows automatically, and everyone works from the same accurate numbers.

The tricky part is choosing which integrations actually matter. In this article, we’ll break down five essential QuickBooks integrations that can streamline your processes, improve financial visibility, and help your business run more efficiently.

TL;DR

- QuickBooks Online becomes significantly more powerful with the right integrations, helping automate workflows, reduce manual entry, and improve financial accuracy across sales, payments, CRM, projects, and expenses.

- Not all native QuickBooks integrations deliver complete data. Many pass only partial information (like missing fees, taxes, discounts, or payout details), which creates reconciliation challenges and reporting gaps.

- Payment, ecommerce, CRM, project management, and expense-management integrations are essential, but each category comes with unique data and workflow pitfalls that businesses should plan for.

- The best QuickBooks integrations are those that match your workflow, offer complete data syncs, scale with your operations, and minimize manual corrections.

- Synder fills the gaps left by built-in integrations, bringing full financial detail from platforms like Shopify, Amazon, Stripe, PayPal, and Square directly into QuickBooks, reducing mismatches and supporting seamless reconciliation.

- Choosing integrations intentionally and supplementing them with automation keeps your books accurate, reducing errors, and helping your team operate more efficiently as you grow.

Benefits of integrating QuickBooks with other software

Connecting QuickBooks Online with the tools your team already uses makes everyday work faster and more reliable. Instead of entering the same information in multiple places, data moves automatically, which cuts down on mistakes and keeps your numbers up-to-date.

A few clear benefits stand out:

- Fewer manual entry errors: When sales, expenses, or invoices sync automatically, you avoid duplicates and typos.

- Real-time financial updates: Your books reflect what’s happening right now, not last week.

- Better collaboration: Sales, ops, and finance all see the same information, which makes decisions smoother.

Overall, integrating QuickBooks means less time fixing data and more time focusing on actual business growth. It removes the back-and-forth work and gives your team a cleaner, more accurate financial view.

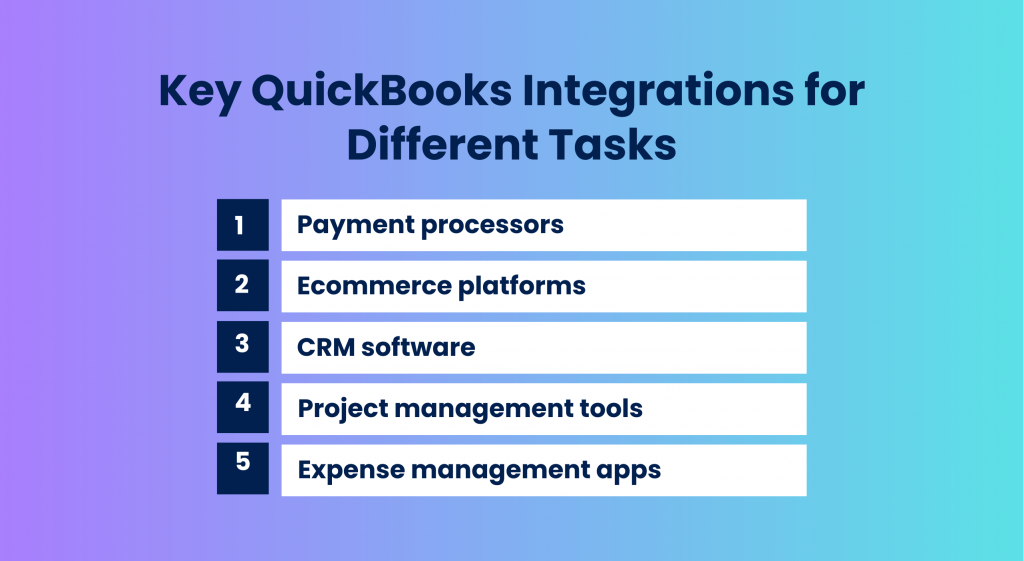

Key QuickBooks integrations for different tasks

QuickBooks Online can be enhanced with various integrations tailored to specific tasks. These integrations improve efficiency across your business operations.

Here are some essential categories of QuickBooks integrations:ortant to note that QuickBooks integration capabilities may not cover all the systems and platforms a business uses. Third-party integration solutions, such as Synder, can bridge these gaps, ensuring that no data or transaction goes missing.

- Payment processors – tools that handle customer payments and transfer funds, including transaction fees, refunds, and payouts.

- Ecommerce platforms – online storefront systems that manage product listings, orders, inventory, and customer purchases.

- CRM software – systems that track customer information, sales activity, and communication across the customer lifecycle.

- Project management tools – platforms used to organize tasks, manage timelines, monitor budgets, and coordinate team workflows.

- Expense management apps – tools that capture receipts, track employee spending, streamline approvals, and manage reimbursements.

Choosing the right QuickBooks integration for each task can help streamline processes and save time.

1. Payment processors

Integrating QuickBooks with payment processors simplifies transaction management by automating the recording of payments and improving cash flow tracking. It reduces manual entry and minimizes discrepancies that can occur when payments, fees, and refunds are handled manually.

Popular options are:

- PayPal: Widely used for secure transactions

- Stripe: Known for easy integration and extensive features

- Authorize.Net: Ideal for small business needs

- Braintree: Provides flexible payment solutions

- Square: Suitable for both online and offline sales

Each offers synchronization with QuickBooks, providing updates on payments and fees and helping reduce manual data entry errors.

Challenges of integrating QuickBooks with payment processors

While payment processors do pass basic transaction information to QuickBooks Online, the level of detail varies. For example, Stripe might send the gross payment amount but not include the associated processing fee or dispute adjustment in the same record, requiring manual entries to keep revenue accurate.

Not all processors send complete financial data, such as fees, partial refunds, chargebacks, or payout breakdowns, which makes it harder to maintain accurate books. This often results in extra manual work and increases the risk of mismatches during reconciliation.

How to solve them

The most effective way to address these gaps is through automated tools that can capture the full financial breakdown of each transaction and deliver it consistently into QuickBooks. Automation reduces the need for manual adjustments, ensures cleaner cash flow tracking, and helps maintain accurate books even when processors provide limited data.

Synder is a good example of such automation. It connects QuickBooks directly with payment processors and imports the complete financial picture, including:

- Payment amounts

- Processing fees

- Refunds and partial refunds

- Chargebacks and dispute adjustments

- Payouts and settlement reports

- Currency conversions and exchange-rate details (when provided)

- Customer identifiers and basic transaction metadata

By filling in the details processors often leave out, Synder helps reduce reconciliation work and supports clean, reliable financial records.

Try Synder free for 15 days to see how clean, complete payment data can transform your QuickBooks workflow.

2. Ecommerce platforms

Connecting ecommerce platforms to QuickBooks helps businesses manage sales activity more efficiently by syncing orders, product information, inventory movements, and customer data directly into the accounting system. This keeps financial records aligned with actual store activity, especially for high-volume sellers.

Key options include:

- Shopify: Reliable syncing for sales, products, and inventory updates

- WooCommerce: Convenient for WordPress-based storefronts

- Magento: Fits complex catalogs and custom ecommerce builds

- BigCommerce: Strong option for fast-growing, multichannel brands

- Amazon FBA: Supports high-volume fulfillment and warehouse operations

These connections help reduce data discrepancies, improve order tracking, and support smoother daily operations.

Challenges of integrating ecommerce platforms with QuickBooks

Ecommerce systems often supply incomplete or inconsistent data when syncing to QuickBooks. For example, a Shopify order with multiple line items, discounts, and shipping charges may sync only as a total amount, leaving out the details needed for accurate categorization. High order volumes, multi-currency sales, and platform-specific fees can also create mismatches that make reconciliation difficult.

How to solve them

Synder addresses these gaps by pulling a full, item-level view of every ecommerce order into QuickBooks. Instead of relying on partial platform feeds, Synder imports:

- Line items (product names, SKUs, quantities)

- Product prices

- Discounts and promo codes

- Shipping charges and shipping method details

- Sales tax amounts calculated by the store

- Customer information (name, email, address)

- Order-level metadata (order ID, tags, fulfillment status)

- Inventory adjustments linked to sales or returns

- Fulfillment and shipping status updates

- Coupons and gift card usage

- Multi-currency order amounts (store currency + customer-facing currency)

This level of detail helps QuickBooks reflect what actually happened in the store, reducing reconciliation work and giving businesses a clearer, more accurate financial picture.

If you’d like a walkthrough of your specific setup, schedule a demo and learn how Synder simplifies multi-platform ecommerce bookkeeping.

3. CRM software

CRM integration with QuickBooks centralizes customer data, improves relationship management and sales tracking, and supports more informed engagement strategies.

Consider these CRM options:

- Salesforce: Popular for comprehensive CRM features

- HubSpot: Known for ease of use and effective tools

- Pipedrive: Focuses on sales pipeline management

- Freshsales: Offers intuitive, AI-driven insights

- Zoho CRM: Provides strong integration capabilities at a lower cost

Connecting CRM software to QuickBooks enhances customer insights and contributes to more accurate financial tracking.

Challenges of integrating CRM with QuickBooks

Integrating a CRM with QuickBooks can create several practical issues. One of the most common is inconsistent customer records. A sales rep might enter someone as “John P. Smith” in the CRM while QuickBooks lists the same customer as “John Smith,” resulting in duplicate profiles once the systems sync.

Differences in how each platform structures data also cause problems. CRMs often store details, like deal stages or lead sources, in formats that don’t match QuickBooks fields, making it unclear how information should map and leading to incomplete or inaccurate transfers.

Sync timing can add friction. Many CRM integrations don’t update in real time, so a deal marked “Closed Won” may not appear in QuickBooks until much later. Finance teams that rely on up-to-date data for invoicing or forecasting often end up waiting or manually checking records.

Conflicts over data ownership are another challenge. Sales teams update customer details in the CRM, while finance adjusts billing information in QuickBooks. When both sides make changes independently, it becomes hard to determine which system holds the correct version.

Technical limitations can further restrict what syncs. Lower-tier CRM plans may limit API access or field availability, forcing teams to rely on manual workarounds. And if CRM usage varies across the team, such as inconsistent naming or missing fields, messy data flows directly into QuickBooks, affecting reporting accuracy.

How to solve them

A reliable CRM-to-QuickBooks connection starts with structured planning and consistent maintenance. Proven steps include:

- Define the data flow clearly. Decide which objects (contacts, deals, invoices, activities) will sync and designate the authoritative system for each.

- Clean and standardize customer data before turning on any sync. Consistent formats significantly reduce integration errors.

- Ensure field mapping aligns with both systems’ structures. Proper mapping prevents mismatches and avoids duplicated or incomplete records.

- Enable or design real-time or scheduled syncing depending on operational needs. Timely updates reduce gaps between CRM activity and accounting data.

- Review and monitor integration logs regularly to catch sync failures early. API changes, updated fields, or user modifications can break workflows.

- Train teams across sales and finance so both sides understand how actions in the CRM affect accounting outcomes, reducing accidental inconsistencies.

Following these practices creates a smoother, more reliable connection between CRM activity and financial reporting, improving both operational alignment and data accuracy.

4. Project management tools

Linking project management tools with QuickBooks improves budget tracking, resource allocation, and ensures that project cost management ties back into financial systems.

Popular project management integrations are:

- Asana: Simplifies task tracking while supporting cost oversight

- Trello: Offers visual boards useful for project activity and team workflows

- Monday.com: Enables customizable workflow setups – useful when tasks span operations and finance

- Jira: Designed for more complex projects and cross-team coordination

- Basecamp: A good choice for collaboration and organizing tasks across teams

Integrating these tools with QuickBooks helps align operational execution with accounting oversight.

Challenges of integrating project management tools with QuickBooks

Many project-management platforms don’t automatically map to the financial categories and cost-code structures used in QuickBooks. For example, a task tracked in Asana may carry a budget label or resource allocation, but when that data hits QuickBooks, it doesn’t align with the project cost codes or GL accounts, forcing manual adjustments.

Teams from operations and finance often speak different languages: project managers track milestones and task completion, while accounting focuses on cost codes, billing and revenue recognition. Without clearly defined ownership, workflows break down and financial tracking becomes unreliable.

Furthermore, generic project tools may lack built-in features for time tracking, billing or resource profitability, meaning teams either work in spreadsheets or build workarounds, both of which increase risk of error and delay.

How to solve them

To create a smooth connection between project management and financial reporting, teams need clear structures, aligned data fields, and consistent processes from the start. Key steps include:

- Develop a unified cost code or project code structure that both project teams and finance use from day one.

- Map your project-management fields (tasks, budgets, resource allocations) to QuickBooks account codes and GL structure so data flows consistently.

- Ensure time tracking, expense entries, and budget changes in the project tool feed into QuickBooks (or at least into a staging area) for review.

- Facilitate a kickoff between project managers and finance to define roles: who updates what, when, and how often data must sync or be reviewed.

- Use dashboards or alerts that show variances between planned vs. actual costs in real time so finance can respond early.

- Select or customise project tools with built-in support for billing, time capture and resource profitability, or add integrations that handle these automatically rather than rely on spreadsheets.

Together, these steps keep project activity and financial data aligned without constant manual correction.

5. Expense management apps

Expense management apps help businesses maintain accurate financial records by capturing receipts, tracking employee spend, and streamlining reimbursements. When these apps integrate with QuickBooks, the result is better expense visibility and tighter control over spend.

Commonly used expense apps include:

- Expensify: Automates receipt capture and expense reports.

- Abacus: Known for real-time expense reporting.

- Zoho Expense: Offers end-to-end expense management with automation.

- Rydoo: Provides seamless integration for real-time expense tracking.

- Receipt Bank (now often known as Dext): Specializes in capturing and storing receipts.

These apps feed directly into QuickBooks, automating approval workflows and ensuring company policy compliance on employee spend.

Challenges of integrating expense management apps with QuickBooks

Despite the benefits, connecting expense-management tools to QuickBooks often brings up persistent problems. Companies may struggle with inconsistent expense coding, like when receipts arrive with minimal detail or mismatched categories. So when synced to QuickBooks the expense shows as “Uncategorized” or under the wrong account.

Capturing and matching digital receipts remains a hurdle: if employees don’t attach images or mobile uploads fail, finance teams later scramble with spreadsheets to reconcile card charges and reimbursements.

Visibility into spend is often delayed; without real-time sync, approvers may only see expense reports days after submission, slowing reimbursement and muddying budget tracking. Expense policies may be applied unevenly: some tools don’t enforce spending limits or enforce receipt filing, leading to non-compliant payments entering QuickBooks.

Finally, varying approval workflows and user adoption across teams mean some employees bypass the app altogether, causing manual workarounds that reduce integration value.

How to solve them

Improving the connection between expense apps and QuickBooks starts with consistent processes and clear data standards. Here are some key practices:

- Establish clear expense-category mapping up front so each receipt or transaction code in the app corresponds to a correct QuickBooks account, reducing “Uncategorized” posting.

- Require mobile receipt capture at the point of expense and attach metadata (date, vendor, category) so data flows cleanly into QuickBooks without manual re-entry.

- Set approval workflows that trigger automatically and sync the approved expense immediately – this ensures timely reimbursements and accurate spend tracking.

- Enforce spending policies via the app (limits, required fields, pre-approval) so that all transactions entering QuickBooks adhere to one standard.

- Monitor sync logs and reconciliation reports regularly. Identify missing transactions or receipt-attachment errors early and correct them before month-end close.

- Train teams consistently on using the expense app (how to capture receipts, upload timely, select correct categories) so the integration works as intended and avoids shadow systems.

A consistent approach keeps expense data clean, speeds up reimbursements, and ensures QuickBooks reflects accurate spending across the business.

Choosing the right integration software for QuickBooks Online

Here’s a chart to help visualize how to choose the right integration software for QuickBooks, followed by some additional insight.

| Factor | What to look for | Why it matters |

| Functionality | Coverage of required workflows and core processes | Prevention of workflow gaps and reduction of manual work |

| Ease of use | Intuitive interface, minimal training needed | Higher team adoption and fewer user errors |

| Compatibility | Smooth connection with your existing systems and tech stack (APIs, connectors, formats) | Reliable data flow and fewer integration failures |

| Scalability | Ability to support growth in data volume, users, and integrations | Long-term stability as the business expands |

| Support & training | Access to responsive support, onboarding, and documentation | Faster issue resolution and better long-term performance |

| Cost-effectiveness | Balance of licensing, setup, and ongoing costs with actual ROI | Stronger budget control and reduced hidden operational costs |

| Security & compliance | Strong data protection, permissions, and audit controls | Reduced risk when handling financial and customer information |

| Trial availability | Option for a free trial or sandbox environment | Opportunity to validate fit before committing |

Takeaway

The best QuickBooks integration software is the one that fits your workflow, connects cleanly with your existing systems, and can grow with your business. Evaluate tools based on functionality, ease of use, compatibility, scalability, support, and security—and always test with a free trial when possible. Choosing the right integrations upfront saves time, reduces errors, and keeps your financial data accurate as your operations expand.

The bottom line

QuickBooks Online integrates with many tools, but not all integrations are created equal. Some connections pass only basic data, others lose detail along the way, and many struggle with fees, taxes, refunds, or high-volume activity. These gaps create bottlenecks in reporting and reconciliation, even when the core integration exists. This is where teams need to be selective. Choose integrations that actually support your workflow, deliver complete data, and scale with your business.

But sometimes these integrations fall short, and Synder becomes the go-to tool for ecommerce and payment platforms. Native connections often miss fees, taxes, discounts, refunds, or payout details, which leads to mismatches. Synder fills those gaps by pulling full order data and complete financial breakdowns from Shopify, Amazon, Stripe, PayPal, Square, and more. It standardizes everything and maps it cleanly into QuickBooks, eliminating the bottlenecks that cause manual fixes.

Picking the right integrations and using Synder where the built-in ones are incomplete keeps your books accurate, your workflows smooth.