So you’re thinking about using PayPal for your business. It can be a great choice if what this payment processor has to offer fits your company’s needs. But it doesn’t have to be. With so many secure and robust online payment services, you should shop around to find the right solution.

In our company, Synder, we work with payment processors like PayPal, Stripe, Square, and many more, so we know firsthand how they work. But that’s not all, as a financial management software, we know them inside out and we help our clients bring all the PayPal transactions straight into the books.

And today, we’d like to share some of our experiences with PayPal transactions, looking at the pros and cons of this payment processor.

Contents

Key takeaways

- PayPal is easy to set up and works with small businesses worldwide, integrating with various online platforms.

- PayPal’s biggest advantages are its simple setup and secure, trusted system for accepting multiple payment types.

- PayPal business accounts are available on desktop and mobile, letting owners manage transactions, invoices, and customer data on the go.

- Despite the perks, businesses should be aware of PayPal’s fees, account freezes, limited customization, high currency conversion costs, and chargeback risks.

What services does PayPal offer?

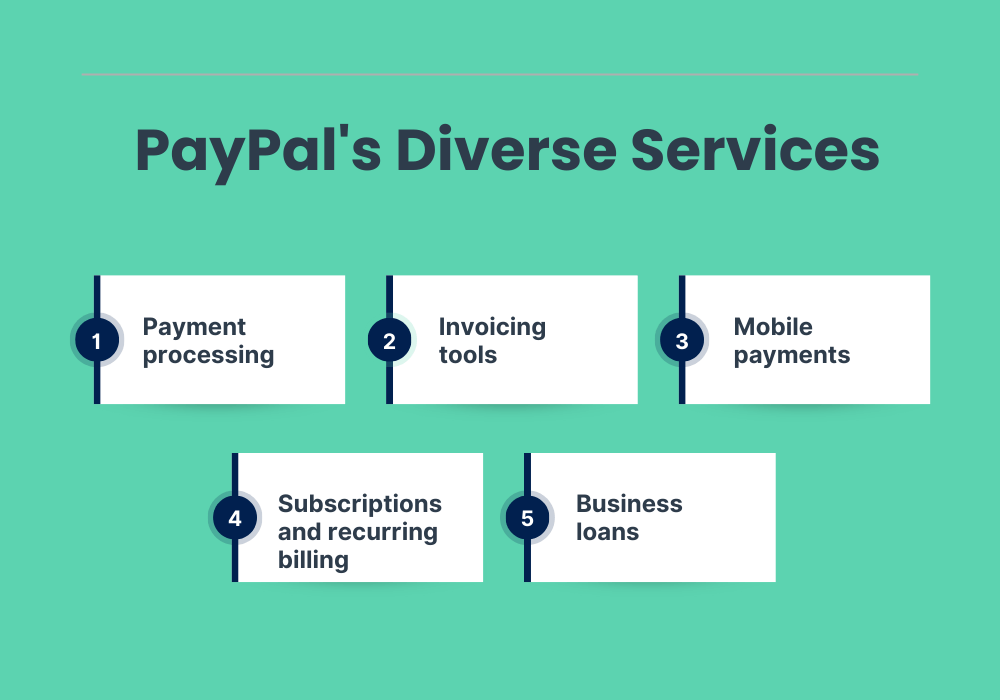

Before we get into the pros and cons of PayPal, it’s important to know that PayPal has more to offer than simply its payment services. Here’s what it can do:

- Payment processing (online, in person, and Pay Later option);

- Invoicing tools;

- Mobile payments (PayPal Here and PayPal QR Codes);

- Subscriptions and recurring billing;

- Business loans (PayPal Working Capital).

While PayPal is mostly related to online shopping, it can easily be used in brick-and-mortar stores, pop-up stores, and the services industry. Can you imagine that in 2023, the average PayPal account completed 58 transactions over the course of the year? That’s an impressive number for an online payment processor.

Now let’s look through the pros and cons of PayPal that every small business owner should know about.

Pros of using PayPal for small businesses

Let’s start with the good stuff and see what business owners like about PayPal.

✔️ Easy setup

Opening up a PayPal business account is easy as all you need is an email address, a bank account, and a few details about your business. PayPal is user-friendly and intuitive, so you shouldn’t have many problems figuring out what’s where.

You can choose to have a simple pay button or a customizable checkout experience for your buyers, depending on what you need.

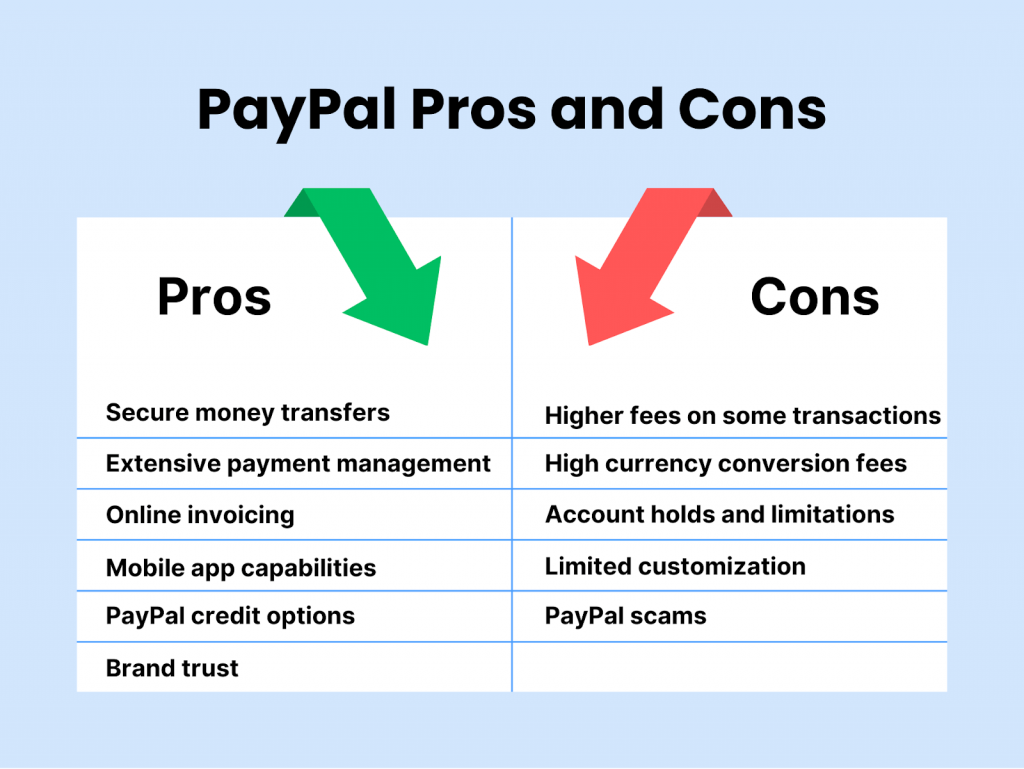

✔️ Secure money transfers for sellers and buyers

Security is a top priority for any payment platform. And PayPal is no exception. It uses advanced encryption and fraud detection systems to protect users’ data and their transactions.

But that’s not all, PayPal offers a Buyer and Seller Protection program that makes both parties feel safer when transacting money. For sellers specifically, PayPal protects them against unauthorized transactions and ill-intended chargebacks. You can also enable credit monitoring to receive alerts of any unauthorized financial activity linked to your identity, adding an extra layer of protection.

✔️ Comprehensive payment management

PayPal is an end-to-end payment solution as it’s a payment processor and payment gateway. This means that once you have PayPal set up, your business is good to go when it comes to accepting and receiving payments.

Here’s a list of payment options that PayPal supports:

- Credit and debit cards (including Visa, MasterCard, American Express, and Discover);

- PayPal balance;

- Bank transfers;

- PayPal Credit (buy now pay later service);

- eChecks;

- Mobile payments;

- QR code payments;

- Digital wallets (e.g. Google Pay or Apple Pay).

You can even accept payments for credit cards over the phone, by fax, or by email. So PayPal really gives you plenty of options to suit your unique business needs.

| Payment processor vs. payment gateway Here’s how they differ in plain words. When a customer buys something from your online store, the payment gateway is like a mailbox that safely collects their payment info and sends it to you. Then, the payment processor is like a mailman who takes that info to the bank, makes sure the money goes into your account, and lets you know the payment is complete. And you need both to operate the business. |

✔️ Online invoicing

Now, we’re moving on to special merchant services that you can choose alongside your PayPal business account, starting with invoicing.

PayPal lets you customize invoices with your brand logos, track their status, and even set up recurring payments for regular clients as well as payment reminders.

✔️ Mobile app capabilities

Next up is mobile access. PayPal has its own mobile PayPal app, available for both iOS and Android devices that lets you manage transactions in your accounts straight from your smartphone.

You can do all your day-to-day tasks like sending invoices, tracking sales, managing payments, and accessing your customer information straight from the app.

✔️ PayPal credit options

For many small businesses, access to funding can be a significant hurdle. To address this, PayPal offers credit services like PayPal Working Capital. These are loans that are based on your business’s PayPal sales history.

PayPal’s credit services have no lengthy forms or long waiting periods. What’s convenient, is that repayments are automatically deducted as a percentage of your daily sales. This gives you a flexible repayment solution that matches the growth of your small business’s sales.

✔️ Brand trust

PayPal has been around for long, providing billions of people with a reliable and secure payment method. When you offer buyers an option to pay with PayPal, you lean on its years of reputation.

What’s more, your customers know that if something goes wrong with their payment, they have PayPal to back them up, and it works the same way for you.

| Did you know? PayPal is present in more than 200 countries and regions with 426 million users. for the sake of comparison, that’s the population of the entire South America! |

Cons of PayPal for small businesses

Now, let’s dive into the disadvantages of PayPal that business owners might face.

❌ Higher fees for selected transactions

There’s no way around fees, that’s a given. For domestic online transactions, PayPal charges a standard rate of 2.9% + $0.30 per transaction. That’s the same as Stripe and Square (PayPal’s big competitors). But when you look closely, you can spot differences in other payment rates.

PayPal charges an additional 1.5% on top of the standard fee for cross-border payments, making it more expensive for international transactions than Stripe, which charges 3.9% + $0.30. What’s more, PayPal takes 2.7% for in-person payments, while Square’s 2.6% + $0.10 rate is slightly lower. It’s not a major difference, but for businesses with a high volume of transactions, this could add up.

❌ High currency conversion fees

In addition to PayPal transaction fees, businesses that trade internationally need to know about currency conversion fees. PayPal charges a 3% to 4% fee above the exchange rate for converting currencies. Compare it to Stripe, charging only a 1% fee for the same service. So, for businesses with international sales, PayPal’s high currency conversion rates might be a significant drawback.

❌ Account holds and limitations

PayPal has a reputation for freezing or limiting accounts without much warning. There are usually some legitimate reasons, but still, the surprise element doesn’t help. Such account holds might be due to disputes, unusual activity, or sudden increases in transactions. Although these measures are designed to protect against fraud, they can be disruptive to your business and affect the cash flow severely.

Another piece of this puzzle comes from PayPal’s (slight) tendency to side with customers rather than sellers during disputes (which are lengthy processes, on top of it). All in all, your money can be tied up for a while or you can even incur losses (e.g. a chargeback fee).

❌ Limited customization

While PayPal’s ease of use and simplicity are part of its appeal, it also means the platform lacks flexibility and customization options compared to other payment processors. If a small business requires more specific features, such as tailored payment plans or unique checkout interfaces, PayPal might not be the best choice.

Also, PayPal redirects your customers to its own site during checkout, limiting the degree to which you can fully control and customize the user experience. While it stems from security issues (PayPal takes all the encryption, servers, and compliance on), it limits your branding capabilities.

❌ PayPal scams

There have been many different types of scams circulating. If you search online, there’s even a term called: PayPal scams. This, of course, has nothing to do with the actual company but it’s rather a testament to its popularity and widespread use.

Simply put, PayPal is a secure and trustworthy payment platform, but criminals often try to impersonate PayPal or exploit its users through phishing scams, fake emails, and fraudulent transactions.

While not PayPal’s fault, it’s something a business owner should know about when evaluating different payment methods.

Pros and cons of PayPal: maybe what happens after a payment is made

It’s easy to think that payments end once they hit your bank account, but that’s not the whole story from the bookkeeping standpoint.

When you want to decide on a suitable online payment processor, you must know how the transaction data will integrate with your accounting software. If you don’t, you’ll need to get all the data from your PayPal statements manually into your books.

At Synder, we help our clients automatically synchronize their PayPal payment data with their accounting systems so that they have the most accurate and real-time financials in their books. Let’s look more closely at how exactly Synder does that.

How to optimize your PayPal workflow with Synder?

Synder syncs transactions from different platforms, not only payment processors (PayPal, Stripe, Square), but sales channels (Amazon, Shopify, eBay, Etsy, etc.), and POS systems too.

Here’s what Synder does for PayPal bookkeeping in a nutshell:

- Automatically imports PayPal transactions into your accounting software.

- Categorizes sales, fees, and taxes for accurate financial records.

- Pre-matches your PayPal payments with your bank statement amounts for easy reconciliation.

- Tracks and records multicurrency transactions with correct conversion rates.

- Gives you real-time sales data so that you can evaluate your PayPal income and expenses as they happen, not just the historical records.

Join our Weekly Public Demo to learn how Synder can improve your PayPal accounting workflow. Or take the first step toward managing your finances and sign up for a free trial today.

Alternatives to PayPal

While PayPal is one of the most popular online payment platforms, it isn’t the only option. Here are some alternatives that small business owners should also consider to make an informed decision. These are, of course, just snapshots of different payment solutions but we’ll find links to dive in further, if you’d like to.

Stripe

Stripe is a payment platform designed for businesses of all sizes. It offers a variety of features, including support for subscriptions and recurring billing, the ability to customize its checkout experience, and support for many different payment methods, such as credit card or bank apps.

If you have a subscription-based business, Stripe gives you plenty of options to set everything up from simple memberships to complex yearly plans with upgrades, partial discounts, and more. Synder RevRec integrates with Stripe, letting businesses recognize this revenue the accrual way.

Square

Nothing beats Square when it comes to its point-of-sale (POS) system. But it also offers a variety of other services, including online payment processing, invoicing, and even business financing.

Its card readers and POS system make it a great choice for businesses that meet their customers face-to-face. Of course, you also need to get the sales data from these portable machines into your bookkeeping system. And Synder does this too, fully automating the real-time syncing of Square transactions to your books.

Authorize.net

Authorize.Net is a payment gateway (if you remember about mailing examples, that’s the mailbox part). This payment platform lets you accept credit and debit card payments, eChecks, and digital wallets (such as Apple Pay and PayPal) for online, in-person, or over-the-phone transactions.

As it’s a payment gateway only, you’ll still need a payment processor to handle the whole process. That’s why Authorize.Net is a good choice for businesses that already have a payment processing setup and want advanced features for their store. When it comes to bookkeeping, Synder can sync sales and refunds (gross amount) straight from Authorize.Net.

Choosing the right payment method

The payment methods we discussed represent the top 4 solutions in the US, namely, PayPal, Stripe, Square, and Authorize.Net. Each has its staple features that are better suited for certain types of businesses.

But of course, that’s just the beginning of the long list of providers. If you’re curious about other solutions, Synder supports a total of 12 different payment platforms. You can check them out here.

Conclusion

There’s no doubt that when assessing the best payment platform for your business, you should consider PayPal. After all, it’s one of the major players in payment processing. However, whether that’s the right choice for your business is a different story altogether.

Its ease of use, robust security measures, and worldwide trust among consumers speak loudly for PayPal. But that’s only one side of the coin. Some drawbacks can significantly impact your cash flow, expenses, and general business health, and you shouldn’t diminish those.

Determining whether PayPal is the right choice for your business largely depends on your company’s specific needs, operating model, and circumstances. Hence, small business owners must evaluate their unique needs and carefully analyze cost-benefit when choosing a payment system.

Read about Xero accounting alternatives and Business savings account.

PayPal FAQs

Why use PayPal for small businesses?

It’s simple. PayPal can be used for e-business, whether you want to receive or send money. Just add it as a payment method on your website and make the process automatic. It’s also possible to use it through the application or connect it to your bank account.

Is PayPal free for small businesses?

You can create an account on the service or in the app for free. PayPal merchant account fees are only charged when transactions begin to take place there. This means that your payment begins only when sales begin.

I just opened up a PayPal credit account, when is my payment due?

Your PayPal Credit payment is due at least 25 days after the close of your billing cycle. You can check your specific due date by logging into your PayPal account and viewing your PayPal Credit statement.

How quickly can I access funds from sales?

Funds are typically available in your PayPal account almost instantly. However, for new accounts, this may take even 21 days. Once the money is in your PayPal account, you can transfer it to your bank account, which usually takes 1-3 business days.

What are the main disadvantages of PayPal?

The main disadvantages of PayPal include high fees for international transactions and currency conversions. This applies only if you trade internationally. PayPal also has a reputation for freezing accounts with little warning, which can disrupt cash flow.

Share your opinion

Have additional PayPal pros and cons that you’d like to share or think we missed something important? We’d love to hear from you! Share your thoughts and experiences in the comments section below and help fellow business owners make informed decisions. Your feedback is invaluable!

I didn’t know that there were so many ways to pay for items and business thanks for the update.

I liked paypal for many years. A few months ago ,i noticed payts automatically going thru every month for something i never ordered. When i advised, they tried to sell me more. So I’m closing my paypal to prevent future fraudulent charges.

Hi Ann, we’re sorry to hear about your experience with unauthorized charges through PayPal and the disappointing response when you sought assistance. It’s understandable why you’d choose to close your account to prevent future issues. Protecting yourself from fraudulent transactions is crucial.

This was an insightful read. These alternative forms of payments to PayPal will be useful for my financial services UK business clients.

Thank you, David! We are pleased that we were able to assist you and that the information was useful.