Those small businesses that were able to survive the last few months, successfully deal with a moved Tax Day date and hopefully get help from the government and utilize local resources now have to think of the new financial year that just began. No matter how hectic the surrounding climate is, it’s always good to stop and analyze where you are headed, for example by revisiting your current financial goals or assessing the existing credit card debt. But is there anything else you could do to grow your business and solidify its financial standing in the upcoming tax year?

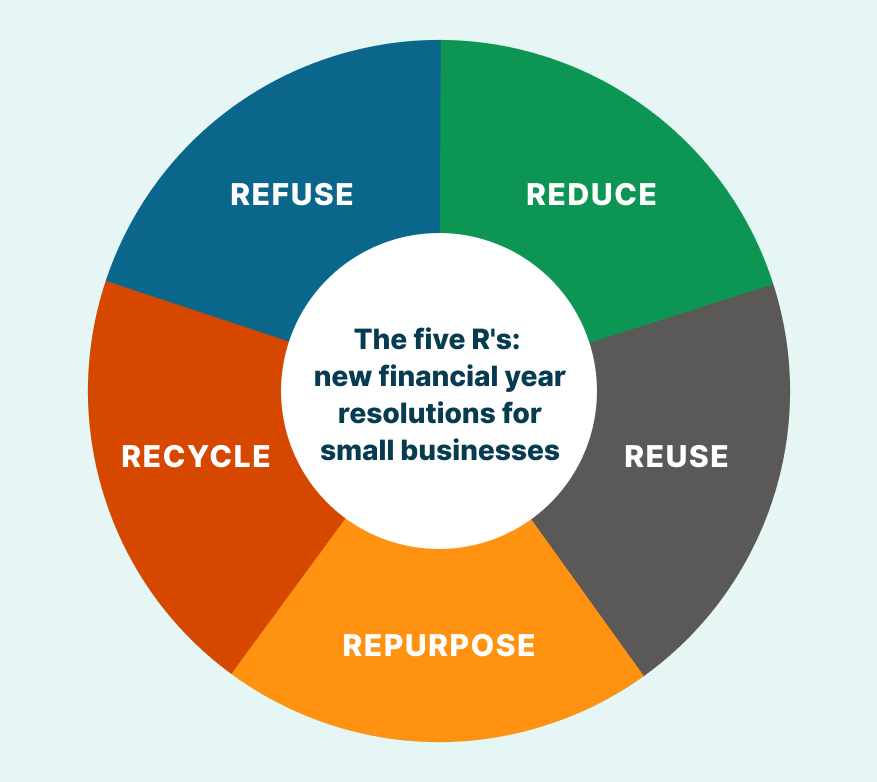

Questions like this are never easy to answer, and especially not amid a global pandemic combined with a looming recession. To help you get started, I’ve put together a list of five R’s to remember when making those new financial year resolutions for your small business.

1. Refuse

Refuse to get buried under the load of manual work

There is a good exercise business analysts use – they ask you to write out all of the repetitive tasks you are doing and note the hours you spend on them. What’s your weekly number? How about several hours every month? If you pay yourself an hourly wage as a small business owner, make that calculation to see how much you are spending on tasks that actually do not need your expertise. If you have employees, repeat the process for them.

All of these hours and dollars could be saved by introducing more automation into your routine. It’s not a new word but sometimes we just need to see the bare numbers to be reminded of the sheer value of using it for your business’ sake. Not only does automation save you money – it improves accuracy and employee performance – people shine when they are given the tasks to shine!

Consider manual accounting (many small businesses do not need more than a combination of Synder + QuickBooks to invoice, automate the bookkeeping, and manage their staff with a Gusto package included for free in every Synder subscription).

If your accounting system is still paper-based, you could be saving thousands of dollars every quarter. The beginning of the new financial year is a great time to look for the potential to automate in the way you run your business.

2. Reduce

Reduce the number of apps you use

The savviest among small business owners have been dealing with way too many apps in the last few years. It seems unreasonable – why spend so much time on automation if you got it to save time and money in the first place?

Every business, no matter the industry, can spend the first months of the new financial year analyzing their digital package, and see whether many apps can be replaced by one that is more powerful? Consider Square for retail, for example. With its POS and wonderful synchronizations with online accounting software it can replace many apps you might be using for tracking the inventory, accepting payments, etc.

Another example is that if you are automating your bookkeeping you don’t need a separate invoicing tool, and all your online transactions can be automatically added into the accounting system, even if they come from different sources, such as Stripe, PayPal or Square. Modern solutions can automate all of that in one place.

In 2020-2021 less is definitely more. If you have been adding various automation options, it might be a good time to revisit your digital portfolio, as well as your website and social media presence to see if you can have fewer apps and plugins doing more.

3. Reuse

Reuse the information you’ve gathered

The beginning of the new financial year is a great time to revisit your project management, planning, and accounting systems and look for the information you can extract from it, such as incredibly valuable reports (see what a balance sheet can tell you about your business, for example). Reports like this one can be the best guide for you when planning your strategy. Many business owners, even the most experienced ones, make the mistake of going with their gut feeling, or simply following the latest trend, when in fact you can be using the science of clear data instead. The same can be said about your website – reviewing its analytics can help you learn more about your customer persona.

With financial reports and website analytics, you have got plenty of data at your fingertips to plan your strategy.

Being scientific and disciplined about the approach you take in the new year is guaranteed to bring the results and makes for a great resolution to follow.

4. Repurpose

Repurpose your resources

You can spend the second half of the new financial year thinking of how to use the time you have freed up thanks to automation. It would be a great time to upskill yourself and your employees, start fulfilling more sophisticated tasks instead of doing routine and mundane work.

Another great resolution to set for yourself is getting more help from the experts. Just as investing in good software can help you earn more in the end, consulting a professional accountant, budget planner, or investing in a great website can bring in more revenue.

5. Recycle

Recycle old ideas about insurance and banking

2020-2021 will be a great time to say goodbye to old ideas you might still have about insurance and banking. When stocking up on new insurance packages or updating the old ones a trend to follow is searching online (fitting for the COVID world) as well as trusting the best policy over the lowest price. Chubb.com also speaks about the importance of integrity for insurance brokers and agents. In the world where everyone’s rated and reviewed great recommendations from your customers are especially important, and good insurers know that.

When it comes to financing, the latest trend is that banks are less likely to give loans to small businesses while help can come from private investors and crowdfunding, according to Business.com. This means that getting in touch with your community is very important, both for you to exactly answer their needs with what you offer, as well as for your business stability.

These Five R’s will be useful when drafting your personal resolutions for the new financial year. Only you will be able to make decisions for what your business needs in the coming months, I hope that the insights shared above will be helpful along the way.

%20(1).png)