If you’ve ever had to deal with taxes, you probably know the frustration of trying to talk to someone at the IRS. It can be a real struggle to get a human on the line, and you might be wondering whether it’s best to call, pay the IRS a visit in person, or send a letter to address your tax-related questions or issues.

Well, if you’re looking for advice on how to actually talk to a real person at the IRS, and what IRS phone numbers to try for different reasons, you’re in the right place. This article is here to help you figure out the best way to go about it.

The IRS phone number: Live person to talk to

Getting hold of an IRS representative live is no easy feat, but the first thing you should know is the right phone number to call.

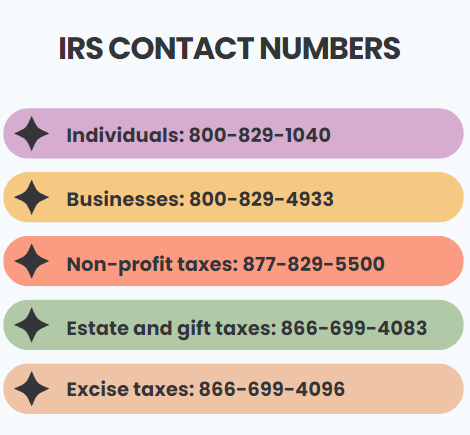

Here are the contact numbers for different tax-related inquiries:

- Number for individuals: 800-829-1040, available from 7 a.m. to 7 p.m. local time.

- Number for businesses: 800-829-4933, available from 7 a.m. to 7 p.m. local time.

- Number for non-profit taxes: 877-829-5500, available from 8 a.m. to 5 p.m. local time.

- Number for estate and gift taxes (Form 706/709): 866-699-4083, available from 10 a.m. to 2 p.m. Eastern time.

- Number for excise taxes: 866-699-4096, available from 8 a.m. to 6 p.m. Eastern time.

For overseas callers, please refer to the IRS International Services page. If you are hearing impaired, you can reach the IRS at TTY/TDD 800-829-4059.

Now that you have the right prone numbers to talk to the live person, it’s time to find out what you need before calling.

What you need before calling

To ensure your identity is verified when you contact the IRS, it’s representatives will need to confirm your identity before discussing your personal information. Here, everything depends on whether you’re an individual or calling on behalf of someone else.

What information do individuals need when calling the IRS?

If you’re an individual, please make sure you have the following information ready when you make your call:

- Social Security number (SSN) and birth date;

- Individual Taxpayer Identification Number (ITIN) if you don’t have a Social Security number;

- Filing status (e.g., single, head of household, married filing joint, or married filing separate)

- Your prior-year IRS tax return

- The specific IRS tax return you’re calling about

- Any correspondence you received from the IRS

What information do third parties calling on behalf of someone else need?

If you’re calling on behalf of someone else, you’ll need:

- Verbal or written authorization to discuss the account

- Taxpayer’s name, SSN, or ITIN

- The IRS tax return you’re inquiring about

- Valid Form 8821, Tax Information Authorization, or Form 2848, Power of Attorney and Declaration of Representative

- Preparer tax identification number or personal identification number

What information do you need if you’re inquiring about a deceased taxpayer?

If you are calling about a deceased taxpayer, you’ll need:

- A copy of the person’s death certificate

- Court approval letter or Form 56, Notice Concerning Fiduciary Relationship (for estate executors)

Being tax audited by the IRS? Find out what the IRS tax audit red flags are.

What are the wait times for the calls to the IRS?

During the filing season (January – April) this is what you can expect when calling:

- Wait times can average around 4 minutes, though some lines may have longer wait times.

- Longer wait times are common on Mondays, Tuesdays, during Presidents Day weekend, and around the April tax filing deadline.

During the post-filing season (May – December), if you want to talk to a real person, the situation is a bit different:

- Wait times can average around 11 minutes, with some lines experiencing longer wait times.

- Mondays and Tuesdays generally have higher wait times.

Not sure how far back the IRS can go? Learn how far back the IRS can audit.

What is the best time to call the IRS?

If you’re trying to get through to the IRS, here’s some helpful advice: try calling as early in the morning as you can.

The IRS phone lines are available for assistance between 7 a.m. and 7 p.m. in your local time zone, from Monday to Friday. However, please keep the following exceptions in mind:

- If you’re in Hawaii or Alaska, please use Pacific time for your reference.

- In Puerto Rico, the IRS phone lines are open from 8 a.m. to 8 p.m. local time.

Why you might need to reach out to the IRS

So, why would you need to contact the IRS in the first place? Well, there are several situations where it makes sense:

1. Requesting more time

Let’s say you’re about to miss a deadline that the IRS has set, like paying your taxes or responding to a notice, and you can’t make it on time. You’d want to call them to request an extension.

2. IRS notices

When you receive an official notice, it’s crucial to call the number provided in that notice to address the specific issue mentioned.

3. Checking tax amounts

Sometimes, you might be uncertain about the exact amount you owe for taxes. In such cases, contact the IRS for clarification.

4. “Where’s My Refund?”

If you’re tracking the status of your tax refund using the “Where’s My Refund?” tool and it directs you to call the IRS to resolve any issues, then making that call becomes necessary.

Find out how long the IRS can hold your refund for review.

5. Checking on IRS actions

If you’re curious about the status of something the IRS is working on, like a tax return or payment, you’ll want to contact them.

6. Questions about payment plans

If you have questions regarding a payment plan you’ve set up with the IRS, they can help you with that.

7. Issues with tax forms

If you’ve lost, received an incorrect Form 1099-R or Form W-2, or haven’t received these forms at all, you might need to reach out to the IRS for assistance.

8. Payment confirmation

Sometimes, you might need to confirm that the IRS has received your payment, and that’s a valid reason to get in touch.

When it’s best to refrain from calling the IRS

On the flip side, there are situations where a call might not be the right choice. For example, if you simply want to complain about taxes or a tax-related problem, calling the IRS isn’t the avenue for that.

Similarly, if you need transcripts, it’s generally best not to call the IRS unless you’re using a specific number designated for transcript requests (800-908-9946).

If you have questions about tax laws themselves, it’s more appropriate to consult a tax professional or someone knowledgeable in tax law.

Lastly, for obtaining specific IRS forms, it’s often easier to download them from the official IRS website or find them through other authorized sources rather than directly contacting the IRS.

Interested in different types of the IRS refunds? Find out what the IRS Treas 310 is.

Can someone else talk to the IRS for me?

You have the option to designate someone else to make the call on your behalf. It doesn’t have to be you personally. You can delegate this responsibility to a tax professional using a straightforward form.

The complexity of your situation often determines whether this is the best course of action to pursue. Tax professionals are well-versed in the language and procedures of the IRS and have access to a dedicated hotline for practitioners. You can grant a tax professional the authority to handle all IRS matters on your behalf or simply to obtain information on your behalf.

How to authorize someone to call the IRS on your behalf?

Not sure how or simply don’t want to deal with the IRS yourself? Authorize a person you trust to do that on your behalf! Here, you’ll have to decide on the scope of responsibilities you transfer to this person and choose either the Power of Attorney or Tax Information Authorization.

Power of Attorney

If you find yourself in a situation where the IRS is auditing your tax return or you’ve received communication regarding an unpaid tax balance that you cannot pay in full or believe you don’t owe, you have the option to designate someone to represent you. How? Use the Power of Attorney!

A Power of Attorney (POA) is a legal document that authorizes a third party to act on your behalf in dealings with the IRS. This authorized individual has the ability to represent you, negotiate, and even sign documents in your name. They can argue based on facts and apply relevant laws to your case. Additionally, individuals with POA can receive copies of IRS notices and transcripts of your account.

Authorized individuals who can act as your representative for the IRS include attorneys, certified public accountants, enrolled agents, general partners, full-time employees, family members, and others.

It’s important to note that POAs must be documented in writing. Also note that Power of Attorney authorizes the third person to completely deal with the IRS on your behalf. Want them to only get information? Then you need a Tax Information Authorization.

Tax Information Authorization

A Tax Information Authorization, or TIA, is essentially a way for you to give someone you trust access to your confidential tax information for specific tax-related matters (including dealing with the IRS) and time periods that you specify. It can be anyone you choose, including your family and friends.

To set up a TIA, you can either do it in writing or over the phone. This authorization allows your chosen representative to receive either verbal or written account information (known as transcripts) and obtain copies of IRS notices on your behalf.

Who can help me with IRS problems?

If you are facing tax problems due to financial difficulties or an immediate threat of adverse action and have not been able to resolve them with the IRS, you may consider seeking help from the Taxpayer Advocate Service (TAS). They may be able to assist you with your tax-related issues.

If you prefer in-person assistance, you can visit your local IRS Taxpayer Assistance Center (TAC). These centers provide help when your tax issue cannot be resolved online or by phone. TACs now operate by appointment, reducing wait times. Find the nearest office using the Taxpayer Assistance Locator tool or through the IRS2Go app under the “Contact Us” option. To schedule an appointment, call 844-545-5640. Please note that IRS offices are closed on federal holidays.

Additionally, according to the IRS, some taxpayers may qualify for free tax return preparation and electronic filing assistance at nearby locations. Check out the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs for more information.

Learn about pre-tax and post-tax deductions.

How to ease the stress of tax filing if you’re a business?

The main thing any business can do is to make sure their financial records are correct and prepared for tax filing. How can they do that? The answer is easy – have a smart accounting software in place and consult with a professional.

Synder is a handy financial software tool designed to make life easier for businesses when it comes to managing their finances. Now, while it won’t directly file your taxes for you, it certainly lends a helping hand in getting your financial records in order for tax time.

How can Synder assist?

First off, it ensures that your financial records are accurate by automatically recording your transactions. No more manual data entry! Synder plays nicely with accounting software like QuickBooks Online and Xero, making it easier to transfer your financial data when it’s time to file your taxes. It also takes care of categorizing your transactions, which is a big help when it’s time to generate those important tax reports.

Need to reconcile your financial data? Synder’s got you covered there too, ensuring your records match up with your bank statements.

And when tax season rolls around, Synder can generate year-end financial reports like profit and loss statements and balance sheets, which are super handy for tax preparation and getting a clear picture of your financial health.

Give Synder a try by signing up for a 15-day free trial, or book a spot at our Weekly Public Demo to see the tool’s capabilities with a specialist.

But remember, while Synder is a fantastic tool for streamlining your financial record-keeping, you might still want to work with a tax professional to ensure your taxes are filed accurately and in compliance with the law. Think of Synder as your trusty partner, simplifying the financial side of your business to make tax time a little less stressful.

Final thoughts

So, whether or not you should reach out to the IRS depends on your unique situation. But here’s the key takeaway: always be prepared with the necessary information before picking up that phone. It not only streamlines the process but also helps the IRS representatives assist you more effectively by verifying your identity.

Now, about timing – it matters! The IRS has its working hours, so try to make your call during those times. This significantly increases your chances of getting through to a real person at the IRS and getting the help you need without unnecessary delays.

Keep in mind that the IRS is here to assist with a wide range of tax-related questions and concerns, from clarifying tax amounts to addressing notices and payment plans. However, remember when not to contact the IRS – like for general complaints or broad tax law questions.

Whether you’re dealing with taxes as an individual or handling matters for a business or non-profit, the IRS has avenues for support. By following the advice in this article, you can approach those interactions confidently, knowing you’re well-prepared to tackle your specific needs and issues effectively.

What’s your experience of calling the IRS? Share in the comments below!

Even after calling the numbers offered. There is NO way to speak to a LIVE agent.. beginning to think that there are no real people at the irs.. all AI robots..

Hi Steven, while it can be incredibly challenging and sometimes feel impossible to reach a live agent at the IRS due to high call volumes and limited staffing, the IRS does employ real people to assist taxpayers. Here are a few tips that might improve your chances of speaking with a live IRS agent. The IRS has multiple contact numbers for different issues. Using the most relevant number to your inquiry can sometimes lead to quicker assistance. If possible, you might consider making an appointment at a local IRS office for face-to-face assistance. If your issue is urgent or causing significant hardship, the Taxpayer Advocate Service (an independent organization within the IRS) may be able to assist.