Jumping into online payments it’s an important step for online businesses. With so many payment platforms waving for attention, Stripe might have caught your eye—and for good reason. It’s clear, straightforward, and reliable. But, to get the best out of it, you’ve got to understand its ins and outs. So, let’s embark on this Stripe journey together, from setting it all up to making sense of different features and functionalities. Ready?

Struggling to bring all your transaction data into your accounting system? Try the solution that solves the most common ecommerce problems.

Understanding the basics of Stripe

Having a reliable and efficient payment processor isn’t just an advantage—it’s a necessity. Stripe, with its user-friendly platform and robust set of tools, offers more than just a payment gateway; it provides a holistic solution tailored for online businesses.

A customized payment experience

First and foremost, understand that Stripe isn’t a one-size-fits-all solution. It allows you to tailor the payment experience to suit your brand and customers’ preferences. So dive deep into its customization options. From embedded payment forms to fully branded checkouts, Stripe can make the payment journey feel like a natural extension of your brand.

Reach a global audience

If you’re eyeing the global market, Stripe has your back. With its support for multiple currencies and local payment methods, you can cater to customers from various parts of the world with ease. Remember, localizing the payment experience can significantly boost conversion rates, making it a strategy worth considering.

Recurring revenue and subscriptions

Subscription models are so important, and for a good reason—they provide predictable revenue. If this model aligns with your offerings, leverage Stripe’s subscription tools. They not only simplify setting up recurring payments but also manage and update customer subscriptions, reducing the manual work on your end.

Transparent fee structure

Financial planning is crucial for business growth. Stripe’s transparent fee structure ensures you’re never caught off guard. While you’ll have standard per-transaction fees, be sure to explore potential charges related to international transactions, instant deposits, or additional services. An informed business owner is always better positioned.

To find out more about fees, read our comprehensive guide to Stripe fees.

Enhanced security and compliance

Lastly, and perhaps most importantly, Stripe places a high emphasis on security. The platform is equipped with advanced fraud detection tools and is compliant with global payment standards. It’s not just about protecting your business; it’s about safeguarding your customers’ trust.

How to set up a Stripe business account?

Navigating the online business world can be a maze, especially when it comes to setting up a reliable payment gateway. Based on collective experiences, Stripe stands out as a top choice for many entrepreneurs like you. Here’s a quick guide to getting started.

Begin your journey on Stripe’s official website. To register you can either use your business email or opt for the swift Google sign-in. During registration, you’ll provide essential business details, from your operation’s country and category to your official address. This is also your chance to introduce your business by linking your website and penning down a brief descriptor.

Where will your earnings go? Stripe’s got you covered. Simply detail your bank’s location, your preferred transaction currency, and key bank details. For sole proprietors, you’ll also share a bit about yourself for identity verification. Stripe encourages two-step verification for added security.

Once you’ve filled in the blanks, hit ‘Activate your account’. Be ready with tax or VAT details, depending on your location. Now, the fun part: integrating Stripe into your business platform. They’ve made this user-friendly with a range of tools tailored to different needs. Before you jump into accepting payments, run a few test transactions. Once you’re confident, toggle from ‘test’ to ‘live’ mode on your dashboard, and voila! You’re all set.

For a more detailed guide to the registration and setup process, read our guide.

Understanding the Stripe Dashboard

Now that we’ve covered some basics, let’s dig deeper into Stripe functionalities. The true magic lies in understanding and utilizing Stripe’s dashboard effectively.

Why Stripe Dashboard matters?

Firstly, think of the Stripe Dashboard as your business’s control center. From monitoring real-time payments to understanding your balance and managing customer information, it provides a 360-degree view of your financial operations. This isn’t just about payments; it’s about steering your business with data-driven insights.

Overview of features and tools

At first glance, the dashboard might feel overwhelming. Fear not, it’s designed intuitively. On the left, you’ll see a menu, and as you explore, you’ll encounter various graphs, tables, and tools. The search functionality at the top is your best friend – allowing you to quickly find transactions or customer details. Let’s delve into the key sections.

Payments

At a glance, you can see all payments that have been made, their status (successful, failed, pending), and their amount. Clicking on any payment will provide detailed information, such as fees charged by Stripe and the net amount that will be credited to your account.

Balance

This section gives you an eagle-eye view of your available balance (ready to be transferred to your bank), pending balance (funds from recent payments that will be available soon), and the payout schedule (how often Stripe transfers money to your bank).

Customers

Here, you can manage and view all your customers. It provides a holistic view, from their payment methods to their transaction history. You can also save customer details for future transactions, making repeat business a breeze.

Products

This section helps you manage products or services effectively. You can add new products, set up pricing, and even handle subscription plans if you’re aiming for recurring revenue.

Developers

Don’t be daunted by its tech-savvy name! This is where you’ll find tools and resources to customize your Stripe experience, especially if you’re integrating Stripe into your website or app. From API keys (which allow your website to communicate with Stripe) to detailed logs of every event, it’s a treasure for troubleshooting and customization.

Stripe Dashboard: Takeaway

Remember, like any tool, the Stripe Dashboard is as effective as your understanding of it. Dedicate time to explore, click around, and perhaps even make use of Stripe’s extensive documentation and tutorial videos. As you grow more familiar with it, you’ll find that it’s more than just a payment gateway; it’s a window into the financial pulse of your business.

How to integrate Stripe with your website?

If you’ve chosen Stripe as your payment solution, the next logical step is embedding it seamlessly into your online presence. Let’s take a look at how you can integrate Stripe into your website and mobile applications.

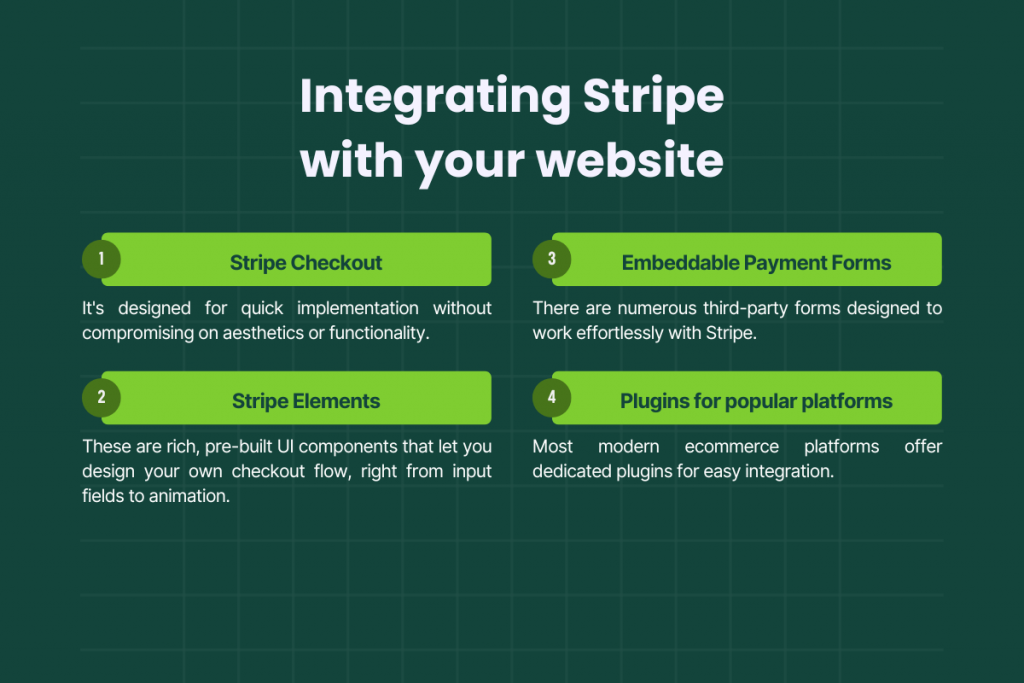

Stripe Checkout

Think of this as the express lane. Stripe Checkout is a pre-built, customizable payment page hosted by Stripe. You simply redirect customers to this page for payments. It’s designed for quick implementation without compromising on aesthetics or functionality. Especially recommended if you’re looking for a swift setup.

Stripe Elements

For those who desire a more personalized touch, Stripe Elements is your toolkit. These are rich, pre-built UI components that let you design your own checkout flow, right from input fields to animation. The flexibility it offers means you can make the payment experience reflect your brand’s identity.

Embeddable Payment Forms

If you’re not looking to build from scratch but still want payment forms embedded on your page, there are numerous third-party forms designed to work effortlessly with Stripe. They provide the middle ground – not entirely pre-built like Checkout, but not as customizable as Elements.

Plugins for popular platforms

Most modern ecommerce platforms and CMSs (Content Management Systems) recognize the pivotal role Stripe plays. As a result, they offer dedicated plugins for easy integration:

- WordPress: If you’re using WooCommerce for your WordPress site, the Stripe for WooCommerce plugin is a blessing. Simple to set up, it lets your customers pay without ever leaving your site.

- Shopify: Shopify has a built-in Stripe integration. Once you provide your Stripe credentials in Shopify’s payment settings, you’re all set. The two platforms collaborate seamlessly behind the scenes.

- Other: Whether you’re on BigCommerce, Magento, Wix, or Squarespace, there’s likely a Stripe plugin waiting for you.

Mobile integration

If you’re venturing into or already have a mobile marketplace, you’re in luck. Stripe offers a neatly bundled iOS SDK. This kit equips you to craft a native payment experience on iOS devices. Whether you’re looking to accept card payments or Apple Pay, this SDK has got you covered.

Similar to its iOS counterpart, the Stripe Android SDK ensures your Android app users have a fluid payment experience. Tailor-made for the Android ecosystem, it ensures a smooth transaction process.

Integrating Stripe: Takeaway

While Stripe makes integration as painless as possible, always test extensively before going live. A seamless payment process isn’t just about convenience; it builds trust. Every successful transaction reaffirms to your customers that they’re in safe hands.

Lastly, remember that while technology facilitates business, it’s the human touch that fosters loyalty. Ensure your payment process, however automated, still reflects the heart and soul of your brand.

To make sure that all your Stripe payments (and other payment gateways like PayPal, Afterpay, etc.) and your marketplace sales (Shopify, Amazon, eBay, Etsy, and many more) and robustly integrated with your accounting software (QuickBooks Online, QuickBooks Desktop, or Xero), try Synder automation.

Implementing Stripe payment methods

To truly maximize your potential, it’s essential to understand and offer a variety of payment methods to cater to a global and diverse clientele. Let’s see how you can leverage Stripe’s array of payment options.

Classic and reliable: Credit and debit cards

Stripe’s support for major card networks like Visa, MasterCard, American Express, and more means that you’re catering to the most widely used payment methods around the globe. If your business model involves subscriptions or recurrent charges, card payments are your go-to. Stripe manages the complexity, ensuring consistent and timely payments.

Given the ubiquitous nature of card payments, always prioritize this integration. Ensure the process is smooth, secure, and user-friendly. Remember, the ease of the checkout process can make or break a sale.

Tapping into the future: Digital wallets

With the proliferation of smartphones, digital wallets like Apple Pay and Google Pay have surged in popularity. They offer customers a swift, one-tap payment solution.

Digital wallets use tokenization for transactions. This means actual card details are never exposed during payment, adding an extra layer of security. As you look towards capturing a tech-savvy audience, integrating digital wallets is imperative. Monitor your analytics to see the adoption rate and always watch for emerging wallet technologies to stay ahead of the curve.

Broadening horizons: International payments & currency conversions

Stripe enables you to accept payments from anywhere in the world. This opens up a world (literally) of opportunities for business expansion. Stripe handles the complexity of converting international payments into your preferred currency. It provides real-time conversion rates, ensuring you get a fair value.

Beyond cards and digital wallets, payment preferences vary across countries. Stripe supports local payment methods like Alipay, SEPA Direct Debit, and more, ensuring you resonate with local audiences.

If you’re contemplating or are already selling internationally, research the preferred payment methods of your target countries. Offering localized payment solutions can significantly boost trust and conversion rates.

Payment methods: Takeaway

Every payment method you offer is like opening a new door for your customers. While it’s beneficial to provide multiple avenues, always prioritize security and user experience. Regularly gather feedback and monitor transaction analytics to understand your customers’ preferences and ensure your payment methods align with their needs.

Subscription and recurring payments with Stripe

Subscriptions offer a steady stream of revenue and foster strong customer relationships, building loyalty over time. To adequately manage subscriptions, it’s good to know the basics of this model and how to apply them on Stripe.

Crafting the perfect subscription models

It’s crucial to carve out a clear space for your product or service within Stripe’s intuitive dashboard. Here, you’ll be laying the groundwork. Set up diverse pricing plans or tiers. The trick? Be flexible. Every customer is unique, and by offering a variety of tiers, you ensure that you’re catering to their individual needs. As for billing intervals, it’s more than just choosing between monthly or yearly options. Pick intervals that resonate with your customers and align with your business goals. For a start, launch with a few straightforward plans. As you become attuned to your customers’ responses, you can refine and expand your offerings based on their feedback.

Subscription management

Stripe isn’t just about setting things up and letting them run—it’s about evolution and adaptation. The platform’s automated renewal feature is a boon, ensuring that your customers enjoy an uninterrupted experience while securing steady revenue for your business. However, remember that as your customers evolve, so should your services. Stripe’s flexibility shines here, allowing you to effortlessly modify subscription plans. Whether it’s offering an upgraded package, adjusting prices, or introducing trial periods, the control is in your hands.

Keep a keen eye on your subscription metrics. If you spot a spike in cancellations or shifts in subscription choices, it’s time to reassess. Engaging in open dialogues with your subscribers can often illuminate areas of improvement or new opportunities.

How to streamline your invoicing and billing with Stripe?

Let’s talk about something that’s often overlooked but absolutely critical: invoicing and billing. These aren’t just routine tasks; they’re a reflection of your brand’s professionalism and reliability. And here’s the good news: with Stripe, this process can be both efficient and impactful.

Creating impactful invoices on Stripe

Think of your invoices as an extension of your brand. Stripe offers a dynamic platform where you can infuse your brand’s personality into your invoices. Customize them to echo your brand aesthetics by adding logos, specific details, and even heartfelt messages. Plus, Stripe’s automatic calculations ensure accuracy down to the last cent, factoring in taxes, discounts, and more. A little advice? Aim for clarity and brevity with your invoices. Remember, every interaction—including invoicing—shapes your customer’s perception of your brand.

Automated reminders

While Stripe’s reminders work wonders to ensure timely payments, what I truly admire is their handling of failed payments. Instead of a cold, transactional alert, Stripe gently nudges the customer to update their payment method. Automation is a marvel, but every now and then, add a sprinkle of personal touch, especially with loyal clients. A considerate, personal reminder can often be more effective than automated messages, especially with key accounts.

Navigating refunds and disputes

No matter how seamless your operations are, refunds and disputes are inevitable. But they’re also an opportunity. With Stripe, you’re empowered with the flexibility to manage these situations efficiently. Whether it’s a full or partial refund, the process is straightforward on the dashboard. Just remember, to keep your customer in the loop during the refund process. This transparency can mitigate potential frustrations, fortifying the trust they have in your brand.

When it comes to chargebacks and disputes, not only will they alert you when a charge is disputed, but their toolkit and guidance can be invaluable when you’re presenting your case. While Stripe liaises with the card network, it’s crucial to remember that the final verdict lies with the network. So, a proactive approach is best. Ensure your payment descriptions are lucid and provide easy channels for customers to communicate any concerns. Address disputes with grace and professionalism—after all, these moments can be a litmus test for your brand’s commitment to customer satisfaction.

Conclusion

Digital payments don’t have to be this mysterious, complicated maze. Platforms like Stripe create straightforward processes to help you with the setup, but the real magic happens when you, as a business owner, grasp the how-tos and the nitty-gritty. Think of Stripe as a tool; its real power shines when wielded with knowledge. So, stay informed, be adaptable, and remember: the easier you make it for customers to do business with you, the more likely they are to return.

Read more about Stripe point-of-sale and the proper Stripe chargeback protection.