Running an ecommerce business without a solid way to manage your money is a bit like steering a ship with a broken compass. You’ll move, sure, but you’ll constantly be off course. And if PayPal is one of your main ways to get paid, trying to keep your books straight by hand feels like bailing water with a spoon. It’s exhausting and never-ending.

Here’s a better way – Synder, a system that automatically pulls every single PayPal transaction: sales, the fees, even the refunds, and drops them into QuickBooks Online with incredible accuracy. No more wrestling with spreadsheets, no more late nights trying to make sense of your numbers. As a result, you get clean, accurate books that practically run themselves in the background.

Let’s walk through how this works.

Your path to syncing PayPal transactions to QuickBooks Online

When connecting PayPal to QuickBooks Online, Synder acts as your personal backstage crew and smart assistant in one, keeping your financial operations smooth, accurate, and effortlessly under control.

1. Connect your QuickBooks Online and PayPal accounts

To get started, create your Synder account with a 15-day free trial, then link your PayPal account. This sets the foundation for seamless syncing. Next, connect your QuickBooks Online account, and Synder will start pulling in every sale, refund, and fee in real time. The setup is fully guided, just plug it in and let Synder do the job.

2. Choose your level of detail

Synder lets you decide how you want your records to look in QuickBooks. You have two main modes:

- Per Transaction Sync is for those who love every single detail. Each sale and refund gets its own entry, like a meticulous diary of your business activity.

- Summary Sync offers a tidy roll-up of all your daily activity. This is perfect if you prefer a cleaner overview without tracking every single pebble.

Either way, your books will stay polished and accurate.

3. Map your categories like a pro

Ever had a PayPal fee disappear into a mysterious account in QuickBooks Online? With Synder, you control where every detail lands. You can assign specific income and expense accounts for PayPal sales, fees, and refunds, and even apply default tax rules or classes. It’s like laying down precise train tracks: once everything’s mapped, Synder routes each transaction exactly where it belongs, automatically and without detours.

4. Get ready for smooth reconciliation

Synder groups your PayPal payouts exactly how they appear on your bank deposit reports and then automatically matches them inside QuickBooks Online. Even those tricky PayPal refunds become seamless, with each one perfectly tied back to the original sale without you ever having to dig around manually.

Why ecommerce sellers love Synder

Using Synder to automate PayPal bookkeeping is like hiring a tireless assistant who never sleeps and always files things exactly where they belong. But don’t just take our word for it. Healthy Meals Direct, a fast-growing meal prep business in New York, experienced the shift firsthand.

Their challenge was a flood of PayPal transactions, with sales, fees, and refunds coming in daily without any clean way to keep it all organized in QuickBooks Online. The manual work was overwhelming, and financial clarity was slipping.

That changed when they found Synder:

“We’re saving real time with Synder. Instead of 3 or 4 hours, I now dedicate around 30–45 minutes to the task of reconciling transactions and making sure everything is perfect in our books. That’s over 70 hours saved each month, which I can now dedicate to more strategic parts of my role.”

Victoria Martinez, Customer Service Manager at Healthy Meals Direct

The team at Healthy Meals Direct can tell you: dealing with PayPal used to be a headache. But with Synder, that’s all in the past. Now, transactions line up on their own, PayPal payouts fall right into place, and month-end closes go from stressful to seamless.

No matter if you’re selling custom t-shirts, delicious baked goods, or the latest fitness tech, Synder helps you keep a clear eye on your finances, ensuring your books always keep pace with your business.

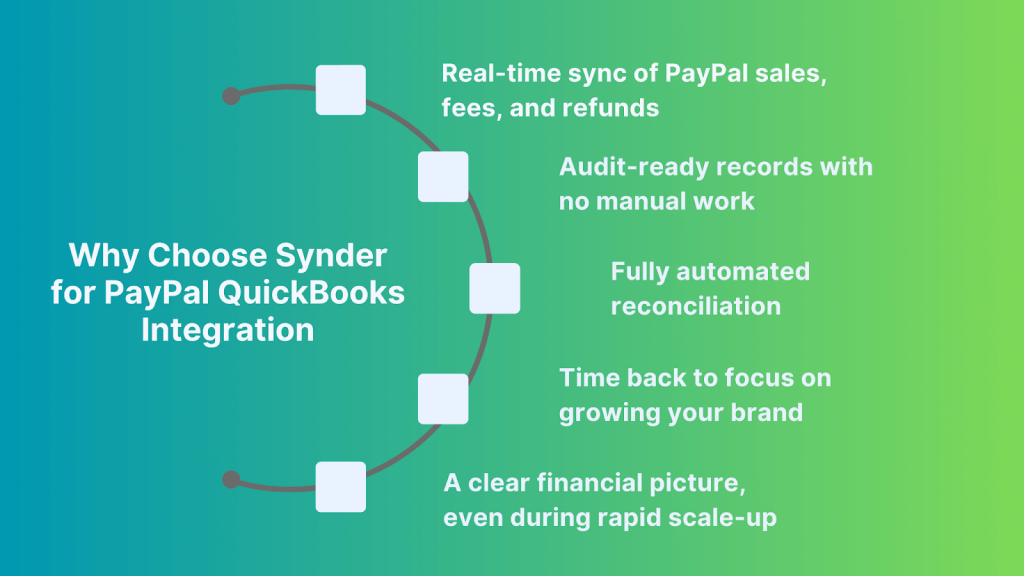

You’ll get:

When your orders start flying in and manual bookkeeping starts cracking under pressure, Synder keeps everything stitched together, just like it did for Healthy Meals Direct.

Want to automate your PayPal transactions into QuickBooks Online? Learn more about it during a 1-1 demo.

FAQ

Do PayPal sales, fees, and refunds sync automatically into QuickBooks Online?

Yes. Once you connect PayPal, Synder sends all your sales, fees, and refunds straight into QuickBooks Online automatically. You don’t have to upload anything or fix categories. Everything shows up in the right place, ready for you to review or reconcile.

Can I bring in older PayPal data into QuickBooks Online?

Yes. Synder can pull in your older PayPal transactions. Just choose the date range you need and let it run, perfect for catching up on past months. Keep in mind that historical imports cost extra on some subscription plans. Just keep in mind that for some plans this option comes with a fee.

Can I customize fee categories or add memos in QuickBooks Online?

Yes, you can set up where PayPal fees, sales, and refunds go in QuickBooks Online. Synder also lets you add automatic memos, like order numbers or product names, so your records are clearer and easier to follow later on.

Does Synder handle multiple PayPal accounts?

Yes, you can connect more than one PayPal account to Synder. Each one can have its own settings and categories, which is handy if you’re running multiple stores or selling under different business names in the same QuickBooks Online account.

Do I need to approve every sync manually?

Not unless you prefer to. Synder can sync everything automatically, or you can turn on manual mode if you’d rather double-check things before they go into QuickBooks Online. It’s up to you: automated when you want speed, manual when you want control.