If you need to sync Ecwid sales, including taxes, shipping, and discounts, into QuickBooks Online without juggling CSV files, you can do it easily with Synder. This platform mirrors your Ecwid store to QuickBooks, importing full order data, including line-item details, and automating reconciliation in real time without manual uploads.

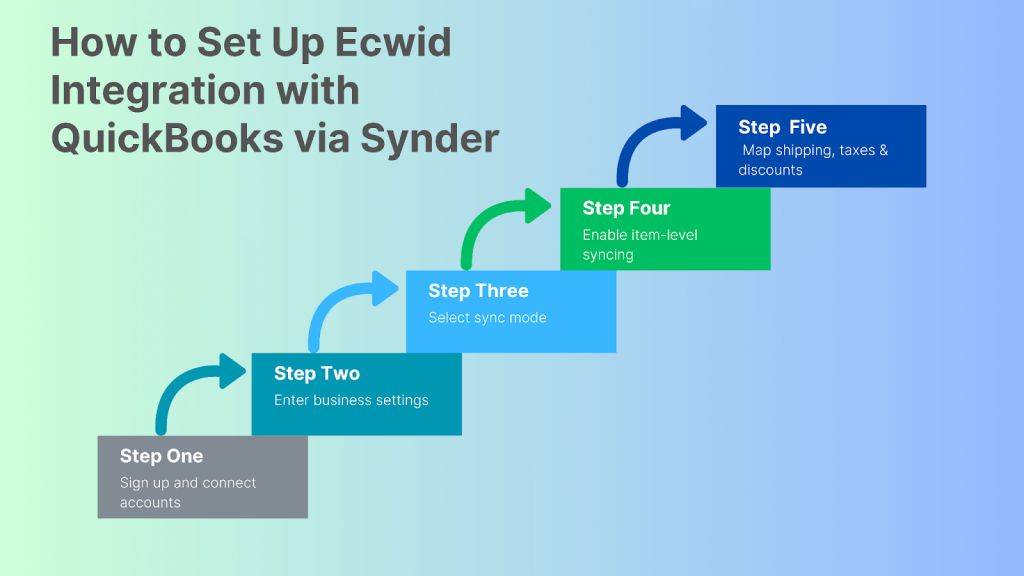

How to set up Ecwid integration with QuickBooks via Synder

Here’s how to get Ecwid and QuickBooks fully in sync, with Synder keeping every sale, tax, and discount right where it belongs.

1. Sign up and connect accounts

Create a Synder account, connect your QuickBooks Online company, then connect your Ecwid by Lightspeed store. If you need to add payment processors (Stripe, Square), do so here. Synder will fetch orders, refunds, fees, and item/tax details from both Ecwid and your payment gateway.

2. Enter business settings

As you onboard, fill in business details, time zone, and home currency. This setup ensures Ecwid tax mapping in QuickBooks Online is accurate.

3. Select sync mode

Choose Per Transaction Sync to import each Ecwid order individually, or opt for Summary Sync to consolidate daily sales into single entries.

4. Enable item-level syncing

Turn on item-level detail so Synder imports each product line, SKU, quantity, price, plus any applied Ecwid by Lightspeed discounts QuickBooks sync accurately, which works well with Per Transaction sync.

5. Map shipping, taxes & discounts

Assign Ecwid shipping, tax, and discount lines to the correct QuickBooks accounts. This prevents lumped entries and clarifies margins.

Additional tips

- Admin access to your Ecwid store is required to complete the connection. If you’re not the owner, you can invite them during setup.

- Businesses selling on multiple platforms can connect additional sales channels through the Synder dashboard, as we support over 30 integrations.

- You can import historical Ecwid data to ensure past transactions are reflected in your books. This feature is included for free for the first 3 months on the Pro plan, and available for a fee afterward.

- Any platforms skipped during onboarding can be connected later through your Synder settings.

Ready to automate your ecommerce accounting? By shifting from manual CSV uploads to a real-time Ecwid–QuickBooks integration, you’ll save time, reduce errors, and maintain clean books. Learn more at Synder’s Weekly Public Demo.

FAQ

Does Ecwid import itemized sales and discounts into QuickBooks Online?

Yes. In the Per Transaction Sync mode, Synder imports each line item from Ecwid, including SKUs, taxes, shipping, and discounts, as separate entries in QuickBooks.

How are Ecwid taxes mapped in QuickBooks Online?

During setup, Synder lets you assign Ecwid tax rates to QuickBooks tax codes for accurate reporting.

Can I import historical Ecwid sales and discounts?

Absolutely. Synder supports backfilling historical sales and discounts from your Ecwid store to QuickBooks. Keep in mind that with the Pro plan, the first three months of historical data sync are free; after that, a fee applies.

How do I prevent duplicate Ecwid transactions?

Synder checks transaction IDs and timestamps, automatically skipping duplicates to keep your books clean.

What if Ecwid discounts are lumped into the wrong account?

You can specify discount account mapping with both Per Transaction Sync and Summary Sync in Synder so they’re posted to the appropriate sales or discount account.