If you want to reconcile eBay payments in Xero quickly, accurately, and without the usual headaches, the most effective solution is to use an integration tool like Synder. Instead of manually entering transactions, Synder automatically syncs your eBay managed payments data with Xero, seamlessly importing eBay settlement reports, tracking fees and refunds, and keeping your Xero inventory and COGS for eBay perfectly aligned.

How to auto-reconcile eBay payments in Xero with Synder

Here’s how Synder helps you sync eBay managed payments with Xero, providing automated reconciliation, precise fee tracking, and minimal manual work.

Step 1: Connect eBay to Synder

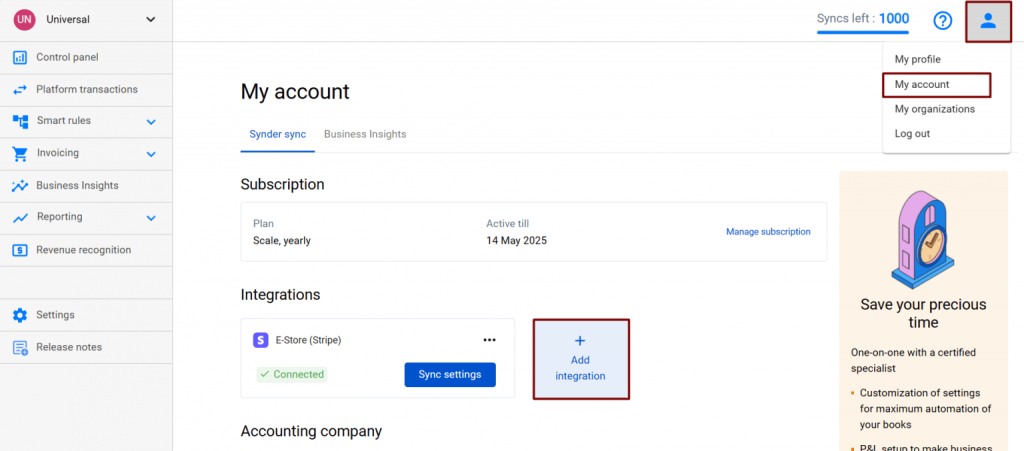

- Switch to the correct Organization in the top-left corner of the Synder page.

- Click the Person icon in the upper-right corner and select Organization settings.

- In the Integrations section click Add integration.

- Select eBay from the dropdown and click Connect. If you lack admin rights, click Invite instead.

- Choose the account for payouts (usually your checking account) so payouts land where you expect. Click Continue to finish the eBay integration.

Step 2: Turn on auto-reconcile in Synder

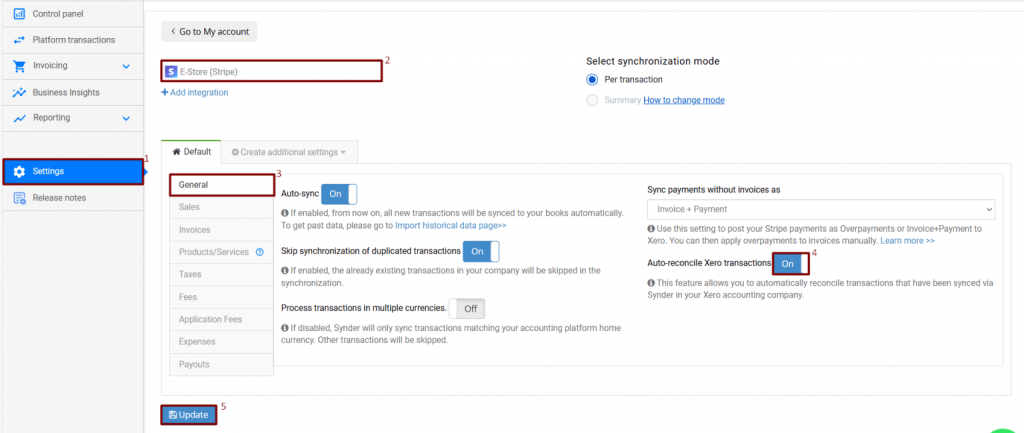

- Open Settings from the left side menu.

- From the integration dropdown choose the eBay integration you just added.

- Go to the General tab.

- Enable Auto-reconcile Xero transactions.

- Click Update to save.

Step 3: Reconcile eBay payouts in Xero (what to do inside Xero)

- In Xero go to Accounting, then Bank accounts.

- Open the Synder clearing account used for eBay. For example, it may be named like “eBay (required for Synder).”.

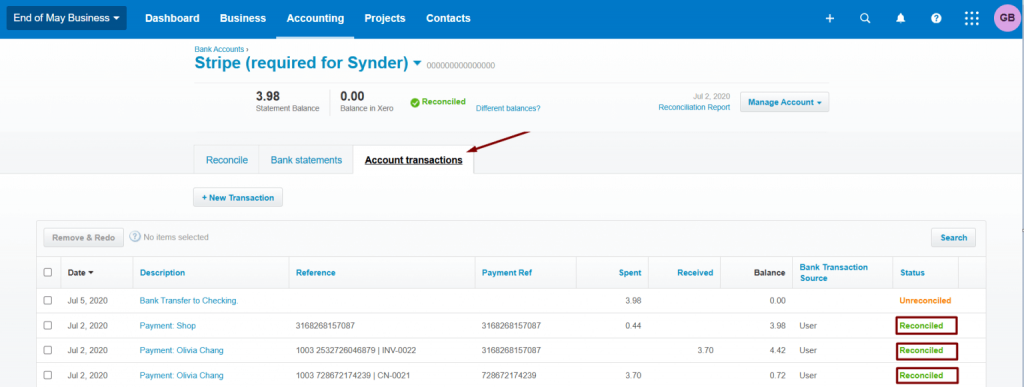

- Go to Account Transactions to confirm income and expense rows created by Synder are marked Reconciled if auto-reconciliation was enabled.

- Open the Checking account where eBay sends payouts. Click Reconcile to open the bank reconciliation screen.

- Locate the bank statement line for the eBay payout deposit you want to reconcile.

- On the Reconcile screen, match that bank statement line to the corresponding payout transaction that Synder created. Use Find & Match or select the suggested match and confirm the match to mark the bank statement line as reconciled.

- If the payout amount doesn’t match the bank statement line, investigate in the clearing account for collected fees, taxes, refunds, or partial settlements. Edit or split the transaction in Xero or create a matching transaction so totals align, then reconcile.

- Repeat for each payout until your checking account statement lines are matched and reconciled.

Step 4: Verify and clean up

- After reconciling payouts, check the clearing account balance. If all settlements have been moved to your checking account correctly, the clearing account balance should reflect only pending or unmatched items.

- If you need to remove an incorrect payout, open the account where that payout lives in Xero, find the payout transaction in Account Transactions, and delete or remove it from reconciliation there.

Step 5: Tips, tax handling, and troubleshooting

- eBay may collect sales tax on your behalf in some US states. Synder records those tax details so your books show the collected tax correctly.

- If your eBay connection drops (for example after an eBay password or user change), re-establish it in Synder by going to Person icon → Organization settings and clicking Reconnect under your eBay integration.

- If you get stuck, contact Synder support via online chat, or email for help with the integration or mapping.

See Synder in action! Book a demo and find out how much time and effort you can save.

How Synder records eBay activity

Synder streamlines your eBay bookkeeping by creating a clearing (holding) bank account in Xero to temporarily store synchronized income and expense transactions.

With Auto-reconcile enabled, Synder automatically marks these transactions as reconciled in the clearing account, leaving your checking account untouched until you match payouts. Since Xero doesn’t allow third-party apps to reconcile Bank Transfer payouts, eBay settlements will sync as Unreconciled and require a quick manual reconciliation in Xero. If you need to delete or roll back payouts, simply remove them directly in Xero, as Synder as Synder cannot delete them on your behalf.

How to track Xero inventory & COGS for eBay in Synder

COGS (cost of goods sold) are the direct costs of producing or purchasing the goods you sell. Accurately tracking COGS and inventory for your eBay sales in Xero is very important to understanding your true profits and keeping your books organized. Synder makes this easy by automatically calculating COGS and syncing everything seamlessly with Xero. Let’s break down exactly how to do it.

Step 1: Access COGS settings

- Log in to your Synder account.

- From the left-side menu, click Settings → COGS tab.

Step 2: Enable COGS tracking

- Find the integration(s) you want to track COGS for (e.g., eBay, Shopify).

- Switch ON the toggle for each integration to enable COGS tracking.

Step 3: Map COGS and inventory asset accounts

- Go to the Mapping tab.

- Assign the appropriate accounts from your Xero or QuickBooks books to the COGS account and inventory asset account.

Step 4: Import product costs

- Go to Products and Services → click Import → select Import CSV.

- Download the template file.

- Fill out the Purchase cost for each product (Sales price is optional). Ensure the Product name or SKU matches your Synder product list.

- Upload the completed CSV to Synder.

Once product costs are imported, Synder automatically calculates COGS for all newly imported daily summaries. For each sale, the software multiplies the quantity sold by the product’s imported cost, debiting the COGS account and crediting the inventory asset account accordingly.

Step 5: Update existing costs

To update costs for existing products:

- Go to Products and Services, click a product, edit Purchase cost, and save.

- Or upload a new CSV with updated costs for multiple products.

Step 6: Apply COGS to previously imported summaries

COGS isn’t automatically applied to summaries imported before costs were added. To update them:

- Contact Synder support and provide the relevant date range.

- The support team will refresh the summaries so the correct COGS is applied.

Keep in mind:

- Import batches of no more than 3,000 products at a time.

- Keep your product SKUs and names consistent to ensure accurate matching.

- Regularly update your product costs to reflect changes in purchasing or manufacturing costs.

FAQ

How should I map eBay fees (final value, ads, shipping labels)?

Synder imports all eBay fees and posts them as expenses in Xero. During setup, choose or create the right expense accounts, and Synder automatically maps each fee type correctly.

How can I break down the eBay settlement (sales, fees, shipping, refunds) properly in Xero?

Synder records detailed settlement data, like sales, fees, shipping, refunds, and taxes in a clearing account. You then reconcile payouts from eBay with this account to keep everything accurate and separated.

How often are summarized eBay entries created in Xero?

Synder offers flexible summary modes, allowing you to choose between daily aggregation, per-payout synchronization, monthly summaries, or even custom date ranges. If you select Summary Sync, Synder combines all eBay sales, fees, refunds, taxes, and discounts into a single record for each day.