Among the myriad of online payment gateways, Stripe stands as a beacon of efficiency. Within its suite of tools, the Stripe Express account is particularly appealing for its combination of speed and simplicity. This article offers an in-depth guide to establishing and optimizing your Stripe Express account.

Stripe: Types of accounts

Stripe offers various products and solutions for online payment processing. One of their products for platform businesses or marketplaces is called Stripe Connect. Stripe Connect provides the tools to facilitate payments and manage users in a marketplace or platform setting.

Within Stripe Connect, there are several types of accounts you can create for your platform users: Standard, Express, and Custom.

- Standard accounts. These are almost like standalone Stripe accounts. The user manages their account directly with Stripe and can even use it outside of your platform. They’ll have to go through the full Stripe onboarding flow, and they’ll log into Stripe Dashboard directly to see their transactions, etc.

- Express accounts. This is a more controlled experience compared to the Standard accounts. The onboarding flow is streamlined and designed for users who just need quick access without the need for a full-blown dashboard. Express account holders get a dashboard, but it’s much more simplified compared to the Standard accounts. Express is designed for platforms that want a bit more control over the user experience but still allow users some level of direct interaction with Stripe.

- Custom accounts. These are fully controlled by the platform. The user doesn’t interact with Stripe directly at all. You, as the platform, handle all user interactions and must build your user interface for account management, transaction views, etc. This is designed for platforms that need maximum control over the user experience.

What is a Stripe Express account?

Stripe Express is a solution provided by Stripe, tailored for online platforms and marketplaces. It simplifies the process for users, allowing them to quickly sign up, handle their transactions, and receive their earnings. For the platform administrators, it reduces the hassles, as Stripe takes care of many intricacies, such as regulatory compliance, bank payouts, and user data security. This means while the platform retains some oversight, it doesn’t have to delve into the nitty-gritty of payment processing. Essentially, Stripe Express streamlines the financial interactions between the platform, its users, and their customers, making the whole process more efficient and user-friendly.

In summary, a Stripe Express account offers platforms a balance between user experience and control. It’s a ready-made solution for quick user onboarding and payouts, with the added advantage of reduced regulatory complexity.

As always, when considering a payment solution, it’s a good idea to review the platform’s documentation and perhaps even consult with financial or legal professionals to ensure it’s the right fit for your specific needs.

The requirements for a Stripe Express account

Stripe Express accounts have requirements, most of which are based on compliance with financial regulations, as well as Stripe’s internal policies to ensure secure and lawful operations. The specific requirements might vary based on the country or region of operation, but some general requirements and considerations include:

Verification information

Stripe, like any financial institution, is required by law in many jurisdictions to collect information about individuals and businesses using its service. This is often referred to as “Know Your Customer” (KYC) requirements. For Express accounts, this could include:

- Full name

- Date of birth

- Address

- Social security number or taxpayer ID (in certain countries)

- Bank account details or other payout destination details

- For businesses, additional information like the business entity type, EIN (Employer Identification Number), and business address might be required.

Country availability

Stripe Express is not available in all countries. The platform’s availability is continually expanding, but you’d need to check Stripe’s official documentation or support to see if Express accounts are available in your specific country.

Business model approval

Stripe has guidelines on the types of businesses it supports. Some business models or industries might be deemed high-risk or are outside Stripe’s acceptable use policy. Before integrating, ensure your business model is supported by Stripe.

Platform responsibility

If you’re a platform integrating Stripe Express, you’re responsible for any activity that happens via your platform. Stripe expects you to monitor your platform for fraudulent activity and ensure that your users comply with their terms of service.

Account activities

There are limits to how much money an account can receive or hold before it’s verified. If certain thresholds are reached or if suspicious activity is detected, Stripe might place limitations on the account or require additional verification.

Tax reporting

Depending on the country, Stripe may be required to report income earned by users of your platform. They might collect and verify tax-related information from users to comply with these regulations.

User agreement

Users need to agree to Stripe’s terms of service. As a platform, you’ll typically integrate this agreement process into your onboarding flow.

Integration requirements

From a technical standpoint, integrating Stripe Express might require adherence to specific integration guidelines, including using the Stripe API correctly and ensuring user data is transmitted securely.

Is Stripe Express free?

Stripe Express, as a part of Stripe Connect, is not entirely free. While there are no upfront fees to start using Stripe Connect or Express, there are costs associated with processing transactions and other services. Here are some of the costs to consider:

Transaction fees

Like with its other services, Stripe charges a fee for every transaction processed through the platform. The exact amount can vary based on your region, but the typical fee in the U.S. is 2.9% + 30¢ for card charges.

Additional Connect fees

For platforms using Stripe Connect (Standard, Express, or Custom), there can be additional fees. These could be a percentage of the volume transacted or a flat fee per transaction. The specific fee structure would depend on the type of Connect account and region. For instance, using Express or Custom accounts typically involves an additional fee beyond the standard Stripe transaction charges.

Payout fees

Depending on your region and payout method, there might be fees associated with sending payouts to your connected accounts.

Currency conversion

If you’re processing payments in multiple currencies, there might be fees associated with currency conversion.

Refunds and chargebacks

If a customer disputes a charge or if you issue a refund, additional fees may apply.

Note: It’s important to note that Stripe’s pricing model is subject to change, and the specific fees can vary based on region, negotiation (for very high volumes), or changes in Stripe’s business strategy. If you’re considering using Stripe Express for your platform or marketplace, it’s essential to check the latest pricing details on Stripe’s official website or get in touch with their sales or support teams to get precise, up-to-date pricing information.

Can I change my Stripe account type?

Once a Stripe Connect account type (Standard, Express, or Custom) is chosen and set up, you cannot directly “change” its type. Each type serves different purposes and has distinct characteristics, and converting from one type to another isn’t as straightforward as just switching a setting.

However, if you find that another account type better serves your needs, you would typically follow these steps:

1. Consultation. Contact Stripe’s support team to discuss your needs and get guidance on the best approach for your specific situation. They might have updates or recommendations based on your requirements.

2. New account creation. If you decide to switch to a different account type, you will create a new Connect account with the desired type (Standard, Express, or Custom).

3. Migration. Depending on your transition, you might need to migrate data or re-onboard your users. For instance, if switching from Express to Custom, you would need to collect and store the required information from your users, as the Custom account provides more control (and responsibility) to the platform.

4. Integration change. You will likely need to adjust your platform’s integration with Stripe. Different account types have different API endpoints, capabilities, and requirements, so you’d need to ensure your platform’s code aligns with the chosen account type.

5. Communication. Keep your users informed. If you’re running a platform or marketplace, any changes in the payment process can affect your users. It’s essential to communicate any upcoming changes, what’s required of them, and how the changes benefit or impact them.

6. Testing. Before finalizing any changes, test the new setup in Stripe‘s sandbox environment to ensure everything works as expected.

7. Closure of old accounts. Depending on your setup, after successfully transitioning, you might need to close or deactivate the old Connect accounts.

It’s essential to approach such a change with careful planning to ensure a smooth transition and maintain trust with your users or customers.

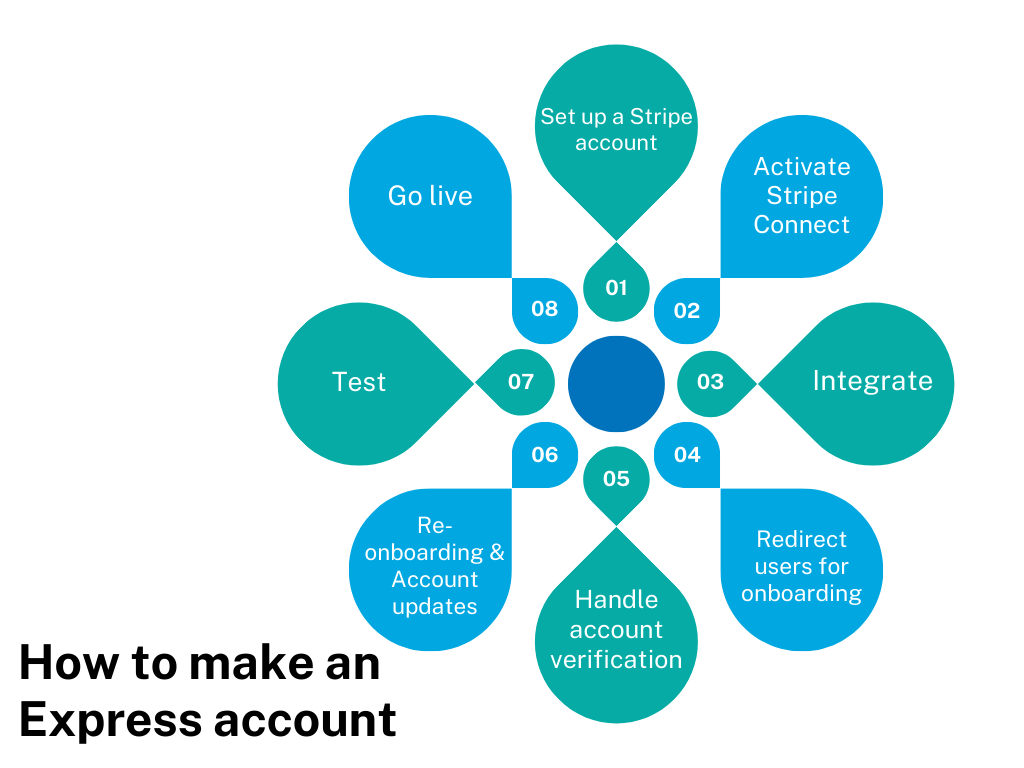

How to make an Express account

Creating a Stripe Express account involves a combination of platform integration (via Stripe’s API) and user interaction (for onboarding and account details). Here’s a step-by-step guide to help you integrate and create an Express account for your platform.

1. Set up a Stripe account

If you haven’t already, start by signing up for a Stripe account at Stripe’s website.

2. Activate Stripe Connect

Once you have a Stripe account, you’ll need to enable Stripe Connect, which is the feature you’ll use to create Express accounts for your users.

3. Integration

Utilize the Stripe API to integrate the creation of Express accounts into your platform. Stripe provides extensive documentation for this.

When a user decides to onboard with Stripe on your platform, you’ll use the Stripe API to create an Express account for that user. This will typically involve a call to the ‘Account’ endpoint in the Stripe API to create an account with the type set to ‘express’.

4. Redirect users for onboarding

Once the Express account is created via API, Stripe will provide a URL to which you should redirect your user. The user will then be taken through the Stripe onboarding process, where they will provide all necessary information (like personal details, bank account information, etc.) and agree to Stripe’s terms. The onboarding process is hosted by Stripe but can be styled to match your platform’s branding.

5. Handle account verification

Stripe may require additional information for verification purposes. You should monitor the account’s status and prompt users to provide any additional required information if necessary. This might include further identification, proof of address, etc.

6. Re-onboarding & Account updates

Over time, users might need to update their account information or re-onboard if there are significant changes to their situation or if Stripe requires more data. Ensure you handle these scenarios in your platform.

7. Testing

Stripe provides a test environment and test card numbers. Before you go live, make sure to test the entire flow thoroughly, from account creation to making transactions to handling payouts.

8. Go live

Once you’re ready and have tested everything, you can transition to the live environment and start onboarding real users.

Bonus step: Monitor & compliance

It’s essential to monitor transactions and user activity on your platform for any suspicious or fraudulent behavior. Stripe provides tools and reports to help you with this.

Remember that while the above guide provides a general overview, the specifics can change based on Stripe’s updates, regional differences, and the specific needs of your platform. Always refer to Stripe’s official documentation and consider consulting with a developer or a technical expert familiar with Stripe’s API when integrating.

Benefits of using Stripe Express

Stripe Express accounts are tailored for platforms and marketplaces that want a blend of user autonomy and platform control. Here are some of the benefits of using a Stripe Express account:

Streamlined onboarding

Express offers a quick and straightforward onboarding process for users. The user experience is optimized to collect necessary information efficiently, making it easier for users to sign up and start transacting.

Simplified dashboard

Users of Express accounts have access to a pared-down version of the Stripe Dashboard. This dashboard offers a clear view of earnings, transaction history, and payout details, removing the complexity of the full Stripe dashboard.

Regulatory and compliance handling

Stripe handles the bulk of regulatory and compliance requirements, such as “Know Your Customer” (KYC) verifications. This offloads a significant amount of work from the platform, ensuring users are compliant with local financial regulations.

Customizable user experience

While the onboarding flow is hosted by Stripe, it can be styled to match the branding of your platform, providing a more seamless experience for users.

Direct payouts

Platforms can set up and automate payouts to users’ bank accounts or other payout destinations directly, making the payment process efficient and timely.

International capabilities

Stripe Express supports international operations, allowing platforms with a global user base to offer consistent onboarding and payout experiences across various regions.

Reduced development overhead

Because Express provides a pre-built, hosted onboarding and account management flow, platforms can save on the development time and costs they would incur building these flows from scratch.

Secure data handling

Security is a top priority for Stripe. By using Express, sensitive user data (like bank account details) is handled directly by Stripe, reducing the platform’s responsibility and potential liability regarding data breaches.

Transparent reporting

Both platforms and end-users have access to clear reporting and analytics, helping track payments, identify issues, and understand transaction trends.

Support and documentation

Stripe provides extensive documentation, tutorials, and support, making the integration and management of Express accounts easier for platforms.

Conclusion

Stripe Express is designed for platforms needing a mix of control and user autonomy. It streamlines user onboarding and provides a simplified dashboard for clear transaction views. The platform benefits as Stripe handles complex regulatory and compliance matters. Globally, Stripe offers consistent onboarding and transactions, making it suitable for international platforms. With Stripe’s security measures, user data is kept safe. The system is developer-friendly, allowing easy integration. While Express is versatile, platforms should still evaluate their specific needs to ensure it’s the right fit.

Gain key knowledge regarding Stripe POS and Stripe business credit card.