Having a clear financial picture is vital for any company’s success – think of it as having a reliable map that shows where you are, where you’ve been, and where you’re heading. The challenge lies in efficiently managing diverse financial data from various sources. Here’s where accounting software integration steps in, ensuring that all financial tools communicate seamlessly, automating tasks, reducing errors, and providing real-time business performance insights.

Today, we’re discussing accounting software integration, its benefits and challenges, and how to approach this integration wisely.

TL;DR

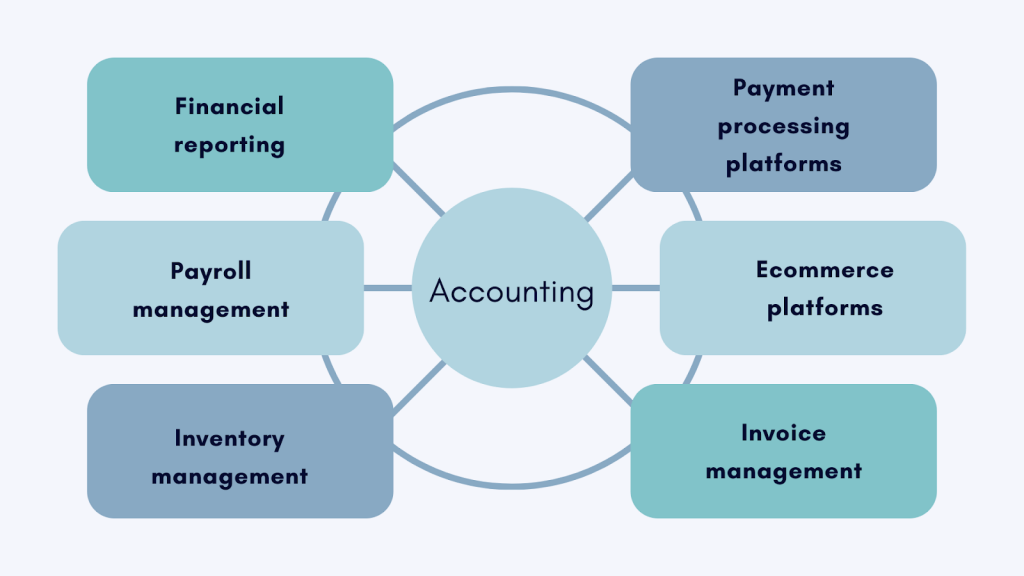

- Integrated accounting systems connect all your financial platforms: payments, ecommerce, invoicing, payroll, inventory, and banking, so data flows automatically and updates your books without manual entry.

- Choosing the right integrations requires a structured evaluation, including business needs, software compatibility, usability, security, scalability, and budget, supported by marketplace research and expert input.

- The benefits are significant: centralized data, fewer errors, smoother reconciliation, major time savings, and scalability for growing operations and multi-entity businesses.

- Synder offers a practical, high-quality example of integrated accounting, with 30+ payment and ecommerce integrations, SOC 2 Type 2 security, support for QuickBooks Online, Xero, Sage Intacct, Oracle NetSuite, and Puzzle, plus automated sync, reconciliation, RevRec, smart rules, and scalability from startups to enterprises.

Breaking down integrated accounting systems

An integrated accounting system connects your financial tools so they share data automatically. When a customer pays you through Stripe, that transaction flows into your books and updates your financial reports without manual entry. Your payroll system updates your general ledger. Your inventory platform adjusts your cost of goods sold. Changes in one system instantly appear everywhere else.

In practice, this means connecting:

- Payment processors (Stripe, PayPal, Square) with your accounting software to automatically record transactions, fees, and reconcile payments

- Ecommerce platforms (Shopify, Amazon, WooCommerce) to sync sales, refunds, and customer data directly into your books

- Invoicing systems to track accounts receivable, send automated payment reminders, and update your GL when invoices are paid

- Inventory management to adjust stock levels, calculate COGS, and maintain accurate asset values as products are sold

- Payroll platforms (Gusto, ADP, Rippling) to process employee payments and automatically post labor costs to the appropriate expense accounts

- Banking and financial reporting to reconcile accounts, generate statements, and provide real-time insights across all connected systems

What is integrated accounting for ecommerce businesses?

Given the huge shift to the online sales model, modern businesses use multiple systems to run operations. Ecommerce sales in Q3 2025 accounted for 16.4% of total US retail sales, reaching $310.3 billion, and this rapid growth means you’re likely dealing with payment processors (PayPal, Square, Stripe), ecommerce platforms (Shopify, Wix, BigCommerce), and online marketplaces (Amazon, eBay, Walmart). They are a source of critical financial data.

Today’s accounting integration connects all these systems with your accounting software. When someone makes a purchase online, the sale details automatically flow into your accounting system with complete information, connecting the dots so you can manage your money and sales efficiently within a single ecosystem.

Major benefits of integrating accounting software with other systems

Building an integrated accounting system yields several key benefits. Here’s what you get:

- Simplified finance management – Minimized errors and discrepancies, accurate financial statements generated automatically, faster reconciliation, and reduced staffing costs of about $60,000+ annually by eliminating the need for additional accounting personnel.

- Centralized data hub – Real-time insights into sales, products, and customer trends across all channels. Data-driven decision-making and strategic planning based on actual numbers instead of assumptions.

- Time savings through automation – Saving 480+ hours yearly on repetitive tasks like data entry, invoicing, and financial reports. Redirect efforts toward analyzing trends, finding opportunities, and building strategies.

- Scalability for growth – Accommodates higher transaction volumes, supports multiple entities and locations, adapts to new platforms, and maintains reporting consistency. Accounting firms particularly benefit, reducing reconciliation time by 50% and saving 6-8 hours per client monthly.

Popular accounting software options

When building your integrated system, you’ll need to choose accounting software that supports robust integrations. Here are eight leading platforms:

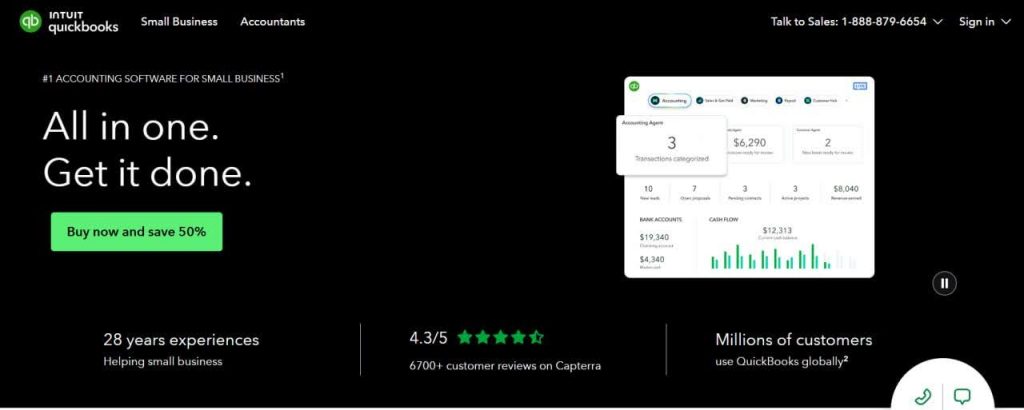

1. QuickBooks Online – Extensive app marketplace

The most widely adopted accounting platform for small to medium businesses, offering extensive third-party integrations through its app marketplace.

Core features:

- Bank reconciliation and automated transaction matching

- Invoicing with online payment acceptance

- Expense tracking and receipt capture

- Financial reporting (65+ reports)

- Multi-user access with permissions

- Mobile app for iOS and Android

Pricing:

| Plan | Price | What’s included |

| Simple Start | $38/month | 1 user, income/expense tracking, invoicing, tax deductions, receipt capture, mileage tracking |

| Essentials | $60/month | 3 users, bill management, time tracking, 1099 contractor management |

| Plus | $115/month | 5 users, inventory tracking, project profitability, 1099 contractors, class tracking |

| Advanced | $275/month | 25 users, custom permissions, batch invoicing, dedicated support, advanced reporting, workflow automation |

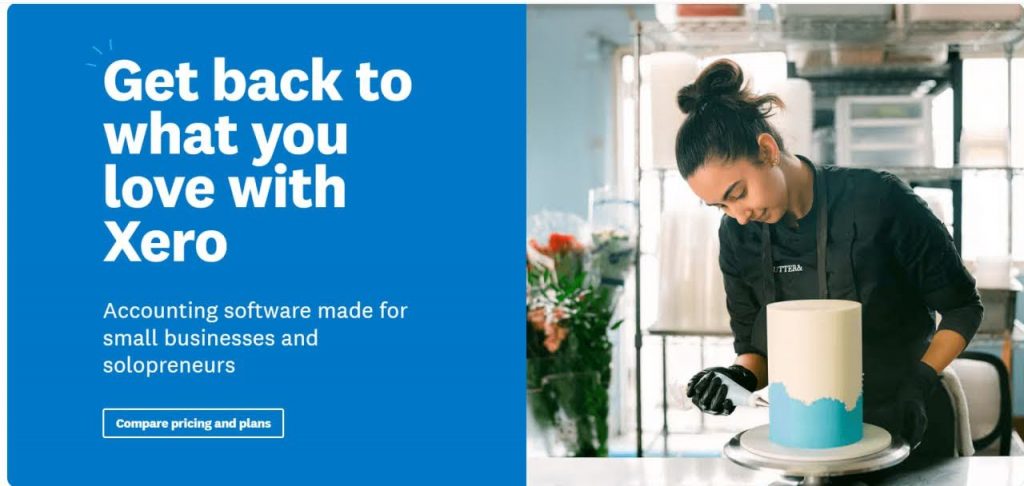

2. Xero – Unlimited user access

Cloud-based accounting software gaining rapid popularity for its unlimited user access and intuitive interface.

Core features:

- Unlimited users on all plans

- Bank reconciliation with automatic matching

- Invoicing with payment tracking

- Inventory management

- Project tracking and expenses

Pricing:

| Plan | Price | What’s included |

| Early | $20/month | Unlimited users, 20 invoices/quotes, 5 bills, bank reconciliation, and receipt capture with Hubdoc |

| Growing | $47/month | Unlimited users, unlimited invoices/bills, bulk bank reconciliation, short-term cash flow insights |

| Established | $80/month | Everything in Growing, plus multi-currency, advanced analytics, project tracking, and expense claims |

3. Sage Intacct – Multi-entity management

Purpose-built for mid-sized companies and growing enterprises, offering advanced multi-entity management and sophisticated reporting.

Core features:

- Multi-entity and multi-location management

- Dimensional reporting and analytics

- Automated workflows and approvals

- Real-time dashboards

- Advanced revenue recognition

- Industry-specific functionality

Pricing: Custom pricing based on modules, users, and company size. Contact Sage for quote.

4. Oracle NetSuite – Comprehensive ERP solution

Comprehensive ERP solution that combines accounting with CRM, ecommerce, and supply chain management.

Core features:

- Full ERP capabilities (accounting, CRM, inventory)

- Multi-subsidiary management

- Advanced financial planning

- Customizable dashboards and KPIs

- Global business management (multi-currency, tax)

- SuiteApps marketplace for extensions

Pricing: Custom pricing based on modules and users.

5. FreshBooks – Time tracking and invoicing

Designed specifically for service-based businesses and freelancers, with streamlined invoicing and time tracking.

Core features:

- Unlimited invoicing with online payments

- Time tracking and project management

- Expense tracking with receipt scanning

- Client portal for collaboration

- Automated payment reminders

- Double-entry accounting

Pricing:

| Plan | Price | What’s included |

| Lite | $19/month | 5 billable clients, unlimited invoices, expense tracking, receipt scanning, mileage tracking |

| Plus | $33/month | 50 billable clients, proposals, project profitability, automated late fees, recurring billing |

| Premium | $60/month | Unlimited clients, 2 team members, client retainers, advanced reporting, and accountant access |

| Select | Custom pricing | Unlimited clients, dedicated account manager, custom onboarding, migration support |

6. Zoho Books – Zoho ecosystem integration

Part of the broader Zoho ecosystem, offering seamless integration with Zoho’s CRM, inventory, and project management tools.

Core features:

- Automated workflows and client portal

- Project time tracking and billing

- Inventory management with serial numbers

- Multi-currency transactions

- Vendor portal for bill management

- 1099 contractor management

Pricing:

| Plan | Price | What’s included |

| Free | $0/month | 1 user, up to $50K revenue, 1,000 invoices/year, basic accounting, bank reconciliation |

| Standard | $20/month | 2 users, automated workflows, recurring invoices, purchase orders, vendor portal |

| Professional | $50/month | 3 users, retainer invoices, timesheet approvals, project billing, custom fields |

| Premium | $70/month | 5 users, budgeting, custom email domain, workflow approvals, vendor credits |

| Elite | $150/month | 10 users, custom workflows, validation rules, data backup, dedicated support |

7. Wave – Free accounting software

Free accounting software with paid add-ons for payroll and payment processing.

Core features:

- Unlimited income and expense tracking

- Unlimited invoicing

- Receipt scanning (mobile app)

- Bank and credit card connections

- Financial reporting

- Multi-business management

Pricing:

| Feature | Price | What’s included |

| Accounting | Free | Unlimited income/expense tracking, unlimited invoicing, receipt scanning, bank connections, financial reports |

| Payments | 2.9% + $0.60 per transaction | Credit card processing, bank payments (ACH 1% with $1 minimum) |

| Payroll | $40/month + $6/employee | Tax calculations, direct deposit, W-2/1099 forms (available in select states) |

| Advisors | $149/month | Professional bookkeeping support, monthly financial review, tax preparation assistance |

8. Puzzle – AI-powered automation for startups

AI-powered accounting software designed specifically for startups and early-stage companies.

Core features:

- AI auto-categorization (90-95% of transactions)

- Real-time startup metrics (burn, runway, MRR/ARR)

- Dual accounting (cash and accrual simultaneously)

- Native fintech integrations (Mercury, Brex, Ramp, Stripe)

- Revenue recognition and deferred revenue

- Continuous accounting (no month-end delays)

Pricing:

| Plan | Price | What’s included |

| Basics | $0/month | Self-serve setup, basic reports, manual categorization, limited support |

| Insights | $42.50/month | AI auto-categorization, startup metrics (burn/runway/MRR/ARR), real-time reports |

| Advanced Automation | $85/month | Custom AI prompts, advanced reconciliation, priority support, and dedicated onboarding |

| Scale | $255/month | Everything in Advanced, plus a dedicated account manager, custom training, and white-glove migration |

Choosing the best integration for your accounting software

Finding the right integrations for your accounting system requires strategic thinking. Here are the essential considerations to guide your selection:

- Tip 1: Assess your business needs. Identify your industry requirements, transaction volumes, pain points, and growth projections to determine which integrations will solve your actual problems.

- Tip 2: Evaluate your current accounting software. Confirm your platform supports integrations and has the technical foundation for an integrated system.

- Tip 3: Research available options. Explore your accounting software’s marketplace and review sites like G2, Capterra, or Software Advice for user ratings and real experiences.

- Tip 4: Set a realistic budget. Weigh costs against value, starting small if needed and adding functionality as you grow.

- Tip 5: Verify compatibility. Ensure seamless connection with your existing systems to avoid workflow disruptions.

- Tip 6: Prioritize usability. Choose integrations with intuitive interfaces and clear setup processes to prevent errors.

- Tip 7: Demand strong security. Look for two-factor authentication, encryption, and role-based access controls to protect sensitive financial data.

- Tip 8: Plan for scalability. Select solutions that can grow with your business and handle increased transaction volumes.

- Tip 9: Consult experts when needed. Get input from accountants or financial specialists to ensure your integrated system aligns with your business requirements.

How to build an integrated accounting system: An example of using Synder

Now that we’ve covered what to look for in accounting integrations, let’s see how these principles apply in practice.

Synder’s capabilities check every box from our selection criteria above:

- Seamless compatibility with major accounting platforms (QuickBooks Online, Xero, Sage Intacct, Oracle NetSuite, and Puzzle)

- 30+ integrations with payment processors (Stripe, PayPal, Square, Authorize.net) and ecommerce platforms (Shopify, Amazon, eBay, WooCommerce, BigCommerce)

- SOC 2 Type 2 certified security to protect sensitive financial data

- Scalability from startups to enterprises handling millions of transactions

The platform’s quality is backed by recognition as an Intuit Platinum App Partner and a 4.7-star rating on G2 from thousands of verified users.

We’ll use Synder to illustrate the integration process, but you can apply these same principles when evaluating other solutions that fit your specific needs.

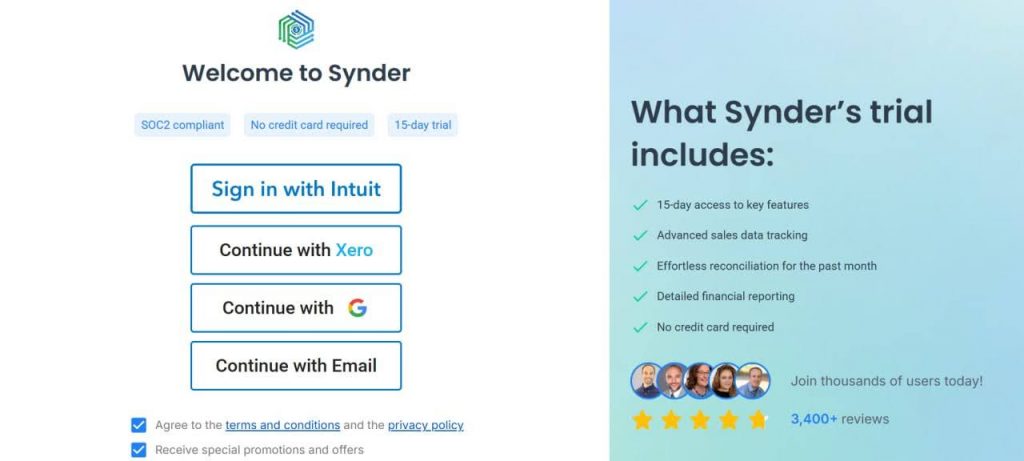

Step 1: Create an account

If you’re getting started, you’ll need to create a free trial account and connect your accounting system first. During the initial setup, you’ll be guided through the onboarding process to establish your organization profile.

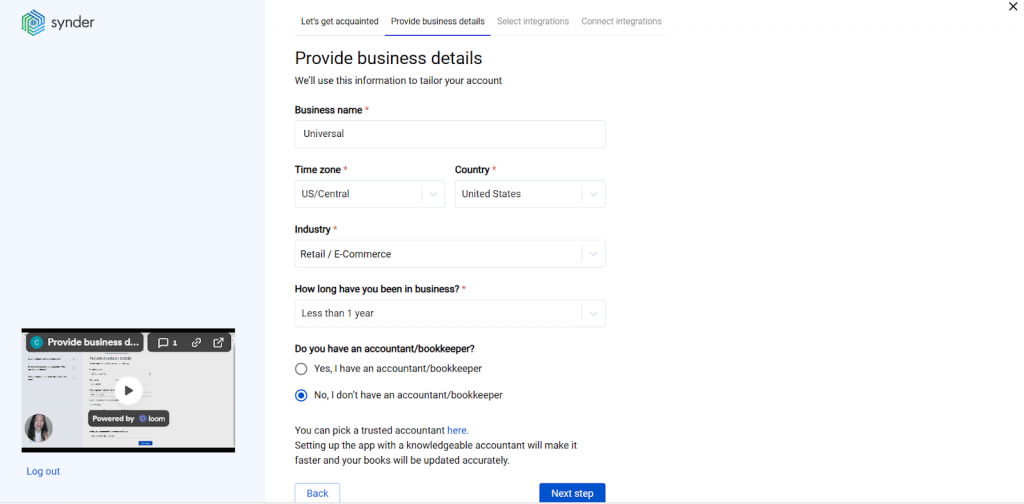

Step 2: Provide your business details

Fill in the information about your business as you go through the organization setup process. This includes essential company details that will help structure your financial data correctly. Once complete, proceed to the next step.

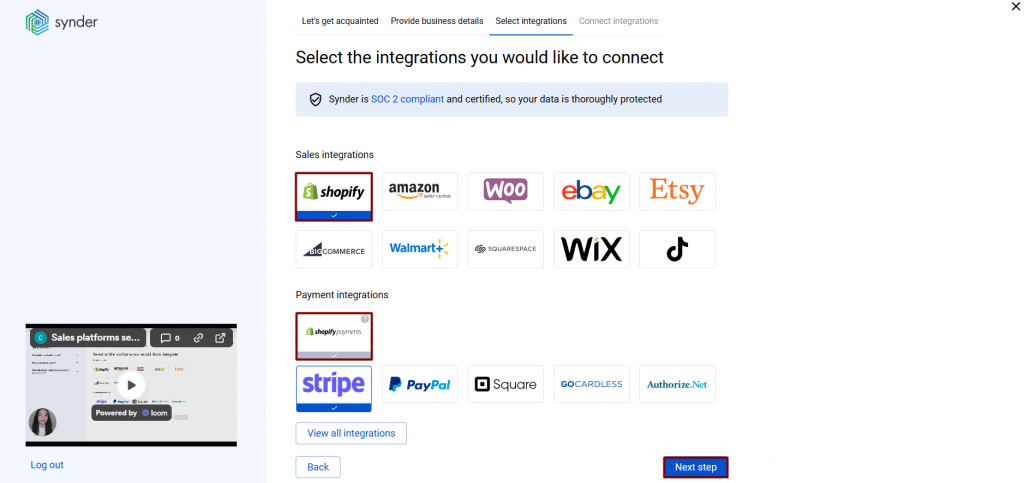

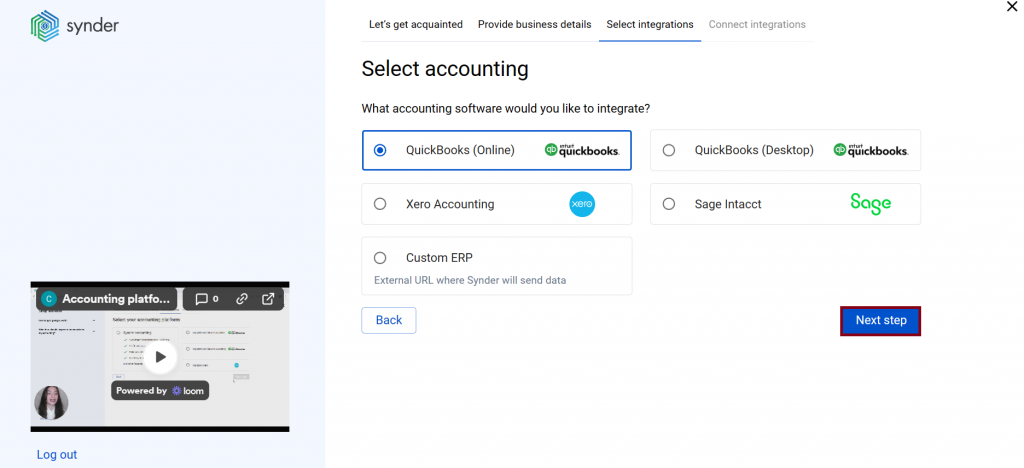

Step 3: Select the platforms you’d like to integrate

Choose which platforms you want to connect. This includes your payment processors, ecommerce platforms, and any other sales channels you use to receive payments. You can select all the services you’re currently using and connect them right away, or skip certain integrations and set them up later.

Step 4: Connect your accounting platform

Select the accounting software you’d like to integrate and proceed with the connection. Follow the authorization prompts.

You may be prompted to choose your sync mode depending on your transaction volume: detailed Per Transaction records or Summary Sync for daily, monthly, per payout, or custom-period journal entries.

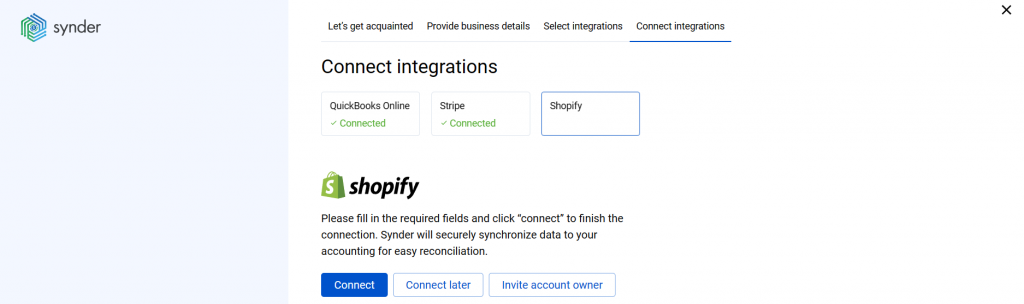

Step 5: Connect your platforms

To complete the setup, connect each sales platform you selected earlier. Open a separate tab and log in to each platform with admin rights, then authorize the connection. If you don’t have the necessary permissions, you can invite the account owner to approve the connection, or connect the platform later once you’ve obtained access.

Step 6: Set up your integrations

For each connected platform, configure the final settings. This typically includes selecting your checking account for payouts to enable smooth bank reconciliation. You can also enable auto-import for automatic synchronization, turn on duplicate detection, configure payment matching to open invoices, and set up multicurrency handling if needed.

Leveraging your integrated system

Once setup is complete, you can access a comprehensive suite of features designed to automate and streamline your accounting:

- Automated transaction sync – All sales, refunds, fees, and payouts flow automatically into your accounting software with complete transaction details, eliminating manual data entry

- Smart Rules automation – Create if-then workflows to automatically apply classes, locations, tax codes, and custom categorization based on transaction criteria like amount, customer, or product

- Balance reconciliation – Verify and confirm financial summaries match your platform balances before posting, with built-in reconciliation history for audit trails

- COGS and inventory tracking – Enable automated cost of goods sold calculations by importing product costs and SKUs, track inventory levels across all channels, and generate accurate profitability reports for each product

- Revenue recognition (RevRec) – Automate GAAP-compliant revenue recognition for subscription businesses, handling deferred revenue, prorations, upgrades, downgrades, and cancellations

- Multicurrency support – Process transactions in multiple currencies with automatic exchange rate application, perfect for international businesses with global sales

- Comprehensive reporting – Access detailed analytics and reports through Synder Insights, tracking sales trends, customer behavior, product performance, and key business metrics in real-time

This setup demonstrates that accounting software integration can be straightforward and quick. After the implementation, the results – accurate books, time savings, and better decision-making – pay off every minute of effort invested.

Ready to see how integrated accounting works for your business? Book a demo to explore how automation can streamline your financial operations.

5 common integrated accounting challenges and how Synder solves them

Beyond basic transaction sync, modern integrated accounting systems need to handle complex scenarios that businesses face daily. Here’s how Synder addresses five capabilities that separate basic integrations from comprehensive solutions.

1. Historical data import

Why it matters: Starting with incomplete books means unreliable year-over-year comparisons, missing trends, and gaps in financial records that complicate audits or due diligence. Most businesses need their accounting system to reflect the complete history, not just future transactions.

How Synder solves it: Import every past transaction properly categorized from the start. Synder syncs unlimited historical data as far back as your platforms store it. The time range depends on your platform limits. Whether you’re migrating from manual processes or switching from another system, you can backfill all transaction history and maintain continuity in your financial records.

2. Complex sales tax tracking and compliance

Why it matters: Sales tax rules vary dramatically by jurisdiction, and platforms handle tax collection differently. Some collect and remit automatically (marketplace facilitator tax), while others leave it entirely to you. Without proper tracking, you risk overstating your tax liability or missing required payments.

How Synder solves it: Synder automatically captures tax data from every transaction and categorizes it based on your accounting software’s requirements and your jurisdiction.

- For regular sales tax collection, assign your sales tax to the appropriate accounting accounts in Settings → Mapping.

- For US accounting software, sales tax posts directly to liability accounts, with the option to enable Group by region to split tax by state automatically.

- For non-US accounting software, enable tax tracking to apply tax codes to journal entries so they appear in tax reports.

- For Marketplace Facilitator Tax (when platforms collect and remit tax on your behalf), Synder records withheld taxes separately without affecting your Sales Tax Payable balance, ensuring you only see liability for taxes you’re actually responsible for remitting.

3. Product bundles and variant management

Why it matters: Ecommerce businesses often sell the same product in multiple variations (sizes, colors, configurations) or bundle items together. Without proper mapping, your accounting system becomes cluttered with hundreds of similar product entries, making meaningful reporting nearly impossible.

How Synder solves it: Synder handles product bundle variations through its Product Mapping feature. If you sell multiple product variants but want them mapped to a single item in your accounting software for cleaner reporting, you can set this up easily.

Go to Settings → Product Mapping, click Add line, and match each product variation from your sales platform to a single consolidated product in your books.

This works whether product names vary or you simply want to unify multiple variants under one item.

4. Multi-store and multi-entity management

Why it matters: Growing businesses often operate multiple storefronts, brands, or entities. Managing each in isolation creates reporting nightmares and makes it impossible to see consolidated performance. You need centralized management with proper separation between entities.

How Synder solves it: You can connect multiple stores and platforms to one accounting company through a single Synder organization.

- Just add each store as a separate integration within the same organization.

- To add another store, switch to your organization, access settings, and add the integration.

All your stores will sync to the same accounting company, with separate transaction tracking for each platform. Note that each accounting company is a separate organization in Synder, so if you want to connect different stores to different accounting companies, you’ll create separate organizations for each.

5. One-size-fits-all sync approaches don’t work

Why it matters: A boutique with 20 monthly transactions needs different data granularity than a high-volume retailer processing 50,000 transactions. Rigid sync systems either overwhelm low-volume businesses with unnecessary detail cluttering their books or fail to provide adequate transaction-level information for businesses that need detailed audit trails. As your business grows, your needs change, but switching systems mid-growth is expensive and disruptive.

How Synder solves it: Synder offers two sync modes with different frequencies to match your business model.

- Per Transaction sync updates your books on an hourly basis. As soon as a new sale comes through, Synder creates a separate sales receipt or invoice with complete details, including customer information, product SKUs, and itemized fees.

- Summary sync creates consolidated summaries based on your chosen period: daily, per payout, monthly, or custom periods – perfect for high-volume operations that need clean books without thousands of individual entries.

Both modes run automatically once you configure them.

Bottom line

To sum up the story, integrating accounting software is crucial for managing finances in today’s business world. It goes beyond combining typical financial tools, including various payment systems and ecommerce platforms. The perks are clear: it streamlines finance tasks, offers a central data hub, saves time through automation, adapts to business growth, and ensures better security.

However, getting there requires careful steps. Businesses should understand their unique needs, assess current accounting software, check marketplaces and reviews, consider budget constraints, ensure compatibility, prioritize user-friendliness and data protection, and plan for future growth. Seeking professional advice can help align the integration with specific business requirements. Ultimately, accounting software integration is more than a tech upgrade. It’s a smart investment in business success.

FAQ

1. What’s the difference between integrated accounting and traditional accounting software?

Traditional accounting software operates as a standalone system, requiring manual data entry or CSV imports to stay up-to-date. Integrated accounting connects your financial tools, like payments, ecommerce, invoicing, payroll, and banking, so data flows into your books automatically, reducing errors and workload.

2. Do I need technical expertise to set up integrations?

Most integrations don’t require coding knowledge. Modern accounting systems and platforms like Synder offer guided onboarding, simple authorization flows, and prebuilt workflows. For more advanced setups, such as multi-entity structures or revenue recognition, working with an accountant or implementation specialist can help.

3. How do I know if my business needs Per Transaction sync or Summary Sync?

Low- to mid-volume businesses often benefit from Per Transaction sync for detailed audit trails, while high-volume operations prefer Summary Sync to keep books clean and performant. Synder supports both modes, allowing businesses to match data granularity to their transaction volume and operational needs.

4. Will integrated accounting work if I operate multiple stores or entities?

Yes. Most modern platforms, including Synder, support multi-store, multi-brand, and multi-entity setups. You can connect several sales channels to a single accounting company or separate entities, depending on your structure. Synder’s organization-based approach keeps data properly separated while maintaining central oversight.

5. Is it safe to connect payment processors and ecommerce platforms to my accounting software?

When using reputable providers, yes. Solutions like Synder use secure authorization, encryption, and SOC-compliant infrastructure to protect sensitive data. They never store platform passwords and rely on strict permission-based access, ensuring your financial information remains safe throughout the integration process.