When shopping and doing business online, smooth transactions are a staple but sometimes hiccups happen and both sellers and buyers need to know how to handle them. Whether a seller initiated a payment by accident or a buyer changed their mind about a single purchase or subscription, knowing how to cancel a it is essential to managing a PayPal account correctly.

In this article, we’ll provide a step-by-step guide on how to cancel a PayPal payment, as well as give you a set of tips on how to avoid pending payments in the future.

Are you a merchant encountering issues with canceled PayPal payments? Let Synder simplify the process for you. Our intuitive platform empowers you to manage and automatically record canceled PayPal transactions with ease. Want to see Synder in action first? Join our Weekly Public Demo to get a tour of the app and ask questions.

TLDR

- You can call off pending or unclaimed PayPal’s payments directly from the Activity page, ensuring control over accidental or changed transactions.

- For completed payments, usually the buyer reaches out to the seller for a refund or use PayPal’s dispute resolution if things don’t go smoothly.

- Proactively managing PayPal settings and communicating the situation can prevent most issues.

Break free from the PayPal puzzle and empower your business with clarity and confidence with our guide. Download now.

Table of Contents

- How to cancel a PayPal payment: Understanding cancelled PayPal transactions

- What are pending payments?

- Why is canceling PayPal payments important?

- How to call off a pending PayPal payment

- What happens after a PayPal payment transaction is canceled?

- How to cancel recurring payments on PayPal

- How to cancel a scheduled PayPal Credit payment?

- How to get your money back if the PayPal transaction is completed

- How can a buyer minimize payment issues on PayPal?

- PayPal payment cancellation: Conclusion

- FAQs

Getting caught in the PayPal maze? Learn how to navigate PayPal transactions seamlessly.

How to cancel a PayPal payment: Understanding cancelled PayPal transactions

When you want to call off a payment on PayPal, you first need to understand its type and the stage of the payment processing you are at, as different routes will be used to resolve the issue at hand.

Begin by assessing what type you want to abort: Is it a regular single payment for a certain purchase, a scheduled one with PayPal Credit, or maybe a recurring payment for a subscription? Each of them will trigger a need for a slightly different solution on PayPal, which we’ll address in the subsequent sections.

To cancel it, you also should be aware of the status of the transaction in question. Direct cancellation is only possible for pending payments on PayPal. For completed transactions, the refund route via the seller or dispute resolution is the way forward.

Now let’s look closer at each of those special cases and their PayPal solutions.

What are pending payments?

A pending PayPal payment is a transaction that hasn’t been completed yet. It means that the money has been moved from the buyer’s account to the seller’s account, but it hasn’t been transferred to the seller’s bank account yet.

When it’s pending, the money is temporarily held by PayPal. During this time, the buyer’s account will show a deduction of funds, but the seller will only be able to access them once the payment has cleared.

After it’s marked as completed, the money is transferred from the seller’s PayPal account to their bank account. The time it takes for the payment to clear and for the funds to be transferred can vary depending on several factors, including the seller’s bank, the type of payment, and the buyer’s and seller’s country.

Why is canceling PayPal payments important?

Canceling a PayPal payment is crucial for managing your account effectively and avoiding any issues that may arise with transactions. Want more details? Here are the reasons for buyers and sellers:

- Buyers: Canceling can help avoid any unauthorized transactions on PayPal. If you notice that a payment was initiated without your approval or by mistake, you can undo it to prevent further transactions. This is particularly important if you suspect fraudulent activity on your account.

- Sellers: When you, as a seller, call off transactions on PayPal, you can avoid incorrect amounts. Why does it matter? Sometimes, a buyer may initiate a payment with an incorrect amount or the wrong currency. Canceling it allows you to correct the mistake and prevent any confusion or loss of money for your business.

How to call off a pending PayPal payment

Buyers

You can only cancel a PayPal payment if the status is “Unclaimed” or “Pending”.

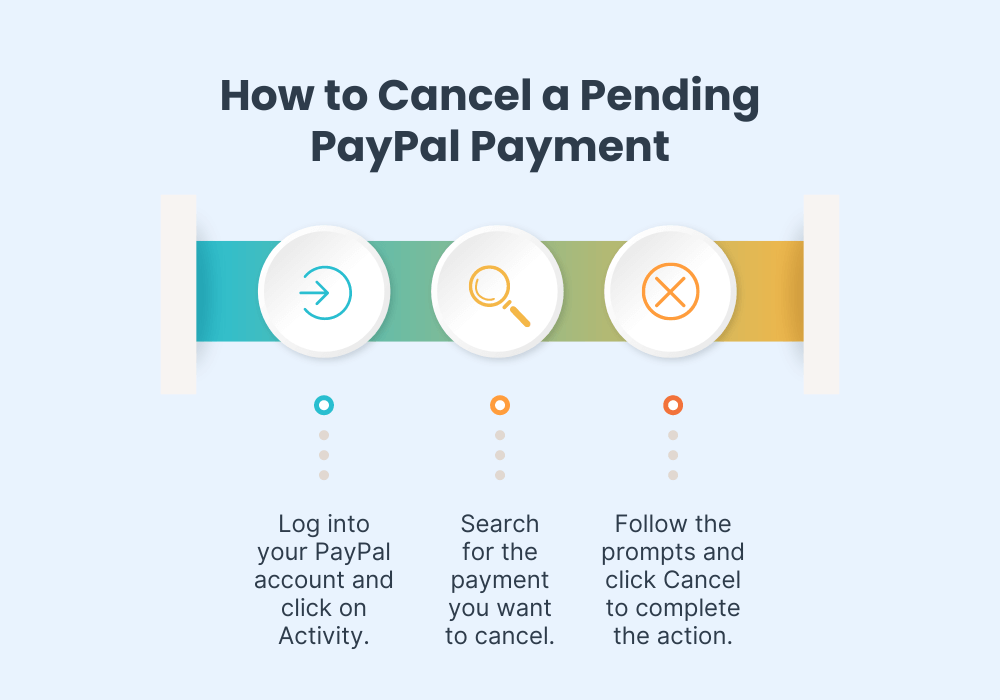

If a payment has been initiated and the buyer realizes that they don’t want to go through with it, they need to follow this simple process:

- Log into their PayPal account and click on Activity.

- Once there, scroll and search for the payment they want to undo.

- Follow the prompts and click Cancel to complete the action.

Sellers

Not all pending or unclaimed PayPal payments can be canceled by the buyers. If a seller opts for manual approval, they have 30 days to accept or deny the transaction. If no action is taken by then, PayPal will automatically cancel the payment and refund the money.

Using PayPal and QuickBooks? Learn how to track the cash flow for your business effortlessly without manual data entry.

Struggling with PayPal? Get hold of useful strategies that can help your business ease your PayPal accounting!

Why is my PayPal payment pending?

There are several reasons, both on the buyer’s and the seller’s sides, why a payment might be pending on PayPal. Some of the most common reasons include:

- Insufficient funds: If the buyer’s account doesn’t have sufficient funds to complete the payment, it’ll be put on hold until the necessary funds are available.

- Technical issues: Technical issues with PayPal’s system or internet connectivity issues may cause a transaction to be put on hold.

- Disputes or claims: If a buyer has filed a dispute or claim regarding the payment, PayPal may put it on hold until the issue is resolved.

- Payment held for review: In some cases, the platform may hold it for review to ensure that it complies with its policies and regulations.

- Seller account issues: If there are issues with the seller’s PayPal account, such as a limitation or suspension, the payment may be pending until the issue is resolved.

- Credit card verification: If a buyer uses a credit card that isn’t linked to their account, the transaction may be put on hold until the buyer verifies the card.

Find out how to easily record PayPal fees in QuickBooks with our quick guide .

Ways to cancel a payment if you suspect a fraudulent transaction

If the payment in question has already been processed, a seller can recover the money via the dispute route.

To report a potentially fraudulent PayPal payment, sellers can either use the Resolution Center or contact PayPal Customer Service. For the online option, you’ll have to navigate to the Resolution Center and opt to Open a dispute for a transaction. From there, identify and select the transaction you suspect is unauthorized and proceed by clicking Continue to initiate the dispute process. Once your claim is filed, the platform will investigate and notify the involved parties, and any transaction deemed unauthorized or in error will be refunded.

What happens after a PayPal payment transaction is canceled?

When a payment is canceled on PayPal, the funds are returned to the buyer’s PayPal account.

- If it was made using a credit or debit card, PayPal would initiate a refund to the card used for the transaction. Depending on the card issuer’s policies, it may take 3-5 business days for the money to appear on the buyer’s account.

- If the payment was made using funds from the buyer’s PayPal Balance account, it’ll be reversed, and the funds will be returned to the buyer’s account.

- If, for a particular payment, a dispute or claim on the platform is filed, the dispute resolution process will continue until a resolution is reached.

- If the payment fails due to technical issues or insufficient funds, it’ll be marked as “Failed” in the transaction history, and the buyer will need to initiate a new payment for the transaction to be completed.

It’s important to note that the time it takes for the money to be returned to the buyer’s account may vary depending on several factors. If you have any questions or concerns about the payment cancellation on PayPal, you can contact customer support for assistance.

Find out more about eBay PayPal and Amazon PayPal payment options.

How to cancel recurring payments on PayPal

Recurring payments are specific types of transactions that happen regularly (e.g., monthly for subscriptions)—often used for services like streaming platforms, online magazines, or gym memberships. It’s an ongoing authorization for a merchant to withdraw funds from a buyer’s account periodically.

If you’d like to undo a recurring payment on PayPal:

- Log in to your account.

- In the Settings menu, find and click on the Payments.

- Look for the section named Automatic Payments – this is where all your recurring payments, subscriptions, and billing agreements are listed.

- Browse through the list and find the merchant or service for which you’ve set up the recurring payment that you wish to call off. Once you select the specific payment, you should see an option to nullify it. Confirm the cancellation to stop future payments.

Note: Any cancellations will only affect future charges, i.e. call off future transactions. Payments that have already been processed cannot be canceled through PayPal.

How to cancel a scheduled PayPal Credit payment?

To undo a scheduled PayPal Credit payment:

- Log in to your PayPal account and click on PayPal Credit.

- Go to View Payments and click Cancel next to the payment you wish to undo.

- Confirm by clicking Cancel Payment. The platform will send an email confirmation once it’s canceled.

Note: Remember, you can’t edit a payment on the day it’s scheduled to be paid.

How to get your money back if the PayPal transaction is completed

If the transaction is already completed, it can’t be canceled as the recipient already has the funds. The best option for the buyer here is to contact the seller directly. Their contact details can be found in the PayPal activity under the specific transaction.

What do the buyers need to do? Easy – politely explain the situation and request a refund. The decision to issue a refund is at the seller’s discretion. The sooner you act, the better your chances of resolving the issue. Also, keep a record of all communications with the seller for reference in the dispute process.

How to get your money back if the seller is uncooperative: Opening up a dispute on PayPal

If you’re unable to resolve the issue with the seller, you can open a dispute in PayPal’s Resolution Center within 180 days.

To open a dispute on the PayPal website:

- Begin by visiting the Resolution Center.

- There, you’ll need to click on Report a Problem, select the specific payment in question, and then proceed by clicking Continue.

- During this process, you’ll be asked to specify the reason for your dispute, such as an item not being received, discrepancies in the description, or issues related to billing. After detailing the issue, submit your dispute by clicking the Submit button.

For those who prefer to use the PayPal app:

- Start by accessing your Recent Activity.

- Find the transaction you’re concerned about and tap on it. After scrolling down, you’ll see the option to Report a Problem.

- Here, you need to select the nature of your issue, provide additional details as necessary, and finalize your action by tapping Submit.

If the dispute remains unresolved, you have a 20-day window to escalate it to a claim. During a claim, the platform will investigate and determine the outcome.

How can a buyer minimize payment issues on PayPal?

Payments issues can be a headache, so the wisest way to deal with problems is to prevent them in the first place. Of course, some issues are unavoidable or simply beyond our control, but there are still things that buyers can do.

Verify your account

Complete the account verification process by linking and confirming your bank account or credit card. This not only lifts your withdrawal limits but also boosts trust among sellers and buyers.

Regularly review and update your contact information, payment methods, and linked accounts. This way you receive all transaction notifications promptly and keep your account in good standing.

Check before you buy

Ensure you have enough funds in your PayPal balance or linked funding source to cover your purchase. This helps avoid delays or denials that can complicate transactions.

Before making a purchase, take a moment to review the seller’s feedback score and read through past customer reviews. This can help you gauge their reliability and the quality of their goods or services.

Understand the terms of the transaction fully, including shipping costs, delivery timelines, and return policies. If anything is unclear, ask the seller for more details before proceeding.

Communicate with the seller

Maintain a line of communication with your seller for updates on your transaction’s status, especially for orders with longer processing times. If issues arise, addressing them directly with the seller can often lead to a quicker resolution.

Accept responsibility and be cautious when shopping online

Approach deals that appear too good to be true with skepticism. If a seller or a deal seems suspicious, it’s wise to steer clear to avoid potential scams.

Frequently review your transaction history for any unauthorized or unexpected activity. Early detection of discrepancies can prevent larger issues down the line.

When using PayPal for online purchases take advantage of the buyer protection program. This adds an extra layer of security in case the item is not received or not as described.

If you encounter any discrepancies or unauthorized transactions, report them to PayPal as soon as possible. Prompt action can aid in the swift resolution of such issues.

Be prepared: Visit the PayPal Help Center for issues

Knowledge is power! For any concerns about pending transactions, make sure to check the PayPal Help Center for helpful insights and solutions.

PayPal payment cancellation: Conclusion

The cancellation process is crucial for both buyers and sellers in the digital marketplace. The ability to cancel online payments, particularly when they are still pending or unclaimed, empowers users to manage their finances effectively and avoid unnecessary complications. This feature, integral to PayPal’s user-friendly design, provides both a safety net in case of accidental or mistaken transactions and reinforces trust in the platform’s security measures.

Being proactive in understanding the nuances of PayPal’s transaction process, including the differences between pending, unclaimed, and recurring payments, can significantly reduce the risk of financial misunderstandings and delays.

FAQs

1. Can you cancel a PayPal payment after sending it?

Yes, you can nullify a payment if it’s still in a pending or unclaimed status. Simply log into your PayPal account, navigate to the Activity page, find the payment in question, and if it’s eligible for cancellation, you’ll see a Cancel option next to it. However, once the payment is completed and the funds have been accepted by the recipient, the option to undo is no longer available.

2. Can you reverse a PayPal payment?

Reversing a payment, once completed, isn’t straightforward. If you need to do it, you must contact the recipient directly to request a refund. If the payment was made by mistake or you’re unable to resolve the issue with the recipient, you can escalate the matter to PayPal by opening a dispute through the Resolution Center within 180 days of the payment date.

3. How do I cancel a payment method on PayPal?

To remove a payment method from your PayPal account, especially if you’re using the PayPal app, follow these steps:

- Open the app and tap on Wallet.

- Select Manage AutoPay to see a list of merchants you’ve authorized for auto payments.

- Choose the merchant for which you want to update or remove PayPal as your payment method.

- Tap Remove PayPal as your payment method to discontinue using PayPal for auto payments to this merchant.

This process helps ensure that PayPal is no longer used for recurring payments with the selected merchant, providing you with more control over your automatic payments.

Share your experience

We understand that navigating the world of online payments can sometimes be challenging, but there’s so much to learn from each other’s experiences. Have you had a successful resolution with a PayPal transaction, perhaps a time when canceling a payment was seamless, or when you resolved an issue with a seller positively? We’d love to hear about it!

*Interesting! Thank you for sharing such an informative article. I look forward to reading more soon.

We’re glad you enjoyed this post.

Hi, I sent a payment to my son for 200 pounds,Didn`t tell him as hes too proud to accept.I then asked if he received it and he said his phone has no text ability at the moment.What can I DO

Hi Rob, if you sent a payment to your son and he hasn’t acknowledged it due to issues with his phone, there are a few steps you can take. First, verify from your end that the payment was successfully processed. Check your bank account or the platform you used to send the money to ensure the transaction went through. If you used a service like a bank transfer or a digital payment platform like PayPal, contact their customer support. They can confirm if the payment was successful and provide details on whether it reached your son’s account. Best of luck!

Hi, I sent 80$ to someone for a commission but their email isn’t functioning like it should. They can’t get into their mail anymore and I’m afraid i just threw 80$ away into a void

Hi Rousseau, we understand your concern about the $80 sent via PayPal and the issue with the recipient’s email. Fortunately, PayPal offers protections for situations like this. If the payment was sent to an email address that isn’t associated with an active PayPal account, the funds would remain unclaimed. You have a couple of options:

Cancel the Unclaimed Transaction: If the payment is still unclaimed (the recipient hasn’t accepted it), you might be able to cancel it directly from your PayPal account. Go to your Activity, find the payment, and see if there’s an option to cancel it.

Contact PayPal Support: If the transaction doesn’t give you the option to cancel because it’s been claimed or for any other reason, it’s best to reach out to PayPal’s customer support directly. They can provide specific guidance and, if possible, assist in reversing the transaction.

Remember, PayPal’s customer support is there to help in situations like this, and they’re usually quite responsive and helpful in resolving such issues.

Best of luck, and we hope you get your $80 back without any hassle!

I wish to cancelled my paypal account

Hi Mohamad, if you’d like to cancel your PayPal account, you can follow our guide. Best of luck!

I wish to cancel PayPal and delete it from chome

Hi Janet, if you’d like to cancel PayPal account, rather than just a PayPal transaction you can follow our guide on: How to delete PayPal account.