In the realm of business, cash flow holds a critical role. It serves as the lifeblood of a business, reflecting its financial health and operational efficiency. In simplest terms, cash flow is the total amount of money being transferred into and out of a business. This article will guide you through the essentials of cash flow, its calculation, and its importance in successful business management.

Understanding cash flow components

Cash flow has three important components:

A. Operating cash flow

Operating cash flow (OCF), sometimes referred to as cash flow from operations, is a measure that shows how much cash a company generates from its regular business operations, excluding capital expenditures and investments. In other words, it represents the cash produced by a company’s primary activities.

B. Investing cash flow

Investing cash flow refers to the cash generated or spent through investment activities. Investment activities typically involve the purchase or sale of long-term assets that will help the company generate income over time. These could include physical assets such as buildings, equipment, land, and machinery, or financial investments such as shares in other companies, acquisition of subsidiaries, or other securities.

C. Financing cash flow

Financing cash flow refers to the cash flow that results from financing activities, such as the issuance or repayment of the company’s debt, equity issuance, or the payment of dividends. Financing activities typically affect the company’s capital structure, which includes equity capital and borrowings. Essentially, it is the net cash a company either raised from, or paid to, its owners (equity investors) and creditors (debt investors).

Calculating cash flow: Cash flow formula

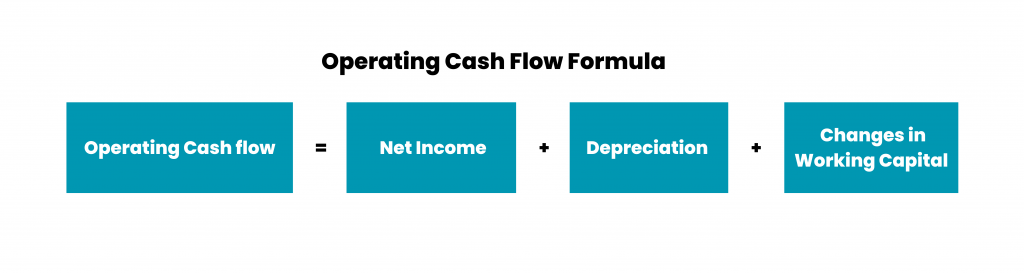

Cash flow formula: How to calculate operating cash flow

The calculation of operating cash flow starts with net income. Adjustments are made to add back non-cash expenses such as depreciation and amortization, and then changes in working capital, including accounts receivable, accounts payable, inventory, and other current assets and liabilities are factored in.

OCF is usually calculated by adjusting net income for changes in non-cash accounts on the balance sheet, depreciation, and changes in working capital. The formula for operating cash flow is as follows:

Where:

- Net income: This is the net profit or loss from the income statement of the company.

- Depreciation: This is a non-cash expense that is added back to net income because it reduces net income on the income statement but does not result in an outflow of cash.

- Changes in Working Capital: This represents changes in current assets and current liabilities on the company’s balance sheet from one period to the next. Increases in current liabilities (such as accounts payable) or decreases in current assets (like inventory) increase operating cash flow. Conversely, increases in current assets or decreases in current liabilities reduce operating cash flow.

Operating cash flow is an important indicator of a company’s financial health and operational efficiency. It provides insights into the company’s ability to generate sufficient cash to maintain and grow its operations, pay dividends, settle debts, and reinvest in its business without relying on external financing.

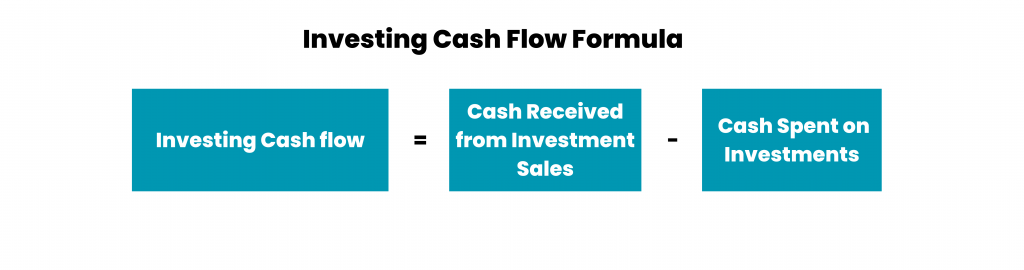

Cash flow formula: How to calculate investing cash flow

Components of investing cash flow typically include:

- Purchase of property, plant, and equipment (PPE) – considered as a cash outflow.

- Proceeds from the sale of PPE – considered as a cash inflow.

- Purchase of marketable securities (such as stocks, bonds, etc.) – considered as a cash outflow.

- Proceeds from the sale of marketable securities – considered as a cash inflow.

- Money spent on acquisitions of other businesses – considered as a cash outflow.

- Proceeds from the sale or disposals of businesses – considered as a cash inflow.

Here’s a basic formula to calculate investing cash flow:

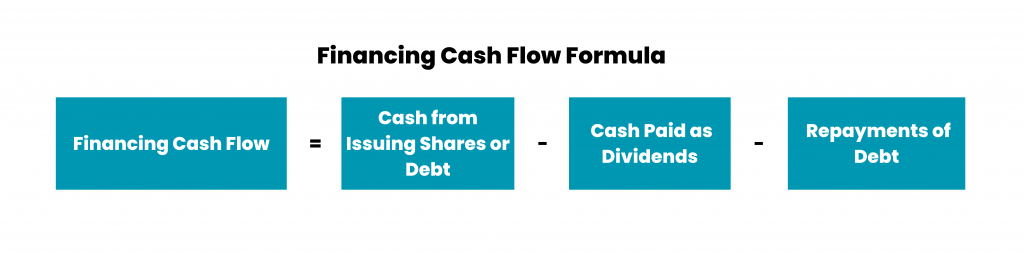

Cash flow formula: How to calculate financing cash flow

Components of financing cash flow usually include:

- Cash received from issuing new shares or equity (cash inflow).

- Cash paid as dividends to shareholders (cash outflow).

- Cash received from issuing debt like bonds or loans (cash inflow).

- Repayment of debt principal (cash outflow).

- Repurchase of the company’s own shares, known as treasury stock (cash outflow).

- Payments for lease obligations (cash outflow).

The formula to calculate financing cash flow is:

Interpreting the cash flow statement

The cash flow statement provides a snapshot of a company’s financial strength. Positive cash flow indicates a company that generates more cash than it spends, while a negative cash flow could signal trouble. Free cash flow (FCF), which represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets, is also a key metric to consider. Importantly, cash flow should not be mistaken for net profit as they measure different aspects of a business’s financial health.

Interpreting a cash flow statement involves analyzing the cash inflows and outflows from operating, investing, and financing activities, as well as understanding what these mean for the financial health of the business.

- Operating cash flow: If a company consistently generates more cash from operating activities than it uses, it is generally considered to be in good financial health.

- Investing cash flow: If the cash flow from investing activities is negative, it could indicate that the company is investing in its future growth by purchasing assets. On the other hand, a positive cash flow could mean the company is selling off its assets.

- Financing cash flow: Positive cash flow here could mean the company is raising more capital, either debt or equity. Negative cash flow might indicate that the company is paying down debt, paying dividends, or conducting a share buyback.

When interpreting a cash flow statement, it’s essential to take into account the company’s stage in its business life cycle. For instance, it’s not uncommon for startups to have negative operating cash flow as they invest heavily in their growth. Conversely, mature companies are expected to have steady, positive operating cash flow.

Also, one must interpret cash flow in context with other financial statements, such as the income statement and balance sheet. In-depth analysis might involve comparing cash flow measures to key metrics like net income, studying trends over multiple periods, or comparing the company’s cash flows to its competitors or industry benchmarks.

Remember, cash flow analysis is an essential tool in assessing a company’s liquidity, investment potential, and overall financial health.

Real-world examples of cash flow calculation in business

Let’s consider two hypothetical companies, Company A and Company B, to illustrate the calculation of cash flow from the three main activities: operating, investing, and financing.

Company A:

Suppose Company A is a mature manufacturing company with stable operations. Let’s consider the following information from their financial statements:

- Net Income: $100,000

- Depreciation: $20,000

- Increase in Accounts Receivable: $5,000

- Increase in Accounts Payable: $10,000

- Purchased Property, Plant, and Equipment: $50,000

- Issued new shares: $30,000

- Paid Dividends: $15,000

Here’s how you would calculate the cash flow for Company A:

Operating Cash Flow = Net Income + Depreciation + Changes in Working Capital Operating Cash Flow = $100,000 + $20,000 + (-$5,000 + $10,000) Operating Cash Flow = $125,000

Investing Cash Flow = Cash Spent on Investments Investing Cash Flow = -$50,000

Financing Cash Flow = Cash from Issuing Shares – Dividends Paid Financing Cash Flow = $30,000 – $15,000 Financing Cash Flow = $15,000

Total Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow Total Cash Flow = $125,000 – $50,000 + $15,000 Total Cash Flow = $90,000

Company B:

Now let’s assume Company B is a fast-growing tech startup with the following information:

- Net Loss: $20,000

- Depreciation: $10,000

- Increase in Accounts Receivable: $5,000

- Increase in Accounts Payable: $15,000

- Purchased New Software: $30,000

- Received Venture Capital Funding: $100,000

Operating Cash Flow = Net Income + Depreciation + Changes in Working Capital Operating Cash Flow = -$20,000 + $10,000 + (-$5,000 + $15,000) Operating Cash Flow = $0

Investing Cash Flow = Cash Spent on Investments Investing Cash Flow = -$30,000

Financing Cash Flow = Cash from Issuing Shares Financing Cash Flow = $100,000

Total Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow Total Cash Flow = $0 – $30,000 + $100,000 Total Cash Flow = $70,000

In both examples, the companies end up with a positive cash flow, but the sources of their cash are drastically different. Company A generates positive cash flow from its operations, while Company B relies on financing activities to generate positive cash flow.

Common mistakes in cash flow calculation

When calculating cash flow, businesses often make several common mistakes that can lead to inaccurate results. Here are some of the most common ones:

1. Not accounting for non-cash expenses

Depreciation, amortization, and stock-based compensation are all non-cash expenses that are subtracted in the income statement but need to be added back when calculating cash flow. Ignoring these adjustments can significantly understate a company’s operating cash flow.

2. Overlooking changes in working capital

Changes in accounts such as accounts receivable, inventory, accounts payable, accrued expenses, and deferred revenue can have a substantial impact on operating cash flow. A company may be profitable, but if it’s not effectively managing its working capital, it may still end up with a cash shortfall.

3. Misclassifying cash flows

Sometimes, cash inflows and outflows can be misclassified among operating, investing, and financing activities. For example, the payment of interest on debt should be classified as an operating activity, but it is often mistakenly classified as a financing activity. This misclassification can distort the true picture of a company’s cash flow.

5. Ignoring one-time items

Companies occasionally have one-time gains or losses, which can significantly affect cash flow. These could be gains or losses from the sale of an asset or a subsidiary, or expenses from a lawsuit. Ignoring these one-time items when analyzing cash flow can give a distorted view of the company’s ongoing cash-generating ability.

6. Not factoring in capital expenditures

While depreciation is added back to net income in the calculation of operating cash flow, the cost of replacing assets due to wear and tear is often not considered. Capital expenditures (CapEx), which are essential for maintaining the operational capacity of a business, should be subtracted to arrive at free cash flow, a key metric used by investors.

By avoiding these common mistakes, businesses can get an accurate view of their cash flow, thereby making more informed financial decisions.

Benefits of regular cash flow analysis

Regular cash flow analysis has several benefits for businesses, providing key insights into their financial health and operational efficiency. Here are some of the main advantages:

Monitoring liquidity

Regular cash flow analysis helps to monitor a company’s liquidity, which is its ability to meet short-term obligations. A company that consistently generates positive cash flow is typically seen as more likely to meet its immediate financial commitments and remain solvent.

Enhancing operational efficiency

Cash flow from operating activities reflects a company’s efficiency in generating cash from its primary business operations. Regular analysis can highlight areas where the business may be overspending or failing to collect receivables efficiently.

Identifying trends

Analyzing cash flow over multiple periods can reveal trends that may not be visible from a single period’s cash flow statement. It can help identify cyclical patterns, seasonal influences, and the impact of specific business strategies on cash flow.

Informing investment decisions

Cash flow analysis is a vital tool for potential investors. Positive free cash flow, which represents the cash a company generates after accounting for capital expenditures, is often seen as a sign of a company’s ability to enhance shareholder value. It’s an indicator that the company can fund growth, pay dividends, and repurchase shares without needing to borrow or issue more shares.

Aiding in planning and budgeting

By providing a clear picture of where money is coming from and where it is being spent, cash flow analysis can aid in budgeting and financial planning. It can help a business anticipate periods of negative cash flow and plan for adequate financing.

Evaluating loan repayment capacity

Lenders often look at a company’s cash flow to determine its ability to repay a loan. Regular cash flow analysis can thus be beneficial when seeking external financing.

Supporting business valuation

Cash flow measures such as free cash flow are often used in discounted cash flow (DCF) models to value businesses. Regular analysis can thus play a role in business valuation.

In summary, regular cash flow analysis provides valuable insights that can help a business maintain financial health, make informed decisions, and plan for future growth.

Accurate view of your business’s finances: Calculating cash flow with Synder

Synder is a financial management solution designed for businesses of all sizes, offering features like automatic synchronization of sales and expenses, invoice creation and management, and financial reporting. Here’s how Synder can help monitor cash flow:

- Automatic synchronization of transactions. Synder automatically synchronizes your sales, fees, expenses, and other transactions across multiple platforms (like Stripe, PayPal, and Square) and accounting systems (like QuickBooks and Xero). This ensures that your books are always up-to-date and provides an accurate reflection of your cash flow.

- Accurate tracking of sales and expenses. Synder has two modes of synchronizing data into boos. Per Transaction sync provides detailed information about each transaction, including income, fees, taxes, and shipping costs. This level of detail makes it easier to track all the components that affect your cash inflow and outflow. Synder’s Daily Summary mode posts daily journal entries with summaries for a day per platform, which gives you a more general overview of your sales and prevents data overload in your accounting.

- Real-time financial reporting. Synder offers financial reporting capabilities that allow you to create comprehensive financial reports in real-time. You can easily view your cash flow statement, income statement, and balance sheet, helping you understand your cash position at any given time.

- Invoice management. With Synder, you can create and send invoices directly to your customers. Payments received are automatically recorded and synced with your accounting system. This helps in monitoring receivables and understanding the inflow of cash.

- Reconciliation of transactions. Synder makes reconciliation easier by matching transactions from your bank statements with corresponding entries in your accounting system. This ensures that your cash balances are accurate.

- Multicurrency support. If you have international transactions, Synder supports multi-currency accounting. This is crucial for businesses operating in multiple countries, as it allows for accurate tracking and conversion of cash flows in different currencies.

- Budgeting and forecasting. By providing a clear and accurate picture of your income and expenses, Synder helps in budgeting and forecasting future cash flows, enabling you to make informed business decisions.

Synder simplifies financial management and cash flow monitoring by automating many of the time-consuming tasks involved in bookkeeping. By providing accurate, up-to-date financial information, it allows businesses to focus on growth and strategic decision-making. Test Synder on a 15-day free trial to see what the solution can do for your business, or sign up for a webinar to check the magic of smart automation with a specialist and ask questions. Make sure you control your cash flow!

Conclusion

Understanding and calculating cash flow is not just an accounting practice—it is an insightful tool for effective business management. By accurately assessing cash flow, you can gauge the heartbeats of your business and steer it towards healthy growth and profitability. Remember, in the corporate world, cash truly is king, that’s why monitoring is a must.