In the intricate world of taxation, the specter of an IRS audit looms as a source of concern for many taxpayers. An IRS audit entails a comprehensive review of a taxpayer’s financial records and returns to ensure compliance with the tax laws. While the very notion of an audit can be unsettling, it’s crucial for individuals and businesses to comprehend the ins and outs of the process.

Navigating the tax code requires not only an understanding of one’s financial situation but also a grasp of the rules that govern audits. As we delve deeper into the concept of the statute of limitations, we uncover a pivotal aspect of tax audits that plays a crucial role in the lives of taxpayers and their financial planning.

Contents:

1. Brief overview of IRS audits

2. Importance of understanding the statute of limitations for tax audits by the IRS

- Explanation of the statute of limitations in legal terms

- Application of the statute of limitations to audit of taxes by the IRS

- General rule for tax audits: Three-year statute of limitations

- Starting point for the three-year period

3. Examples illustrating when the statute of limitations applies

4. Exceptions: Extended statute of limitations

5. Cases where substantial income omission is involved

- Example 1

- Example 2

- Indefinite statute of limitations

- Focus on cases of tax fraud or willful tax evasion

- How technological advances impact the statute of limitations

6. Variations in statute of limitations for different tax categories

7. Recordkeeping and documentation

8. Amending tax returns and statute of limitations

9. State vs. federal statutes of limitations

10. Recent developments and changes

11. The taxpayer’s perspective

12. Final words

Brief overview of IRS audits

IRS audits, at their core, involve a meticulous examination of financial documents, deductions, credits, and other relevant information provided in tax returns. These audits can be triggered for a variety of reasons, ranging from random selection to discrepancies flagged by automated systems. The audit process is designed to verify the accuracy and authenticity of the information presented in tax returns, ensuring that taxpayers are fulfilling their legal obligations.

If you’re an ecommerce business owner or an accounting professional serving online businesses and are eager to streamline dealing with sales taxes and other financial matters, take advantage of Synder Sync – an automated software tool that takes care of the transaction info from in your sales channels and payment gateways including taxes, discounts, refunds, platform fees, and more, and syncs it with the accounting software. Synder’s unique duplicate detection feature minimizes the risk of errors and discrepancies preparing your books for a seamless reconciliation when tax season comes.

Test Synder’s powerful functionality for ecommerce businesses during a 15-day free trial which requires no commitment or credit card, or book a seat at our Weekly Public Demo.

You could also learn about how Synder simplifies tracking taxes and sales by countries and states.

Importance of understanding the statute of limitations for tax audits by the IRS

Amid the apprehension that an audit may induce, understanding the statute of limitations is a vital aspect of navigating the tax landscape. The statute of limitations defines the timeframe within which the IRS can initiate an audit on a particular tax return. This temporal boundary serves as a safeguard, preventing the IRS from revisiting older tax returns indefinitely. For taxpayers, being aware of these limitations can provide a sense of security and certainty, offering a clear framework within which their tax matters can be scrutinized.

Explanation of the statute of limitations in legal terms

The statute of limitations, in legal terms, refers to a legally defined time period within which a particular legal action can be initiated. It establishes a cutoff point beyond which the affected parties lose their right to bring a claim, file a lawsuit, or take legal action. This temporal restriction is designed to promote fairness, certainty, and the efficient resolution of disputes.

The rationale behind the statute of limitations is multi-faceted. It aims to ensure that legal actions are pursued in a timely manner, preserving the integrity of evidence, and preventing the undue delay of justice. It also seeks to protect individuals and entities from facing perpetual threats of litigation or liability for events that occurred in the distant past.

In the context of tax law and IRS audits, the statute of limitations serves as a time limitation on the IRS’s authority to assess additional taxes or initiate an audit based on a specific tax return. It defines the time frame during which the IRS can examine a taxpayer’s financial records, make adjustments to reported income or deductions, and assess any resulting taxes, penalties, or interest. Once this time period expires, the IRS generally loses its ability to challenge the information presented in the tax return and demand additional payments.

It’s important to note that the statute of limitations varies depending on the type of legal action or the specific area of law. In tax law, as it pertains to IRS audits, the statute of limitations is a critical concept that both taxpayers and tax authorities must understand. It not only outlines the boundaries within which the IRS can operate but also provides taxpayers with a degree of certainty regarding the time frame during which their tax matters may be subject to examination and adjustment.

Application of the statute of limitations to audit of taxes by the IRS

The application of the statute of limitations to IRS tax audits is a fundamental aspect of the U.S. tax system, governing the timeframe within which the Internal Revenue Service (IRS) can initiate an audit or make adjustments to a taxpayer’s returns. Understanding this application is essential for both taxpayers and tax authorities to ensure a fair and orderly process. In the following sections you’ll find details of how the statute of limitations applies to IRS tax audits.

General rule for tax audits: Three-year statute of limitations

The cornerstone of the statute of limitations for IRS tax audits is the three-year rule. Under this rule, the IRS generally has a window of three years from the date a tax return is filed to audit that return. This means that once the three-year period elapses, the IRS’s authority to initiate an audit or make adjustments to that particular tax return is restricted. The three-year statute of limitations applies to most routine tax returns, covering a wide range of individual and business taxpayers.

Starting point for the three-year period

The starting point for the three-year statute of limitations is typically the date the taxpayer files the tax return. If the return is submitted on the tax deadline, such as April 15th, that date marks the beginning of the three-year period. However, if the return is filed before the tax deadline, the three-year clock still begins ticking from the tax deadline. This approach ensures a consistent timeframe for the IRS to assess returns regardless of when they are submitted.

Examples illustrating when the statute of limitations applies

Example 1: Standard filing

- Taxpayer A files their 2021 tax return on April 1, 2022.

- The three-year statute of limitations for the IRS to audit this return starts on April 15, 2022 (the tax deadline).

- The IRS generally has until April 15, 2025, to initiate an audit for Taxpayer A’s 2021 return.

Example 2: Early filing

- Taxpayer B files their 2021 tax return on February 1, 2022.

- Even though the return was filed early, the three-year period still begins on April 15, 2022 (the tax deadline).

- The IRS generally has until April 15, 2025, to initiate an audit for Taxpayer B’s 2021 return.

Example 3: Amended return

- Taxpayer C originally files their 2020 tax return on April 15, 2021.

- On September 1, 2021, Taxpayer C files an amended return for the 2020 tax year.

- The statute of limitations for the IRS to audit Taxpayer C’s 2020 return resets with the amended return.

- The IRS now has until September 1, 2024, to initiate an audit for Taxpayer C’s 2020 return.

The three-year statute of limitations provides taxpayers with a sense of closure after filing their tax returns. Once this period expires, taxpayers can generally have confidence that their returns won’t be subject to routine IRS audits. However, it’s important to remember that specific circumstances, such as certain tax evasion or fraud situations, can lead to exceptions where the statute of limitations doesn’t apply in the same manner.

Exceptions: Extended statute of limitations

Six-year statute of limitations

While the three-year statute of limitations is the general rule for IRS tax audits, there are instances where the IRS is granted an extended period of time to initiate an audit. This extension is known as the six-year statute of limitations. Unlike the standard three-year period, the six-year statute applies when specific conditions are met, allowing the IRS an extended timeframe to review tax returns.

Conditions under which extended statute of limitations is applied

The six-year statute of limitations comes into play when a taxpayer significantly understates their gross income. This means that if a taxpayer omits a substantial amount of income from their tax return—specifically, if the amount omitted is 25% or more of the gross income reported—the IRS is granted an additional three years beyond the standard three-year window to initiate an audit. This provision is designed to address situations where there is a substantial distortion of income, warranting a more extended period for the IRS to detect and rectify discrepancies.

Cases where substantial income omission is involved

Example 1

- Taxpayer X reports $50,000 of gross income on their 2020 tax return.

- They fail to report an additional $20,000 of income earned during that year.

- The total unreported income is 40% of the reported gross income ($20,000 / $50,000).

- As the omitted income is more than 25% of the reported gross income, the six-year statute of limitations applies.

- The IRS has until April 15, 2027 (six years from the tax deadline of April 15, 2021), to initiate an audit for Taxpayer X’s 2020 return.

Example 2

- Taxpayer Y reports $150,000 of gross income on their 2022 tax return.

- They neglect to report an additional $30,000 of income earned during that year.

- The unreported income amounts to 20% of the reported gross income ($30,000 / $150,000).

- As the omitted income is less than 25% of the reported gross income, the standard three-year statute of limitations applies.

- The IRS has until April 15, 2025 (three years from the tax deadline of April 15, 2023), to initiate an audit for Taxpayer Y’s 2022 return.

In short, the six-year statute of limitations aims to address cases where taxpayers deliberately or significantly misrepresent their income, ensuring that the IRS has a reasonable opportunity to discover such inaccuracies and take appropriate actions. This provision underscores the importance of accurate reporting and the consequences of substantial income omission in tax returns.

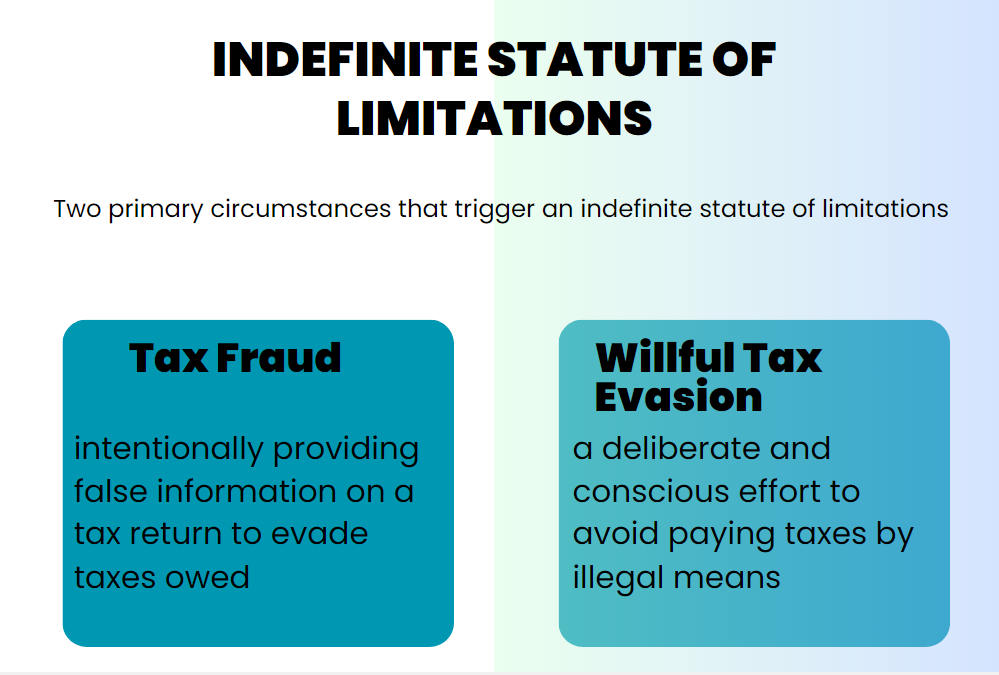

Indefinite statute of limitations

In certain cases, the statute of limitations for IRS tax audits becomes indefinite, meaning that there is no time limit within which the IRS can initiate an audit or take legal action. These exceptional situations typically involve serious violations of tax law that warrant more extensive investigation and potential penalties. Two primary circumstances that trigger an indefinite statute of limitations are tax fraud and willful tax evasion.

Focus on cases of tax fraud or willful tax evasion

Tax fraud involves intentionally providing false information on a tax return to evade taxes owed. Willful tax evasion goes a step further, implying a deliberate and conscious effort to avoid paying taxes by illegal means. In both cases, due to the gravity of the offense, the statute of limitations does not apply, enabling the IRS to take legal action at any time. This serves as a deterrent against fraudulent activities and reinforces the importance of adhering to tax laws.

How technological advances impact the statute of limitations

Technological advancements have reshaped the way financial information is managed, shared, and tracked. With the rise of digital transactions and electronic recordkeeping, detecting instances of tax fraud or evasion has become more efficient and precise. This, in turn, has led to increased scrutiny and a more proactive approach by tax authorities. As technology enables the easier identification of discrepancies, the need for extended or indefinite statute of limitations in cases of fraudulent activities becomes all the more relevant.

However, it’s important to strike a balance between leveraging technological advancements and respecting individuals’ rights. As technology accelerates the identification of potential issues, it also emphasizes the significance of accurate and transparent reporting by taxpayers.

On the whole, the absence of a statute of limitations in cases of tax fraud and willful tax evasion underscores the severity of these offenses. As technology evolves, the effectiveness of tax enforcement improves, influencing the need for extended time frames to address complex cases that undermine the integrity of the tax system.

Variations in statute of limitations for different tax categories

The statute of limitations isn’t a one-size-fits-all concept in the realm of taxation. Different types of taxes and specific circumstances can lead to variations in the application of the statute of limitations. While the general principles remain consistent, understanding how the statute of limitations varies across tax categories is essential for both taxpayers and tax authorities.

1. Statutes of limitations for income tax

The standard three-year statute of limitations applies to most income tax returns. However, as mentioned earlier, substantial income omission triggers a six-year statute of limitations, while cases of fraud or willful tax evasion can lead to no statute of limitations.

Learn how to file income tax return.

2. Statute of limitations for employment tax

Employment tax matters, including Social Security and Medicare taxes, have a time limit of three years from the later of the due date or the actual payment date of the tax return. Similar to income tax, an exception occurs for cases of employment tax fraud.

3. Statute of limitations for estate tax

Estate tax returns are typically subject to a three-year statute of limitations from the date of filing. However, the IRS has an extended period of time to audit estate tax returns when an estate includes certain assets whose values are difficult to determine.

4. Statute of limitations for gift tax

For gift tax returns, the three-year statute of limitations starts from the date the gift tax return is filed. Gifts that aren’t adequately disclosed on the return can extend the statute of limitations.

5. Statute of limitations for international tax matters

The statute of limitations can be extended for international tax matters if a taxpayer fails to report certain foreign financial assets or transactions. This extension is designed to give the IRS more time to address offshore tax evasion.

6. Statute of limitations for miscellaneous tax matters

Various other tax matters, such as excise taxes or certain specialized taxes, may have their own specific statute of limitations based on the nature of the tax and the associated regulations.

Understanding these variations in the statute of limitations across different tax categories empowers taxpayers and tax professionals to navigate the complexities of the tax system more effectively. It underscores the importance of accurate reporting and timely compliance across the diverse spectrum of tax obligations.

Recordkeeping and documentation

Importance of maintaining tax records

The significance of maintaining accurate and organized tax records cannot be overstated. Proper recordkeeping serves as the foundation of a sound financial and tax management strategy. Records provide a comprehensive and transparent view of your financial transactions, ensuring that you can substantiate the information presented in your tax returns if ever required.

How proper documentation affects the statute of limitations

Solid documentation directly impacts how the statute of limitations applies to your tax returns. Maintaining thorough records can potentially safeguard you from extended audits or disputes with the IRS. If you have comprehensive documentation to support your reported income, deductions, and credits, it becomes easier to address any inquiries that arise within the statute of limitations. Conversely, insufficient or disorganized records might complicate the audit process and necessitate an extension of the audit window.

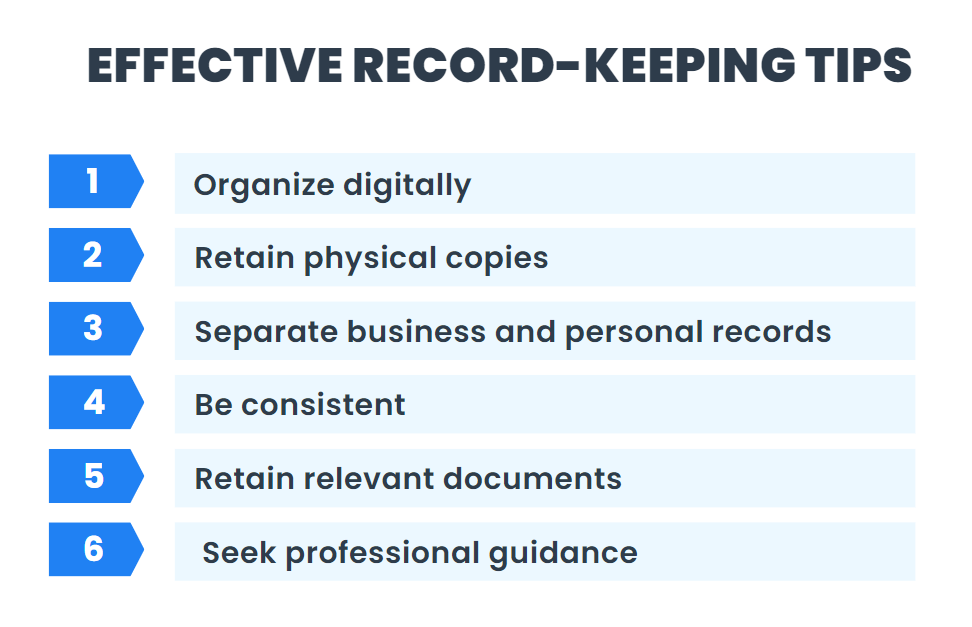

Practical tips for effective recordkeeping

- Organize digitally: Utilize digital tools or software to store and manage electronic records. This simplifies retrieval and reduces the risk of loss.

- Retain physical copies: Keep physical copies of important documents, such as receipts, invoices, and statements, in an organized manner.

- Separate business and personal records: If applicable, maintain separate records for personal and business transactions to avoid confusion.

- Be consistent: Regularly update your records to reflect current financial activities, ensuring accuracy and relevancy.

- Retain relevant documents: Keep records related to tax returns, deductions, credits, and other financial transactions for at least the duration of the statute of limitations.

- Seek professional guidance: Consult tax professionals for guidance on which records are critical for your specific tax situation.

Maintaining meticulous records empowers you to face tax audits with confidence. Should the IRS initiate an audit within the statute of limitations, your well-documented records provide a basis for clear and accurate explanations. In addition to ensuring compliance, effective recordkeeping is an essential practice for making informed financial decisions and fostering long-term financial health.

Amending tax returns and statute of limitations

Statute of limitations’ impact on amending tax returns

The statute of limitations plays a pivotal role in the process of amending tax returns. When you initially file a tax return, the statute of limitations sets the time frame during which the IRS can initiate an audit or make adjustments to that return. However, once you decide to amend a return, the statute of limitations can be influenced, potentially extending the window for IRS actions.

How filing an amended return may reset the statute of limitations

Filing an amended tax return can essentially reset the statute of limitations for that specific tax year. When you submit an amendment, the IRS recalculates the statute of limitations from the date you file the amended return. This means that the IRS gains a new window of time to initiate an audit or make changes to the return. The reasoning behind this is that an amended return implies that new information has come to light, necessitating a reevaluation.

For example, if you filed your 2019 tax return on April 15, 2020, the three-year statute of limitations would generally end on April 15, 2023. However, if you file an amended return for 2019 on September 1, 2020, the statute of limitations for that year would be reset, and the IRS would typically have until September 1, 2023, to initiate an audit or take any actions related to your amended return.

It’s crucial to be mindful of the potential implications of filing an amended return, especially if the statute of limitations is close to expiring. While amending a return is a legitimate way to correct errors or provide additional information, it’s wise to consult with tax professionals before doing so, particularly when it comes to the potential impact on the statute of limitations.

State vs. federal statutes of limitations

The interplay between state and federal statutes of limitations adds an additional layer of complexity to the tax landscape. State-level statutes of limitations often mirror the federal rules, but there can be notable differences. States have their own tax codes, regulations, and enforcement agencies, which can lead to variations in the statute of limitations for state taxes.

While federal statutes of limitations are uniform across the nation, each state can set its own rules for tax audits and enforcement. Some states might adopt the federal statutes verbatim, while others might extend or limit the timeframes based on their individual tax policies.

Interaction between state and federal statutes in case of overlapping jurisdictions

When state and federal statutes of limitations intersect, the question of which statute applies can arise. If a taxpayer’s situation falls under the jurisdiction of both state and federal tax authorities, the interaction between these statutes can vary depending on the nature of the issue.

- Concurrent time frames: In some cases, state and federal statutes might have concurrent timeframes, meaning that both jurisdictions have the same statute of limitations. This simplifies matters, as both the federal and state audits would need to be initiated within the same timeframe.

- Differing time frames: When state and federal statutes have differing timeframes, it’s essential to address each jurisdiction separately. Taxpayers and tax professionals must be aware of the specific rules in both jurisdictions to avoid unexpected audits or disputes.

- Tolling and extensions: Some situations might lead to tolling or extending the statute of limitations, affecting both federal and state audits. For instance, if a taxpayer is under investigation by either jurisdiction, the statute of limitations might be suspended until the investigation concludes.

Navigating the potential overlaps and divergences between state and federal statutes of limitations requires a comprehensive understanding of both sets of rules. Taxpayers with multistate tax obligations should be diligent in remaining compliant with all applicable statutes and seek professional advice to ensure they understand their obligations in each jurisdiction.

Recent developments and changes

The landscape of tax regulations isn’t static; it evolves over time in response to changing economic conditions, technological advancements, and legislative priorities. Recent updates or changes to the statute of limitations can significantly impact how taxpayers, businesses, and tax authorities navigate the tax system.

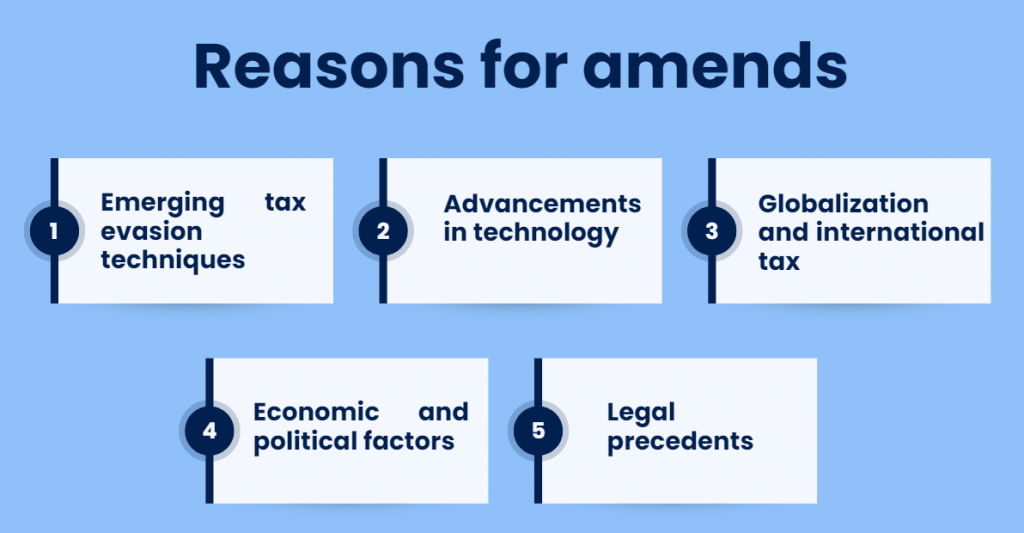

Possible reasons for amendments and their implications

- Emerging tax evasion techniques: As new methods of tax evasion and fraud emerge, lawmakers might amend the statute of limitations to ensure that tax authorities have the necessary tools to address these evolving challenges.

- Advancements in technology: Technological innovations can lead to changes in how transactions are conducted and recorded. This might prompt adjustments to the statute of limitations to accommodate the complexities of digital financial systems.

- Globalization and international tax: With the increasing globalization of business, cross-border tax matters are gaining prominence. Changes to the statute of limitations could reflect the growing need for international tax cooperation and information sharing.

- Economic and political factors: Economic downturns or changes in political administrations can influence tax policy. Adjustments to the statute of limitations might be proposed as part of broader tax reform initiatives.

- Legal precedents: Landmark court cases can prompt legislative responses, resulting in changes to the statute of limitations to address legal ambiguities or gaps.

These amendments can have a range of implications, from providing tax authorities with additional tools to enforce compliance to affecting taxpayers’ rights and responsibilities. Staying informed about recent developments ensures that taxpayers can adapt their strategies to align with current regulations.

As the tax landscape continues to transform, it’s crucial for taxpayers and tax professionals alike to stay updated on any changes to the statute of limitations and related tax regulations. This knowledge empowers individuals and businesses to make informed decisions and maintain compliance with tax laws.

The taxpayer’s perspective

Advice for taxpayers on understanding their rights

Understanding your rights as a taxpayer is essential to navigating the tax system confidently and effectively. Key rights include:

- Right to representation: You have the right to be represented by a tax professional during audits or interactions with tax authorities.

- Right to appeal: If you disagree with an audit outcome, you have the right to appeal the decision through an administrative process or the court system.

- Right to privacy: Your tax information is protected by privacy laws, and tax authorities must adhere to strict guidelines when accessing and using your data.

- Right to clear communication: You have the right to receive clear and understandable explanations of tax assessments and audit findings.

- Right to confidentiality: Information you provide to tax professionals or authorities should be treated confidentially.

Being aware of your rights empowers you to actively participate in the tax process, ensuring that your interests are respected and protected.

Importance of seeking professional advice when dealing with complex situations

Tax matters can become intricate, especially in cases involving complex financial transactions, multiple income sources, or international tax obligations. Seeking professional advice from certified accountants, tax attorneys, or enrolled agents can have several benefits:

- Expertise: Professionals possess specialized knowledge and experience to navigate complex tax regulations and optimize your tax situation.

- Compliance: Professionals help ensure that you adhere to the correct tax codes, minimizing the risk of errors or omissions that could trigger audits.

- Audit representation: If you face an audit, a tax professional can represent you, providing expertise and reducing the stress of dealing with tax authorities.

- Strategic planning: Professionals can help you devise tax strategies that align with your financial goals, potentially reducing your overall tax liability.

- Peace of mind: Knowing that a qualified professional is handling your tax matters gives you peace of mind, allowing you to focus on other aspects of your life or business.

Complex tax situations warrant careful consideration, and a skilled tax professional can guide you through the intricacies, ensuring that you make informed decisions and optimize your financial outcomes.

By understanding your rights and enlisting professional assistance when necessary, you can confidently navigate the tax landscape, making the most of your financial resources while adhering to legal requirements.

Final words

Overall, to answer the question how far back the IRS can audit, we need to understand the concept of the statute of limitations and its implications for IRS tax audits, the time frames defined by the statute of limitations, general rules and different multistate tax scenarios as well as recent developments and changes can impact the tax landscape, prompting adjustments to the statute of limitations.

Navigating the world of taxes requires ongoing vigilance and a proactive approach. Staying informed about the statute of limitations, tax regulations, and your rights as a taxpayer empowers you to make informed decisions. Whether you’re an individual taxpayer, a small business owner, or part of a larger organization, understanding the nuances of tax regulations can help you remain compliant, minimize audit risks, and optimize your financial strategies.

Remember, seeking professional advice when needed and maintaining accurate records are instrumental in ensuring that your tax matters are handled effectively. By staying engaged with your tax obligations and keeping up with changes in the tax landscape, you’re taking the necessary steps to secure your financial future and navigate the intricacies of the tax system with confidence.

You might also be interested in reading about small business tax deductions, forensic accounting or double-entry in accounting

Share your experience

We’d love to hear from you about your experiences with IRS audits and how far-reaching they may have been for you or your business. Whether it was a comprehensive examination or a more limited review, your insights can provide valuable perspectives for others navigating tax matters. Please share your stories and thoughts in the comments section below. Your experiences can help shed light on the complexities of IRS audits and offer guidance to those facing similar situations.How far the IRS audited you or your business? Share in the comments section below!