Good bookkeeping practices are essential for any business, but they’re especially important in the restaurant industry because of the high volume of transactions that occur each day. Keeping accurate records allows you to easily identify areas where you may be overspending or not taking advantage of available savings opportunities and other resources. Additionally, good bookkeeping helps achieve easy and fast reconciliation, ensure that taxes are paid on time and in full and that financial statements accurately reflect your restaurant’s financial health.

In fact, the list of challenges associated with restaurant bookkeeping is huge – you need to take care of cash and online sales reporting, COGS, accounts payable, bank reconciliation, tips allocation, tax, and much more. No wonder restaurant owners prefer to hire a professional who can make sure all the aspects of bookkeeping are taken care of. That’s something Evangeline, a CPA with 10+ years of experience and a Synder customer for over 2 years, has been successfully doing for her clients for quite a time. Why Synder? Let’s find out!

Get the summarized journal entry that your restaurant clients actually need. Explore the full features of Synder accounting.

Restaurant bookkeeping – managing thousands of sales daily

As her client base grew, Evangeline noticed that ensuring the accuracy of figures in restaurant bookkeeping was becoming more and more problematic due to the amount of records in the books. This could led her to consider the traditional method of bank reconciliation in Excel as a comparison point to understand the challenges and inefficiencies involved.

“Restaurant businesses have thousands of small sales a day – from a morning ritual of ordering a cup of coffee with croissants, to having a family dinner out on Saturday – all restaurant orders have to be properly accounted for in the books. What’s more, food, soft drinks, wine, beer, and lots of other sales should go to different sections in accounting reports so that my clients can see the fluctuating costs for each item. Tips, fees, cash and online payments don’t make my job easier either. Reconciliation becomes a real nightmare, taking more and more of my time”.

Evangeline had been repeatedly facing all those problems with several of her clients in the restaurant industry, until she took on one more client 2 years ago, who was using Square (POS) and Clover (POS) to process a huge amount of transactions and whose QuickBooks was completely messed up. The accounting system was overloaded with data and the restaurant owner posted sales net amounts from bank feeds ignoring payment processing fees.

“My client didn’t need all those details, not to mention all those transactions. Since the restaurant owner just reconciled net amounts from the bank, the sales were incorrect and the fees were missing completely, nothing made sense and correct reconciliation seemed to be literally impossible. Additionally, they wanted to know how much they made each day and what categories brought the most income”.

She knew she had to find a better way to clean her restaurant clients’ books and keep their books neat in the future, and started looking for restaurants accounting software that could automate data entry. She found some free apps but they completely ignored Square invoices, other apps ignored fees or integrated with only 1 POS system, when she needed the integration to cover several POS systems. At that point, her friend, a restaurant bookkeeper, advised her to give Synder a try.

Restaurants accounting software – automating reconciliation with Synder’s Daily Summary

Synder, which partners with Square and supports Square cash, tips, fees, invoices and Clover integration, turned out to be the best fit for Evangeline. When she voiced her concerns and needs during a one-on-one set up session, our specialist immediately came up with a solution – what she needed was Synder’s Daily Summary and product mapping feature, which came across as the perfect way to resolve the data overload and reconciliation problems, as well as can serve as a practical chart of accounts example.

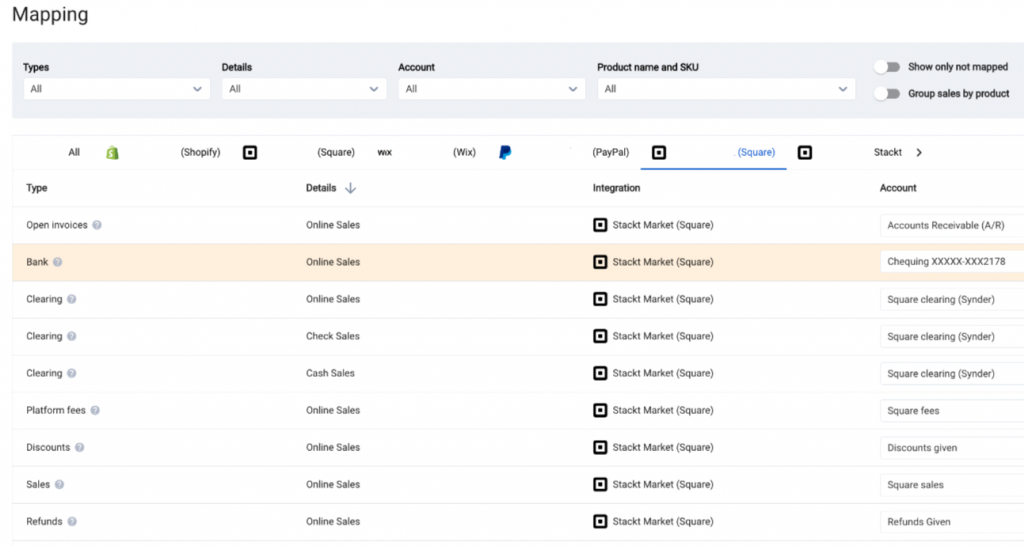

Synder’s Daily Summary Sync mode posts summarized daily journal entries per each connected platform to the clearing account in the books – no customer data, only the financial info that matters. The mapping feature allows you to map sales, fees, tips, taxes, refunds, discounts to different accounts so that you can see their full breakdown in your P&L report, and provides product mapping to track groups or products there.

Evangeline mapped her Square online sales to hit one clearing account, and directed the cash to another one to keep track of them separately. She mapped fees to a separate expense account, so that her restaurant client now has the correct income gross and net in the books.

“Daily Summary is perfect for my restaurant clients. I enter the month ending balance and I can reconcile their online sales clearing account. If I see any difference (which almost never happens), I can easily spot it comparing daily sales totals. Cash rests on a separate account (for some clients it is Undeposited Funds, for some it’s just a specific cash account) and is reconciled separately. Spotting a mistake has never been easier.”

“I set up a mapping for products to make sure my restaurant client will see the broad categories (salads, food, beverages, etc.). The app puts tips into a separate category, separates cash into a clearing account, so it’s easier to reconcile and it isn’t mixed with online sales that clear out on their own.”

Having seen what the tool can do in terms of automation and management for one restaurant client, Evangeline onboarded all the rest of her restaurant clients to Synder and the tool sorted out all of their major issues. She went with the Daily Summary mode in most cases, although decided to stick to the detailed per transaction sync for some low-transaction volume clients.

Find out how the summarized journal entry can streamline your work by booking a 1:1 consultation.

Hassle-free bookkeeping – reducing the reconciliation process to just a few clicks with the right restaurant accounting software

Synder Daily Summary allowed Evangeline to achieve fast and accurate reconciliation and save time on categorizing sales and fees manually. The reconciliation process is straightforward and effortless – what used to take days now can be done in a few clicks with accounting reconciliation software.

“Synder has saved me multiple hours on reconciling the books – everything is streamlined and hassle-free. I reconcile both checking and clearing accounts, as only this way I, as an accountant, can verify that everything is done correctly. Clearing account reconciliation is simple because I should only go to Square once a month to get the ending balance from there. Checking account reconciliation is even easier, as Synder matches what they call “payouts” (which are money transfers from Square to the bank) to bank feeds. So I literally have to confirm the match with one click. This is ridiculously good!

What I like most is that I can easily manage multiple clients with different platforms in Synder and I don’t have to juggle different apps to do that. It works perfectly for big restaurant clients, and does fit small business needs as well. I give credit when the credit is due and Synder definitely deserves your attention.””

With Synder software, Evangeline managed to optimize the accounting processes for all her restaurant clients. Now she is exploring Synder’s functionality further – her clients are planning to start tracking COGS in QuickBooks.

Ready to reduce the tedious reconciliation process to a few clicks just like Evangeline?

Check out Synder’s Daily Summary during our 15-day free trial and save hours on your Stripe export to QuickBooks or any other platform you use.

Book a demo with one of our specialists and discover the full potential of automated accounting tools created to ease clients’ management and streamline your bookkeeping practice!

I am so glad you shared this information. It is very helpful for me.