Ecommerce platforms and online marketplaces give folks a chance to make some extra cash by selling their old stuff from time to time or even kickstart their little online businesses. You can sell various sorts of things – handmade crafts, unique goodies, vintage treasures – you name it.

Now, here’s the deal: if you’re just cleaning out your closet and getting rid of things you no longer need, you usually don’t have to worry about taxes. It’s like a digital garage sale. But stepping into the business grounds makes things get more interesting. Let’s say you’re one of those creative souls selling your handmade crafts on Etsy. That’s a business, and guess what? Taxes enter the picture.

So, what’s the lowdown on taxes for Etsy sellers? Do they need to deal with all that tax stuff? Well, buckle up, and let’s find out.

When to consider your Etsy sales a business?

Let’s first clarify the difference between your hobby sales and a business. After all, your tax obligations depend on that.

While Etsy doesn’t lay an exact line in the sand for when your Etsy hustle switches from casual selling to official business, they do offer some pointers. Etsy suggests you might be running a business if you consistently sell items you’ve made, resell items you’ve purchased, or even sell items you’ve acquired with the intention of reselling. Basically, if you treat your Etsy experience as more than just a hobby or a one-time thing, you’re likely treading into business waters.

As you can see, there’s no black or white here – no strict rule like “after 50 sales” or “once you make $1000”, making it more of a gray zone. A good rule of thumb, at this point, is to look at what the IRS has to say about it. And according to them, if you’re making a regular profit off your sales, it’s really a business.

Do you need a taxpayer ID to sell on Etsy?

So, you run a business on Etsy. Congrats on that! At this point, as mentioned above, you pay taxes. And before we go and break down the whole scope of taxes you will have to face, let’s talk about you as a taxpayer.

Do you need any taxpayer ID to sell on Etsy as a business? The short answer is yes. But let’s look at it in more detail.

If you’re operating as a sole proprietor – meaning you’re not structured as a corporation, partnership, or limited liability company – your Social Security number can be your go-to for tax filing and reporting. However, if you fall under the business entity umbrella, you’ll require a federal employer identification number (EIN) to manage your tax responsibilities.

Even if you’re piloting a solo ship with your Etsy shop as a sole proprietor, you still have the option to acquire an EIN. This choice comes with certain advantages. You can bring employees on board, explore incorporation, establish a limited liability company or partnership, and even set up an individual 401(k) retirement plan.

Consider this: opting for an EIN instead of your Social Security number holds benefits. It enhances protection against identity theft and presents you as an independent contractor, adding credibility to your business endeavors. So, mull over the EIN path if you’re inclined to elevate your Etsy venture.

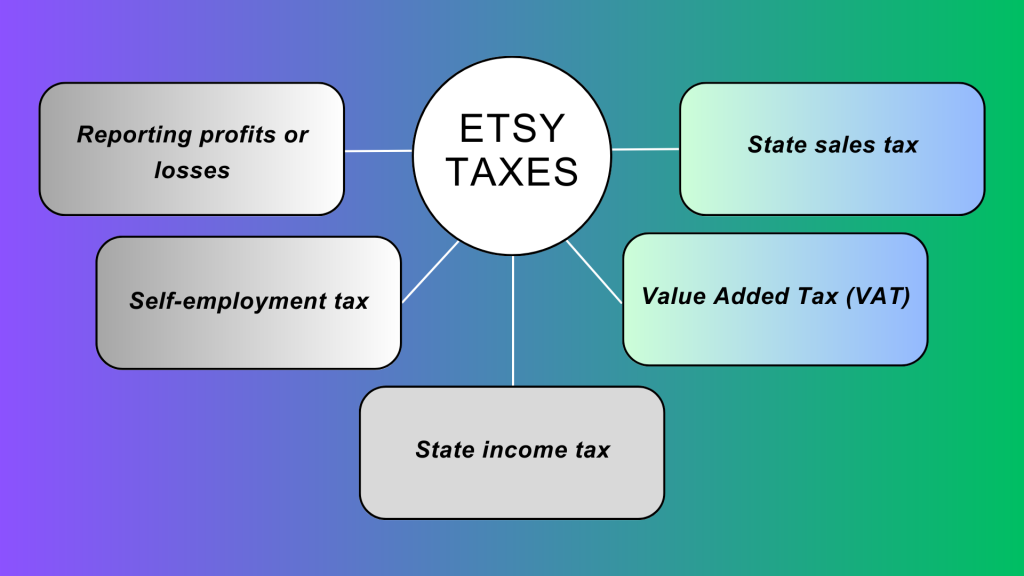

What taxes do you pay as a seller on Etsy?

For Etsy businesses that meet the official criteria, handling taxes on your earnings is part of the game. Understanding these Etsy tax twists and turns can make a real difference in how your business thrives. So, wrapping your head around these tax ins and outs is a smart move as you make your way through the Etsy world.

So let’s dive in the taxes mix you face as an Etsy seller.

etsy taxes

Reporting Etsy profits or losses

When reporting your profits or losses — every year you’ll roll up your sleeves and get cozy with a Schedule C. This nifty form is your way of telling the tax folks how much you’ve earned or possibly lost from your business efforts. And guess what? Whether your Etsy shop is officially stamped as a business or not, this step is still a must.

But hold on. There’s a twist. At hitting certain checkpoints, like keeping your business expenses on the down-low (around or under $5,000) and managing to dodge a business loss, you might be in for a treat. Instead of the regular Schedule C, you could use the simplified one – Schedule C-EZ form. It’s like taking a shortcut through tax paperwork, and who doesn’t love that? So, whether you’re a full-on business wizard or a part-timer on Etsy, the Schedule C dance is one you can’t skip.

Etsy self-employment tax

If you’re earning a solid $400 or more from your self-employed endeavors, it’s time to acquaint yourself with the self-employment tax scenario. This tax isn’t your typical kind; it encompasses both your Medicare and Social Security responsibilities.

But no need to stress – there’s no requirement to get worked up. Navigating this tax landscape involves engaging with a useful form known as Schedule SE. And you won’t be immersed in tax matters throughout the entire year; it’s a once-a-year affair. Think of it as a way to ensure you’re well-prepared for those appealing health and retirement benefits that await you down the line.

So, whether you’re a seasoned solo professional or just testing the waters of self-employment, the self-employment tax ensures you’re contributing your fair share towards those future benefits. And keep in mind, that yearly rendezvous with Schedule SE ensures everything remains aligned and in good standing.

Etsy state income tax

Depending on your location, your state might have its eye on a slice of your business earnings in the form of state income tax. This means that in addition to your federal tax obligations, you’ll also need to consider your state’s tax requirements.

Every state sets its own rules when it comes to taxing business income. Some states might have a flat rate that applies to all business earnings, while others might have a progressive tax system that takes into account the amount of income you make. This can add another layer of complexity to your tax situation, as you’ll need to navigate both federal and state tax regulations.

It’s important to research the specific tax laws in your state to understand what’s expected of you as a business owner. This might involve registering your business with the state’s tax agency, calculating your state business income tax liability, and ensuring that you meet all filing deadlines. Ignoring state tax obligations could result in penalties or legal issues down the line.

So, whether you’re based in a state with straightforward tax rules or a more intricate tax structure, being aware of your state’s income tax requirements is crucial for maintaining a smooth sailing business journey.

Etsy state sales tax

Sales taxes on Etsy is a bit of a dance, but don’t worry, Etsy’s got your back in many states. They take the lead when it comes to collecting and remitting sales tax for the physical items you’re selling. But that’s not all – they’re quite the multitaskers.

For starters, they also manage sales tax for digital downloads in a bunch of states. Yep, that includes both those “instant” downloads that customers can snag right away and the personalized “made-to-order” ones that require a bit more crafting on your end.

In a nutshell, Etsy’s handling the sales tax choreography for your items. So, while you’re focused on curating and creating, they’re making sure the tax steps are in sync across states and digital realms alike. It’s all about keeping the financial dance smooth and harmonious for both you and your customers.

Etsy Value Added Taxes (VAT)

If you’re well-versed in the world of Value Added Tax (VAT), there’s an additional layer to consider for your Etsy products. You might find yourself needing to apply a VAT charge to the items you’re selling on the platform. Luckily, in certain cases, Etsy steps up to the plate by handling the responsibility of collecting and forwarding this tax on your behalf. This takes some of the administrative burden off your shoulders.

However, it’s wise to keep in mind that VAT doesn’t limit itself to just the products you sell. You might also encounter VAT in relation to certain fees associated with your Etsy activities. This adds another layer of complexity to your financial considerations.

In essence, being a VAT-savvy seller involves carefully navigating the intricacies of VAT charges, collections, and potential fees. As Etsy aids in streamlining this process for you, it’s important to stay informed about the details of VAT regulations and how they pertain to your specific shop and situation.

How often do you pay taxes selling on Etsy?

From what taxes to pay, let’s move to how often you should pay your Etsy taxes.

The rhythm of tax payments when you’re selling on Etsy isn’t a one-size-fits-all scenario; it varies based on factors like your business structure, location, and earnings. Generally, taxes aren’t deducted automatically from your Etsy sales like they might be from a paycheck. Instead, you’re responsible for setting aside a portion of your earnings to cover your tax obligations.

For income taxes, if you’re in the United States, you typically pay these on a yearly basis. Sole proprietors might pay estimated quarterly taxes to the IRS. These are like advance payments to cover your annual income tax bill.

On the other hand, if you’re required to collect and remit sales tax, the frequency of payments depends on your state’s regulations. Some states might require monthly sales tax remittance, while others might be quarterly.

It’s important to stay on top of your earnings, expenses, and potential tax obligations throughout the year. Consulting a tax professional can be extremely helpful in determining the appropriate schedule for your tax payments based on your specific circumstances.

How can Synder help track sales and taxes efficiently?

Synder offers a streamlined solution for tracking sales and taxes, making financial management a breeze for businesses. With Synder, you can seamlessly integrate your e-commerce platforms like Etsy, ensuring that all sales data is captured accurately. This eliminates the hassle of manual data entry and reduces errors.

The platform categorizes transactions and syncs them with your accounting software, whether it’s QuickBooks, Xero, or others. This categorization simplifies the process of sorting and reporting your income and expenses, ultimately aiding in accurate tax calculations.

For a comprehensive guide on transacting and handling payments on Etsy, explore Etsy Payments.

Synder’s intelligent automation extends to sales tax management. It automatically calculates sales tax based on your business’s location and your customers’, ensuring compliance with tax regulations. This feature not only saves time but also reduces the risk of miscalculations and penalties.

In essence, Synder acts as your financial ally by effortlessly organizing your sales data, automating tax calculations, and seamlessly integrating with your accounting software. This holistic approach streamlines your financial management process, allowing you to focus on growing your business.

Should you believe that Synder might be the right solution for your business, Book a seat at our webinar or sign up for a free trial to learn more about how it can address your particular business needs.

Bottom line

Making the long story short, navigating the world of Etsy taxes as a seller involves understanding the transition from casual selling to a business, obtaining the necessary taxpayer ID, and comprehending the array of taxes that come into play. Recognizing when your Etsy endeavor becomes a business venture is essential, as is choosing between your Social Security number and an EIN for tax filing. The various taxes, including income tax, self-employment tax, state income tax, state sales tax, and VAT, require careful consideration and adherence to regulations. Remember that the frequency of tax payments depends on factors like business structure and location, and seeking professional advice is a prudent step to ensure you manage your tax obligations effectively. By grasping these key aspects, Etsy sellers can confidently navigate the tax landscape and pave the way for a successful and compliant business journey.

If you’re looking for alternative platforms to Etsy, consider exploring our guide on Choosing an Etsy Alternative. It provides insights into other platforms that may suit your needs.”