In the rapidly evolving world of e-commerce, businesses need reliable and efficient solutions to process online payments seamlessly. Two prominent players in this field are Stripe and PayPal. While many have to make a decision whether to choose Stripe over PayPal or vice versa, others wonder if they can leverage both platforms to provide a better experience to their customers.

Let’s explore whether Stripe and PayPal can work together and how this collaboration can benefit small businesses. We’ll compare the pros and cons of each platform, provide a guide to integrating Stripe and PayPal, and touch upon improving accounting for Stripe and PayPal to maximize the potential of both systems for your business.

Hop on reading to learn more about:

1. A general view of Stripe and PayPal as platforms for processing payments

2. Stripe vs. PayPal: pros and cons for small businesses

3. Why would businesses want to use both Stripe and PayPal?

4. Stripe PayPal integration: how to make both Stripe and PayPal work for your business

- Integrating Stripe and PayPal into your website

- Integrating Stripe and PayPal into e-commerce platforms

- Integrating Stripe and PayPal into marketplaces

- Using WPForms for Stripe and PayPal integration

5. Best practices and tips for successful integration of Stripe and PayPal

6. How to account for Stripe and PayPal payments efficiently

A general view of Stripe and PayPal as platforms for processing payments

Stripe and PayPal are two prominent platforms in the world of payment processing, each offering unique features and services to businesses and individuals. Understanding what sets them apart can help you make informed decisions about which platform is best suited for your payment processing needs, or how you can leverage using them both.

What is Stripe?

Stripe is a comprehensive payment infrastructure designed to simplify the complexities of accepting online payments. It provides businesses with a developer-friendly solution, offering a range of powerful tools and customizable features.

Stripe’s robust APIs enable seamless integration of payment processing into websites and applications. It supports various payment methods, including credit cards, digital wallets, and local payment options, making it a versatile choice for businesses operating on a global scale.

Stripe also prioritizes security, ensuring that sensitive payment information is protected throughout the transaction process. With its user-friendly interface and extensive features, Stripe empowers businesses to streamline their payment processes and enhance the overall customer experience.

What is PayPal?

PayPal is a well-established online payment system that has revolutionized digital transactions. It allows individuals and businesses to send and receive payments securely, both domestically and internationally. With PayPal, customers can make payments using their PayPal accounts or credit/debit cards, leveraging flexibility and convenience.

PayPal offers additional services like PayPal One Touch, enabling faster checkouts by eliminating the need for repeated logins or card details. Businesses can integrate PayPal Checkout buttons into their websites, simplifying the payment process for customers.

PayPal is known for its strong buyer and seller protection policies, providing peace of mind to both parties involved in a transaction. As one of the most recognized and trusted payment platforms, PayPal continues to be a preferred choice for many consumers and businesses worldwide.

In a nutshell, both Stripe and PayPal are leading platforms in the payment processing industry. While Stripe excels in its developer-friendly infrastructure and versatile payment options, PayPal offers a user-friendly interface and strong buyer and seller protection. Combining both options can be beneficial for a business (we’ll get to it a little further), however, you might also want to consider potential bottlenecks of the combination.

Stripe vs. PayPal: pros and cons for small businesses

As a business owner, understanding the differences between Stripe and PayPal is critical when choosing the right payment processing platform for your small business. Not only does it impact your ability to accept payments effectively, but it also influences your accounting and overall financial management. Let’s look in more detail at the pros and cons of each platform to see what businesses can leverage and look out for to make the most of their experience with these payment processors.

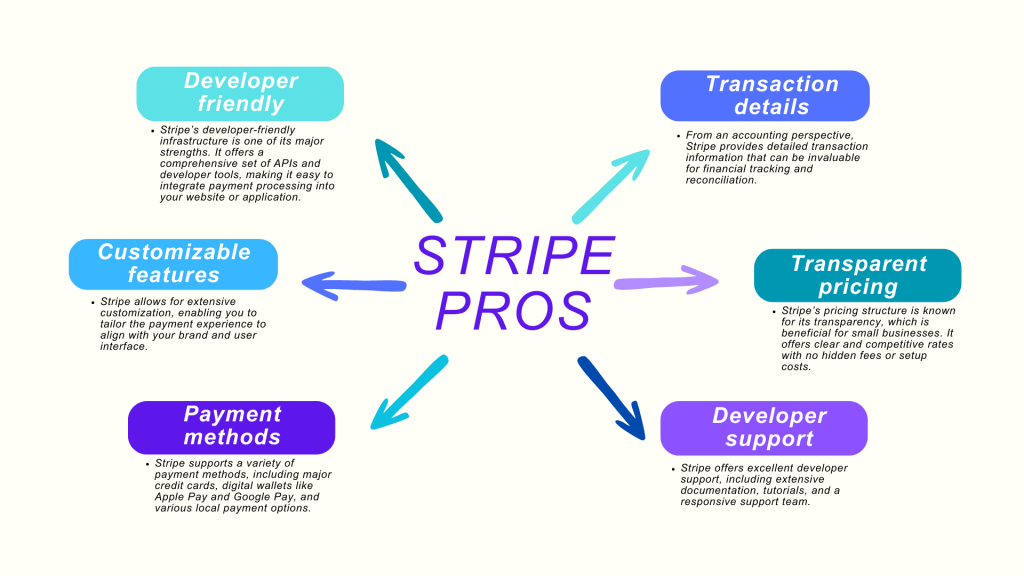

Stripe pros

Stripe comes with a bunch of advantages, including developer-friendly infrastructure, customizable features, a wide range of payment methods, detailed transaction information, transparent pricing structure, and robust developer support, allowing small businesses to enhance their payment processing capabilities and deliver a seamless payment experience to their customers.

- Developer-friendly infrastructure

Stripe’s developer-friendly infrastructure is one of its major strengths. It offers a comprehensive set of APIs and developer tools, making it easy to integrate payment processing into your website or application. Whether you have an in-house development team or rely on external resources, Stripe provides the necessary resources and documentation to streamline the integration process.

- Customizable features

Stripe allows for extensive customization, enabling you to tailor the payment experience to align with your brand and user interface. You have control over the checkout flow, design, and user experience, ensuring a seamless and cohesive payment process for your customers.

- Wide range of payment methods

Stripe supports a variety of payment methods, including major credit cards, digital wallets like Apple Pay and Google Pay, and various local payment options. By offering multiple payment methods, you can cater to the preferences of a broader customer base, improving conversion rates and customer satisfaction.

- Detailed transaction information

From an accounting perspective, Stripe provides detailed transaction information that can be invaluable for financial tracking and reconciliation. You can access comprehensive reports, including transaction history, settlement details, and customer information, simplifying the bookkeeping and reporting processes for your business.

- Transparent pricing structure

Stripe’s pricing structure is known for its transparency, which is beneficial for small businesses. It offers clear and competitive rates with no hidden fees or setup costs. You can easily calculate and forecast your payment processing expenses, helping you make informed financial decisions.

- Excellent developer support

Stripe offers excellent developer support, including extensive documentation, tutorials, and a responsive support team. If you encounter any technical challenges or have questions during the integration process, Stripe’s resources and support channels are available to assist you promptly.

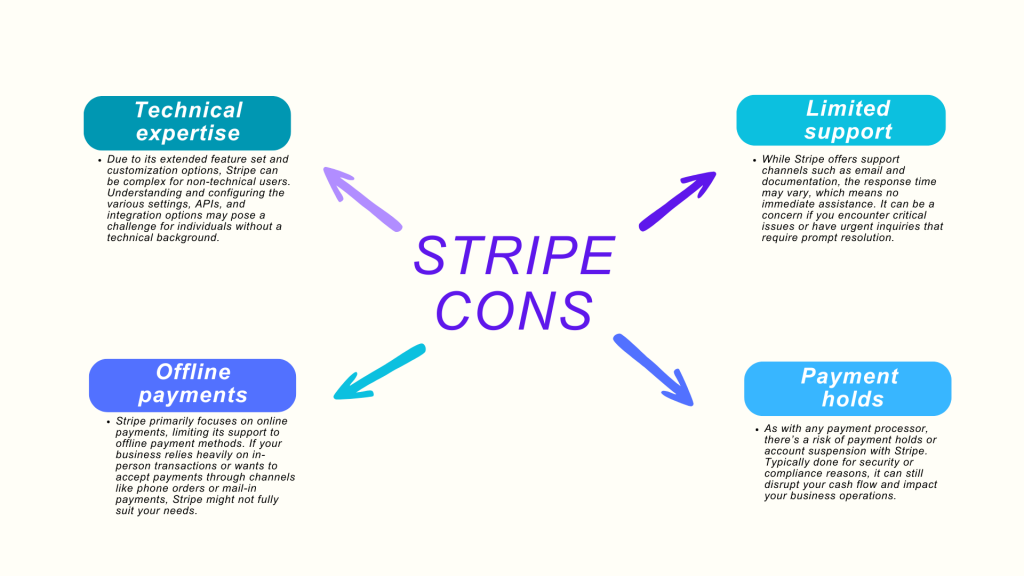

Stripe cons

At the same time, Stripes brings several limitations you might want to consider when choosing this platform as your payment processor.

- Technical expertise required

While Stripe’s developer-friendly infrastructure is a benefit, it can also be a drawback for business owners or accountants without technical expertise. Due to its extended feature set and customization options, Stripe can be complex for non-technical users. Understanding and configuring the various settings, APIs, and integration options may pose a challenge for individuals without a technical background. This complexity may result in a steeper learning curve and potentially slower implementation for businesses without the necessary resources.

- Limited customer support availability

Another potential drawback of Stripe is that its customer support may not always be easily accessible. While Stripe offers support channels such as email and documentation, the response time may vary, which means no immediate assistance. It can be a concern if you encounter critical issues or have urgent inquiries that require prompt resolution.

- Risk of payment holds and account suspension

As with any payment processor, there’s a risk of payment holds or account suspension with Stripe. Typically done for security or compliance reasons, it can still disrupt your cash flow and impact your business operations. Ensuring compliance with Stripe’s terms of service and industry regulations can minimize the likelihood of account-related issues.

- Limited offline payment support

Stripe primarily focuses on online payments, limiting its support to offline payment methods. If your business relies heavily on in-person transactions or wants to accept payments through channels like phone orders or mail-in payments, Stripe might not fully suit your needs. At this point, you might want to explore alternative payment processors that specialize in offline payments or research for some workarounds.

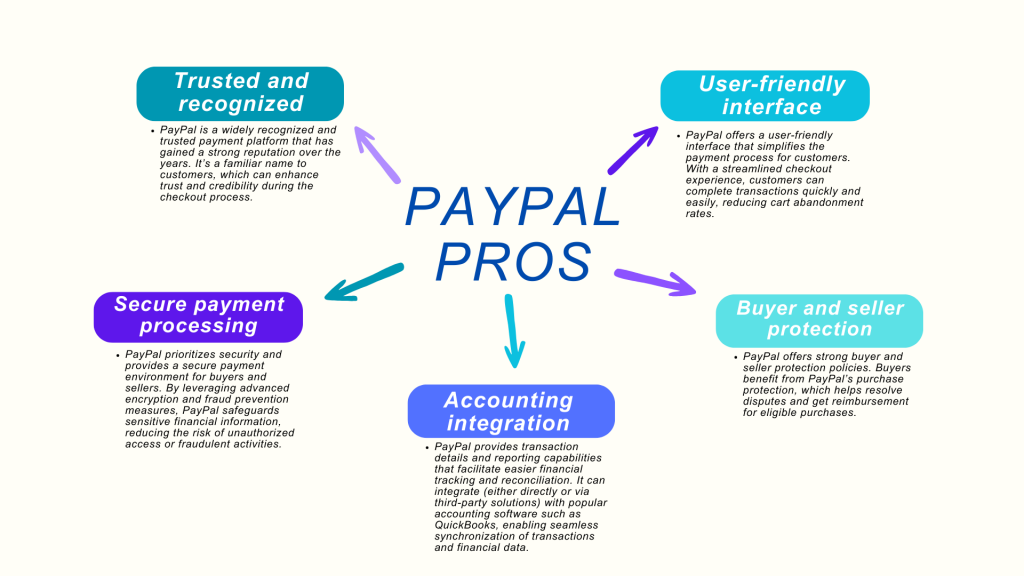

PayPal pros

PayPal offers numerous advantages: from worldwide recognition to the high level of security that businesses can leverage to build a trustworthy relationship with customers.

- Trusted and recognized

PayPal is a widely recognized and trusted payment platform that has gained a strong reputation over the years. It’s a familiar name to customers, which can enhance trust and credibility during the checkout process. The recognizable PayPal logo and brand association can instill confidence in buyers and thus increase conversion rates.

- User-friendly interface

PayPal offers a user-friendly interface that simplifies the payment process for customers. With a streamlined checkout experience, customers can complete transactions quickly and easily, reducing cart abandonment rates. PayPal’s interface is intuitive and familiar to many users, creating a seamless payment experience across devices.

- Secure payment processing

PayPal prioritizes security and provides a secure payment environment for buyers and sellers. By leveraging advanced encryption and fraud prevention measures, PayPal safeguards sensitive financial information, reducing the risk of unauthorized access or fraudulent activities. This level of security can instill trust in customers and protect your business from potential fraud-related losses.

- Buyer and seller protection

PayPal offers strong buyer and seller protection policies. Buyers benefit from PayPal’s purchase protection, which helps resolve disputes and get reimbursement for eligible purchases. Sellers benefit from Seller Protection, which safeguards against unauthorized transactions and fraudulent claims, reducing the risk of financial losses.

- Integration with accounting software

PayPal provides transaction details and reporting capabilities that facilitate easier financial tracking and reconciliation. It can integrate (either directly or via third-party solutions) with popular accounting software such as QuickBooks, enabling seamless synchronization of transactions and financial data. This integration simplifies the bookkeeping process and enhances accuracy in financial reporting.

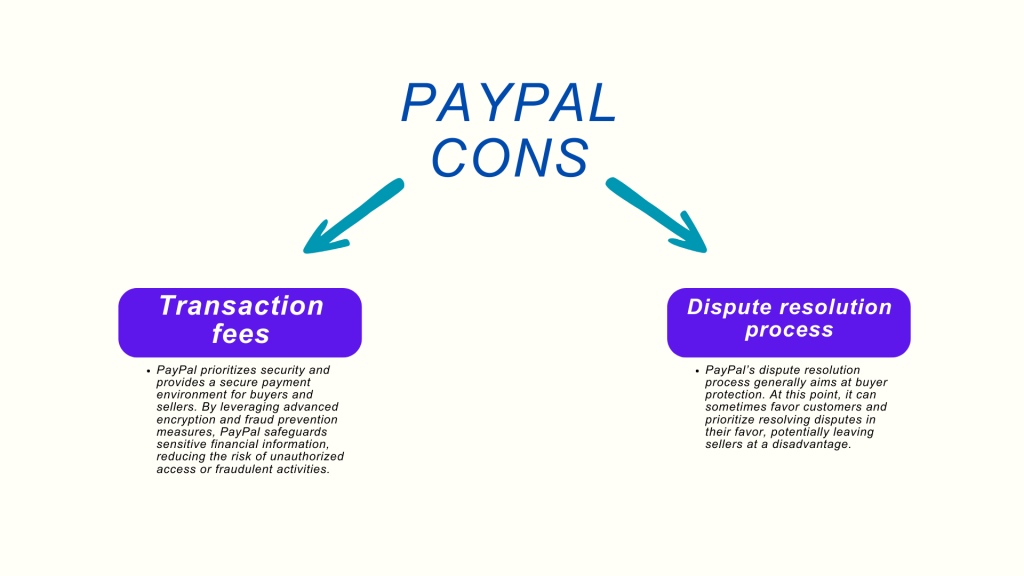

PayPal cons

Still, there are a couple of drawbacks you can stumble upon using PayPal as a payment processor.

- Transaction fees

One potential downside of PayPal for small businesses is its transaction fees, which can be relatively higher compared to other payment processors like Stripe. These fees are typically a percentage of the transaction value and can impact your bottom line, especially if you have a high volume of sales. It’s essential to consider the transaction fees and factor them into your pricing strategy and profit margins.

- Dispute resolution process

PayPal’s dispute resolution process generally aims at buyer protection. At this point, it can sometimes favor customers and prioritize resolving disputes in their favor, potentially leaving sellers at a disadvantage. To mitigate this risk, you might want to maintain quality customer service, clear refund policies, and comprehensive documentation to support your case in the event of a dispute.

To make a long story short, Stripe and PayPal both have bright and darker sides. So, as a business owner, you might want to be aware of everything you’re going to face and come to a decision having a deep understanding of your capabilities to implement and maintain the payment processor of your choice, the possibility of easily accounting for payments received through the payment platform, and the preferences of your customers on the markets you sell to. At this point, your decision on which payment processor to choose – Stripe or PayPal – will be well-informed, saving you from troubles in the long run.

Why would businesses want to use both Stripe and PayPal?

Many businesses, however, prefer not to choose between the platforms but go with both to leverage the unique advantages and reach a broader customer base. This sort of Stripe-PayPal collaboration can be beneficial at many points if approached strategically, allowing businesses to maximize their payment processing capabilities and provide a seamless experience for their customers.

Let’s break it down.

Diversity of payment methods

By integrating both Stripe and PayPal, businesses can extend the range of payment options they offer to their customers. While Stripe supports various credit cards, digital wallets, and local payment methods, PayPal allows customers to pay using their PayPal accounts or credit/debit cards. This way, businesses can cater to the preferences of different customer segments, increasing the likelihood of completing transactions.

Enhanced conversion rates

Some customers may have a strong preference for one payment method over the other. By offering Stripe and PayPal, businesses eliminate any potential friction in the payment process and provide more flexibility and a better experience to a larger customer base. As a result, conversion rates might improve, as customers can choose the payment method they trust and feel most comfortable using.

Global reach

Stripe and PayPal have different geographic coverage. Stripe is available in many countries. Still, PayPal has a more extensive global presence. Integrating both platforms enables businesses to expand their reach and tap into international markets where customers prefer using PayPal. It can be particularly beneficial for e-commerce businesses targeting customers from various regions.

Risk mitigation

Diversifying payment processors allow businesses to mitigate the risk associated with relying solely on one platform. If there are any issues or disruptions with one payment processor, having an alternative can ensure business continuity. It provides a backup solution to keep accepting payments and avoid potential revenue losses due to payment processing interruptions.

Stripe PayPal integration: how to make both Stripe and PayPal work for your business

Stripe and PayPal work perfectly well together and can be integrated into e-commerce websites, platforms, and marketplaces to facilitate seamless transactions. It’s worth mentioning that speaking of integration, we don’t mean the integration between those platforms (like connecting one to the other and turning them into a sort of single payment gateway for both) but the integration of both payment processors into a website. They’ll still be working as separate platforms and processing payments independently.

You can handle the integration in several ways, including direct integration, integration via plugins and payment gateway solutions, and more, depending on where you need to implement payment processing. We’ll look at them right below.

Disclaimer: Please be advised that those are examples of how you can perform Stripe and PayPal integration, not actual instructions. For any guidance and steps of implementation, turn to the corresponding websites and support services.

Integrating Stripe and PayPal into your website

If you run a dedicated website to sell your products and services, you can consider the following means of integrating Stripe and PayPal.

API integration

Both Stripe and PayPal offer developer-friendly APIs that allow businesses to integrate their payment processing functionality directly into their website. Developers can utilize the documentation and resources provided by Stripe and PayPal to implement the necessary code and create a seamless payment experience for customers.

Plugin integration

Many content management systems (CMS) and e-commerce platforms provide plugins or extensions that support Stripe and PayPal integration with minimal setup required. By installing and configuring the appropriate plugin, businesses can quickly start accepting payments through both payment processors.

Third-party payment gateways

Several third-party payment gateway solutions, such as Braintree or Square, support integration with both Stripe and PayPal. These payment gateways act as intermediaries, enabling businesses to connect their website or platform to multiple payment processors, including Stripe and PayPal, streamline the integration process, and manage transactions from different payment sources more efficiently.

Integrating Stripe and PayPal into e-commerce platforms

Various e-commerce platforms can drastically facilitate running an e-commerce business, including Stripe and PayPal implementation to receive and manage payments. Let’s look at some examples.

WooCommerce

WooCommerce, a popular e-commerce platform built on WordPress, offers built-in support for Stripe integration. You might want to configure the necessary settings within the WooCommerce plugin to connect your Stripe account to the WooCommerce store and start accepting payments seamlessly.

Similarly, WooCommerce provides native integration with PayPal. Businesses can enable PayPal as a payment option within WooCommerce, allowing customers to choose PayPal as their preferred payment method during the checkout process.

Shopify

Shopify, a leading e-commerce platform, allows businesses to integrate Stripe directly into their online stores. By setting up a Stripe account and connecting it to Shopify, they can accept payments through Stripe.

Shopify also supports PayPal integration, enabling businesses to offer PayPal as a payment option. By linking a PayPal account to Shopify, they can expand their payment options and cater to customers who prefer using PayPal.

Integrating Stripe and PayPal into marketplaces

Marketplace platforms like Etsy, Amazon, eBay, and others provide unique opportunities for businesses to reach a vast customer base and increase sales. Integrating payment processors like Stripe and PayPal into these marketplaces can enhance the payment experience for both sellers and buyers. It’s worth mentioning that not all of them allow for adding both PayPal and Stripe. But at least one of these payment processors can supplement the payment processing options these marketplaces offer (the majority provide their own solutions).

Etsy

Etsy offers its own payment processing solution called Etsy Payments. It allows sellers to accept various payment methods, including credit cards, debit cards, and Etsy gift cards.

At the same time, Etsy supports PayPal integration as an additional payment option for buyers. Sellers can link their PayPal account to their Etsy shop, allowing customers to choose PayPal as their preferred payment method during checkout.

Amazon

Amazon Pay is a payment processing service provided by Amazon. Sellers can integrate Amazon Pay into their Amazon Seller Central account, enabling customers to make purchases using their Amazon account information. Amazon Pay supports credit cards, debit cards, and bank transfers.

Amazon also allows sellers to integrate third-party payment gateways, including Stripe and PayPal. Sellers can set up their Stripe or PayPal accounts, configure the necessary settings within their Amazon Seller Central account, and start accepting payments through these payment processors.

eBay

PayPal has historically been the primary payment method on eBay. Sellers can link their PayPal account to their eBay seller account, and buyers can make payments using their PayPal accounts or credit/debit cards processed through PayPal.

eBay has since transitioned to its own managed payment system. While this system initially didn’t support PayPal, eBay has expanded its managed payments program to include it as a payment option, allowing sellers to continue accepting PayPal payments.

Using WPForms for Stripe and PayPal integration

WPForms is a popular WordPress form builder plugin supporting integration with both Stripe and PayPal. So if a business has a website on WordPress as a sales channel, they might leverage it to accept payments through both payment processors.

Stripe Add-On

WPForms offers a Stripe add-on that allows businesses to connect their Stripe account and embed payment forms into their website. Customers can securely enter their payment information, and Stripe will process the transactions.

PayPal Add-On

WPForms also provides a PayPal add-on, enabling businesses to integrate PayPal into their forms. Customers can choose it as their payment method, and thus, transactions will be securely processed through PayPal.

Best practices and tips for successful integration of Stripe and PayPal

To ensure a smooth and successful integration of Stripe and PayPal and make the most of it, you might want to consider the following best practices:

- Clearly communicate to customers that you accept payments through both Stripe and PayPal. Display recognizable logos for both payment methods during checkout to build trust and confidence.

- Streamline the checkout process to minimize friction and increase conversions. Ensure the integration handles redirects between Stripe and PayPal, maintaining a consistent user experience.

- Assure customers that their payment information is secure by highlighting the security measures implemented by both Stripe and PayPal, including SSL encryption, PCI compliance, and fraud detection systems.

- Encourage customers to choose a specific payment method by offering incentives such as discounts, exclusive promotions, or faster order processing. It can help drive the adoption of your preferred payment method while providing choices to customers.

- Keep track of updates and changes in Stripe and PayPal APIs, features, and policies. Regularly update your integration to ensure compatibility and take advantage of new functionality.

How to account for Stripe and PayPal payments efficiently

Being able to receive payments from both Stripe and PayPal brings us to critical questions about how to manage these payments efficiently. No doubt, it’s essential for businesses to maintain accurate financial records and streamline their accounting processes. However, handling payments from multiple processors can come with potential bottlenecks. So, let’s look at those and figure out how to address them.

Potential bottlenecks of managing payments from both Stripe and PayPal

Managing payments from multiple payment processors can present several challenges. Those include:

- Complexity and fragmented data

Handling payments from different processors can lead to a fragmented data landscape, hampering effective consolidation and analysis of payment information.

- Manual data entry

Without automated solutions, manually entering payment data from multiple processors can be time-consuming and error-prone, increasing the risk of inaccuracies in financial records.

- Reconciliation challenges

Reconciling payments from different processors with corresponding invoices or sales records can be difficult without a streamlined process, potentially leading to discrepancies in revenue recognition and financial reporting.

- Inconsistent reporting

Varying reporting formats and customization options across payment processors can hinder the generation of consistent and comprehensive reports, limiting financial visibility and analysis.

How to stay on top of Stripe and PayPal payments management?

Modern accounting software can facilitate handling payment data from multiple platforms. It’s especially true for solutions tailored for e-commerce businesses like Synder. Here’s how you can stay on top of accounting for Stripe and PayPal transactions and make sense of your e-commerce data to control your business performance and power strategic decisions.

- Automated transaction syncing

Synder automatically syncs transactions from multiple processors into the accounting system, eliminating manual data entry and ensuring accurate financial records.

- Reconciliation made easy

Synder’s reconciliation features match payments from different processors with corresponding invoices, simplifying the reconciliation process and ensuring accurate financial reporting.

- Unified dashboard and reporting

With Synder, businesses have access to a unified dashboard that provides a comprehensive view of payment transactions from multiple processors, enabling consistent and detailed reporting.

- Time and cost savings

By automating data entry and reconciliation, Synder saves businesses time and reduces the risk of errors, resulting in improved efficiency and cost savings.

- Compliance and security

Synder helps businesses stay compliant with payment processor requirements and security protocols, ensuring data privacy and reducing potential risks.

Should you believe Synder might be the right solution for your business, feel free to book office hours with the team to discuss your needs and how Synder can address them in more detail. You can also sign up for a free trial to explore the interface and capabilities of the software. Don’t hesitate to contact our team should you need assistance or have any questions.

Bottom line

Integrating Stripe and PayPal can provide small businesses with a powerful combination of features, flexibility, and customer trust. Businesses might want to consider the strengths and weaknesses of both platforms to make informed decisions and leverage the integration to optimize their payment processes. While managing payments from multiple payment processors can be challenging, geared with the right tools, businesses can overcome these bottlenecks, efficiently manage payments, maintain accurate financial records, and optimize their accounting processes.