Client accounting services, otherwise commonly known as CAS, have grown from a niche add-on to a core revenue stream for many firms worldwide. Back in 2022, industry forecasts predicted rapid growth in this area, and in 2025, it doesn’t seem to be slowing down in the slightest. In fact, firms saw a 17% median increase in CAS revenue in 2023 and projected up to 99% growth over the next three years, according to the latest CPA.com & AICPA CAS Benchmark Survey.

But growth alone isn’t enough. In fact, it isn’t anything at all without a proper foundation. Building a scalable and profitable CAS practice requires firms to have thoughtful pricing, clear service design, the proper technology, and the right team structure. So what does it actually take to build a profitable, scalable CAS practice? This article breaks down exactly how to get there, starting with your core services.

What core services should a CAS practice offer to ensure long-term profitability?

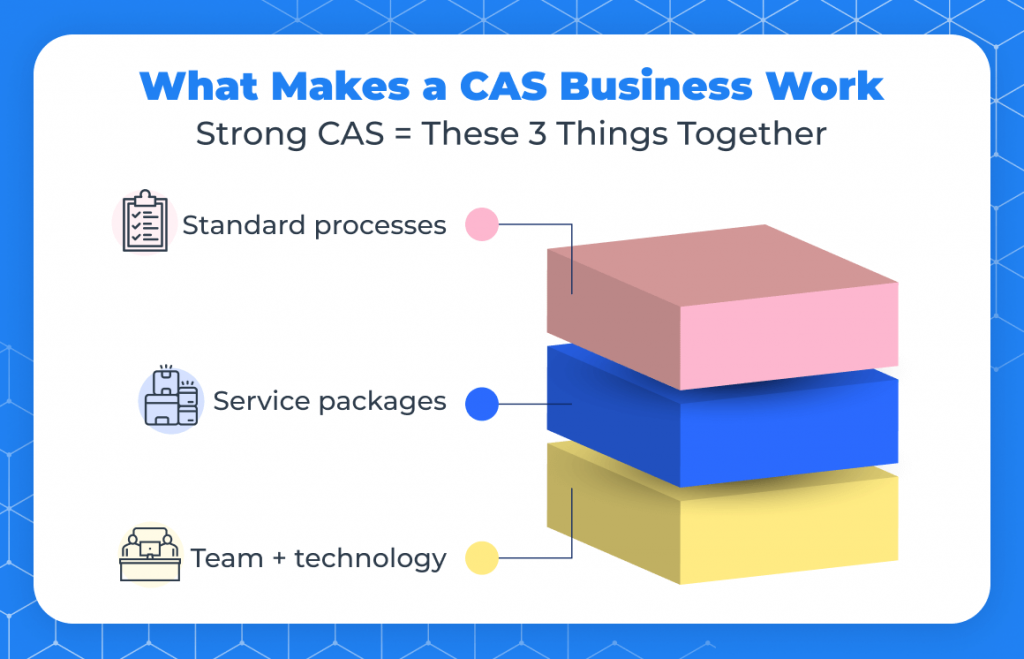

When it comes to ensuring long-term success in building a practice that’s scalable, sustainable, and repeatable, there are a few things to keep in mind.

Standardize & automate

To deliver consistently and scale effectively, you need structure. These practices help your firm decrease variability while freeing up capacity.

- Develop playbooks, templates, and automations for each core service to ensure consistency and efficiency.

- Build repeatability by staffing at the right levels and implementing standardized processes.

- Focus on sustainability through strong client relationships that foster trust and long-term value.

- To scale effectively, combine the right mix of technology and support staff, including offshore teams where appropriate.

Value-based packaging

Without structured packages, consistent pricing and scalable delivery become difficult.

- A good practice is to bundle your services into clearly defined tiers or packages.

This creates transparency for clients and allows for more consistent pricing and delivery.

Partner ecosystem

When it comes to growth, no firm grows in isolation. These tactics will help you expand your reach, tap into referrals, and better collaborate across teams:

- Cultivate referral relationships with key software vendors.

- Collaborate closely with your tax team to help them understand how CAS differs from traditional bookkeeping and write-up services so that they can identify cross-sell opportunities more effectively.

Continuous improvement

Just because something is working today doesn’t mean it’ll work flawlessly next year as well. These steps help you build a feedback loop that keeps your services sharp and competitive.

- Gather client feedback on a regular basis, such as through quarterly surveys. Net Promoter Scores (NPS) or service-specific surveys.

- Reinvest a portion of your revenue (for example, 10%) into R&D to refine tools and processes and support ongoing training.

Choosing the right CAS model for long-term profitability

Long-term profitability in CAS starts with designing a service model that finds value in the monthly, not just the year-end. Offering fixed-fee, recurring services like bookkeeping, reconciliation, and financial reporting builds the foundation. But the real growth happens when firms structure these services to scale into higher-value advisory.

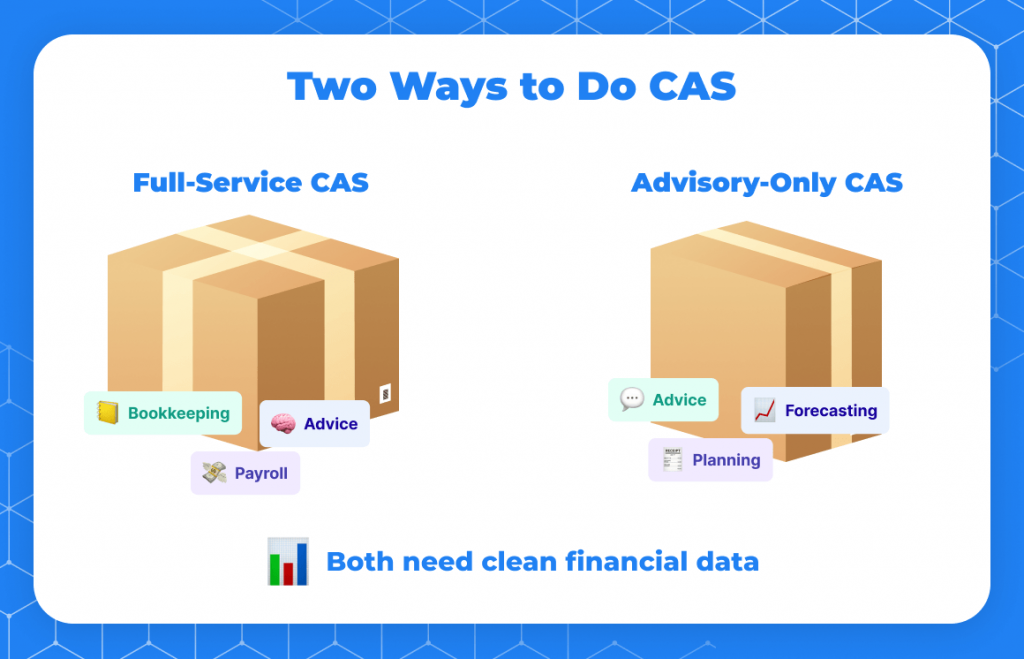

While these principles apply broadly, the way firms implement them often depends on whether they follow a full-service or advisory-only CAS model.

There are two main models emerging in the CAS space:

- Advisory-only CAS: Firms that choose not to handle the transactional layer and instead focus solely on interpreting clean data, offering strategic insights, forecasting, and decision support.

- Full-service CAS: Firms that offer both transactional (bookkeeping, payroll, AP/AR) and advisory services often build offshore or outsourced teams to maintain margin while owning the client relationship and data quality.

Both can be profitable, but regardless of the model, clean, reliable data is non-negotiable when it comes to accounting. Whether your firm manages the bookkeeping in-house, outsources it, or partners with a provider, there needs to be someone to ensure the books are accurate. Without that dedicated person in your corner, advisory simply doesn’t work.

Ultimately, the success of CAS is rooted in knowing your ideal client, pricing for value, and selecting the right service stack that supports margin, scale, and evolution over time.

Once your services are properly structured, the next step is deciphering how to scale delivery, and that starts with your technology.

How can technology be leveraged to scale a CAS practice efficiently?

Scaling a CAS practice efficiently begins with building a thoughtful tech stack, one that balances core functionality alongside flexibility.

Level 1: Build your operational core

First, start with your core tools: general ledger, bill pay, payroll, expense management, and reporting. Ideally, it would be best to opt for solutions that are industry-agnostic and integrate well with one another. All of these core tools combined will create the operational backbone of your CAS firm.

Level 2: Specialize and evolve

As your CAS practice matures and begins to specialize by industry, your tech stack should evolve in parallel. This might involve adopting industry-specific tools for verticals like construction, legal, or healthcare; software that offers in-depth insights; or automated workflows aligned to that niche.

Level 3: Turn efficiency into profitability

But here’s the major key many forget about: technology only drives efficiency when it’s paired with the right pricing model. If you’re still billing hourly, the time saved by automation won’t translate into increased profitability for your business. But with fixed fees in place, such as monthly, every efficiency gained through tech directly impacts your bottom line, which creates true scale, not just speed without profitability.

Ultimately, technology is the initial enabler, but strategy, pricing, and process are what turn tech into profit.

Of course, the most effective tech stack means very little in the long run without a pricing model that actually supports scale.

What pricing models work best for building a sustainable CAS business?

As previously stated, the most sustainable CAS pricing model out there is a monthly fixed fee. However, the success of this model hinges on conducting careful analysis and clear scoping prior to implementation. Here’s how to do that:

1. Conduct a prospect analysis

Review financials in detail, historical P&Ls, transaction volumes, and account complexity. Ask targeted questions to uncover one-off projects (cleanup, onboarding, quarterly/annual work) and ongoing monthly requirements.

2. Structure your fee bundles

Define service “buckets”: cleanup, special projects, onboarding, knowledge transfer, and quarterly/annual deliverables. Then, create tiered packages so prospects can self-select. Each tier has bound services, and upsells require moving up one level.

3. Precisely document scope

Spell out deliverables down to the number of accounts you’ll reconcile and the typical monthly transaction volume. Be sure to embed a volume-adjustment clause, e.g.,

“Pricing is based on transaction volume as of [Date]. If volume rises by more than 20% over any 60-day or 90-day period, the client will meet with the firm to renegotiate fees.”

Not only does this protect your margins when clients grow, but it also builds trust by committing to fee reductions if volumes decline.

4. Lock in your margin

Set fees before applying technology efficiencies. Any productivity gains from automation or process improvements should boost your firm’s margin, not be discounted for the client.

With pricing locked in, the next critical piece is structuring your team to deliver at scale without sacrificing quality.

How do you structure a team for growth and high-value client delivery in CAS?

Structuring your CAS team for growth means more than just hiring. It’s about aligning talent, training, incentives, and intentional design to deliver value at scale.

Begin by matching roles to the highest and best use of your talent. Too often, skilled CAS professionals are stuck in transactional work, creating a bottleneck in the workflow. To fix this, firms must first rethink incentives: your team won’t push work down, adopt new tech, or drive efficiency unless they’re incentivized to do so. Growth begins when team members are rewarded for creating capacity, not just doing the work.

That capacity is exactly what allows you to invest in upskilling, the exact gap Infinite Ties is helping firms fill. With a clear training roadmap, your team can evolve from processors to problem-solvers, gaining the skills to support higher-value advisory.

Now speaking from an operational standpoint, take the time to build a support engine beneath your core team: whether it’s offshore or onshore, create a structure that handles onboarding, transactional work, and cleanup.

But don’t stop there. To compete in the advisory space, you’ll need to expand the definition of “accounting talent.” Bring in experts in FP&A, data analysis, CFO services, and innovation. Hire or designate a tech-forward lead to own your CAS stack and client automation strategy.

However, even with the right team in place, businesses can still hit major roadblocks if they fall into a reactive rather than a proactive mindset.

What are the most common pitfalls firms face with their CAS practice, and how can they be avoided?

The biggest pitfall, without a doubt, is building reactively instead of strategically. Too many firms launch CAS to solve today’s problems. Perhaps a client needs help with bill pay, or there’s a staffing gap in bookkeeping, so they start layering services without a scalable plan in place.

This “build-as-you-go” approach might get the practice off the ground in the beginning, but it rarely leads to long-term sustainability. In fact, it often results in misaligned pricing, overextended teams, and tech stacks that don’t integrate, all of which enormously stall growth.

However, there is a clear solution to this pitfall that many don’t even realize is one to begin with. It’s simple: pause and assess. Start off by evaluating your current service model, pricing, technology, team structure, and client segmentation. Then rebuild the foundation intentionally with scale, specialization, and profitability in mind.

Sustainable CAS success comes from thoughtful strategy, not rushed decisions. Don’t just build to solve today’s pain. Build with tomorrow in mind.

Tomorrow’s CAS practice starts today

At the end of the day, building a CAS practice isn’t rocket science; it’s utilizing your current tools and implementing new ones to lay the foundation. Standardize your core services and automate wherever possible. Make sure to price with intention by having fixed fees, clear scoping, and tiered packages for your clients. Create a team that supports both transactional delivery and advisory growth, and leverage tech not for speed but for strategy. And of course, continuously refine your model through client feedback and reinvestments.

Ultimately, growth in CAS isn’t linear. It’s layered in a well-thought-out manner. Make sure to align your team around capability, not just capacity, and you’ll unlock scalable, high-value delivery.