The first point when thinking of starting a new business is always understanding if it’s worth it. Can the business bring profit? Is it relevant in today’s market? In this article we’ll answer these questions about a bookkeeping business upfront, so that you can be sure you’re making the right choice.

Starting any business takes a number of steps to follow and the whole process may seem a bit overwhelming. This article focuses on starting a bookkeeping business and the major things you need to consider in the process.

Key takeaways:

1) Bookkeeping can be a low-investment and very rewarding career that doesn’t require a necessary formal education to start, but taking various training courses and later getting a licensure is what gives you the skills and credibility.

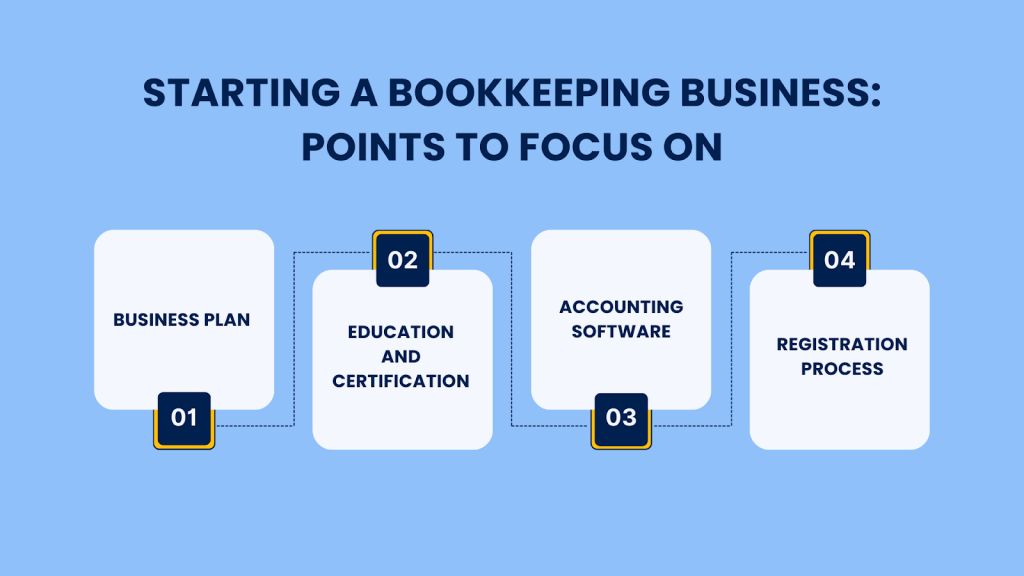

2) Acquiring necessary bookkeeping skills, developing a detailed business plan, and implementing accounting software are the major points to focus on when you decide to start a bookkeeping business.

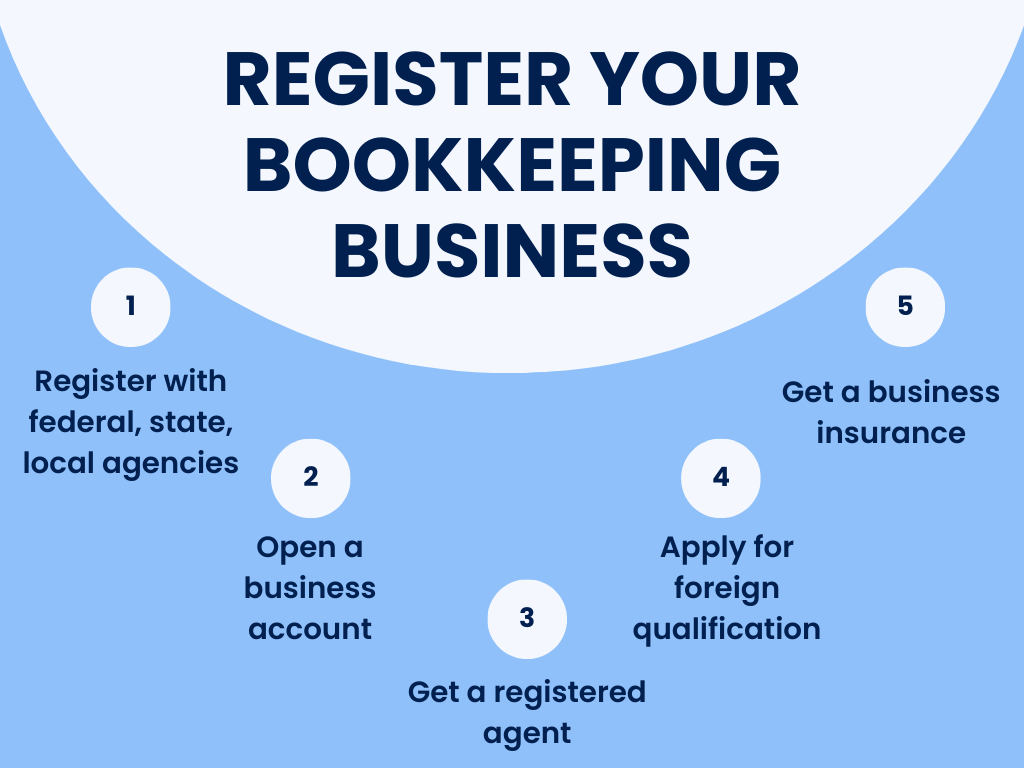

3) Registering a bookkeeping business consists of registration with federal, state and local agencies, getting a registered agent, applying for foreign qualifications (if necessary), getting a business account and insurance.

Contents:

2. Why bookkeeping? Benefits of the job

3. How much does it cost to start a bookkeeping business?

- Executive summary

- Company description

- Market analysis

- Marketing and sales strategy

- Management structure

- Operations plan

- Financial projections and growth strategy

5. Bookkeeper education and certification

7. Registration of your bookkeeping business

8. Bottom line

What is bookkeeping?

The first associations with the word “bookkeeping” are probably tons of manual work, long hours and complicated calculations. In fact, bookkeeping today is much simpler and more diverse thanks to cloud accounting.

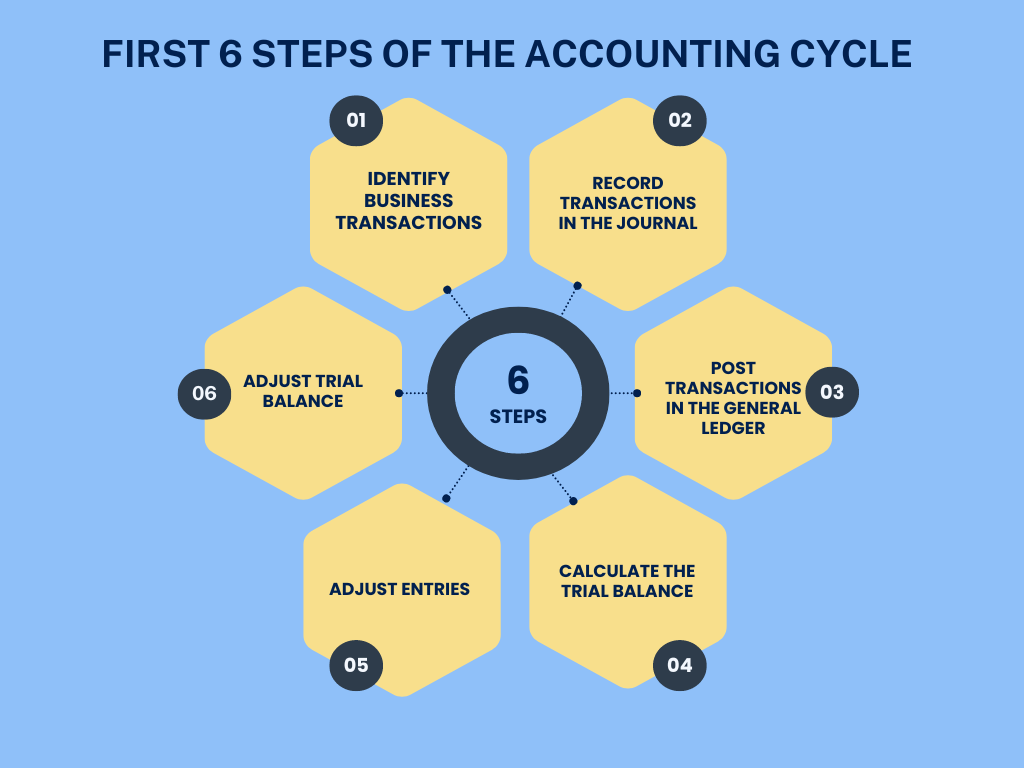

Essentially, bookkeeping means recording all the financial transactions that a business conducts, while accounting is more connected to analyzing the financial data and interpreting it. A bookkeeper normally covers the first six steps of the accounting cycle:

- Identifying business transactions;

- Recording transactions in the journal;

- Posting transactions in the general ledger;

- Calculating the trial balance;

- Adjusting entries;

- Adjusting trial balance.

Why bookkeeping? Benefits of the job

With a growing number of businesses opening up, the number of vacancies for bookkeepers should be consequently increasing. On the other hand, there’s a 6% expected employment decline for bookkeepers, accounting and auditing clerks in the period between 2022-2032, according to the U.S. Department of Labor’s Bureau of Labor Statistics. This is partially explained by the growth of cloud computing and adoption of automated accounting by many businesses. But it’s clear that accounting software is here to aid professionals not to replace them.

It takes time to get adjusted to the shift from manual bookkeeping to more analytical tasks, which is the point for professional growth. At the same time, taking into consideration the growing gap between the number of young people entering the industry and the number of bookkeepers heading for their retirement, the demand for the bookkeeping job is unlikely to fall drastically.

As we settled the question about the relevance of a bookkeeping job in today’s market, there might be some more questions to answer. Why bookkeeping? What are the benefits of the job?

Let’s address this question with the help of the person who has first-hand experience in discovering the career of a bookkeeper at the age of 38, which completely changed his life. Bill Von Fumetti is the CEO of Booming Bookkeeping Business and the Wall Street Journal bestselling author of Keyboard Rich. According to him, a bookkeeping business has a number of benefits making it very attractive for entrepreneurs:

Flexibility

A bookkeeping business can totally replace your 9-to-5 job, giving you more time with your family and friends. You can successfully do it while traveling as cloud accounting enables you to work from anywhere convenient, which is a good option in terms of work-life balance.

Minimal investment

Bill argues that unlike many other businesses that need significant investment, a bookkeeping business just needs an ordinary computer and choosing the right software, many of which are free for bookkeepers.

Relatively low entry barrier

Despite the popular belief that bookkeepers are math whizzes or geniuses, a bookkeeping job online now is simpler with the help of accounting software. However, no accounting software can substitute a set of skills and knowledge required to oversee the bookkeeping processes.

Reliability and profitability

A bookkeeping business can be both, a reliable source of extra income alongside your main career or a full-time six-figure business.

All in all, a bookkeeping business can be a viable online career that’s accessible, profitable, low investment, and a relatively simple option when you’d like to start a new business and achieve financial freedom.

How much does it cost to start a bookkeeping business?

Bookkeeping is considered to be one of the most profitable businesses, as it has almost no overhead costs. Basically, all you need is a computer, while the software might be available for free. So your costs mainly boil down to the salary, necessary business license from the city or state, and potential marketing expenses if you decide to invest in them. You could also factor in the expenses for bookkeeping certification and licensure, which can amount to up to $3,000. However, it’s optional for bookkeepers; it rather helps them stand out from the competition in the job market, where the average base salary is around $22 per hour. We’ll look at the education and certification process a bit later.

Business plan

If the benefits of starting a bookkeeping business and its low starting cost attract you enough to start your own company, the next thing you need to work on is your business plan consisting of the following points:

Executive summary

Executive summary briefly describes your bookkeeping business with its target market, unique selling proposition, mission, information about employees (if you plan to hire any). You can also highlight your financial goals and how you plan to achieve them.

Company description

This part defines the legal structure of your business (sole proprietorship, LLC, etc.), outlines the services you’ll offer (e.g., bank reconciliation, accounts payable/receivable management, payroll processing) and briefly explains your approach to bookkeeping and how it benefits clients.

Market analysis

The aim of this part of your business plan is to identify your target market, analyze the size and growth potential of your target market. One more important step here is to research your competitors and identify their strengths and weaknesses, which helps you see how your business can stand out.

Marketing and sales strategy

You need to define your marketing channels like online advertising, networking events, explain your pricing strategy and describe your sales process for acquiring new clients. In the case of a bookkeeping business marketing strategy, it’s sensible to think about a professional website, social network presence, LinkedIn page and joining professional business associations and local professional clubs.

Management structure

This part outlines the roles and responsibilities of your team highlighting relevant skills, the legal structure of your business.

Operations plan

Operation plan describes your bookkeeping workflow and technology stack, data security and privacy protocol, client onboarding and communication.

Financial projections and growth strategy

This part includes financial forecasts, including revenue projections, expense estimates, and break-even analysis. You can also specify your funding requirements if needed. Growth strategy presupposes your long-term vision for the business with a possible plan for expanding your service offerings or client base. You might also consider potential risks and mitigation strategies.

Business plan is not a requirement for a bookkeeping business, but drafting it helps to analyze many aspects and clarify your goals. At the same time a business plan can be a must when applying for business funding.

Bookkeeper education and certification

When you decide to open your own bookkeeping business, you might already have the necessary education and skills, or even the certification. If that is the case, you can skip this section. If you’re new to the accounting industry, there are some steps to consider before starting your own bookkeeping business.

Option 1: University degree

One way to get some knowledge about bookkeeping is to get a university degree in accounting, but that’s not necessary.

Option 2: Online programs

You can opt for online programs with Coursera, Udemi, Skillshare and other platforms, which will give you a set of necessary bookkeeping skills and the understanding of the sphere. You can start off with that and later think about the certification. There are also additional programs with a specific focus on particular areas like taxation for example.

Option 3: Certified bookkeeper certifications

A bookkeeping certification is the official proof of your skills that may play to your advantage on the market and give you national credibility. You can obtain such certification with the help of colleges, universities and accredited professional programs like the American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB).

To obtain your certification, you have to take an exam at a cost of under $450 for NACPB and a bit less than $600 for AIPB. All the candidates must either have a degree in accounting or complete the preparation courses and have previous one year or 2,000 hours of bookkeeping experience.

Option 4: Certification with QuickBooks

Another option is to get certification with QuickBooks for under $600. The popular accounting software provides QuickBooks comprehensive training program and QuickBooks Online Accountant program. It does make sense if you choose to work with QuickBooks.

All in all, any additional education and certification you choose to get in the process gives you more confidence and reliability in the field.

Accounting software

When the question with education and skills is settled, you’d want to choose the accounting platform to work with. The choice is really ample now with dozens of small businesses accounting software and enterprise accounting solutions.

Bookkeeping business with QuickBooks

Bill Von Fumetti’s choice is QuickBooks Online, as it allows you to create a free account for bookkeepers to run your business. QuickBooks is a platform that’s well-known in the industry and has multiple solutions, training materials and tutoring videos to help you work with it. As long as accounting software is user-friendly enough for small business owners to manage their own books, you don’t necessarily need to be a CPA to launch your own bookkeeping business. Since many small business owners prefer not to handle their own books, you can provide significant value to them by taking on this responsibility.

Bookkeeping business with Synder

If you’re starting your career as a bookkeeper, the odds are high that your clients will be ecommerce businesses that process a high number of transactions from various ecommerce platforms and payment gateways. In that case, you’ll also need an accounting integration to add up to your accounting platform. This is where Synder steps up to reconcile your clients’ multi-channel sales in QuickBooks, Xero and Sage Intacct, and categorize online sales automatically, getting accurate reports.

Synder’s smart duplicate detection feature will make you even more efficient. And with the roll back function, you can easily undo any transactions and re-sync them using new configurations.

Adding to that, Synder provides you with more than 25 integrations at no additional cost. You can choose between the daily summary mode where you get 1 general entry with an account of all your transactions for a day, or a more detailed per transaction mode, based on your accounting needs. Finally, you can join Synder’s exclusive Partner Program with special perks to discover.

Sounds promising, right? Join Syner’s Weekly Public Demo or go for a free trial to see how Synder be of help for your business.

Registration of your bookkeeping business

Once you have the toolset and the skills to do bookkeeping, the next step is to register your company. When it comes to a small business, the process of registration boils down to having your business name registered with the state and local government. But before venturing into this process, you need to settle three important things:

- Business structure (defined in your business plan);

- Business name;

- Location.

These things define the way your registration process goes, and we have detailed guide on how to register a business in the USA providing you all the necessary details on the process.

In a nutshell, the registration procedure consists of the following steps:

Step 1. Registration with federal agencies

Applying for federal tax ID, also known as EIN (Employer Identification number), trademark protection or tax exempt status, in most cases is the process of registration with federal agencies .

Step 2. Getting a registered agent

Getting a registered agent is necessary if your business structure is an LLC, corporation, partnership, or nonprofit corporation.

Step 3. Registration with state agencies

At this stage, you file all the necessary state documents and fees, which vary from state to state. The typical set of the documents includes your business name, location, ownership, management structure and registered agent. You might also apply for any necessary permits and licenses if required by the state. To clarify internal roles as you grow, consider downloadable sheets to map staff competencies, they help document who can handle which tasks as you formalize roles.

Step 4. Applying for foreign qualifications (if needed)

If you plan to operate in more than one state and your business structure is LLC, corporation, partnership, or nonprofit corporation, you need to apply for foreign qualifications. This point doesn’t concern sole proprietors.

Step 5. Registering with local agencies

This point concerns the businesses that chose an LLC, corporation, partnership, or nonprofit corporation as their structure. The process involves getting the necessary permits from the local government.

Step 6. Opening a business account

Your business will need a separate business account not to merge your private assets with your business assets.

Step 7. Getting a business insurance

The requirements of minimum business insurance vary depending on the state, but small businesses most likely get commercial insurance, business owner’s policy, professional malpractice and product liability.

Bottom line

A bookkeeping business today can give you the desirable flexibility and financial freedom with minimal investment. At the same time you always have the room for professional growth thanks to a variety of specialized bookkeeping courses and certification programs, which can give your business a competitive advantage and trustworthiness.

The most important moment to succeed with your bookkeeping business is to choose the right accounting software from the onset, follow a carefully drafted business plan and pay attention to the legal requirements in the registration process. While starting your own bookkeeping business might seem a bit overwhelming at the beginning, it can be a very fulfilling job to focus on.

Thanks for the article!

We’re very glad you enjoyed it! Thank you for your continuous support of our blog!