Unexpected problems are never easy and when they hit your business, your response and timing often define if you make it or break it. On December 27th, Bench shocked the business world with an abrupt closure, leaving over 12,000 U.S. businesses scrambling to access their critical accounting and tax records.

Bench as you knew it? No more. While it’s not really gone, the chaos speaks volumes. Now under Employer.com, Bench is working to steady the ship and restore operations—but will it sail smoothly or sink further? Only time will tell. In the meantime, a smart backup plan, like switching to a reliable, user-friendly solution, is your safest bet.

As frustrating as it is, it’s also your chance to level up. That’s why we’ve handpicked the best Bench accounting alternatives to turn this chaos into an opportunity. We will break them down one by one and find the perfect solution for your business. But first, let’s talk about what you’ll need for a smooth transfer.

Bench let you down? Here’s how to bounce

Here are the essentials you need to smoothly switch your company to a new accounting software:

- Trial balance: The backbone of your books, ensuring debits and credits are balanced for a smooth transfer.

- Balance sheet: Your financial snapshot—assets, liabilities, and equity all in one place, ready for the new system.

- Income statement (P&L statement): Tracks revenue, expenses, and net income, making sure your profitability history stays intact.

- General ledger: The hub of all transactions—transferring it ensures no data gets left behind.

- AR and AP details: Know what customers owe you, so no payments slip through the cracks (AR) and stay on top of vendor payments to avoid disruptions or late fees (AP).

- Bank and credit card reconciliations: Matches your records with statements to catch discrepancies and keep data accurate.

Why do you need these?

These aren’t just essentials—they’re your safety net. Nail them, and your transition will be seamless. Miss them, and you’re in for a headache.

| Still waiting for access to your Bench account? While their website is reportedly back online and access might be restored soon, the uncertainty lingers. Don’t wait in limbo—Synder can pull data directly from your sales channels, restoring your financial info in your new accounting platform, even if your original data isn’t available yet. |

Top accounting alternatives to the rescue

Not every Bench alternative will work for your business—and the clock is ticking. You need a solution that fits your needs and delivers results fast. Let’s cut to the chase: we’ve narrowed down the best options to keep you on track and get you fully prepared for tax season. Let’s begin.

Synder

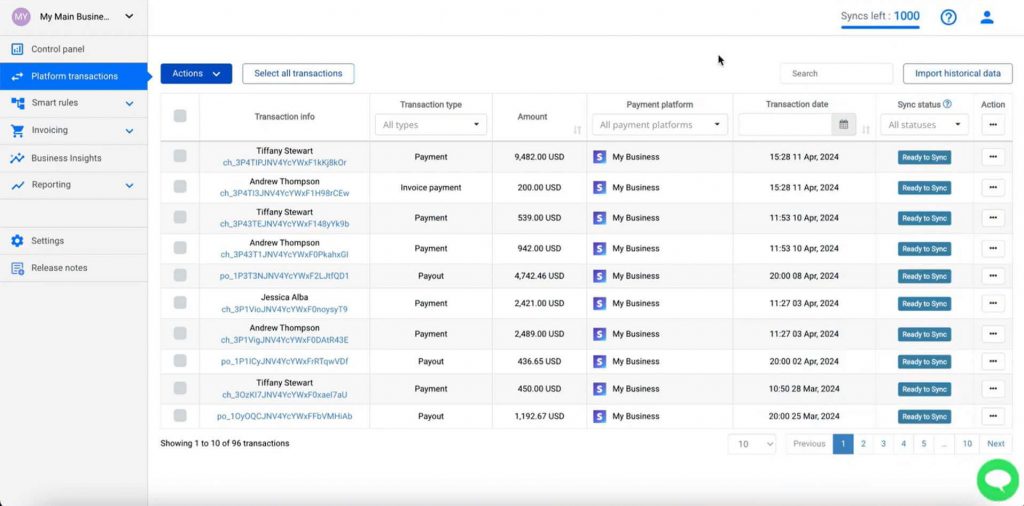

Synder is here to turn the Bench turmoil into triumph. Built for SaaS and retail businesses, it has revolutionized the accounting workflows of over 5,000 companies. But what makes it so special?

Synder seamlessly connects accounting platforms like QuickBooks Online, Xero, and Sage Intacct to over 30 sales and payment systems, creating a unified system for your financial data. By kicking manual data entry (and its drama) to the curb and organizing the way data lands in your books, it streamlines your workflow, gives you back control, and powers your business like never before. And the best part is it’s just the beginning.

Need a trusted guide to cut through the chaos left by Bench? Synder’s Accountants Directory unites 60+ vetted pros with years of experience serving businesses like yours who know Synder inside and out and are ready to take charge, guiding you through this critical time.

Why do both retail and SaaS businesses and accountants trust Synder? Here’s what it brings to the table:

Key features

- Automated data sync: Why juggle data when Synder can do it for you? Sync QuickBooks, Sage Intacct, or Xero with all your platforms—Amazon, Shopify, you name it. Choose between Summary Sync or Per Transaction modes for the perfect level of detail, capturing everything—costs, clients, products, taxes, and more.

- Historical data import: Need to start your books from scratch? Synder offers you unlimited access to historical data import, giving full flexibility and control over your financials. No more worries about lost data or missed opportunities. The only limitation is your third-party provider.

- Revenue recognition: Synder RevRec makes automated GAAP-compliant revenue recognition simple. Subscriptions? Handled. Custom billing? Easy. Refunds? No sweat. Synder RevRec crushes accurate deferred and recognized revenue reporting, processing invoices with extended payment terms, multicurrency transactions, discounts, and more.

- Hassle-free reconciliation: Synder flawlessly logs everything into your books just the way you need it, and thus transforms a tedious chore into a lightning-fast solution.

- Financial reporting: If you need numbers that make sense, Synder will deliver detailed P&L and Balance sheet reports, and pull data straight from invoices, receipts, and bills. Whether it’s month-to-date, year-to-date, or your custom range, you’ll always have the insights you need at your fingertips.

- Accurate tax calculations: Taxes don’t have to be taxing. Let Synder handle this task for you. It records everything based on your sales and tax rates, matches it with the right codes, and keeps you fully compliant.

| Pricing | ||

| Medium | Scale | Large |

| $52/mo | $92/mo | $220/mo |

Don’t let the Bench situation derail your plans. Start fresh with Synder—enjoy a 15-day free trial or join our Weekly Public Demo to learn how Synder can transform your workflow.

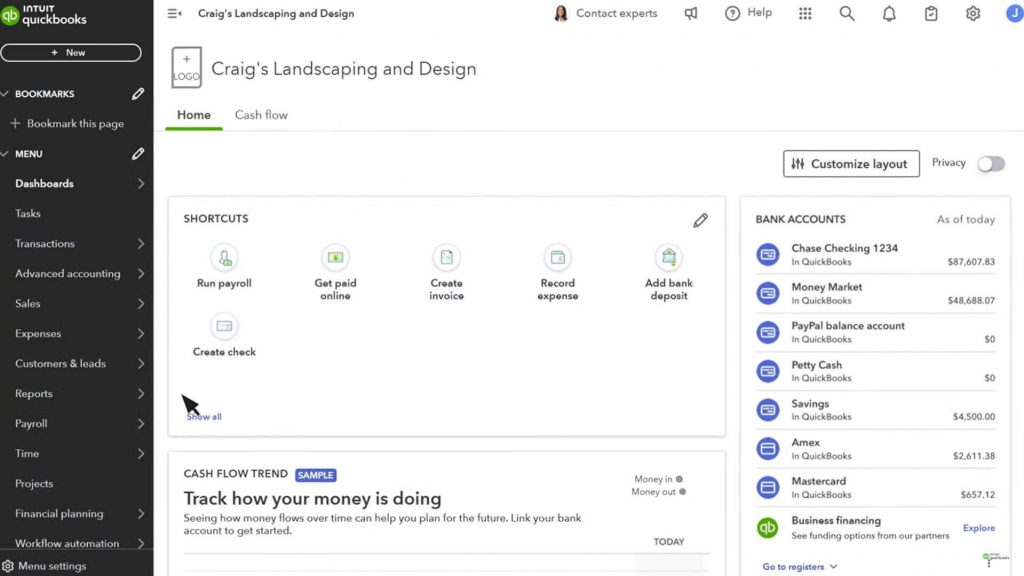

QuickBooks Online

QuickBooks Online is a savvy, no-fuss bookkeeping solution built for SaaS and retail businesses. It eases the hard stuff—automating invoicing, tax filing, and bank reconciliations—so your finances stay flawless with zero hassle. With Bench’s sudden shutdown throwing businesses into disarray, QuickBooks Online steps in to get you back on track.

Key features

- Enhanced control: Unlike Bench’s one-size-fits-all approach, QuickBooks Online puts you firmly in the driver’s seat, giving you the control your business deserves.

- All-in-one financial management: From invoicing to tax prep, QuickBooks Online keeps everything under one roof—streamlined, simple, and always in your control.

- 24/7 access: With cloud-based access, your financial data is just a click away—anytime, anywhere. No surprises, no waiting, just smooth sailing.

| Pricing | |||

| Simple Start | Essentials | Plus | Advanced |

| $35/mo | $65/mo | $99/mo | $235/mo |

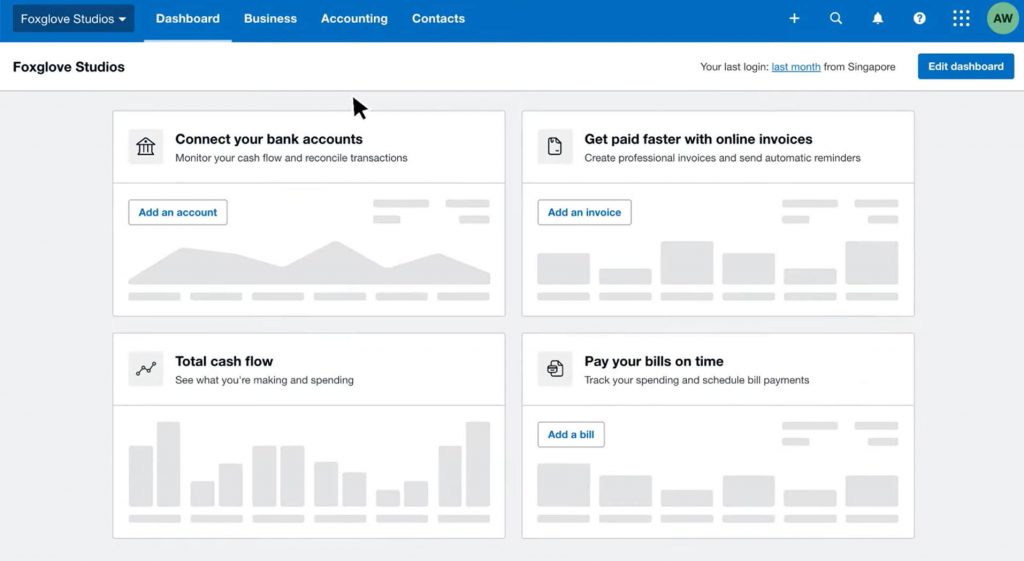

Xero

For SaaS and retail businesses, Xero is one of the cloud-based solutions that gets the job done. It handles invoicing, reporting, and reconciliation with powerful automation and easy-to-use tools. This Bench accounting alternative helps you to avoid hassle and with its smarter accounting features you can focus on growing your business.

Key features

- Powerful reporting: Xero helps you to stay on top of your finances with detailed balance sheets, P&L statements, and cash flow insights—all just a click away.

- Inventory management: It keeps your shelves stocked and your stress levels low. Xero’s inventory tools track what’s on hand and set reorder points, so you’re always prepared—no overstock, no shortages, just smooth operations.

- Multicurrency support: With automatic currency updates, Xero makes going global easy, so your business can thrive across borders without skipping a beat.

| Pricing | ||

| Starter | Standard | Premium |

| $29/mo | $46/mo | $62/mo |

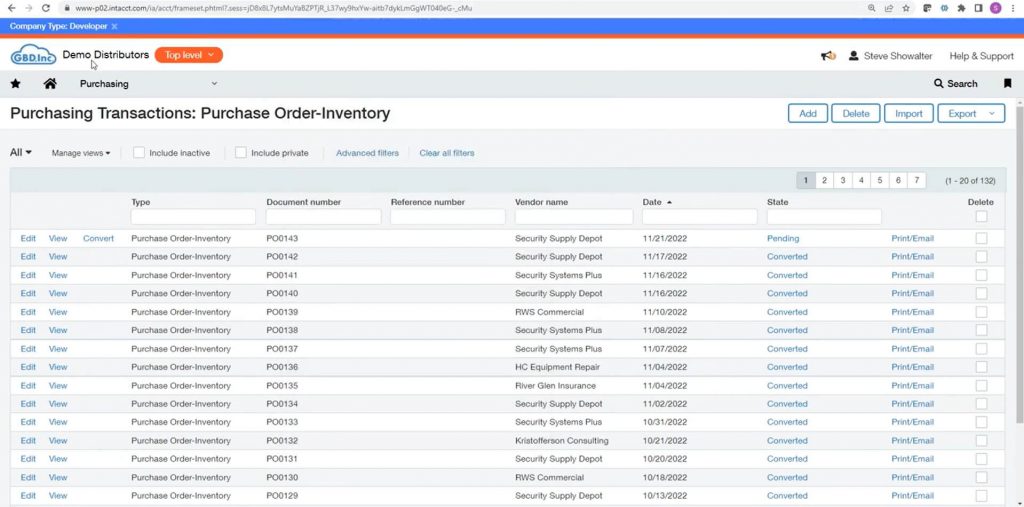

Sage Intacct

Sage Intacct takes the grind out of financial management by automating billing, revenue recognition, and inventory tracking. Say goodbye to late nights wrestling with spreadsheets—skip the manual work and focus on what really matters: growing your business.

Key features

- Real-time visibility: With dynamic dashboards and customizable reports, you’ll have a crystal-clear view of your financials.

- Effortless integrations: Sage Intacct seamlessly connects with CRMs, payment platforms, and other tools, turning your workflow into a well-oiled machine. It’s like having your business on autopilot.

- Multi-entity mastery: Sage Intacct handles automated consolidations, currency conversions, and intercompany transactions. Because your finances should dance to your tune—not the other way around.

Note: For pricing, contact a software representative.

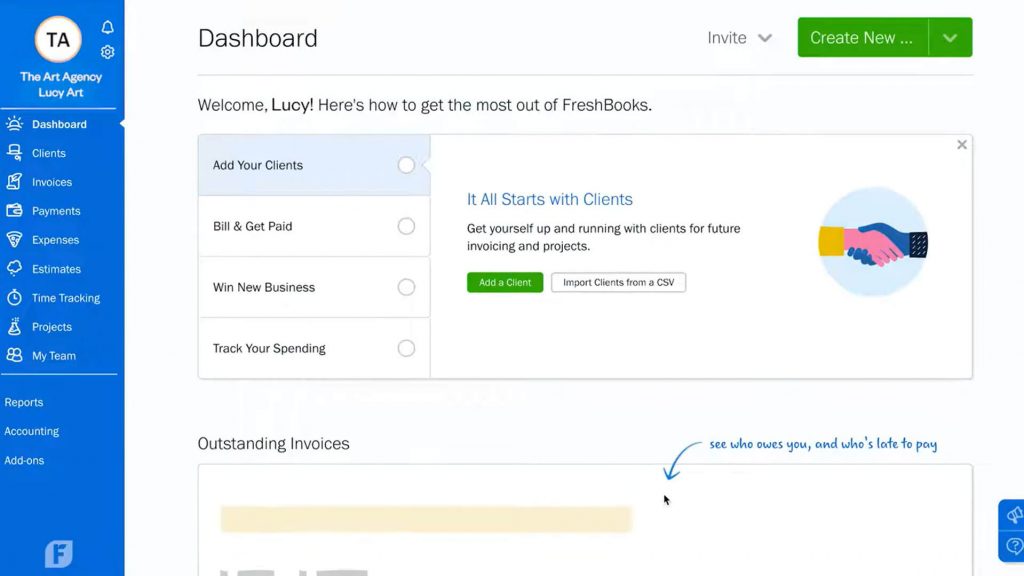

FreshBooks

With smart automation, clear insights, and a customer support team that always has your back, managing your finances with FreshBooks has never been this easy.

Key features

- Simple invoicing: With FreshBooks, you can create sleek, professional invoices in minutes using customizable templates. Automated reminders make sure you get paid on time—keeping your cash flow solid.

- Time tracking built-in: FreshBooks tracks your billable hours directly in the platform, turning your hard work into accurate invoices. It’s like having a personal timekeeper at your fingertips.

- Global business ready: FreshBooks simplifies international operations with multi-currency and multi-language support. From Paris to Tokyo, you’re ready to work globally.

| Pricing | ||

| Lite | Plus | Premium |

| $19/mo | $33/mo | $60/mo |

Conclusion: What is the best Bench alternative for your bookkeeping?

This unexpected plot twist with Bench’s sudden exit may have thrown off your mood and workflow, but don’t worry—there are plenty of options waiting to turn things around. Accounting software like Synder is built to have your back, not just when things are smooth, but especially during a crisis. We’re not pointing fingers, but you get the idea. Sure, you could spend hours sifting through reviews, but with tax season breathing down your neck, every second counts. Remember, setbacks are just setups for comebacks.