As we all know, taxes are a necessary evil, but they don’t have to be a nightmare. Especially if you can clearly understand your options, that can save you time and money. From hiring a CPA to using tax software or even exploring free filing services, there are plenty of ways to get your taxes done right. But how do you know which path is best for your unique needs?

In this article, we want to explore ways to get your taxes prepared. We’ll look at the cost of dues preparation by the CPA (Certified Public Accountant) for businesses and individuals, touch upon a wide variety of preparation options, and explain how they can fit into your needs and budget.

Contents

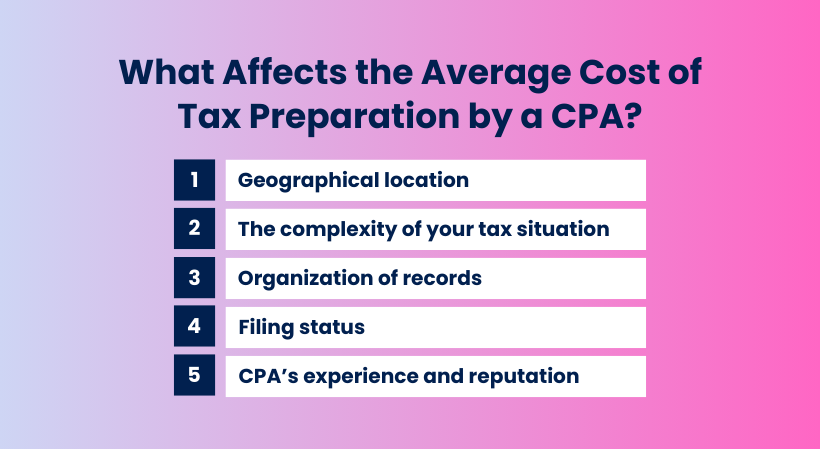

What affects the average cost of tax preparation by a CPA?

Determining how much you’ll pay for CPA tax preparation isn’t straightforward, as several factors come into play:

These factors aren’t the only ones that influence the average cost, but they’re important, so let’s break them down one by one.

1. Geographical location

The cost of tax preparation by a CPA in the U.S. isn’t one-size-fits-all, and your location plays a big role. Here’s how:

Urban vs. rural areas:

- Urban areas: In big cities like New York, CPAs charge more to cover the high cost of living. So, don’t be surprised if a tax preparer in NYC has a higher price tag than one in a laid-back Midwest town.

- Rural areas: In quieter, rural areas, you’ll likely find more affordable rates, thanks to lower overhead costs and a friendlier cost of living.

State-specific tax regulations:

Some states have a more complex tax landscape, which means CPAs may need to roll up their sleeves and dig deeper into the details. States like California, with their intricate tax codes and additional state taxes, can drive up fees as CPAs work their magic to navigate the maze.

2. The complexity of your tax situation

Let’s say you’re a business owner with multiple income streams, employees, and a pile of expenses. As the complexity of your taxes grows, you’ll need more than just a simple filing—think detailed bookkeeping, payroll management, and business deductions, all of which can bump up CPA fees.

If you need a bit more than just the basics, these additional services come with their own price tag. Some of the extras include:

- State returns;

- Audit representation;

- Tax planning;

- Consultations;

- Extensions and amended returns.

3. Organization of records

How well you manage your business records can really affect the cost of tax preparation by a CPA. Here’s the deal:

- Well-organized records: If your financial documents are tidy and complete, the CPA can zip through your tax return, saving both time and money.

- Messy records: But if your records are all over the place, the CPA may need to spend extra time sorting through them and verifying details, which can increase the fees.

4. CPA’s experience and reputation

A CPA with decades of experience, specialized expertise (like international law or non-profits), and a stellar reputation will usually charge more.

But don’t count out the less experienced CPAs just yet. They might offer more competitive pricing while still delivering exactly what you need. It’s all about finding the right match for your business.

5. Filing status

Depending on how your business is set up, the complexity can swing from simple to a bit more involved, which can impact your CPA fees. That’s how different filing statuses shake out:

- Simple filing statuses: If you’re a sole proprietor or have a single-member LLC, your tax return is relatively straightforward and less expensive to prepare. This is because sole proprietorships, partnerships, and S-corporations pass their tax obligations onto the owners’ personal tax returns. As a result, the business’s income, deductions, and credits are reported on the owner’s return, keeping things simpler and less costly.

- Complex filing statuses: On the other hand, if your business is structured as a corporation or partnership, things become more complex. Corporations and partnerships require additional forms, tax rates, and compliance tasks, which increases the cost of preparation. C-corporations are the only business type that directly handles their own taxes, meaning they file separate returns for the business itself, which adds complexity and cost.

We’ll be looking at the actual prices in the later sections.

Learn more about the accounting landscape. Read our articles about the Big 4 and top accounting firms in the US.

What’s the cost of tax preparation for a business?

The cost of tax preparation for a business can vary wildly. It’s like asking “How much does a car cost?” – a Kia and a Ferrari are both good and high-quality cars, but the price difference is astronomical. Same with businesses. Let’s take a closer look at the cost of tax prep depending on your business structure and situation.

The typical cost of tax prep for businesses

- Simple Schedule C filers (Sole proprietors, freelancers): If your business has straightforward income and expenses, you might pay anywhere from $500 to $750. Think of the “Kia” scenario – you can probably get away with basic tax software or a less expensive preparer.

- Corporations (C-Corps): Large corporations with complex financial structures, multiple subsidiaries, and international dealings often pay $1,000 to $5,000 or even more. Think “luxury car” – you need a high-performance engine (a specialized tax expert) to handle it.

The average cost of tax preparation for LLC

You might be wondering why LLCs (Limited Liability Companies) have disappeared from this list. The reason is simple: the IRS doesn’t treat LLCs as a tax entity. Instead, your LLC will file taxes based on how it’s classified—either as a sole proprietorship, partnership, S-corporation, or C-corporation.

If you run your LLC as a sole proprietorship, you’ll follow the same rules as a sole proprietor. Got a business partner? Then it’s a partnership filing for you. If you’ve chosen to go the S-corp or C-corp route, just fill out the forms for those entities.

Learn how to file income tax returns with the filing preparation guide.

Standard fees used by CPAs

CPAs generally use one of 3 pricing structures (or a combination of them):

- A flat fee: A flat fee is a fixed price. CPAs often use them for more predictable work, like a standard tax return. It’s a straightforward method and you won’t get any surprises when the bill comes.

- An hourly rate: When it comes to an hourly rate, the final cost depends on how long it takes to get the job done. If your tax situation is a bit more complicated, like a business tax return with plenty of nuances, a CPA might charge by the hour.

- A per-form fee: Another common pricing structure is charging a set fee for each form. For example, a CPA might charge one price for Form 1040, a different price for Schedule C, and more for forms like Schedule D or Form 1120.

How much does preparing specific tax forms cost?

The National Society of Accountants (NSA) report is a great place to get reliable information regarding the costs associated with preparing specific forms by CPAs.

Here’s a summary of the costs for some common forms.

| Tax form | Average per form fee | Average hourly fee |

| Form 940 (Federal Unemployment) | $78 | $111.95 |

| Schedule SE (Self Employment Tax) | $41 | $148.12 |

| Schedule C (Business) | $192 | $149.95 |

| Schedule E (Rental) | $145 | $149.52 |

| Schedule EIC (Earned Income Credit) | $65 | $146.70 |

| Form 1040 (Not itemized) | $220 | $153.74 |

| Form 1040 (Itemized) | $323 | $161.34 |

| Form 709 (Gift Tax) | $421 | $178.29 |

| Form 1041 (Fiduciary) | $576 | $172.66 |

| Form 990 (Exempt Organization) | $735 | $171.48 |

| Form 706 (Estates) | $1289 | $188.63 |

| Form 1065 (Partnership) | $733 | $177.29 |

| Form 1120-S (S Corporation) | $903 | $179.81 |

| Form 1120 (C Corporation) | $913 | $181.57 |

N.B. Despite this report being the latest available source, things change fast and current prices may be somewhat higher.

If you want to know how to become a QuickBooks ProAdvisor, read our article.

How Synder helps you and your CPA prepare for tax season

If your records are a hot mess, CPA services can get pricey fast since they’ll need to clean up your books first. If you want to avoid that and cut down on costs, you need to keep your records neat and steady. And Synder can make that happen. With Synder, you get both reliable accounting software and access to professionals from Synder’s Accountants Directory, who are ready to step in and guide you through tax season.

But how exactly can Synder help? Synder is an accounting automation software that syncs transaction data from over 30 platforms, including PayPal and Stripe, and integrates smoothly with tools like QuickBooks Online/Desktop, Sage Intacct and Xero. And that’s just the start. Here’s what Synder can do:

- Seamless data transfer: Synder ensures smooth data transfer with real-time synchronization across all connected platforms.

- Error-free reconciliation: Software automates transaction reconciliation, reducing errors and duplicates and ensuring your client data is accurate and workflows run smoothly.

- Accurate tax recording: Synder matches sales data with the right tax codes, simplifying tax compliance and ensuring accuracy.

- Detailed P&L reports: The software generates customizable profit and loss reports for any period, with the ability to break them down by product, vendors, or payment processor for better insights.

Ready to Try Synder? Sign up for a 15-day free trial or book a seat at our Weekly Public Demo to experience how Synder can transform your financial processes.

What are your other options for filing tax returns?

While CPAs are a popular choice for business tax preparation, they’re not the only option. Here’s a breakdown of alternatives, keeping in mind that the best choice depends on your business’s complexity, your budget, and your comfort level with tax laws:

1. DIY options:

Tax software: Intuit TurboTax, H&R Block, and TaxAct offer business versions of their software. These programs guide you through the process, perform calculations, and often offer error checking.

| Pros | Cons |

| Affordable, convenient, good for simple returns, and offers some guidance | Can be challenging for complex returns, and limited support if you get stuck |

Online tax forms: The IRS website provides fillable forms for various business types.

| Pros | Cons |

| Free, direct access to IRS forms | Requires strong tax knowledge, no error checking or guidance |

2. Other tax professionals

Enrolled agents (EAs): EAs are federally authorized tax practitioners specializing in taxation. They can represent taxpayers before the IRS in audits, collections, and appeals.

| Pros | Cons |

| Expert knowledge of tax code, often less expensive than CPAs, can handle a wide range of tax situations | Potentially less expertise in broader accounting and financial matters compared to CPAs |

Tax attorneys: Attorneys specializing in tax law can provide advice on complex tax issues, tax planning, and legal representation in tax disputes.

| Pros | Cons |

| Deep understanding of tax law, can handle highly specialized situations, provide legal representation | Typically the most expensive option |

3. Specialized services

Bookkeepers: While not tax preparers, bookkeepers can help maintain accurate financial records throughout the year, making tax preparation smoother. You can then use this organized information to file yourself or provide it to a tax professional.

| Pros | Cons |

| Accurate record-keeping, time-saving | Extra cost to your business operations |

4. Tax filing apps

With the increasing reliance on mobile technology, some companies are exploring the development of tax filing applications to simplify the process. For instance, the Department of Government Efficiency (DOGE) is considering creating a mobile app to streamline tax filing for Americans.

| Pros | Cons |

| A convenient and accessible way to file taxes, potentially saving users time and money | Limited functionality and privacy concerns, especially for those with complex tax situations |

5. IRS free file program

For eligible taxpayers, the IRS offers a Free File program that provides free online tax preparation and filing services. This program partners with various tax software providers to offer free services to individuals and businesses meeting certain income criteria.

| Pros | Cons |

| No extra cost for eligible taxpayers | Only available If your AGI is $79,000 or less |

* Some states offer their own free filing programs for state taxes, which you can access through their respective Department of Revenue websites. However, there are usually some limitations and requirements attached to these free file-state programs.

Conclusion

Finding the right tax help can feel overwhelming, like hacking through a jungle with a dull machete. It’s not just about getting your taxes done – it’s about accuracy, efficiency, and compliance.

CPAs offer expertise and peace of mind, but they’re not the only option. Explore software, online forms, or even enlist a different type of tax professional. The key is finding the perfect match for your needs and budget.

And remember, organized finances are your secret weapon. Tidy books and tools like Synder can simplify the process and potentially save you money, no matter who prepares your taxes. So ditch the stress and conquer tax season with confidence.

Disclaimer

The information provided in this article is for general informational purposes only and doesn’t constitute professional advice. Tax laws and regulations are subject to change, and individual circumstances can vary. For personalized assistance and advice, please consult a tax professional.

Share your experience

Have you used CPA services, preparation software, or another method to file your taxes? Share your experiences and any tips in the comments section below—we’d love to hear from you!

I like that you talked about firms that will be able to offer in-person income tax preparation services which are actually more affordable and suitable for those with moderately complex situations. I can imagine how helpful this piece of information would be for anyone who is a professional, self-employed, or with a business. In my opinion, getting help from an expert will be for your own benefit because you can focus on other things that you understand and do while they handle that aspect that you might not be trained for.

Hi Mia, thank you for your insightful feedback! We’re glad that you found the discussion on affordable in-person income tax preparation services useful. You’re absolutely right – seeking assistance from tax experts can be incredibly beneficial. It not only ensures accuracy and compliance with complex tax regulations but also allows individuals to focus on their core activities and strengths. If you have any more thoughts or questions on the topic, feel free to share! Your input adds great value to the conversation.

CPAs can help you and your business out when tax season comes around. Knowing the average cost of a CPA’s tax preparation work will help you make a well-sounded decision. Thanks for sharing.