As a business, you might face events like IPO stocks, share issuance, or mergers during your development. So, you might come across the concept of APIC or additional paid-in capital and have to reflect it in your accounting statements correctly, being a matter of compliance. At this point, you might want to understand this concept and what to do about it accounting-wise.

Well, let’s look at APIC in more detail and figure out what it is, how to calculate it, and where it should go in the financial statements.

Key takeaways

- Understanding APIC is essential for properly recording the extra money investors pay over the par value of shares in a company’s financial statements.

- APIC is beneficial because it boosts a company’s equity without increasing fixed costs or needing collateral, keeping existing assets safe.

- APIC appears in the shareholders’ equity section of the balance sheet, showing the additional capital gained from selling shares at a price above their par value.

Contents:

2. APIC formula: let’s calculate it

3. Additional paid-in capital in accounting

4. Understanding additional paid-in capital: final word

The definition of additional paid-in capital (APIC)

Let’s start with the definition.

Additional paid-in capital (APIC) is a term in accounting that represents the amount of capital investors have paid to a company over the par value of its shares.

When a company issues stock, the par value is the nominal or face value assigned to each share. However, the actual price investors are willing to pay for these shares is often higher. The difference between this market price and the par value is recorded as APIC.

For example, if the par value of a share is $1 but investors pay $10 per share, the additional $9 per share is considered additional paid-in capital.

We’ll look at the par value and the share issuing prices in a bit more detail further on. Meanwhile, let’s figure out why understanding additional paid-in capital is critical for a business.

Shall we?

Level up your accounting with smart automation! Integrate all your sales channels with accounting and make sense of your numbers in a single ecosystem. Have your books always ready for financial reporting, analysis, and taxation. Make full use of a 15-day free trial to explore Synder and book a seat at our Weekly Public Demo for a guided tour by our support team.

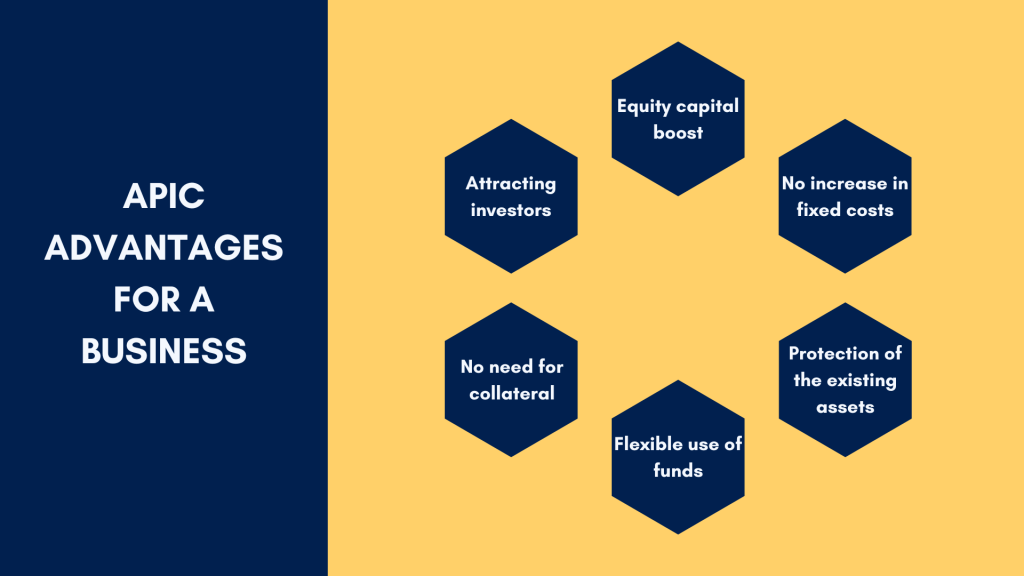

Why is APIC an advantageous way to increase resources?

Additional paid-in capital offers significant advantages for companies looking to bolster their financial position and fuel growth.

Let’s break down the benefits.

Equity capital boost

APIC might help a business top up their capital. It’s especially logical for early-stage businesses that haven’t yet accumulated substantial retained earnings. This extra capital can be their safety cushion, helping them stay stable against financial challenges. Further on, as the retained earnings take a hit, APIC might help maintain a strong financial position.

No increase in fixed costs

A business might get additional funds through various sources, like loans or issuing bonds. However, these means require regular interest payments, increasing the costs to handle. Raising capital through APIC doesn’t usually create any mandatory payment obligations. Dividends to shareholders are optional and, depending on their goals, a business might choose to pay or not pay them.

Protection of the existing assets

Unlike other ways of raising funds, investors who buy shares contribute to APIC without claiming on the company’s existing assets or demanding collateral (as in the case of debt financing, for instance). This way, the company can secure control over their assets and use them freely to cover business needs.

Flexible use of funds

The APIC funds come without limitations or obligations in how a business can use them. The company can freely decide where to allocate them – from paying off existing debts to purchasing new equipment to investing in R&D or expanding its operations. This flexibility is a big advantage.

No need for collateral

As mentioned above, receivigng additional paid-in capital doesn’t require a business to offer collateral. At this point, businesses without much of assets to use for securing loans or borrowings of the kind might benefit from issuing shares. They, actually, obtain funds without adding more liabilities on their plate.

Attracting investors

Investors often find buying shares at a company’s IPO or in share offerings very profitable, especially when they see the company’s growth potential. As they preview the possibiity of gaining more profit, they might be eager to invest in a company’s shares. The company, in its turn, to raises substantial funds. So, it’s kind of a win-win situation.

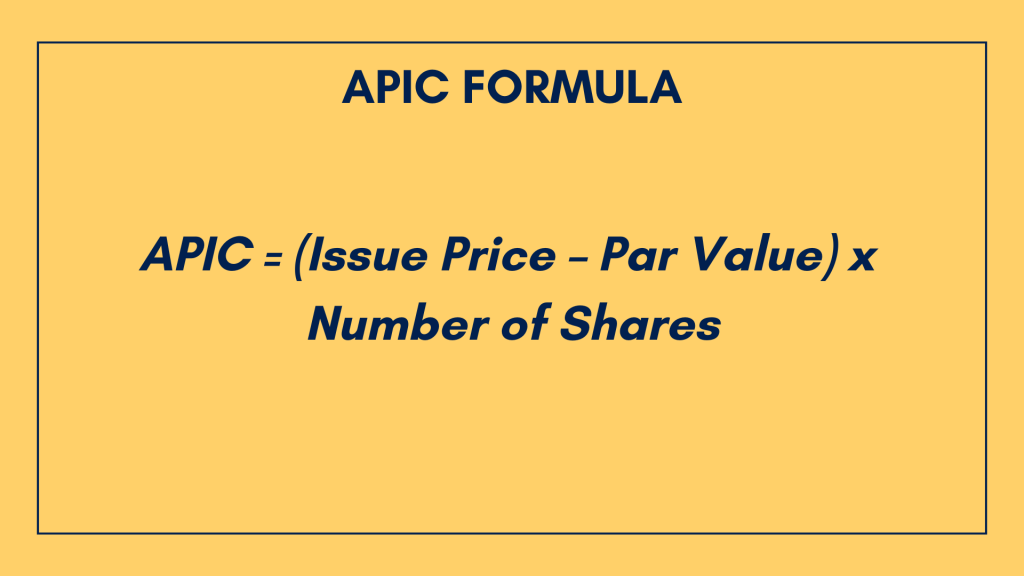

APIC formula: let’s calculate it

Now that we know what additional paid-in capital is, it’s time to learn how to figure it out mathematically.

Recalling the definition, APIC is the amount investors pay above the par value of a company’s issued shares. In other words, it’s the difference between the par value of the issued shares and their actual value (the price at which the company offers them).

At this point, we can define the components of the APIC formula. Let’s look at what we have.

- The par value of an issued share;

- The issue price the company offers (or the market value);

- The number of issued shares.

Now, we have these components taken their places in the calculation. First, we figure out the difference between the issue price and the par value per share. Then, we multiply the result by the number of issued shares. This way, we’ll come to the additional paid-in capital the issuing company will get from selling their shares to investors.

Mathematically, it looks as follows:

APIC = (Issue Price – Par Value) x Number of Shares

Par value vs. market value

Let’s break down the components of the formula and look at the par value and the market value, or issuing price, if you will, in more detail. Especially since we promised to do it.

What is par value?

Par value is a nominal value assigned to each share of stock when it is created.

This value is usually very low and is often set at a minimal amount, such as $0.01 or $1 per share. The par value is more of a legal and accounting formality than a reflection of the stock’s actual worth. It represents the minimum price at which shares can be issued and is used to establish the company’s legal capital, which is the total par value of all issued shares.

For example, if a company issues 1,000 shares with a par value of $1 each, the total par value of these shares is $1,000.

What is market value?

Market value, also known as the issue price or offering price, is the actual price at which shares are sold to investors in the market.

This value is determined by the company’s perceived worth, investor demand, and market conditions. The market value is typically much higher than the par value, especially if the company is performing well and has strong growth prospects.

For instance, if the same company issues those 1,000 shares at a market value of $10 each, the total amount raised from the issuance would be $10,000.

APIC calculation example

So, additional paid-in capitalcomes into play when there is a difference between the par value and the market value of the shares. The excess amount paid by investors over the par value is recorded as APIC and reflects the extra money investors are willing to pay because they believe in the company’s future potential.

Using the earlier example, if the company issues 1,000 shares at a market value of $10 each, but the par value is $1 per share, the APIC can be calculated as follows:

- Total proceeds from issuance = $10,000 = 1,000 shares x $10 market value;

- Total par value = $1,000 = 1,000 shares x $1 par value;

- APIC = $9,000 = $10,000 total proceeds – $1,000 total par value.

Or using the formula provided above, we’ll have:

APIC = (10 – 1) x 1,000 = 9 x 1,000 = $9,000

This $9,000 is recorded as APIC in the company’s financial statements, reflecting the additional capital raised beyond the nominal value of the shares.

And that’s what we’ll tackle upon right away, namely, handling APIC in accounting.

Additional paid-in capital in accounting

We’ll start by mentioning that additional paid-in capital comes as a part of shareholder’s equity that (as we know) represents the owners’ claim on the company’s assets after all liabilities have been deducted. It is essentially the company’s net worth from the shareholders’ perspective.

APIC contributes to this equity as the excess amount investors pay over the par value of the shares they purchase.

Creating a jounal entry for APIC

When a company issues shares, it typically receives more than the par value of those shares. The total amount received from the sale of shares is split into two parts – the par value and the additional amount paid by investors, which is recorded as additional paid-in capital.

Let’s look at how it works on the example we had previously.

Once again, a company issues 1,000 shares with a par value of $1 each at a market price of $10 per share. For them, it receives $10,000 from investors (1,000 shares x $10 per share).

We figured out the APIC, in this case, to be $9,000 ($10,000 total received – $1,000 par value).

To record this transaction, the company makes the following journal entry that can be as follows:

- Debit Cash (or Bank) – $10,000

This debit entry shows that the company has received cash from the investors. - Credit Common Stock (at par value) – $1,000

This credit entry records the total par value of the shares issued. - Credit Additional Paid-In Capital (APIC) – $9,000

This credit entry records the excess amount paid by investors over the par value, representing the additional capital contributed by shareholders.

How does APIC appear in financial statements?

As a part of shareholders’ equity, APIC usually appears in a company’s balance sheet.

A balance sheet is an organized financial statement presenting the financial information of a business firm at a given period. It states what the company has (assets), what it owes (liabilities), and the residual (shareholders equity).

It includes cash and other tangible properties that the company owns, debts that are owed to the company or payable by the company, and shareholders’ equity is the residual interest in the total assets after deducting liabilities, representing the amount of company ownership attributable to shareholders.

The balance sheet always has to balance. The total value of assets must be equal to total liability and shareholders’ equity, known as the basic accounting equation.

Assets = Equities + Liabilities

A balance sheet assists investors, creditors, and managers in evaluating the company’s financial position and hence making appropriate decisions.

Let’s look at how this is presented in the financial statements with an example for two scenarios: one where shares are sold at par value and another where shares are sold at market value.

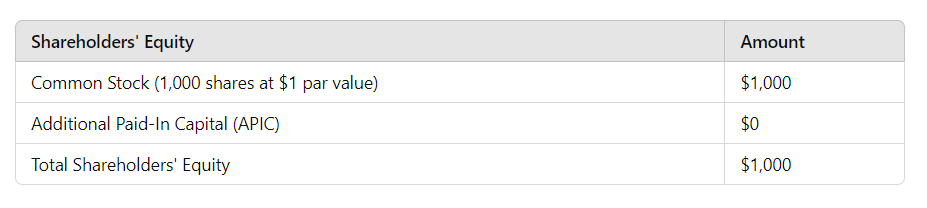

We’ll be using the same example as above, where a company decides to issue 1,000 shares, each with a par value of $1.

Scenario #1 – Shares sold at par value

If the shares are sold at their par value of $1 each, the total cash the company earns from this issuance would be $1,000. This is straightforward because the number of shares (1,000) multiplied by the par value ($1) equals $1,000.

Here’s how it might look on the balance sheet.

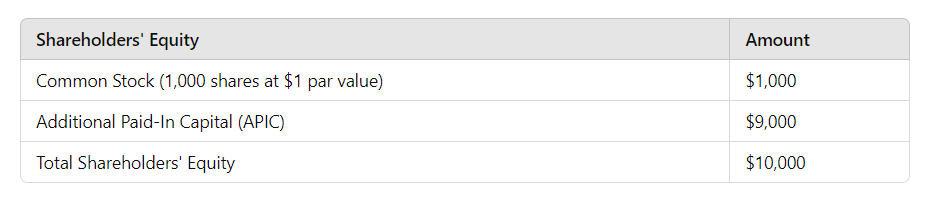

Scenario #2 – Shares sold at market value

Now, consider the company sells the same 1,000 shares but at the current market value of $10 per share.

In this case, the total cash the company receives is $10,000, calculated by multiplying the 1,000 shares by the market price of $10 each.

Here, the APIC comes into play. Since the par value is $1 per share, the additional paid-in capital is the difference between the market value and the par value. For these 1,000 shares, the APIC is $9,000 ($10,000 total received minus $1,000 par value).

Let’s break down what we see here.

- Common Stock

It represents the par value of the issued shares. In both cases, it’s $1,000 because 1,000 shares were issued at a par value of $1 each. - Additional Paid-In Capital (APIC)

In the first case, since the shares were sold at par value, there is no APIC. In the second case, shares were sold at a market value of $10, resulting in an APIC of $9,000 (the excess amount paid by investors over the par value). - Total Shareholders’ Equity

It’s the sum of the common stock and APIC. In the first case, it’s $1,000, and in the second case – $10,000, reflecting the additional capital raised through APIC.

Understanding additional paid-in capital: final word

Let’s wrap it up, shall we?

So, for businesses dealing with or planning to issue shares at a premium or during mergers and acquisitions, it might be critical to understand additional paid-in capital and how to account for it.

APIC might be a great source of additional funds from investors buying shares at a price above the par value. This way, they can increase their equity and strengthen their financial position. On top of that, companies are flexible in allocating funds received through APIC as they wish, covering their operational needs without taking on extra debt or financial obligations.

It’s worth mentioning that a business getting additional paid-in capital should know how to account for it correctly. Since APIC is a component of shareholder’s equity, it impacts financial reporting, namely the balance sheet. To stay transparent and comply with financial reporting standards, a business should grasp accounting for additional paid-in capital.

Long story short, additional paid-in capital highlights investor confidence in a company’s financial health and growth perspectives. Businesses, in their turn, can utilize APIC to cover their operational needs, contributing to their long-term growth.

Share your thoughts

Have you ever dealt with corporate accounting or issuing company shares? Tell us about your experience or share your thoughts in the comments section below!