If you’ve been selling on Amazon for a while, the basics of FBA aren’t the problem. Orders come in, payouts arrive, and the business runs. Yet when you look at the numbers, things often feel less clear than they should. Sales look strong, cash looks fine, but profit is harder to trust.

This usually starts as volume grows. More orders bring more fees, adjustments, refunds, and timing differences that don’t line up neatly in accounting reports. Nothing is broken, but the picture gets harder to read, especially at month-end.

Amazon generated nearly $638 billion in global net sales in 2024, which puts it at the center of a huge share of ecommerce activity, including accounting. This guide looks at Amazon seller accounting from a practical angle. Not how Amazon FBA works, but how bookkeeping behaves once settlements, fees, and inventory start shaping your reports. The aim is to help you understand your numbers without having to explain them away later.

TL;DR

- Amazon accounting issues come from settlement timing and structure, not from missing data or platform errors.

- Treating payouts as summaries and using clearing accounts keeps sales, fees, and refunds from distorting reports.

- Fees, refunds, inventory, and tax need to follow activity, not cash, to keep margins and performance reviews reliable.

- Accounting automation platforms like Synder organize Amazon data before it reaches the ledger, reducing manual corrections and making reports easier to trust.

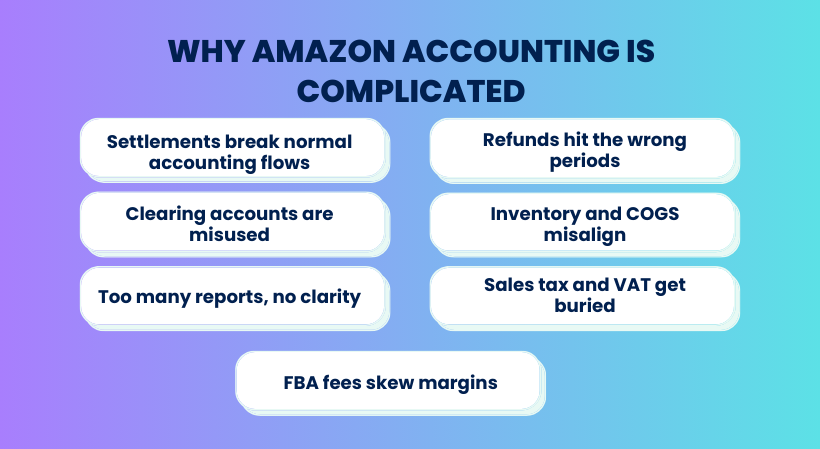

Why Amazon accounting still feels harder than it should

For most experienced sellers, the problem isn’t missing data or lack of platform knowledge. Amazon reports sales, fees, refunds, and inventory movements on different timelines, while accounting systems expect a clean, chronological flow of transactions. When settlements bundle activity across days and apply adjustments later, the result is accounting records that technically add up but are hard to explain, review, or rely on without extra work.

Settlements change how accounting behaves

Amazon settlements collapse days or weeks of activity into a single payout, while accounting systems expect individual events recorded in sequence. When settlements are treated as the main accounting input, cause and effect disappears.

Why this creates pain:

- Sales, fees, refunds, and adjustments are bundled into one number.

- Timing differences between activity and payout distort period reporting.

- Month-over-month movement becomes harder to explain.

- Reviews focus on totals instead of underlying drivers.

The settlement total may be correct, but it does not explain why numbers moved. For accounting, that missing path is often where questions begin.

Clearing accounts are skipped or misused

When settlements are posted directly to revenue and expense accounts, Amazon activity and cash movement are treated as the same thing.

This shortcut keeps books technically balanced but removes the separation needed to explain timing differences.

Why this creates pain:

- Revenue and fees shift based on payout timing, not activity.

- Month-end close depends on manual explanations and adjustments.

- Small timing differences accumulate into larger inconsistencies.

- Errors are masked by corrections instead of resolved structurally.

Too many Amazon reports, too little clarity

Amazon provides dozens of reports, but only a few actually support accounting decisions. Teams often pull more data than they can practically use.

Why this creates pain:

- Orders reports show what sold, not what settled.

- Fee and adjustment reports explain changes, but arrive out of context.

- Settlement reports contain the answers, but require digging.

- Reconciliation turns into report hunting instead of validation.

The issue is not lack of data. It’s knowing which reports explain movement rather than just totals.

FBA fees distort margin analysis

FBA fees often post later than the sales they relate to and follow schedules unrelated to current demand or pricing.

Why this creates pain:

- Margins shift even when pricing and ads stay the same.

- Storage and long-term fees reshape results retroactively.

- Comparisons between periods become unreliable.

- Fee impact is explained by timing, not performance.

When fees are absorbed into payouts or collapsed into one line, margin analysis stops reflecting what actually changed.

Refunds and reimbursements land in the wrong periods

Refunds and reimbursements often appear days or weeks after the original sale and may be included in unrelated settlements.

Why this creates pain:

- Revenue remains in one period while corrections land in another.

- Reports show artificial overstatements or dips.

- Returns trigger manual fixes instead of clean reversals.

- Reimbursements are easy to misplace or overlook.

The real issue isn’t the refund itself, but how it’s recorded and where it lands in the books.

Inventory and COGS drift out of sync

Inventory moves continuously through Amazon, but cost recognition often waits for payouts or invoices.

Why this creates pain:

- COGS follows payment timing instead of sell-through.

- Product profitability shifts after the fact.

- Reviews require mental adjustments to understand results.

- Inventory becomes a correction, not an input.

When cost trails activity, performance analysis loses its anchor.

Sales tax and VAT disappear inside payouts

Marketplace facilitator rules handle collection, but tax still flows through settlements, refunds, and adjustments. When tax is not clearly separated, reporting loses transparency even if compliance itself is covered.

Why this creates pain:

- Tax is flattened into revenue or ignored in analysis.

- Refunds return tax separately from sales.

- Cross-region totals become harder to verify.

- Gross versus net figures are harder to explain.

Amazon accounting automation and where it fits

Amazon accounting reaches a point where accuracy depends less on recording transactions and more on structuring them correctly. Settlements combine multiple financial events, each with its own timing, while accounting systems expect those events to arrive already classified and aligned.

Synder’s role in Amazon accounting workflows

Synder is an accounting automation software that sits between Amazon and your accounting system and focuses on making Amazon activity behave like accounting data before it ever reaches the ledger.

Instead of treating Amazon payouts as income, Synder works from the underlying activity inside each settlement. Sales are recorded as sales. Fees stay fees. Refunds reverse the right activity. Cash simply settles what already exists. In practice, that means:

- Amazon orders are recorded as invoices.

- Amazon financial events are recorded as payments and adjustments.

That separation sounds small, but it’s what prevents most of the problems described earlier. What this changes in day-to-day Amazon accounting:

- Settlements stop blurring results. Settlements are treated as summaries, not transactions. Sales, fees, refunds, tax, and adjustments are recorded individually, while payouts clear a dedicated clearing account instead of reshaping revenue.

- Timing differences stop breaking comparisons. Activity is recorded when it happens, not when Amazon releases cash. Late fees or refunds no longer pull results into the wrong month and force explanations during review.

- Clearing accounts start doing their actual job. Amazon activity and bank deposits are kept separate. Clearing accounts absorb timing differences, so reconciliation confirms balances instead of uncovering surprises.

- FBA fees stop distorting margins. Fulfillment, storage, and commission fees are posted as their own entries, tied to Amazon activity rather than buried inside payouts. Margins change when something changes, not because a fee arrived late.

- Refunds and reimbursements land where they belong. Refunds reverse the original activity instead of reducing unrelated payouts. Reimbursements are recorded without shifting revenue or expense into the wrong period.

- Marketplace facilitator tax stays visible. Even though Amazon collects and remits tax, the books still reflect it. Tax appears as tax, not as a missing piece hidden inside net deposits, which keeps gross figures readable and reviewable.

- Volume doesn’t force a different workflow. High-volume sellers can use summary syncing to keep books manageable. Teams that need detail can sync transactions individually. Either way, the accounting logic stays consistent.

When Synder is in place, the impact shows up quickly in day-to-day work. In one case, daily reconciliation work dropped from three to four hours to under an hour, saving more than 70 hours each month as settlements and fees no longer needed manual breakdown. In another, a lean finance team avoided adding headcount and saved over $60,000 annually while maintaining better than 99.5% reconciliation accuracy across high-volume sales. In both cases, the gains came from removing timing and structure fixes during close, not from speeding up review.

See what Amazon accounting looks like when the numbers line up naturally. Start a free Synder account or book a demo to review clean settlements, fees, and reconciled payouts.

Closing thoughts

Clean Amazon accounting changes how conversations happen inside the business. Pricing discussions rely less on instinct. Ad performance reviews take less explanation. Product decisions are based on current results, not adjusted expectations.

Accounting automation platforms like Synder support that shift by organizing Amazon activity before it reaches the ledger. When the data arrives already aligned with how Amazon operates, accounting becomes quieter, faster to review, and easier to trust. At that point, the books stop shaping decisions indirectly and start supporting them directly.

FAQ

Do Amazon sellers need a clearing account for FBA bookkeeping?

Yes, a clearing account separates Amazon activity from bank payouts, allowing sales, fees, refunds, and adjustments to be recorded correctly without deposits distorting revenue or expenses.

Why don’t Amazon payouts match revenue in accounting reports?

Amazon payouts don’t match revenue in accounting reports because they bundle sales, fees, refunds, tax, and adjustments from different dates into a single deposit. Revenue reflects business activity, while payouts reflect settlement timing rather than performance.

Can Amazon accounting be automated without losing reporting accuracy?

Amazon accounting can be automated without losing reporting accuracy when settlement data is structured before it reaches the ledger. Accounting automation platforms like Synder break Amazon settlements into sales, fees, refunds, tax, and adjustments, record each component in the appropriate accounts, and use clearing accounts to reconcile payouts without altering revenue or expenses.