In a business, accounting is like the heart, and the accounting cycle is the circulatory system – it keeps the financial lifeblood flowing.

The accounting cycle is a structured process: recording every transaction, analyzing what it all means, and organizing it all into clear reports. This cycle gives you a real-time view of your company’s financial health. Without this system, things can get messy fast.

But how exactly does the accounting cycle work? Let’s break down its steps and challenges one by one.

What is the accounting cycle?

Let’s start with the theory. The accounting cycle is a process that tracks and manages a business’s financial transactions. It starts by identifying transactions and ends with closing the books. This cycle keeps everything accurate and organized, ensuring financial reports are on point and complete.

The accounting cycle helps you:

- Identify every dollar earned and spent.

- Record everything correctly.

- Analyze where all that money went.

- Summarize everything into clear reports.

The accounting cycle keeps a company’s finances in the best shape. And who doesn’t love a bit of order in their life?

Steps of the accounting cycle

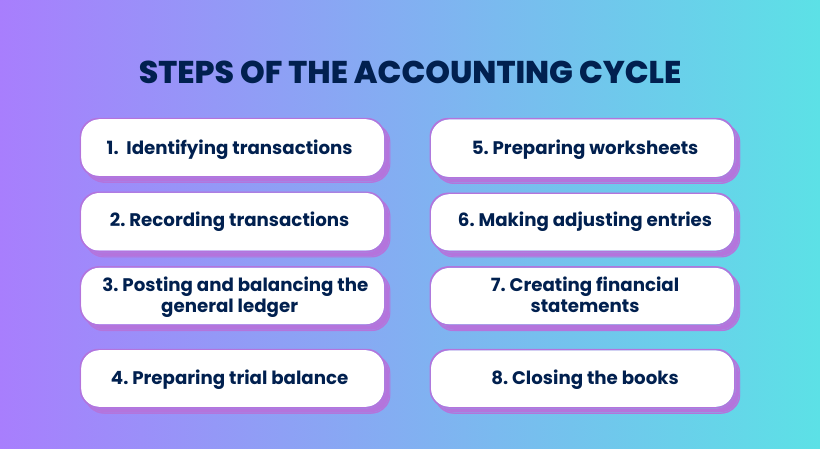

There are 8 main steps of the accounting cycle, which can’t be missed if you want to close your books without any problems. Let’s take a closer look at each of these fundamentals.

Step 1. Identifying transactions

First off you need to identify your business’s transactions. These may include everyday sales and purchases and more complex things like acquisitions, investments, or large contracts. Once these transactions occur, they’re recorded in the books and included in the financial statements.

Businesses typically adopt one of two accounting periods:

- Calendar year: From January 1 to December 31.

- Fiscal year: A custom accounting period that can end in any month of the year, as chosen by the business and approved by the IRS.

Step 2. Recording transactions

Once transactions are identified, they’re recorded in accounting journals using the double-entry bookkeeping method. This means each transaction hits at least two accounts. For example, a sale would involve recording both revenue and a corresponding increase in cash or accounts receivable.

To stay organized, businesses can also use subsidiary journals to track specific financial data, such as:

- Aged accounts receivable;

- Aged accounts payable;

- Cash disbursements;

- Fixed assets & accumulated depreciation.

Step 3. Posting and balancing the general ledger

After logging transactions in the journal, the next step is to move them to the general ledger, where all the action happens. This ledger keeps everything organized, showing how each account is affected over time.

Here’s how to transfer those journal entries into the ledger:

- Pick the account: Record the transaction in the dedicated account(s) defined for the business.

- Mark the date: Note when the transaction occurred.

- Enter the amount: Log the amount that belongs to debit or credit.

- Add a reference: Link back to the original journal entry for easy tracking.

Once the journal entries are posted, it’s time to balance things out. This means:

- Totaling debits and credits: Add up all the debits and credits in each account.

- Calculate the balance: Subtract credits from debits (or the other way around) to get the account balance.

Balancing gives you a full picture of how transactions impact each account, ensuring the books stay in harmony and the accounting equation holds.

Step 4. Preparing trial balance

A trial balance is a financial checkpoint for a business, ensuring everything adds up. It shows the balances of all accounts in the company’s books, neatly split into debit and credit columns. The goal? To make sure both columns are equal, signaling that the books are in balance.

Usually prepared at the end of each accounting period, a trial balance helps verify the accuracy of financial records. Think of it as a worksheet with two columns:

- Debit column: Tracks all the debits during the period.

- Credit column: Tracks all the credits for the same time frame.

It covers everything from revenue to liabilities and assets, giving a full picture of the company’s financial activities.

The trial balance’s main job is to catch any errors. When debits and credits match up, it means the books are spot on. If they don’t, it’s time to hunt down the mistake and get things back on track.

Step 5. Preparing worksheets

This step of the accounting cycle helps you analyze, reconcile, and fine-tune your accounts to ensure accuracy and provide a clear picture of your financial standing.

Regular reconciliation is key

Make reconciliation a regular habit. Aim to reconcile each balance sheet account at least monthly to catch any discrepancies early on. Here are key areas to focus on:

- Bank reconciliation: Compare your bank statements to your general ledger cash account and identify any outstanding payments, transit deposits, or bank service fees.

- Accounts receivable: Compare customer account aging reports with your general ledger to ensure accurate tracking of outstanding invoices.

- Accounts payable: Reconcile accounts receivable aging reports with the general ledger to verify outstanding invoices and payment schedules.

- Other assets and liabilities: Reconcile inventory levels, fixed assets, advances, liabilities, retained earnings, and capital accounts.

Multi-entity consolidation

If you deal with multiple entities within your business, consolidate their financial data into one worksheet. Be sure to exclude any intercompany transactions, as these are internal and don’t reflect external financial activity.

Step 6. Making adjusting entries

In the accounting cycle, adjusting entries is necessary to update the account balances before financial statements are prepared. They ensure that revenues and expenses are recognized in the period they occur, fix any errors or discrepancies you found earlier, and make your financial statements spot-on.

These tweaks Adjustments may include accrued expenses, prepaid expenses, depreciation, and revenue recognition adjustments. Don’t forget to give these entries a good review and approval before moving forward.

After posting the adjustments to the general ledger, double-check that the total debits match the total credits—this is your essential accounting control. Run an adjusted trial balance sheet to confirm everything’s balanced and in sync.

Step 7. Creating financial statements

After all your hard work tracking and organizing data, you’re now ready to prepare the key financial statements that tell your business’s story.

First, decide on the timeframe for your statements. This will depend on your company’s needs and reporting requirements:

- Monthly: Provides an ongoing overview of your financial performance so you can quickly adjust to changes and update the data to be more current.

- Quarterly: Provides a broader overview and is often used for internal review and management decision-making. Public companies are typically required to file quarterly reports with regulators.

- Annual: Provides a comprehensive overview of financial performance for the entire year and is needed for external reporting, tax purposes, and year-over-year comparisons.

The following three core financial statements work well together to provide a complete picture of your company’s financial health:

- Income statement: This report, also known as the P&L statement, summarizes your company’s financial performance over the chosen period. It shows your revenues, expenses, and the resulting net income or loss.

- Balance sheet: This statement provides a snapshot of your company’s financial position at a specific point in time.

- Cash flow statement: This report tracks the movement of cash in your business during the reporting period. It categorizes cash flows into operations, investing, and financing activities, highlighting how your company generates and uses cash.

Learn what type of asset cryptocurrency is.

Step 8. Closing the books

You’ve made it through the twists and turns of the accounting cycle, and now it’s time for the final act—closing the books. Unlike monthly closings, this is a once-a-year process that clears the slate and locks in your financial results.

To keep things clean for the new year, you’ll need to close out temporary accounts, which include:

- Revenue accounts – Everything you earned throughout the year.

- Expense accounts – All the costs and deductions along the way.

These accounts don’t carry over to the next year. Instead, their balances are transferred to retained earnings, a permanent account that holds onto your company’s accumulated profits (or losses). This ensures that the next accounting period starts fresh.

Once the closing entries are made, generate a post-closing trial balance to verify that:

- Total debits equal total credits;

- All temporary accounts have been zeroed out;

- The retained earnings balance is correctly carried forward for the next fiscal year.

This report serves to confirm that the books are balanced and ready for the next accounting cycle.

Review all entries one last time, ensuring that financial data is accurate and complete. If everything aligns correctly, your books are officially closed, and you’re set to start fresh in the new fiscal year.

Common challenges in the accounting cycle

The accounting cycle is your guide, but it’s not so simple and has complexities that can’t be overlooked. Let’s define them first.

Tracking small transactions

Tracking transactions isn’t just number-crunching—it’s a high-stakes balancing act. A missed $1 might seem like nothing. But what if you overlook $100? Or $1,000? That’s not just loose change—it’s a financial avalanche waiting to happen. In accounting, every penny has a place, and every cent needs to add up. Even the smallest hidden fee or forgotten charge can trigger a butterfly effect, turning into a full-blown financial storm when tax season rolls around.

Month-end close

Let’s say every transaction is recorded—but that’s only half the battle. At the end of each month, you need to reconcile them to ensure accuracy. If done manually, this can be a long and painstaking process that demands serious attention. Miss a transaction or create duplicates, and your books could become a battlefield when tax season arrives. Instead of reviewing just one month, you’ll be untangling 12 months of chaos. Sounds daunting, right? That’s why effective reconciliation is the foundation for a smooth year-end close.

Accounts payable and accounts receivable

This duo won’t let you rest—accounts payable and receivable demand constant attention. You’ll always need to track the money you owe and what’s owed to you. A late payment to suppliers? A problem. A client delaying their payment? Also a problem. When these inconsistencies pile up, the numbers in your books start dancing the tango, throwing your cash flow off balance. And guess what? That all snowballs into one big headache at year-end.

Financial reporting

Creating financial statements is as essential as breathing. Why? Simple—these reports give you a clear picture of your financial health. Profit and loss statements, balance sheets, and more—all form the foundation of your business. Without solid data and well-structured reports, building your financial skyscraper and reaching new heights becomes nearly impossible.

How to optimize your accounting cycle with Synder?

Now that you know what the accounting cycle is and what challenges await you, you may think that closing your books successfully is very hard. Let’s be honest – it is hard. But it’s not impossible. Accounting software like Synder can make a world of difference.

Synder is an automation tool that integrates with over 30 platforms, including payment gateways like Stripe and PayPal, sales channels such as Amazon and Shopify, and accounting software like QuickBooks Online/Desktop, Xero, and Sage Intacct. It ensures seamless data transfer between these systems. But Synder’s capabilities go far beyond that. It tackles the challenges of the accounting cycle head-on with features like:

- Simplified reconciliation: No more manual entries and errors. Synder automates reconciliation, eliminating duplicates and ensuring accuracy.

- Automatic invoice sync: Sync open invoices from platforms like Stripe or Shopify automatically, minimizing errors and maximizing accuracy.

- Comprehensive reporting: Generate detailed P&L and balance sheet reports directly from your invoices, receipts, and bills. Choose any timeframe—month-to-date, year-to-date, or a custom range—for the insights you need.

- Accurate tax recording: Simplify tax compliance by letting Synder match sales data with the correct tax codes.

Synder offers even more than this. In the accounting cycle, you need to be as accurate as possible. But with reliable automated software on your side, it’ll be much easier to avoid mistakes.

If you want to test Synder for yourself, sign up for our 15-day free trial or join the Weekly Public Demo to see how Synder can lift the weight off your shoulders.

Conclusion

Recording transactions, closing books, reconciling accounts, preparing the general ledger, or creating balance sheets—none of it is easy. And to make things even trickier, accuracy in the accounting cycle is a must if you want to avoid headaches when tax season arrives. That’s where the accounting cycle becomes your reliable partner, guiding you through the hell of numbers and tables.

With a solid plan and a clear roadmap, you can successfully close your books without stress. With Synder’s automation, you’ll optimize the process and minimize the risk of errors. So don’t fear the eight steps of the accounting cycle—it’s your financial companion, working to keep your business on the right track

What’s the accounting cycle: FAQ

What is the purpose of the accounting cycle?

The main objectives of the accounting cycle are to systematically record, classify, and summarize the financial transactions of a company and to ensure accurate and complete financial reporting.

What is the difference between a journal and a ledger?

In short: A journal, often called the book of original entries, is a subsidiary ledger that records transactions in chronological order as they occur. A general ledger is a primary ledger that classifies transactions recorded in a journal.

How often should the accounting cycle be completed?

The frequency of the accounting cycle depends on the specific needs and scale of the business. It’s typically completed at the end of an accounting period, which can be monthly, quarterly, or annually.

Can the accounting cycle be automated?

Yes, the accounting cycle can be significantly automated with modern accounting software.

For example, tools like Synder can help you automate the process by reducing manual entry, which means lowering errors and problems in the future.

How do adjustments affect the accounting cycle?

Adjustments in the accounting cycle are made at the end of an accounting period to ensure that revenues and expenses are recorded in the period in which they’re incurred. These adjustments, which include accrued revenues, accrued expenses, deferred revenues, and deferred expenses, are essential for adhering to the accrual basis of accounting.