As a business, you might know how critical it is to pay attention to the 1099-MISC form. It helps report payments to contractors and freelancers to the IRS. If you fail to file or accurately report it, you might end up with penalties and audits. So, keeping track of payments and correctly filling out the 1099-MISC form is crucial to avoid legal and financial troubles.

The 1099-MISC instructions guide you on accurately completing the form, ensuring compliance with IRS regulations. Let’s look at the 1099-MISC form and instructions in more detail.

Key takeaways

- Filing the 1099-MISC form accurately is crucial for businesses and individuals to report non-traditional income and avoid penalties and audits from the IRS.

- 1099-MISC instructions are essential for correctly reporting various types of income, such as rents, royalties, and awards, and meeting deadlines.

- Additional features like the Free File Program and updates on future developments aim to simplify tax compliance and provide resources for eligible individuals, enhancing the overall tax filing process.

Understanding 1099 forms and the 1099-MISC form

It might be good to start by saying that 1099 is the IRS form series – a set of tax documents that track various types of income beyond traditional employment wages. The series includes multiple 1099 forms that help track and report diverse income streams (other than your paycheck), ensuring everyone pays their fair share come tax time.

Whenever you receive payments from sources other than your employer, like rental income, freelance work, or even gambling winnings, the payer fills out the appropriate 1099 form. They send copies to you and the IRS, ensuring transparency about your earnings during the tax year.

If you get a 1099 form, it’s up to you to include that income on your tax return.

The IRS uses different letter codes to differentiate the 1099 forma based on the source of income. There may be 1099-A, 1099-DIV, 1099-INT, and many more, including the 1099-MISC form we’re looking at in more detail here.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What’s the form 1099-MISC is about? Who’s the sender, recepient, payments to report, and more

The 1099-MISC form is a document used to report various types of payments made as a business, excluding those made to employees for their wages or nonemployee compensation. It’s a way for businesses to inform the IRS and recipients about income transactions beyond standard salaries.

Related:

Payroll Taxes for an Employer: How Is Payroll Tax Calculated?

What payments does the 1099-MISC form report?

Before 2022, distinguishing between W9 vs 1099 was less crucial, as you’d use the 1099-MISC form to report various payments and compensations, including rents, royalties, prizes, and awards. However, starting in 2020, nonemployee compensation shifted to Form 1099-NEC, while other payments still go on Form 1099-MISC. This change streamlined reporting, making it more transparent for businesses and recipients.

So, as of today, the payments to report under the 1099-MISC form include:

- Rentals;

- Awards and prizes;

- Medical and health care payments;

- Income payments;

- Gross proceeds to attorneys;

- Cash payments for notional principal contracts;

- Cash payments for fish and aquatic life;

- Royalties or broker payments;

- Direct sales of consumer products, and some more.

Who sends and who receives the 1099-MISC form?

Companies and individuals involved in trade or business send the 1099-MISC forms to recipients who received payments above certain thresholds during the tax year. Recipients include individuals, partnerships, estates, or other entities who provided services or received payments in the course of business.

Understanding the difference between W-2 and 1099 is vital for companies and individuals involved in trade or business

What are the conditions for filing or receiving the 1099-MISC form?

The conditions for filing or receiving a 1099-MISC form vary based on the type of payment and its amount. Generally, you should expect to receive a 1099-MISC form if you’ve received payments for rent, royalties, prizes, awards, or other income-related transactions totaling at least $10 or $600, depending on the category. Businesses and self-employed individuals are responsible for issuing these forms to recipients by January 31st and filing them with the IRS by February 28th if on paper or March 31st if filing electronically.

What if you fail to fill in the 1099-MISC form correctly?

A bit of bad news. Failing to fill in the 1099-MISC form correctly can lead to various unpleasant consequences you might want to avoid facing. Let’s look at those.

#1 – Penalties

The IRS imposes penalties for inaccuracies or failure to file the 1099-MISC form. Penalties can vary depending on factors such as the timing of the correction and whether the errors were or weren’t intentional.

#2 – IRS audits

Inaccurate reporting on tax forms, including the 1099-MISC, can trigger IRS audits. Audits generally are time-consuming and stressful and may result in additional fines or taxes owed if they find any discrepancies. Total pain in the neck, if you will.

#3 – Legal issues

Incorrect reporting can lead to legal issues, especially if it seems an attempt to evade taxes or intentionally misrepresent financial information. Legal consequences may involve fines, lawsuits, or other legal actions.

#4 – Loss of tax deductions

Another unwanted outcome is the loss of tax deductions associated with those payments. So, you end up with higher taxable income and increased tax liability for the business.

#5 – Reputation damage

Inaccurate reporting reflects poorly on the business’s reputation. It can erode trust with vendors, contractors, and clients who rely on accurate financial documentation. Reputation damage can have long-term consequences for business relationships and future opportunities.

#6 – Increased scrutiny

Consistent errors or omissions on tax forms may attract increased scrutiny from tax authorities in subsequent years. This heightened attention can make tax compliance more challenging for businesses and may result in closer monitoring of financial activities. (Do you need it? That’s what I thought).

With all the above in mind, businesses might want to understand the requirements for filing the 1099-MISC form. And it brings us to 1099-MISC instructions being a helping hand in mitigating those pesky risks.

Instructions for 1099-MISC form – your tax form reading guide

The IRS provides 1099-MISC instructions to help people accurately fill out the 1099-MISC form. These instructions are basically guidelines that tell you what information you need to include and how to report it correctly.

The purpose is to ensure individuals and businesses accurately report their miscellaneous income to the IRS. The instructions break down each section of the form and explain what types of income you should put in there. They also provide details on where to send the completed form once.

Besides, the instructions may include updates or changes to tax laws that affect income reporting on the 1099-MISC form. Following these instructions can help taxpayers avoid mistakes and potential penalties from the IRS.

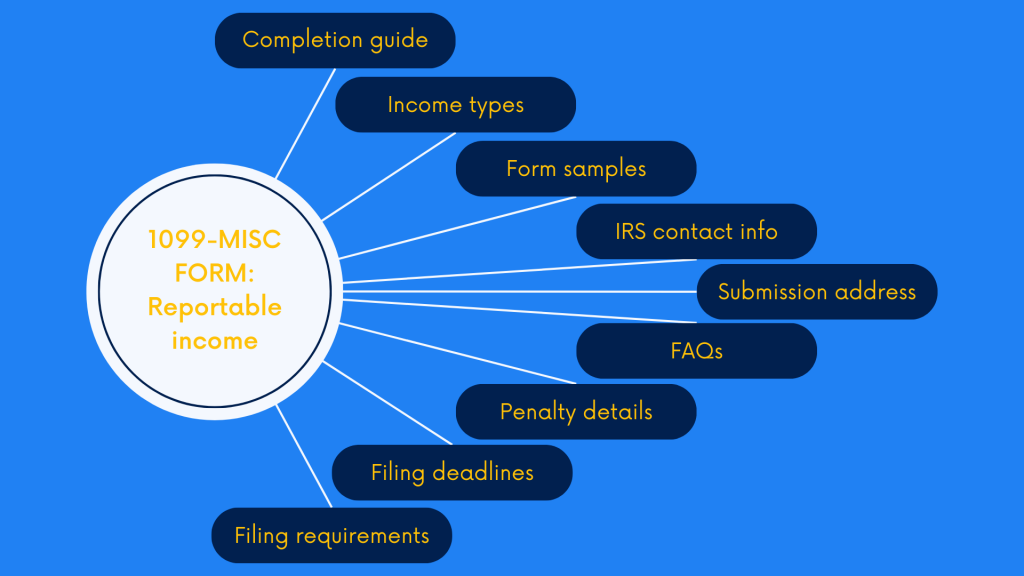

If summed up, the instructions provide the following information:

- Explanation of who needs to file the form.

- Instructions on how to fill out each section of the form.

- Guidance on what types of income to report.

- Details on where to send the completed form.

- Deadlines for filing the form with the IRS.

- Updates on any changes to tax laws or reporting requirements.

- Information on penalties for inaccurate reporting or late filing.

- Frequently asked questions and answers.

- Contact information for the IRS for further assistance.

- Examples and illustrations of filling out the form correctly.

Usually, you can find the instructions on one of the last pages of the 1099-MISC form. Below, we’ll go through the 1099-MISC form and instructions, breaking them down in detail.

The anatomy of the 1099-MISC form

The 1099-MISC form usually comprises several copies and pages. Let’s explore and understand the different parts and versions that make a 1099-MISC form.

What are copies?

In forms like the 1099-MISC, copies refer to duplicate versions of the same document. These copies contain identical information but serve different purposes and address different parties. The 1099-MISC form typically comprises Copy A, Copy B, Copy C, and Copies 1, 2, and sometimes 3.

Copy A – an informational document

This copy, often colored red, is not sent to the IRS. It’s a purely informational document submitted to state tax departments, but only if required by the specific state’s regulations. It contains the same information as Copy B. However, it’s intended for state tax reporting, helping state authorities track income earned within their jurisdiction.

Copy B – the recipient’s copy

Copy B is sent directly to the recipient of the income. Payers must provide this copy to recipients by January 31 of the year following the tax year in which the recipient received income. Recipients use Copy B to accurately report their income on their federal and state tax returns. Payers must timely and accurately distribute Copy B to avoid potential penalties.

Copy C – the payer’s copy

As a payer, you usually retain Copy C for record-keeping. It serves as documentation of the income reported and distributed to recipients. Payers must maintain this copy for their records, as it provides a comprehensive overview of the payments made throughout the tax year. Keeping accurate records helps businesses track their financial activities and facilitates tax compliance.

Copy 1, 2, and (or) 3 – local or state authorities’ copies

These additional copies, numbered 1, 2, and (or) 3, usually serve state or local tax reporting purposes, depending on the regulations of the relevant tax jurisdictions. Payers may use these copies for their records or – if required – submit them to state tax departments. The specific requirements for these copies vary by state, so payers might want to know the regulations applicable to their business operations.

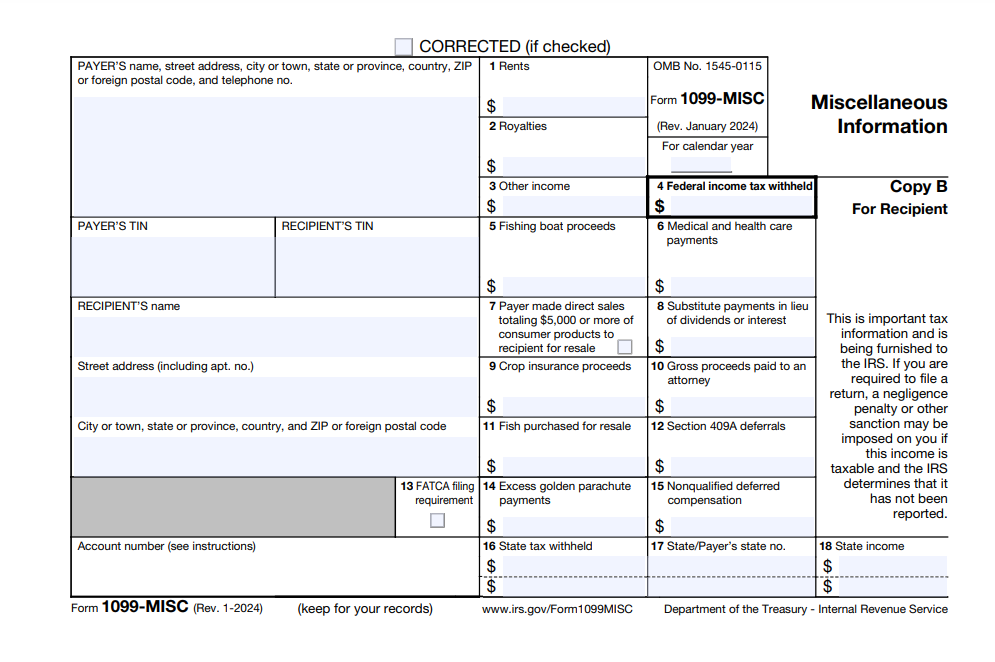

What are boxes about?

Each 1099-MISC form copy consists of sections called boxes, each designated for reporting specific types of income or information. These boxes are labeled with numbers and descriptions corresponding to the income type or information they represent.

Let’s break down the purpose of each box on the 1099-MISC form:

- Box 1 – Rents

Here, you report rental income of $600 or more, excluding payments made to real estate agents or property managers. - Box 2 – Royalties

In this box, you should include gross royalties of $10 or more, covering various types like those from oil, gas, mineral properties, and intellectual properties such as patents and copyrights. - Box 3 – Other income

In this box, you can report miscellaneous income of $600 or more not included elsewhere, covering prizes, awards, and specific categories listed in the instructions. - Box 4 – Federal income tax withheld

Here, you report any federal income tax withheld under backup withholding rules. - Box 5 – Fishing boat proceeds

If applicable, you report here proceeds from fishing boats with fewer than ten crew members, including individual shares of catch sales and minimum catch contingent cash payments. - Box 6 – Medical and health care payments

You can report here $600 or more payments for medical and health care services, excluding prescriptions. - Box 7 – Direct sales of consumer products

This box is for reporting direct sales of $5,000 or more of consumer products for resale outside permanent retail establishments. - Box 8 – Substitute payments

Any broker payments of $10 or more as dividends or tax-exempt interest go here. - Box 9 – Crop insurance proceeds

Report crop insurance proceeds of $600 or more paid to farmers. - Box 10 – Gross proceeds to attorneys

Here, you can report gross proceeds of $600 or more paid to attorneys, including amounts deducted for claims or settlement agreements. - Box 11 – Fish purchased for resale

Report cash payments of $600 or more for fish purchased for resale. - Box 12 – Section 409A deferrals

It’s an optional box for reporting deferrals of $600 or more under nonqualified plans. - Box 13 – FATCA filing requirement

It’s a checkbox that you should tick if FATCA filing is required. - Box 14 – Excess golden parachute payments

It’s a place to report excess parachute payments over the base amount. - Box 15 – Nonqualified deferred compensation

Report amounts deferred under section 409A that are includible in income. - Box 16 – State tax withheld

Enter state income tax withheld here. - Box 17 – State/Payer’s State No.

Here, you should enter the abbreviated state name and a payer’s state identification number. - Box 18 – State income

Here, you need to report the amount of state payment.

As you can see, these boxes embrace various income streams, so you need to fill in those that apply to you.

The number-labeled boxes make the right side of the 1099-MISC form. And there, you fill in your income-related information. The boxes on the left contain the fields for the information about the payer and recipient, such as name, address, and taxpayer identification number (TIN). Additionally, there may be boxes for account numbers, contact information, and other details pertinent to the transaction or reporting requirements. These sections identify the payer and recipient and ensure the necessary information is accurately recorded for tax purposes.

Other instructions for the 1099-MISC form

Besides the specific instructions on what to fill in each box of Form 1099-MISC, the instructions also provide additional points for consideration, namely, Future developements and Free File Program. Let’s look at them in more detail.

Future developments

Future developments refer to any changes or updates that might occur after the instructions for Form 1099-MISC are published. These changes might include new laws or regulations that affect how to fill out the form or what information to report. Filers might want to stay informed about these developments to ensure they comply with the latest requirements on the form filing.

The instructions advise filers to regularly check the IRS website for any updates or announcements regarding Form 1099-MISC to help them accurately report their income and meet their tax obligations.

Free File Program

The Free File Program, administered by the IRS, is designed to provide eligible individuals with a cost-free option for preparing and filing their federal taxes online. This program offers several benefits, including electronic filing (e-filing) and the option for direct deposit or payment of tax refunds.

Eligibility for the Free File Program is determined based on income thresholds and other criteria set by the IRS. You can visit the official IRS website to see if you qualify for the program. Once there, you can access the Free File Program section and use the provided tools to check eligibility.

Those eligible can leverage the program’s online tax preparation services by participating tax software companies. These services guide users through completing their tax returns, ensuring accuracy and compliance with IRS regulations.

This way, participating in the Free File Program can save you money on tax preparation fees and help filing your taxes more conveniently. It’s a valuable resource, allowing taxpayers to meet their filing obligations efficiently and effectively while maximizing their potential refunds.

These additional points demonstrate the IRS’s efforts to keep taxpayers informed about resources and programs that simplify the tax filing process and ensure compliance with tax regulations.

Final word

So, as a takeaway, understanding how to handle the 1099-MISC form is crucial for businesses and individuals to accurately report non-traditional (aka out-of-employment) income to the IRS and avoid penalties and audits. Failing to file correctly can result in legal issues and reputation damage. The provided IRS instructions guide taxpayers in completing the form accurately, covering income types, deadlines, and reporting requirements. Additional features like the Free File Program and updates on future developments aim to simplify tax compliance for eligible individuals. With all this in mind, considering whether does an llc get a 1099 is part of the broader context that 1099-MISC form instructions aim to clarify, offering a helpful guide for accurate reporting

Continue reading: How to delete journal entries in QuickBooks?

Share your thoughts

Have any questions or ideas? Feel free to ask or share our experience in the comments section below!