This guide is for users who already use Synder and want to change how Synder posts future transactions to your accounting platform when your current sync mode no longer fits your needs.

Synder has two sync modes:

- Per Transaction Sync: Synder posts each sale/refund/fee as a separate record in your accounting platform.

- Summary Sync: Synder groups transactions for a selected period (for example, by day or by payout) and posts them as one aggregated record per period.

Change the sync mode when:

- Your current sync mode does not fit your accounting needs and you want to change how future data is posted

Do not change the sync mode if:

- You expect past data to be updated, rebuilt, or converted

- You are trying to fix historical posting issues or reconciliation problems

Note: Moving forward, make sure to select a specific date from where you want to start syncing data with the new sync mode and create a new organization. This helps you avoid duplicates.

How to make the switch

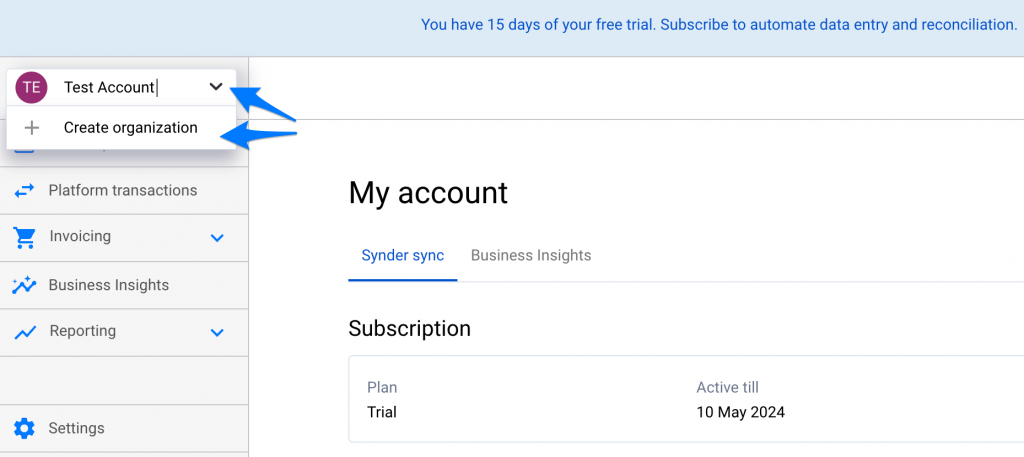

- In Synder, open the organization dropdown in the top-left corner.

- Create a new organization.

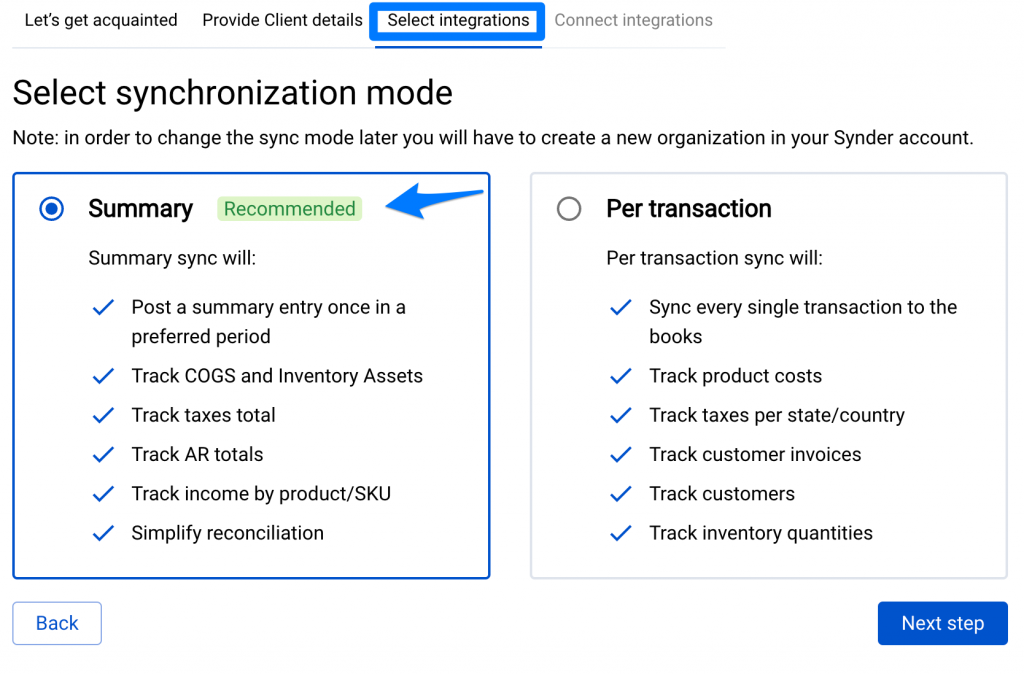

- Complete onboarding for the new organization.

- When asked to choose the sync mode, select a different sync mode than the one used in your current organization.

- Connect your accounting company and sales/payment platforms.

- Finish syncing all data you want to keep in the old organization.

- In the new organization, start syncing only the data that was not synced by the old organization.

What to expect afterward

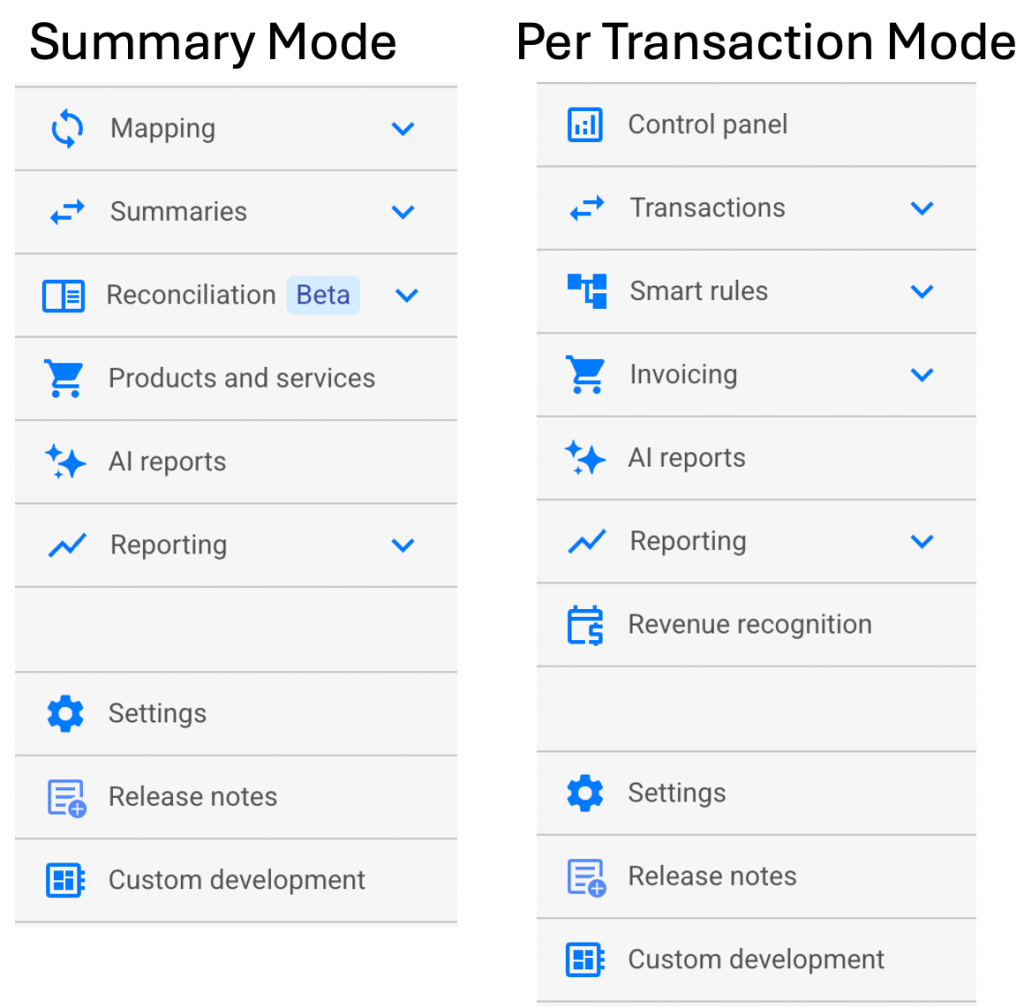

- You will be working in the new organization you created for the switch (check the organization name in the top-left dropdown).

- The left-hand menu will reflect the sync mode you selected during onboarding (for example, Summaries when using in Summary Sync).

Important notes

- You cannot change the sync mode inside an existing organization. To switch sync modes, you need to create a new organization and select the mode during onboarding.

- Changing the sync mode affects future data only. Previously synced data is not modified.

- The exact posting type in your accounting platform depends on the selected sync mode and your platform.

Troubleshooting

To prevent overlapping entries in your books, syncing should start from the cutoff date of the previous sync mode.

If both sync modes have posted overlapping transactions, you will have to make some manual adjustments in the books.

What to do:

- Decide which version of the data you want to keep (individual transactions or summarized posting).

- Remove the other version from your accounting platform manually, or roll it back from the Synder side.

- Continue syncing only non-overlapping data in the new organization.

FAQ

Do I have to create a new organization to change the sync mode?

Yes. The sync mode is selected once per organization.

Will changing the sync mode update past data?

No. Past data remains unchanged.

Where do I sync data after changing the mode?

After changing the mode, you start syncing data in the new organization.

What about the paid period on my Per Transaction account?

Please contact our support team, and we will help you transfer your subscription.

What to Do Next

You can archive your previous organization after transferring your subscription to the new one (if applicable) to keep your account organized.

To archive an organization:

- Click the profile icon in the upper-right corner of Synder → List of organizations

- Click the three-dots action menu next to the desired organization → Archive.

For more information, please refer to this guide: Manage Organizations in Synder: How to Archive or Delete Organizations

Reach out to Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!