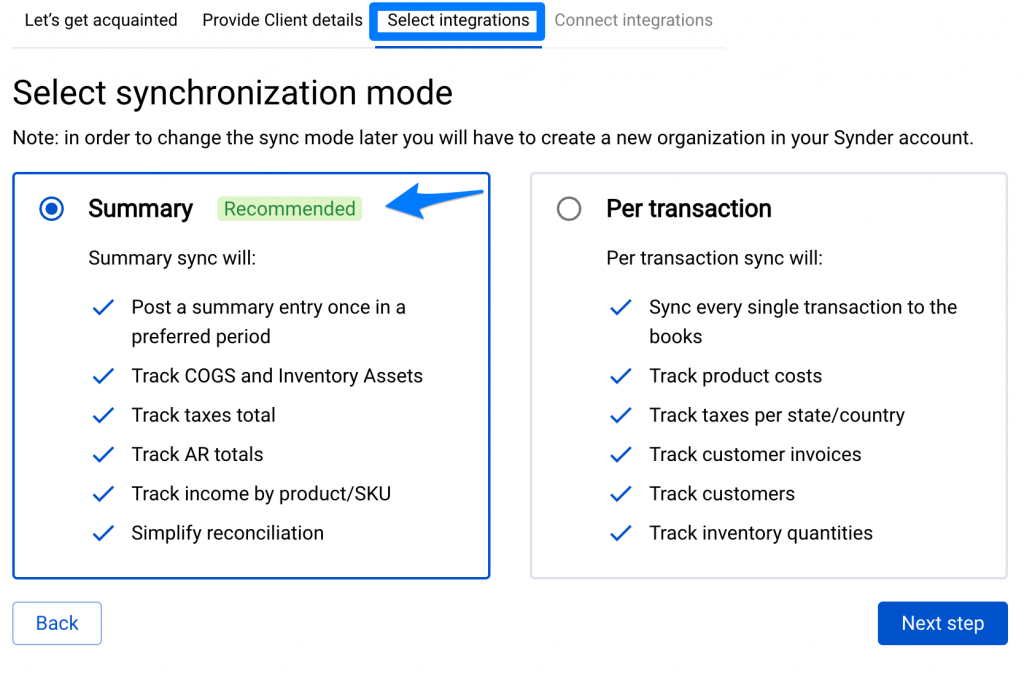

Two what we call “modes” are supported in Synder: Summary sync and Per transaction sync.

Summary sync – posts 1 summarized Journal Entry (for QuickBooks Online) or 1 Invoice/Credit note (for Xero) per connected platform for the day/per payout, depending on the integrations you have and summary period settings to reflect your daily activity in your books. So your books stay clean and easy to reconcile and are not overloaded with data if you have thousands of transactions.

Per Transaction sync – posts individual sales receipts/invoices/refunds/fees, so that you have all the details possible transferred from the connected integration to your books. This makes your accounting provider a good instrument for business reporting and inventory management.

Your business or your client’s needs may change over time, and you may need to switch from one mode to another. However, the sync mode is selected once per organization. So in order to change the sync mode, you would simply need to create a new one and connect all the systems to it.

Follow the steps below to learn how:

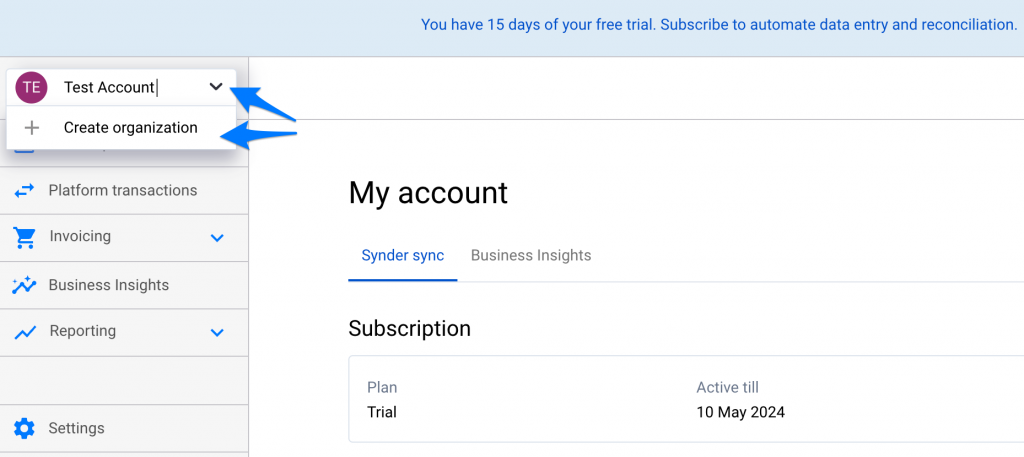

1) Create a new organization using the drop-down in the top left corner in Synder.

2) Fill in organization details and connect your platforms to your new organization (learn more here).

Important: select Summary sync mode if you used Per transaction one and vice versa.

3) Finish the onboarding and enjoy a new mode!

Tip: to avoid any duplicates, we recommend taking a note on the date you have finished synchronization with your previous sync mode, so that starting from the next day you could use your new mode.

4) You can archive your old organization after transferring your subscription to the new one (if any) to keep your account clean. In order to archive an organization:

– click the person icon in the top right corner of Synder→ My organizations

– click the 3 dots action menu for the needed organization → Archive.

Check out this guide for more details.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!