Operating cash flow (OCF) is one of the most important metrics to measure the financial performance of a company. It’s the cash a business receives from its operations and uses to pay for day-to-day expenses, investment expenses, and other financial obligations. You might want to understand OCF because it can provide insight into the company’s ability to generate cash and invest in future growth. Knowing the basics of OCF, business owners and investors can evaluate the financial health of a company more accurately and make informed decisions.

Here’s what you’ll learn:

1. What is operating cash flow (OCF)?

2. How operating cash flow differs from other financial measures

- What is the difference between cash flow and operating cash flow?

- Operating cash flow vs free cash flow

- Is operating cash flow the same as EBIT?

3. Understanding business operations with OCF: Why is operating cash flow important?

4. How to calculate operating cash flow — the formula

6. What is an operating cash flow statement?

7. What is a good operating cash flow ratio?

8. How Synder software can help with operating cash flow calculations

What is operating cash flow (OCF)?

Operating cash flow (OCF) is an important benchmark to evaluate the financial success of a company’s core business activities.

Operating cash flow is a measure of the income generated by the normal business operations of a company, such as sales and services. It represents the cash that a company generates from its core business activities, regardless of whether or not it’s profitable, which can be a more accurate measure of a company’s financial strength than other measures, such as earnings.

OCF is a more direct reflection of a company’s ability to generate cash than other financial metrics like net income, as it can’t be easily manipulated with accounting techniques, and it gives a clearer picture of the cash available in the company for reinvestment or to return to shareholders.

A company with a strong operating cash flow is better able to pay off its debts, invest in growth opportunities, and pay dividends to its shareholders. Operating cash flow also helps investors evaluate whether or not investing in a particular company will be beneficial. A strong operating cash flow indicates that the company has enough money to cover operational expenses, which makes it an attractive option for potential investors.

A business should strive for a positive operating cash flow to remain profitable and continue operations without interruption. Companies with a positive OCF can remain competitive in their industry and are more likely to succeed in their long-term goals.

What does ‘operating’ mean in the operating cash flow definition?

In the context of “operating cash flow,” “operating” refers to the regular, day-to-day activities of a business that are involved in producing and selling goods or services. Examples of operating cash inflows include cash received from sales of products or services, interest income, and cash received from customers. Operating cash outflows include payments made for salaries and wages, rent, utilities, and other operating expenses.

For example, if a company makes furniture, the operating activities would include buying raw materials, manufacturing the furniture, paying employees, and selling the finished product. The cash inflow from selling the furniture and the cash outflow for raw materials, wages, and other related expenses would be part of the operating cash flow.

Investment activities (like purchasing a new factory) or financing activities (like issuing new shares or paying dividends) aren’t included in the operating cash flow, as they aren’t part of the core business operations.

Read our articles on SG&A or Selling, General and Administrative Expenses, and Variable Expenses.

How operating cash flow differs from other financial measures

There are various metrics that help assess the financial health performance of a business. Some of them share some similarities with operating cash flow. So in order to avoid confusion, let’s review some of the related terms.

What is the difference between cash flow and operating cash flow?

Cash flow and operating cash flow are both measures used to evaluate a company’s financial health. However, there’s a difference between the two.

Cash flow refers to the total amount of cash that flows in and out of a company during a given period of time. This includes all cash received from sales, investments, and financing activities, as well as all cash paid out for expenses and investments.

Operating cash flow, on the other hand, refers specifically to the amount of cash a company generates from its operations. It’s calculated by subtracting the company’s operating expenses from its operating revenues. This is important because it gives investors and analysts a better understanding of how much cash a company is generating from its core business activities, which can be a more accurate measure of a company’s financial health.

In short, while cash flow includes all cash inflows and outflows, operating cash flow focuses specifically on the cash generated from a company’s operations.

Operating cash flow vs free cash flow

As mentioned before, operating cash flow is the amount of cash a company generates from its normal business operations. Free cash flow, on the other hand, is the cash a company generates after accounting for all of its expenses, including capital expenditures (CAPEX).

Free cash flow is calculated by subtracting capital expenditures from operating cash flow. Free cash flow represents the cash a company has available to invest in growth opportunities, pay dividends, pay off debt, or buy back shares. It’s considered a more accurate measure of a company’s ability to generate cash that is available to its shareholders.

So, to put it simply, free cash flow measures the cash that is available for the company to use after accounting for all of its expenses, including capital expenditures while operating cash flow measures the cash generated from a company’s normal business operations.

Is operating cash flow the same as EBIT?

In short — no, operating cash flow and earnings before interest and taxes (EBIT) are not the same. While both measures are used to evaluate a company’s financial health, they represent different aspects of a company’s operations.

EBIT is a measure of a company’s profitability that reflects how much it earns from its operations before accounting for interest and taxes. It’s calculated by subtracting a company’s operating expenses from its revenue.

Understanding business operations with OCF: Why is operating cash flow important?

Now that we can easily identify and differentiate operating cash flow from other financial measures, let’s focus on the importance of OCF in the broader picture of the company’s finances and review some of the most crucial benefits of calculating OCF:

- Cash flow is necessary for a company’s day-to-day operations. A company needs cash to pay its bills, purchase inventory, pay employees, and invest in growth opportunities. Operating cash flow measures a company’s current ability to generate cash from its operations to cover these expenses.

- Operating cash flow shows how well a company is managing its working capital. Changes in working capital, such as accounts receivable, inventory, and accounts payable, can have a significant impact on a company’s cash flow. OCF measures how effectively a company is managing these items and generating cash from its operations.

- Operating cash flow can be used to pay off debt. A company that generates strong operating cash flow can use that cash to pay off its debts, which can help reduce interest expenses and improve its financial position.

- Operating cash flow is a better indicator of a company’s financial health than earnings. Earnings can be manipulated through accounting practices, but cash flow is a more tangible measure of a company’s financial health. Strong OCF can provide a buffer against unexpected events and help a company weather economic downturns.

- By analyzing the operating cash flow, businesses can identify which activities are generating the most revenue, and which ones are consuming the most cash. For example, a decrease in operating cash flow may be due to an increase in expenses – such as higher wages or an increase in marketing costs – or a decrease in sales. In either case, the analysis of operating cash flow can provide valuable insights into how to improve business operations and create a plan for the future.

- A profound understanding of operating cash flow is particularly important when making decisions about capital investments and acquisitions. By understanding the actual costs associated with an investment or acquisition, businesses can determine whether or not it’s feasible to move forward with the decision. Additionally, when considering financing options, an analysis of operating cash flow can provide useful information on how borrowing will affect future cash flows.

So, no matter whether you run a small business or a big one, operating cash flow is one of the metrics you’ll definitely want to keep track of.

Want to master your cash flow? Check out our article on cash flow management tips.

Two methods of presenting operating cash flow

Generally accepted accounting principles (GAAP) recognize two methods for presenting operating cash flow data in a company’s financial statements – the indirect method and the direct method.

- Direct method. The direct method reports actual cash inflows and outflows from a company’s operating activities. This method involves adding up all the cash received from customers, subtracting all cash paid to suppliers and employees, and then adding back any cash paid or received for taxes and interest. Though this approach doesn’t provide as much detail as the indirect method, the direct method provides a more accurate picture of a company’s operating cash flows. Keep in mind, however, that the direct method is more time-consuming and costly to implement.

- Indirect method. The indirect method starts with net income and then makes adjustments to account for non-cash items (such as depreciation and amortization) and changes in working capital (such as an increase or decrease in accounts receivable, inventory, and accounts payable). This method is more commonly used because it’s less complex and less expensive to implement. It allows for a better understanding of the cash flow from operations since it considers all changes in working capital, including those that aren’t necessarily related to cash transactions.

Both methods provide valuable data about a company’s operating cash flows, but the direct method provides a more detailed breakdown of cash inflows and outflows, while the indirect method provides a more simplified picture.

Read more about the differences between direct and indirect cash flow.

How to calculate operating cash flow — the formula

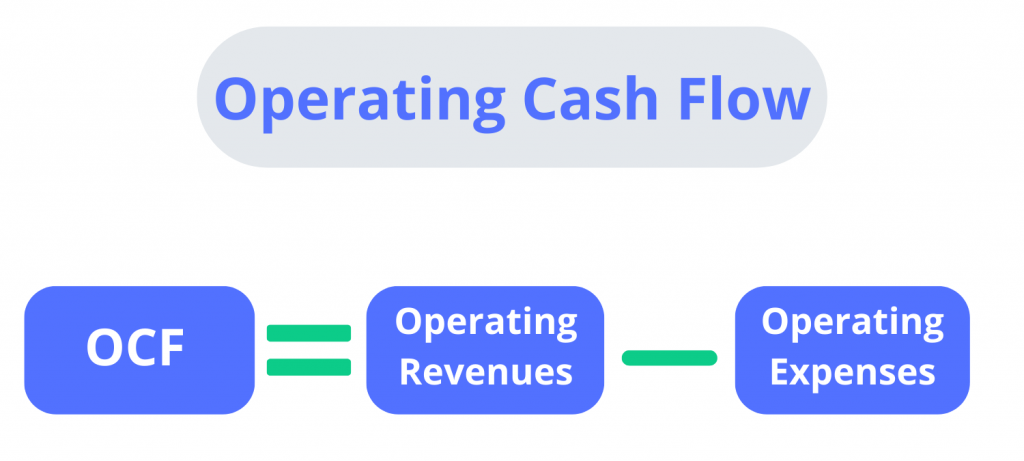

If you use the direct method, OCF is calculated by subtracting a company’s operating expenses from its operating revenues.

The formula for calculating operating cash flow using the direct method is as follows:

Operating revenues include all the money a company earns from its normal business activities, such as sales of products or services, interest income, and cash received from customers.

Operating expenses include all the costs a company incurs to generate its operating revenues, such as salaries and wages, rent, utilities, and other operating expenses.

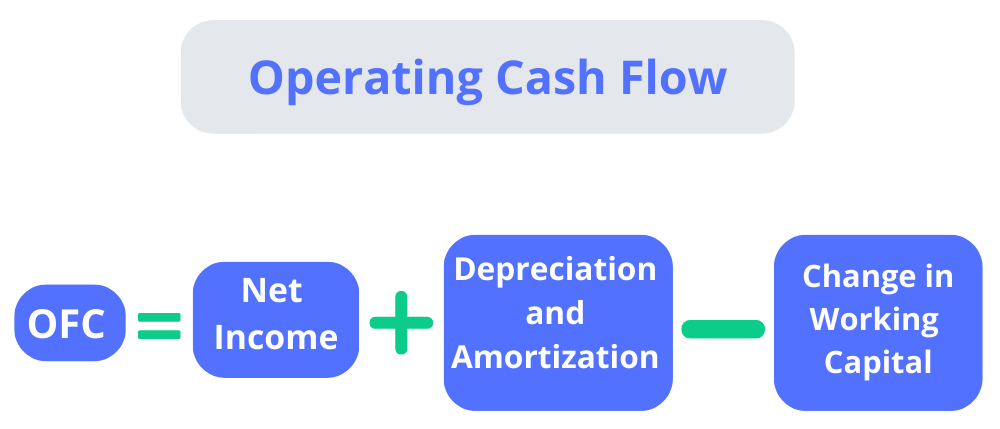

On the other hand, the indirect method of calculating operating cash flow is used to adjust net income from an accrual basis to a cash basis. This process involves adding non-cash items such as depreciation and amortization and adjusting accounts receivable and accounts payable. Taxes are also taken into account when calculating operating cash flow.

Now, the formula that uses the indirect method might slightly differ depending on the character of the business but the basic one should look as follows:

OCF = Net Income + Depreciation and Amortization – Change in Working Capital

This formula might also include non-cash items other than amortization and depreciation (we’ll get to it later on).

It’s worth mentioning that understanding the different components of this equation is necessary to obtain an accurate result and fully grasp the nuances of flow operating.

Also, it’s important to note that different accounting methods can affect the calculation of operating cash flow, so it’s important to carefully review a company’s financial statements and notes to understand how the calculation was made.

OCF components

As previously mentioned, you can calculate operating cash flow by looking at its components, including net income, depreciation and amortization (and other non-cash items), and changes in working capital.

- Net income is the company’s total income, that is, profit after subtracting any expenses incurred during the accounting period.

- Depreciation and amortization are non-cash expenses that are used to account for the cost of assets over time.

- Changes in working capital refer to changes in the company’s current assets and liabilities during a given period, such as accounts payable and accounts receivable.

- Other non-cash items include stock-based compensation, pension costs, and gain or losses on asset sales.

To have accurate numbers on all these components, from income to working capital, you need to know where to find those on financial statements, i.e., the cash flow statement. Usually, the cash flow statement starts with the Cash Flow from Operating Activities section, and you’ve got everything you need there. Let’s look closer at it.

What is an operating cash flow statement?

An operating cash flow statement, also known as a statement of cash flows, is one of the main financial statements used in accounting, along with the balance sheet and income statement. The statement measures the cash generated or used by a company’s core operations during a specified period.

It is divided into three sections:

Operating Activities: This section reports cash flow from core business operations, like revenue and expenses from producing and delivering goods and services. This is where Operating Cash Flow (OCF) is calculated. This portion also includes changes made in cash from activities such as accounts receivables, accounts payable, depreciation, and amortization.

Investing Activities: This part shows cash flow from all investing activities, which generally include purchases or sales of long-term assets, such as property, equipment, and securities.

Financing Activities: This shows cash flow from all financing activities, which often includes the cash used in or generated from debt and equity. This includes repayments of debt, issuance of new debt, payment of dividends, and issuance or repurchase of company shares.

What is a good operating cash flow ratio?

The operating cash flow ratio, also known as the cash flow coverage ratio, measures a company’s ability to generate cash from its operations to cover its current liabilities. A higher ratio indicates that a company is in a better position to pay off its short-term debt obligations.

Generally, a good operating cash flow ratio is considered to be greater than 1. A ratio of 1 indicates that a company is generating enough cash from its operations to cover its current liabilities. Above 1 ratios indicate that a company is generating more cash than it needs to cover its short-term obligations, which can be a positive sign of financial health.

However, the ideal operating cash flow ratio can vary by industry and company. It should also be evaluated in the context of a company’s overall financial situation. Companies with higher levels of debt may require a higher operating cash flow ratio to meet their debt obligations, while companies with lower levels of debt may not need as high one.

How Synder software can help with operating cash flow calculations

Synder is an online accounting software that helps in automating financial processes for businesses, which includes transactions from e-commerce platforms, online payments, point of sales (POS systems), and even banking operations. As a financial solution, it can help with operating cash flow calculations and statements.

Most importantly, Synder can generate financial reports, including cash flow statements. These reports can provide insights into your business’s operating cash flow, helping you identify trends and make informed decisions.

Moreover, Synder can help with tracking business expenses, which are a crucial part of managing cash flow. By keeping an accurate record of your expenses, you can find opportunities to cut costs and improve your operating cash flow.

What’s key is that all the recording and tracking of the financial data happens automatically. So long gone are days of spreadsheets and pen-and-paper calculations. Each transaction from your payment processors and bank accounts is automatically imported and categorized in your accounting software, ensuring the data is always accurate, up-to-date, and error-free.

Remember, while Synder provides tools that aid in managing and calculating operating cash flow, the interpretation of the data and strategic decisions will still depend on you or your financial advisor.

Conclusion

Operating cash flow is an important accounting metric that can give you plenty of insights into a company’s financial health and ability to meet its obligations. It excludes cash flows from investing and financing activities, which might be irregular or not directly tied to the day-to-day operations of the business.

It’s a critical measure used by stakeholders, including investors, creditors, and analysts, to assess the company’s financial stability, efficiency, and profitability in its core business operations. By examining OCF, stakeholders can make more informed decisions about the company’s financial stability and growth potential. Hence, it’s important to pay attention to operating cash flow to keep track of the financial health and stability of a company.