The key to running a successful business is being able to keep your financials accurate and up-to-date. This is where reconciling an account becomes one of the major cornerstones. Just imagine being able to catch the mistakes before they can turn into an expensive nightmare and preventing sneaky fraud in its tracks. And picture having accurate financial information in your hands, literally at your fingertips, to make intelligent, informed decisions.

Interested? This post goes through the process of account reconciliation, deepens the understanding of various available types of reconciliation, and explains how tools like Synder cut all of this complexity. Read on to find out how you can smoothen your financial management and keep your business on sound footing.

Key takeaways:

- Account reconciliation ensures the accuracy of transactions in financial statements and helps trace errors in records.

- Businesses must reconcile accounts to prevent discrepancies and fraud, manage cash flow, support strategic decisions, gain financial insights, maintain compliance, and optimize operational efficiency.

- The best way to streamline the account reconciliation process is by automating it with software.

Contents:

2. Why businesses must reconcile their respective accounts

3. Reconcile your accounts with Synder

How to reconcile accounts?

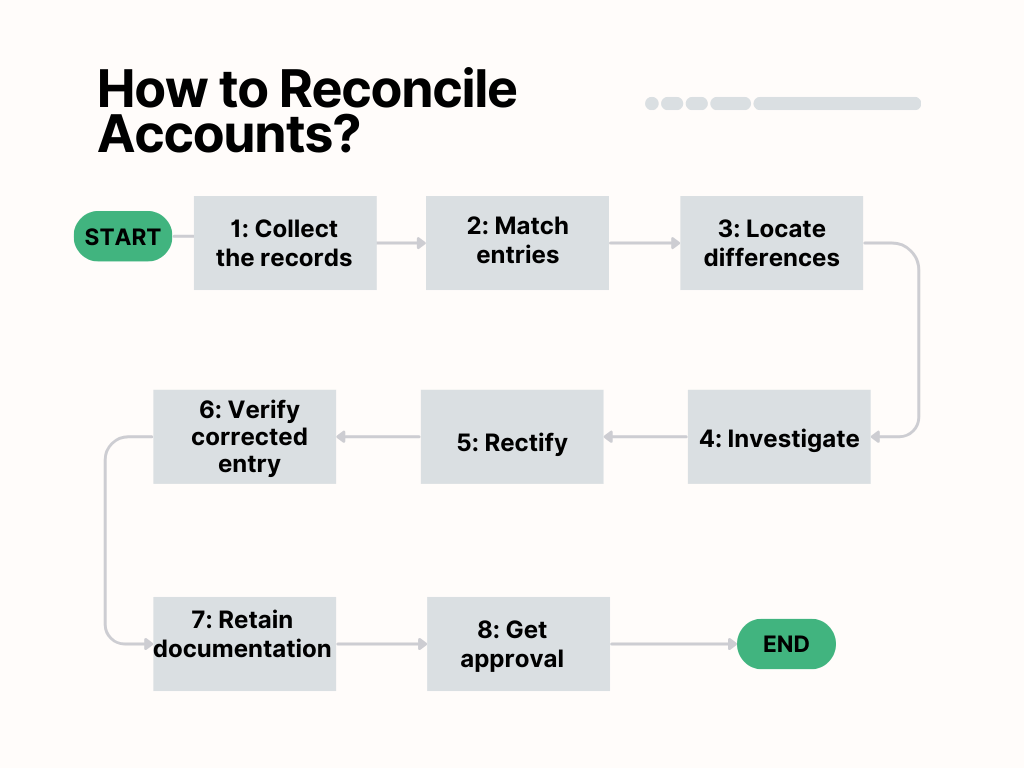

Account reconciliation is the line-by-line process of verifying that all the data in all of your accounting records is correct and consistent across all outside statements. These are the steps you follow with it:

Step 1: Collect the records

Gather bank statements, invoices, receipts, and ledger entries.

Step 2: Match entries

Go through the activity of comparing your entries against those in bank statements so that they correspond.

Step 3: Locate differences

Find the differences, including omissions, repeated entries, wrong amounts, or anything else that could explain a discrepancy.

Step 4: Investigate

Determine the cause of every difference, be it clerical errors or omitted transactions.

Step 5: Rectify

Correct the entries so that the records are a true reflection of the accounts.

Step 6: Verify corrected entry

Verify every rectification for the correct balancing and that every entry is correct.

Step 7: Retain documentation

Maintain enough documents of evidence through which the reconciliations can be performed.

Step 8: Get approval

Ask for the managers’ or the internal auditor’s approval of the reconciliation once it’s ready.

Note: Account reconciliation is performed on a monthly, quarterly, or annual basis to track the actuals at regular intervals.

Why businesses must reconcile their respective accounts

- Verification of accuracy: Reconciliation of accounts ensures the legitimacy of the records reflected on the financial statements. In this regard, for instance, an online sales business might discover the truth that their $1,000 was missing; thus, it verifies the accuracy of sales and revenue records.

- Prevents fraud: Reconciliation becomes helpful in fraud identification. An ecommerce business could realize that an employee had made false invoices and pocketed whatever payments were made, therefore preventing the loss.

- Managing cash flow: Effectively managing cash flow is possible because online sales businesses can ensure prompt payment for expenses and salaries by being informed about incoming and outgoing cash.

- Strategic decision making: Reconciliation would assist in making strategic decisions. By having exact financial data, an online store would be able to take effective decisions related to inventory, marketing options, or even expansion opportunities.

- Financial insights: Account reconciliation provides vital financial information. For example, an ecommerce business might come to realize that a few of their customers are taking 90 days instead of the 30 days stipulated to pay on time, which would show that it might have a problem with payment terms and, by extension, cash flow.

- Managed compliance: Compliance with financial regulations matters a lot. A business can ensure that all invoices and transactions are accounted for correctly—an area for potential penalties for a tax jurisdiction.

- Optimization of operational efficiency: Identifying discrepancies might eventually mean streamlining operations. For example, online stores will be able to pick up errors related to handling of inventory from reconciliation to correction of the errors to increase efficiency.

Reconcile your accounts with Synder

Can you imagine selling across multiple platforms with different payment processors, such as Shopify, Amazon, eBay, Walmart, Etsy, and so on? Those chinks and missing links soon turn into a time-intensive and exhaustion-filled nightmare: manual data entry, inconsistent records, account reconciliation.

But the solution is simple: automate this labor-intensive and error-prone process by using software that integrates with your financial systems. With Synder, high-tech accounting software, you can easily pre-match payouts with transactions recorded from 30+ sales or payment platforms, streamlining the entire payout reconciliation process, which can be connected to the app. This ensures that your accounting system records in QuickBooks, Xero, or Sage Intacct align with your real bank account. The more accurate records you have in books, the lower the chance of discrepancies. This means, no stress over missing transactions come audit or tax season.

Other Synder’s benefits for businesses:

- Real-time updates: Get real, up-to-date transactional behavior from Synder. It’ll help you perform a more realistic audit of your cash flows and financial performance.

- Customizable rules: Custom transaction categorization rules make it simple to deal with many types of sales and fees in your bookkeeping.

- Comprehensive reporting: Get comprehensive reports with Synder to watch whether everything is run like a clock. It will help to detect all the discrepancies really fast.

- Error detection and correction: Automating the reconciliation process, Synder helps unearth the errors early, and its rollback gives you the ability to deep-hand any changes done to resync data again.

Conclusion

Account reconciliation ensures financial records are accurate, hence, it’s the ultimate solution for precise and reliable financial management. It catches mistakes, fraud, and helps you make smarter decisions. With Synder, the process is a breeze. Synder automatically syncs your accounts; updates in real time; at the end, it provides accurate books and reconciled accounts. Be it a retail store or a tech startup, let Synder keep your business finances in order and keep cash flow healthy. Make your accounting simple and set your business up for success with Synder!

Share your thoughts

We’d love to hear from you. How do you manage account reconciliation in your business? Have you tried automation tools like Synder to streamline the process? Share your experiences and insights with us!

Thanks for the article! It was helpful learning about reconciling an account. This will help in management of my financial services UK business.

Thank you, David! We’re happy our article was helpful to your business!