If you’re not a U.S. taxpayer, you might be curious about why you’re being requested to complete a W-8BEN form. Well, the W-8BEN isn’t just another piece of paperwork – it’s a significant document for anyone who’s earned interest in the U.S. during a calendar year. In fact, it has the potential to put more money back in your pocket. Let’s dive into what W-8BEN is, why this form matters, who should file it and how to fill it out.

Disclaimer: This article is designed to offer a broad understanding of W-8BEN and does not constitute personalized tax advice. Tax regulations can be intricate and subject to individual nuances. Should you or your business require guidance regarding the completion of the W-8BEN tax form or have specific tax-related inquiries, it is strongly recommended to seek the expertise of a qualified tax professional. Solely relying on the information presented here for tax preparation or decision-making is discouraged.

What is W-8BEN?

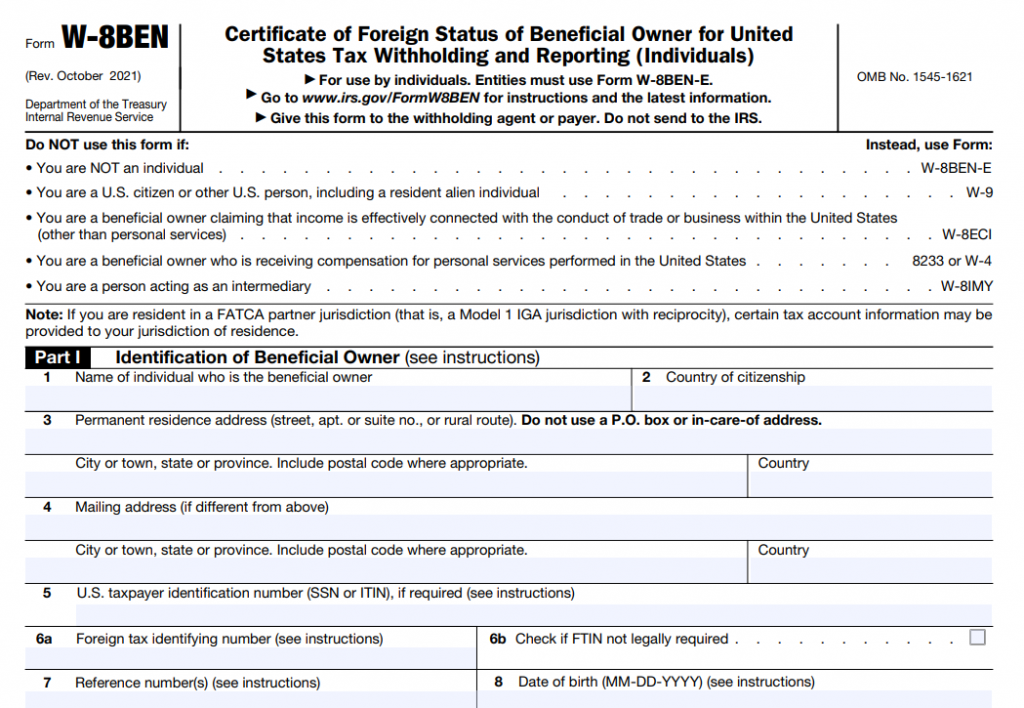

Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) is a tax document used by non-U.S. individuals (foreign individuals) and entities to establish their foreign status, claim benefits, and prevent excessive withholding of taxes on income earned from U.S. sources. It helps ensure that the correct amount of tax is withheld in accordance with U.S. tax laws and international tax treaties.

In straightforward terms, completing your W-8BEN form has the potential to put money back in your pocket. Let’s delve into why it matters!

Don’t understand why the Internal Revenue Service is auditing you or your business? Find out what the most common IRS tax audit red flags are!

What is a W-8BEN tax form for?

The W-8BEN form serves as your declaration that you’re a non-U.S. taxpayer who has received income from U.S. sources.

Why is this important? Well, it grants you the opportunity to request an exemption from the compulsory withholding tax, which can reach a substantial 30% of the interest you’ve earned.

Picture this: Without this form, financial institutions are obliged to follow yearly withholding regulations and apply the full 30% withholding rate to your account. What’s more, the withheld interest is handed over to the IRS. Reclaiming this money can be challenging if you’re not a U.S. tax filer.

By taking the time to complete this tax document, you can hold onto your hard-earned interest and sidestep those significant withholdings on your account. In essence, it’s a simple step that can keep more money in your wallet.

Note: Non-U.S. individuals or entities are liable to a 30% U.S. tax rate on income derived from U.S. sources, including but not limited to:

- Interest (including specific types of original issue discount).

- Dividends.

- Rental income.

- Royalties.

- Premiums.

- Annuity payments.

- Compensation for services rendered or anticipated.

- Substitute payments in securities lending transactions.

- Other regular or periodic gains, profits, or income of a fixed or determinable nature.

Want to contact the Internal Revenue Service? Learn how to talk to a live person at the IRS.

Who should fill out a W-8BEN form?

Form W-8BEN is a crucial document for foreign individuals who aren’t U.S. residents but earn income from U.S. sources. Let me explain in plain language who needs to fill out this form and under what circumstances:

- If you’re getting income subject to withholding

If you’re a non-U.S. resident (foreign individual) and you’re about to receive some money from the U.S., you should hand over Form W-8BEN to the person or organization giving you that money. This helps you tell them that you’re not from the U.S. and might qualify for a lower tax rate or even be exempt from certain taxes.

- If you’re a foreign financial institution account holder

If you have an account with a foreign financial institution (FFI) and you want to let them know that you’re not a U.S. resident, you’d use Form W-8BEN to document your non-U.S. status.

- If you own a one-person company

If you’re the sole owner of a company that’s not considered a separate entity from you (it’s called a disregarded entity), and you’re getting paid income through it, you still fill out Form W-8BEN when asked, even if you’re not asking for any special tax treatment.

- If you’re getting payments that need reporting (Section 6050W)

Imagine you’re a foreign individual receiving certain types of payments like credit card transactions or payments through third-party networks, and they’re supposed to be reported to the IRS under section 6050W. In that case, you’d typically give Form W-8BEN to the company handling these payments. But, if your income is connected to doing business in the U.S., then you’d use Form W-8ECI instead.

- If you’re selling life insurance contracts (Section 6050Y)

If you’re an individual selling life insurance contracts, and you’re not getting income connected to a U.S. business, you must provide Form W-8BEN to a specific type of issuer mentioned in the regulations.

- If you’re receiving reportable death benefits

Lastly, if you’re an individual receiving payments classified as reportable death benefits under certain tax rules, you’d give Form W-8BEN to the entity paying you.

Want to maximize your tax advantages? Check our articles to explore the distinction between pre-tax and post-tax deductions why they’re essential for making informed financial decisions.

Dreading the tax season? By automating many of the manual and time-consuming tasks associated with accounting and tax preparation, Synder can reduce the stress and anxiety often associated with tax season. You can have confidence in the accuracy of your financial records and reports. Sign up for a 15-day free trial to check the tool yourself, or book a seat at our Weekly Public Demo to delve into Synder’s capabilities with an expert. Streamline your work for greater efficiency!

How do you fill out an 8BEN?

Filling out the W-8BEN form is easier than you may think.

W-8BEN: Part 1

Line 1 – Name

If you are a foreign individual who owns a disregarded entity and are not claiming treaty benefits, complete this form with your own name. If the account is in the disregarded entity’s name, inform the withholding agent. This can be done by including the disregarded entity’s name and account number on line 7.

Line 2 – Country of citizenship

Enter the country of your citizenship. If you’re a dual citizen, use the country where you are both a citizen and resident at the time of filling out the form. If you’re not a resident in any of your citizenship countries, use the country where you were most recently a resident.

Line 3 – Permanent residence address

This is your address in the country where you claim to be a resident for income tax purposes. Don’t use the address of a financial institution or a post office box. If you have no tax residence, use your regular place of residence. If your country doesn’t use street addresses, you can describe your address accurately as per your jurisdiction’s practice.

Line 4 – Mailing address

Fill this in only if it’s different from the address on line 3.

Line 5 – Social security number (SSN)

If you have an SSN, enter it here. If not, and you’re not eligible for one, you can apply for an Individual Taxpayer Identification Number (ITIN) using Form W-7.

Partners in partnerships conducting business in the U.S. need an ITIN and must provide it on this form.

If you’re eligible for treaty benefits, you generally need to provide an ITIN, SSN, or foreign TIN on line 5 or foreign TIN on line 6, depending on the circumstances.

Line 6a – Foreign tax identifying number (FTIN)

If you’re an account holder at a U.S. financial institution, provide the FTIN issued by your jurisdiction of tax residence, unless certain exceptions apply.

Line 6b – Special box

You can check this if you’re an account holder and not legally required to obtain an FTIN from your residence jurisdiction.

Line 7 – Referencing information

This line can be used for referencing information useful to the withholding agent or to associate the form with another form, like Form W-8IMY.

Line 8 – Date of Birth

If you’re an account holder at a U.S. financial institution, provide your date of birth in MM-DD-YYYY format.

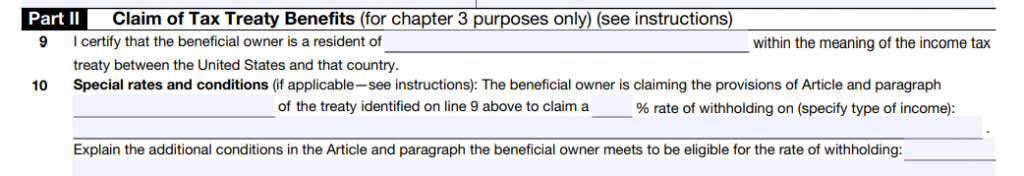

W-8BEN: Part 2

Line 9 – Claiming treaty benefits as a resident of a foreign country

This line is used to declare your eligibility for treaty benefits as a resident of a foreign country with which the United States has an income tax treaty. You need to identify the specific country where you claim residency based on the terms of the tax treaty. You can find a list of U.S. tax treaties at IRS.gov. Note that if you have a significant relationship with the withholding agent and receive over $500,000 subject to withholding in a calendar year, you might need to file Form 8833 for treaty-based return position disclosure.

Line 10 – Additional information for treaty benefits

This line comes into play when the treaty benefits you’re claiming require conditions not covered in Line 9 or Part 3 of the form. It’s generally not used for treaty benefits related to interest or dividends. Examples of when to complete Line 10 include cases like different withholding rates for various types of royalties, foreign students or researchers claiming treaty benefits, or situations where business profits aren’t connected to a permanent establishment.

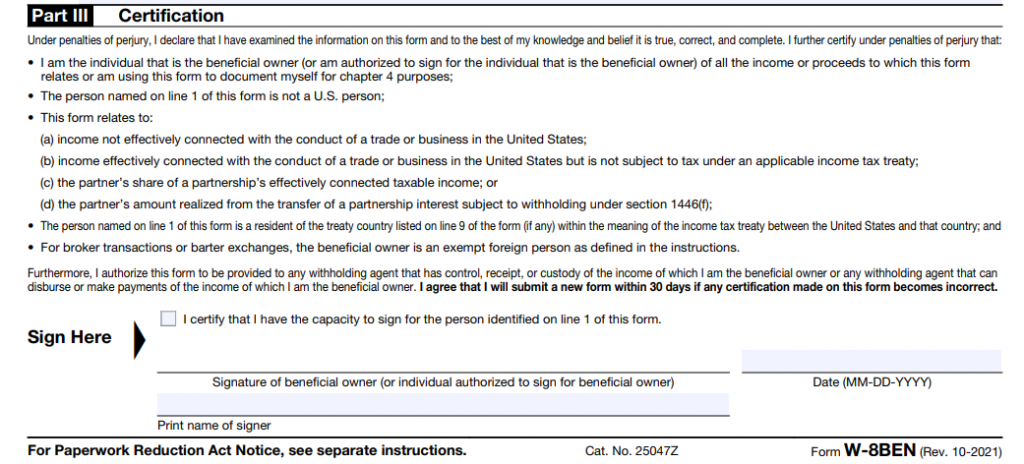

W-8BEN: Part 3

This part clarifies the certification and signature requirements for Form W-8BEN and provides details about electronic signatures and exemptions for certain transactions with brokers or barter exchanges.

Signing and dating the form

Form W-8BEN must be signed and dated by the beneficial owner of the income subject to withholding or the account holder of a Foreign Financial Institution (FFI). If an agent completes the form on behalf of the beneficial owner or account holder, the agent must be legally authorized and should include a proper power of attorney or a copy specifically authorizing them to act on behalf of the principal. The IRS Form 2848 can be used for this purpose. Both the agent and the beneficial owner/account holder can be held liable for penalties if the form contains errors, false, or fraudulent information.

Electronic signatures

Some withholding agents may accept electronically signed forms. However, the electronic signature must indicate that it was signed by an authorized person, typically including a time and date stamp and a statement confirming the electronic signature. Simply typing your name on the signature line is not considered an electronic signature. The withholding agent can rely on electronically signed withholding certificates if you provide additional requested information or documentation to prove its authenticity.

Updating incorrect information

If any information on Form W-8BEN becomes incorrect, you must submit a new form within 30 days. This rule applies unless you are no longer an account holder of the FFI requesting the form, and you won’t receive any future payments related to the account.

Exemption for broker transactions or barter exchanges

If you engage in transactions with a broker or a barter exchange, you may be subject to reporting and backup withholding unless you file Form W-8BEN or a substitute form to inform the broker or exchange that you are an exempt foreign person. You qualify as an exempt foreign person for a calendar year if you meet the following criteria:

- You’re a nonresident alien individual or a foreign corporation, partnership, estate, or trust.

- You haven’t been and don’t plan to be present in the United States for a total of 183 days or more during the calendar year.

- You’re not engaged or planning to be engaged during the year in a U.S. trade or business with effectively connected gains from transactions with a broker or barter exchange.

Learn about W-2 and why it matters.

How do you file W-8BEN?

Don’t send Form W-8BEN to the IRS, and it’s not something you file with your tax return either. Instead, you should give the completed form to the person or organization that asked you for it. Usually, this is the entity that’s paying you. It’s important to get this form sorted out before they make the first payment; otherwise, they might have to withhold the maximum 30% amount as required by U.S. tax laws.

Once you’ve filled out Form W-8BEN, it stays valid for at least three whole calendar years. To be more specific, it expires at the end of the third complete calendar year after you’ve signed it. For example, if you signed a W-8BEN form on July 20, 2023, it’ll be no good after December 31, 2026.

If anything changes and the information on your submitted W-8BEN form becomes incorrect, you’ll need to provide a new one sooner (for example, if your tax address or tax status changes). The IRS states that you have to notify your withholding agent, payer, or FFI you have an account with within 30 days of any changes in your situation. Plus, you should file a new Form W8BEN or the right form for those changes.

Be very careful when filing updated W-8BEN forms, as scammers often take advantage of this opportunity via tax scam emails.

Managing a business and trying to do your payroll right? Check out our breakdown of the most important payroll tax forms an employer needs to submit to the Internal Revenue Service.

W-8BEN: Conclusion

Form W-8BEN is a crucial document for non-U.S. individuals and entities who earn income from U.S. sources. This tax document allows you to declare your foreign status, claim treaty benefits, and potentially reduce or eliminate the withholding tax on your U.S. income.

By completing the W-8BEN form, you can keep more of your hard-earned money and avoid substantial withholding rates. It’s essential to understand who should fill out this form, the importance of accurate information, and the potential expiration of the form after three years.

So, if you’re a non-U.S. taxpayer receiving income from U.S. sources, taking the time to complete the W-8BEN form can be a simple yet significant step in your financial journey.

Have you ever filled out a W-8BEN form? Share your experience in the comment section below. We’d love to hear from you!