Validating accounts payable (AP) and accounts receivable (AR) is essential for maintaining accurate financial records and ensuring your books reflect the true state of cash flow. If you’re preparing for month-end close or resolving discrepancies in the ledger, accountants need a clear process to confirm what’s owed and what’s due.

This guide provides actionable steps for validating AP and AR, outlines common reconciliation challenges, and offers practical solutions to streamline the process.

Common challenges in validating accounts payable and receivable

1. Sub-ledger and general ledger mismatches

It’s not uncommon for balances in AP or AR sub-ledgers to differ from the general ledger. This often results from missing journal entries, incorrect cutoff dates, or duplicated transactions.

2. Timing issues with invoices and payments

Delays in recording invoices or customer payments can cause inaccurate aging reports and lead to disputes or cash flow mismanagement.

3. Data entry errors

Manual entry of vendor bills or customer invoices can introduce discrepancies in amounts, dates, or account classifications, impacting financial reports.

4. Lack of standardized processes

When teams follow inconsistent procedures for invoice approval, payment posting, or customer billing, it becomes difficult to track and verify balances reliably.

5. Limited use of automation

Without automation, accountants spend more time manually reviewing transactions, often leading to delays, missed errors, or incomplete validations.

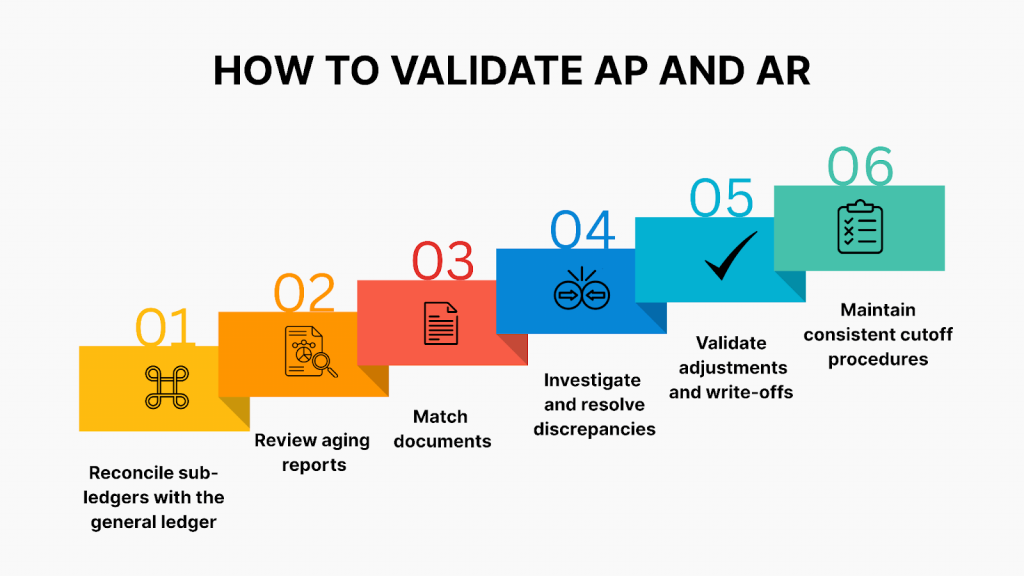

A guide to validate AP and AR

Here’s what you should do:

1. Reconcile sub-ledgers with the general ledger

Start by ensuring the AP and AR sub-ledgers match the corresponding GL control accounts. Run reconciliation reports and investigate any variances. Look for unposted journal entries, misclassified transactions, or timing differences.

2. Review aging reports

Generate up-to-date aging schedules for both payables and receivables. Verify the due dates, open balances, and terms. This helps identify past-due items, unapplied credits, and potential bad debts.

3. Match documents

- For AP: Match vendor invoices against purchase orders and receiving reports (three-way match).

- For AR: Match customer invoices against sales orders and proof of delivery. Confirm that payments received align with the invoice details.

4. Investigate and resolve discrepancies

Drill down into mismatches. Common causes include duplicate invoices, payments posted to the wrong accounts, or early/late entries. Cross-reference the original source documents to confirm.

5. Validate adjustments and write-offs

Ensure any adjustments, such as discounts, credits, or write-offs, are approved and properly documented. These entries should be consistent with company policy and clearly reflected in the ledger.

6. Maintain consistent cutoff procedures

Ensure transactions are recorded in the correct accounting period. Cutoff misalignment can cause reporting errors that ripple through financial statements.

Streamlining AP and AR processes long-term

To prevent recurring issues, consider standardizing invoice approval workflows, adopting integrated accounting systems, and performing regular training. Tools like Synder can help streamline multi-platform accounting by automatically syncing transaction data into your books, reducing reconciliation work, and improving audit readiness. They can automate parts of the reconciliation process, detect mismatches in real time, and reduce reliance on manual entry, which greatly cuts down on validation time and improves accuracy across multiple platforms.

Want to see how it works? Start a 15-day free trial (no credit card required) or book a personal demo to get your questions answered live by an expert.

FAQ

Why do discrepancies occur between sub-ledgers and the general ledger?

Discrepancies usually stem from timing differences, missing or duplicate journal entries, and misclassified transactions. Regular reconciliation and clear cutoff procedures help avoid these issues.

How can I reduce data entry errors in AP and AR processes?

Automating invoice capture, approval, and payment processes reduces human error. Use accounting software with validation checks and approval workflows.

What are the benefits of regular audits in AP and AR processes?

Regular audits help identify fraud, uncover errors, and ensure compliance with financial policies. They also promote consistency in reporting and reconciliation practices.

How do aging reports assist in managing accounts payable and receivable?

Aging reports highlight overdue payables or receivables, helping businesses manage cash flow, prioritize collections or payments, and identify doubtful accounts.

What role does accounting automation software play in validating AP and AR?

Automation tools like Synder improve data accuracy by syncing transactions across platforms in real time, reducing manual work, and providing clear audit trails.