As SaaS businesses continue to thrive in today’s competitive landscape, tracking revenue growth becomes crucial for their success. One key metric that plays a vital role in measuring and understanding revenue growth is Net Revenue Retention (NRR). In this article, we will delve into the concept of NRR, its significance for SaaS businesses, and why it should be an integral part of their growth strategy.

The definition of Net Revenue Retention

Net Revenue Retention (NRR), also known as Net MRR Retention, is a metric that assesses a SaaS company’s ability to retain and expand revenue from existing customers over a specific period. It takes into account the revenue generated from retained customers, upsells, cross-sells, and expansion revenue, while excluding revenue lost due to churn and contraction.

Net Revenue Retention and business performance evaluation

Incorporating NRR into business performance metrics provides a comprehensive understanding of a SaaS company’s overall growth. Comparing NRR with other financial and growth indicators, such as customer acquisition cost (CAC) and lifetime value (LTV), helps evaluate the effectiveness of different business strategies. Moreover, NRR assists in making data-driven decisions, identifying potential bottlenecks, and allocating resources effectively.

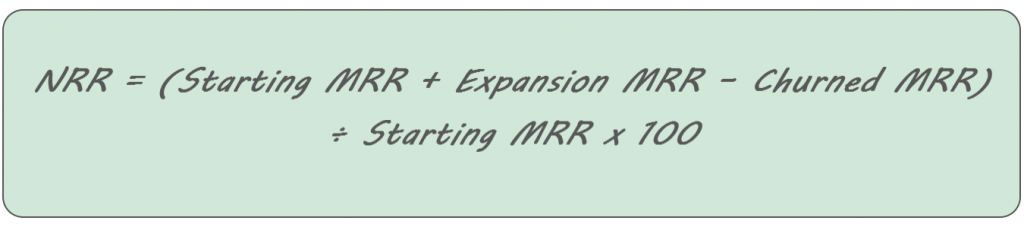

How to calculate Net Revenue Retention?

To calculate NRR, gather data on monthly recurring revenue (MRR) at the beginning of a specific period, including expansion revenue, downgrades, and churn. Subtract the total revenue lost from churn and contraction from the initial MRR, and then add the expansion revenue during that period. Divide the resulting value by the initial MRR and multiply by 100 to obtain the NRR percentage.

Why understanding billing cycles might be important to calculate NRR

Billing cycles are predetermined time intervals in which SaaS businesses invoice and charge their customers for the services or products they provide. These cycles determine the frequency at which customers are billed and the corresponding revenue generated for the business. Understanding billing cycles is essential when calculating Net Revenue Retention (NRR) as it ensures accurate measurement of revenue retention and expansion over time.

Calculating Net Revenue Retention (using Stripe billing as an example)

To explain how billing cycles apply when calculating NRR, let’s consider an example using the Stripe billing system. Stripe is a widely used payment processing platform that offers flexible billing cycle options for SaaS businesses. Let’s imagine a SaaS company that offers a monthly subscription plan to its customers and utilizes Stripe for billing purposes.

In this scenario, each customer’s subscription fee is billed on a monthly basis through Stripe. The monthly billing cycle means that customers are charged and revenue is generated every 30 days, starting from their initial subscription date.

Calculating NRR involves the following steps:

- Determine the specific period

Select the period for which you want to calculate NRR. For example, let’s consider a six-month period from January to June.

- Gather the initial MRR

Start by recording the total Monthly Recurring Revenue (MRR) at the beginning of the selected period. Let’s assume the initial MRR in January is $50,000.

- Account for expansion revenue

Identify any revenue generated from existing customers during the period due to upsells, cross-sells, or upgrades. Suppose the expansion revenue amounts to $5,000 over the six-month period.

- Consider churn and contraction

Calculate the revenue lost during the period due to customer churn or downgrades. Let’s assume that the total churn and contraction amount to $10,000.

- Calculate NRR

Subtract the revenue lost from churn and contraction ($10,000) from the initial MRR ($50,000). Then, add the expansion revenue ($5,000). In this example, the resulting value would be $45,000. To obtain the NRR percentage, divide this value by the initial MRR ($50,000) and multiply by 100. The NRR in this case would be 90%.

Accurate NRR calculations provide valuable insights into a SaaS company’s ability to retain customers, expand revenue from existing accounts, and drive sustainable growth. At this point, you might want to know how to interpret NRR results.

How to interpret the results of Net Revenue Retention calculations

Interpreting NRR results involves assessing the direction and magnitude of the metric, benchmarking against industry standards, analyzing customer segments, and considering its relationship with churn. This analysis helps businesses evaluate their revenue retention strategies, identify growth opportunities, and make informed decisions to drive sustainable growth. Here are some key points to consider when interpreting NRR results:

- Positive NRR

A positive NRR indicates that, on average, existing customers are generating more revenue over a given period compared to the previous period. This signifies that the business has been successful in retaining and expanding its customer base, leading to increased revenue. A positive NRR is a desirable outcome as it demonstrates the effectiveness of customer retention strategies and the ability to drive revenue growth from existing accounts.

- NRR Percentage

The NRR percentage provides insights into the overall revenue retention and expansion efforts. For example, an NRR of 100% means that the business retained all its existing revenue from customers during the specified period. If the NRR percentage is above 100%, it indicates additional revenue generated from upsells, cross-sells, or expansion within the existing customer base. Conversely, an NRR below 100% suggests a net loss of revenue due to churn or downgrades.

- Benchmarking

Interpreting NRR results becomes more meaningful when compared to industry benchmarks or historical performance. Comparing the calculated NRR against industry standards or competitors can provide a context for understanding how well a business is performing in terms of revenue retention and expansion. Additionally, tracking NRR over time allows businesses to evaluate their own progress and identify areas for improvement.

- Customer Segmentation

NRR can be further analyzed by segmenting customers based on different attributes such as pricing tiers, customer cohorts, or subscription plans. This segmentation helps identify specific customer groups that contribute significantly to revenue retention and expansion. By understanding which customer segments have higher or lower NRR, businesses can tailor their strategies and resources accordingly to maximize revenue growth.

- Relationship with Churn

NRR and churn are closely related metrics. Analyzing NRR alongside churn rates provides a comprehensive view of customer retention efforts. A high NRR coupled with low churn rates indicates a strong ability to retain customers and drive revenue growth, while a low NRR alongside high churn rates may indicate areas that require attention to improve customer retention.

Why Revenue retention (NRR) matters to SaaS businesses

NRR is a valuable metric for SaaS businesses for several reasons. It directly reflects the impact of customer retention and expansion on a company’s revenue growth, provides insights into the effectiveness of customer success and sales strategies, and helps identify revenue leakage points and areas that need improvement, such as reducing churn rates and maximizing upselling opportunities.

Let’s break it down.

Reflecting net revenue growth through customer retention and expansion

NRR serves as a direct reflection of the impact of customer retention and expansion efforts on a company’s revenue growth. By tracking changes in revenue from existing customers over a specific period, businesses can evaluate their ability to retain customers and drive additional revenue through upsells, cross-sells, and upgrades. A positive NRR indicates a successful retention and expansion strategy, showcasing the company’s ability to generate more revenue from its existing customer base.

Assessing the effectiveness of customer success and sales strategies

NRR provides valuable insights into the effectiveness of customer success and sales strategies. A high NRR suggests that the company has implemented successful initiatives to ensure customer satisfaction and loyalty. It indicates that customers are renewing their subscriptions and possibly purchasing additional services, validating the efforts of the customer success team. Conversely, a low NRR may signal potential issues with customer retention and expansion strategies, prompting a reassessment of the company’s approach.

Identifying revenue leakage points and areas for improvement

By closely monitoring NRR trends, businesses can pinpoint segments or factors contributing to revenue loss. This analysis can reveal patterns of customer churn, indicating the need for enhanced customer retention strategies. Additionally, NRR highlights missed opportunities for upselling or cross-selling to existing customers. Identifying these areas allows businesses to implement targeted initiatives to reduce churn, enhance customer satisfaction, and maximize revenue potential.

Strategies for improving Net Revenue Retention

To enhance NRR, SaaS businesses can focus on implementing effective customer retention strategies. This includes proactive customer support, personalized onboarding experiences, regular communication to build strong relationships, and more. Let’s look at those in more detail.

Proactive customer support and personalized onboarding experiences

Providing proactive and attentive customer support is essential for maximizing customer satisfaction and reducing churn. SaaS businesses can invest in customer support teams that are readily available to address customer inquiries, concerns, and issues promptly. By offering timely and personalized assistance, businesses can ensure that customers feel valued and supported throughout their journey.

Additionally, delivering personalized onboarding experiences can significantly impact customer retention. By tailoring the onboarding process to each customer’s specific needs and goals, businesses can help customers understand and effectively utilize their SaaS product. This personalized approach fosters a positive customer experience, increases product adoption, and minimizes the likelihood of early churn.

Regular communication and relationship building

Maintaining regular communication with customers is crucial for building strong relationships and driving customer loyalty. SaaS businesses can implement strategies such as newsletters, email updates, and in-app notifications to keep customers informed about product updates, new features, and industry trends. By staying engaged with customers and providing them with valuable information, businesses can strengthen the customer relationship and encourage long-term commitment.

Identifying upselling and cross-selling opportunities

Upselling and cross-selling present valuable opportunities to increase revenue and improve NRR. SaaS businesses can analyze customer usage patterns and behaviors to identify potential upsell opportunities. For instance, if a customer consistently utilizes specific features or reaches certain usage thresholds, it may be an opportune time to offer an upgraded plan that better aligns with their needs. Cross-selling can be achieved by promoting complementary products or add-ons that enhance the customer’s overall experience. By effectively leveraging targeted marketing campaigns and product expansion, businesses can maximize revenue from their existing customer base and drive NRR growth.

Addressing customer churn with proactive measures

To improve NRR, it is crucial to address customer churn proactively. Businesses can analyze churn data to identify patterns and reasons behind customer attrition. For example, if customers are frequently canceling their subscriptions during the onboarding phase, it may indicate a need to enhance the onboarding experience or provide additional support during this critical period. By understanding the root causes of churn, businesses can take proactive measures to mitigate them, such as implementing customer success programs, offering incentives for long-term commitments, or making product improvements based on customer feedback.

Challenges and limitations of Net Revenue Retention

While NRR is a valuable metric, it does have some limitations. Data accuracy and consistency are crucial for precise NRR calculation, and challenges may arise from different billing cycles and revenue recognition methods.

Inconsistencies in data collection and calculation can lead to inaccuracies in determining the true NRR value. Therefore, it is crucial for businesses to establish data management practices and implement standardized procedures to mitigate these challenges.

Moreover, it is essential to recognize that NRR provides a focused perspective primarily on revenue retention and expansion, and it may not offer a comprehensive view of a company’s overall financial health and growth. For example, it doesn’t account for factors such as new customer acquisition or the impact of external market conditions on a company’s performance.

Therefore, it is imperative to consider contextual factors, such as market conditions and customer behavior, alongside NRR when evaluating a SaaS business’s overall financial performance. For instance, a high NRR value may indicate strong customer loyalty and effective upselling strategies, but it could also be influenced by external factors like a lack of viable alternatives in the market. Conversely, a low NRR value may suggest customer churn or challenges in revenue expansion, but it might also be a result of broader market trends or specific industry dynamics. By considering these contextual factors, businesses can gain a more nuanced understanding of their NRR results and make informed decisions regarding their growth strategies.

Long story short, businesses should consider utilizing NRR in conjunction with other relevant metrics to gain comprehensive insights into their financial health, growth potential, and the effectiveness of their customer retention and expansion efforts.

Understanding Revenue retention: final words

Net Revenue Retention (NRR) is a powerful metric that offers insights into the revenue growth potential of SaaS businesses. By understanding and tracking NRR, SaaS companies can gain valuable information about customer retention, expansion, and overall revenue performance. Improving NRR requires a combination of effective customer success strategies, upselling opportunities, and churn reduction efforts.

As NRR becomes an integral part of business performance evaluation, SaaS companies can make informed decisions, identify areas for improvement, and drive sustainable growth in the competitive SaaS landscape. It’s worth mentioning that financial data accuracy plays a tremendously important role in understanding and managing NRR. At this point, businesses might want to leverage accounting software to automate recording of transactions, prevent data loss, and maintain accurate reporting and comprehensive business analytics.

![Accounting Security and Data Accessibility in Accounting [2024]](https://synder.com/blog/wp-content/uploads/sites/5/2024/04/how-to-balance-accounting-security-260x195.png)